Financial Transparency At X: Understanding The Data From The Recent Debt Sale

Table of Contents

Understanding the Debt Sale's Purpose and Structure

Company X recently undertook a debt sale to secure funding for its ambitious expansion plans. This strategic move aims to accelerate growth in several key market segments. The company issued a series of 10-year bonds, a move that allows them to access capital at a relatively fixed interest rate over an extended period. The structure of the debt sale includes:

- Debt Instrument: 10-year corporate bonds with a fixed coupon rate of 4.5%.

- Key Dates: The bonds were issued on October 26th, 2023, with a maturity date of October 26th, 2033.

- Credit Rating Agencies: Moody's and Standard & Poor's assigned investment-grade ratings to the bonds, reflecting X's strong financial standing.

This structured approach ensures a predictable flow of funds for X while managing the associated risks effectively. The bond issuance allows for a controlled injection of capital without diluting existing shareholders' equity.

Analyzing the Financial Data Released

Company X has released comprehensive financial data regarding the debt sale, offering considerable insight into its financial position. Key data points include:

- Proceeds: The debt sale generated $500 million in net proceeds after deducting underwriting fees and other expenses.

- Expenses: Underwriting fees and other associated costs amounted to approximately $10 million.

- Debt-to-Equity Ratio: The debt-to-equity ratio has increased slightly following the issuance, but remains within the company's target range and below industry averages.

[Insert chart or graph here showing debt-to-equity ratio before and after the debt sale.]

This transparency allows investors and stakeholders to properly assess the impact of the debt sale on X's overall financial health. The comparison to previous issuances (if applicable) further strengthens the context provided.

Assessing the Impact on Company X's Financial Health

The debt sale is expected to have a positive impact on Company X's long-term financial stability. The increased capital will allow for investments in research and development, expansion into new markets, and potential acquisitions. However, the increased debt also carries risks:

- Increased Interest Expense: Servicing the debt will require regular interest payments, which could impact future cash flows.

- Financial Covenants: The bond agreement includes covenants that place certain restrictions on Company X's financial operations. The company must maintain its commitment to these conditions.

- Credit Rating Impact: The successful issuance and maintained investment-grade rating indicate a minimal credit rating impact.

While these risks exist, the potential benefits outweigh the concerns, particularly given X's robust financial performance and strong management team. The company's ability to service the debt comfortably, as reflected in their financial projections, confirms its financial strength.

Ensuring Ongoing Financial Transparency at X

Company X remains committed to fostering financial transparency at X. Regular financial reporting and open communication are integral to maintaining trust with investors. Access to ongoing financial information includes:

- Financial Reports: Quarterly and annual reports are published on the company's investor relations website, providing detailed information on financial performance.

- Investor Relations Website: [Insert link to investor relations website here]

- Investor Presentations: Company X regularly hosts investor presentations and conference calls. Details of upcoming events are posted on the investor relations website.

- Future Plans: Future debt issuances or refinancing plans will be disclosed proactively and transparently.

This consistent communication strategy ensures that investors and stakeholders remain well-informed about X's financial position.

Conclusion: The Importance of Financial Transparency at X

Company X's recent debt sale exemplifies the importance of financial transparency. The company's comprehensive disclosure of financial data related to the sale allows for a thorough understanding of its financial strategy and its potential impact. By maintaining open communication and regular reporting, Company X reinforces trust with investors and stakeholders. Understanding the financial implications of such transactions is crucial for making informed investment decisions. We encourage you to stay informed about Company X's financial performance by regularly monitoring their disclosures and engaging with their investor relations resources. Maintaining financial transparency at X is key to their continued success.

Featured Posts

-

Cancellation Of Thunder Over Louisville Fireworks Ohio River At Record Levels

Apr 29, 2025

Cancellation Of Thunder Over Louisville Fireworks Ohio River At Record Levels

Apr 29, 2025 -

Us Researcher Exodus How Funding Cuts Fuel Global Talent Acquisition

Apr 29, 2025

Us Researcher Exodus How Funding Cuts Fuel Global Talent Acquisition

Apr 29, 2025 -

Alberto Ardila Olivares Garantia De Gol Real O Promesa Vacia

Apr 29, 2025

Alberto Ardila Olivares Garantia De Gol Real O Promesa Vacia

Apr 29, 2025 -

Schumer Stays Put No Plans To Pass The Torch Says Senate Majority Leader

Apr 29, 2025

Schumer Stays Put No Plans To Pass The Torch Says Senate Majority Leader

Apr 29, 2025 -

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025

Latest Posts

-

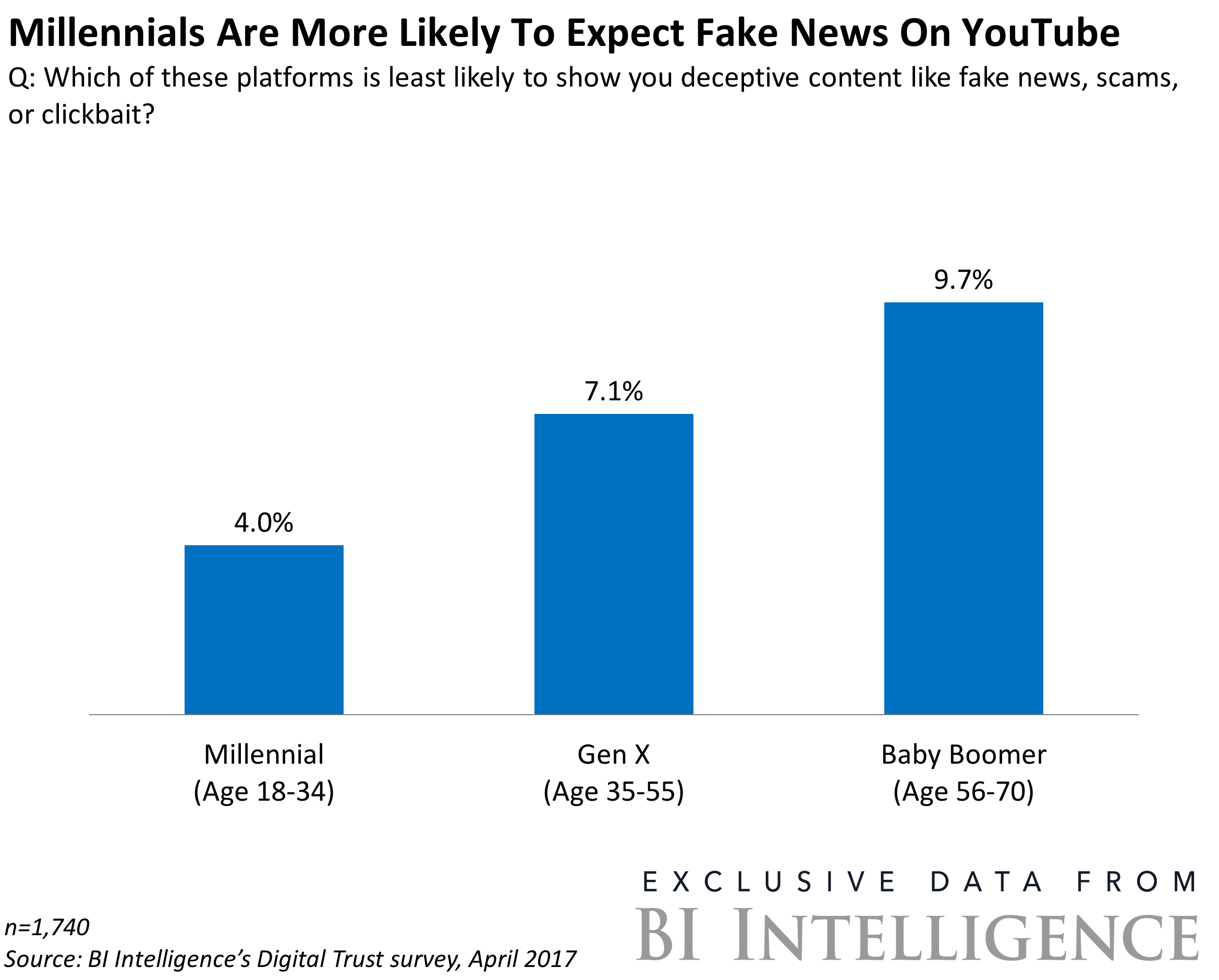

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025 -

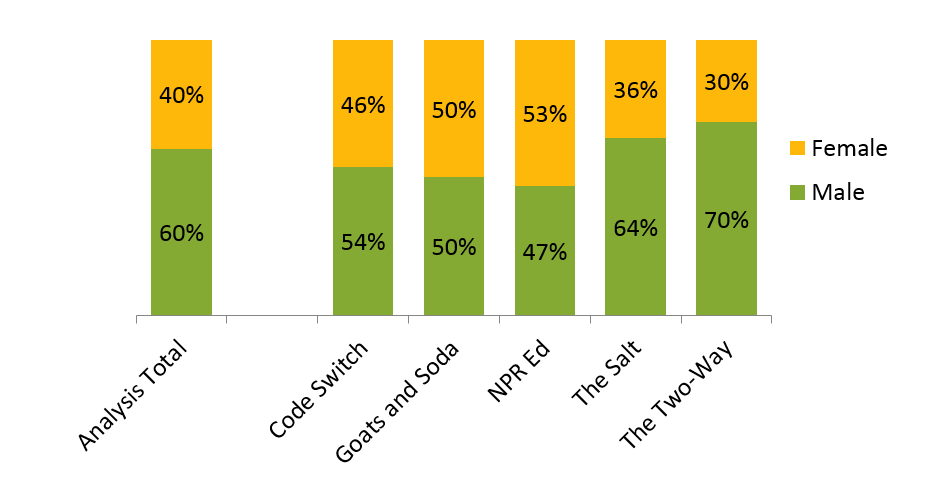

How Npr Explains You Tubes Expanding Older Adult User Base

Apr 29, 2025

How Npr Explains You Tubes Expanding Older Adult User Base

Apr 29, 2025 -

Is You Tube Becoming A Senior Destination Npr Explores The Shift

Apr 29, 2025

Is You Tube Becoming A Senior Destination Npr Explores The Shift

Apr 29, 2025 -

The Rise Of Older You Tube Users Data And Insights From Npr

Apr 29, 2025

The Rise Of Older You Tube Users Data And Insights From Npr

Apr 29, 2025 -

Analyzing You Tubes Growth Among Older Demographics An Npr Perspective

Apr 29, 2025

Analyzing You Tubes Growth Among Older Demographics An Npr Perspective

Apr 29, 2025