Financing 270MWh Battery Energy Storage Systems (BESS) In Belgium's Merchant Market

Table of Contents

Understanding the Belgian Merchant Energy Market and its Impact on BESS Financing

The Role of BESS in the Belgian Energy Transition

Belgium, like many EU nations, is committed to ambitious renewable energy targets. The intermittent nature of solar and wind power necessitates effective energy storage solutions to ensure grid stability and reliability. BESS plays a crucial role in this energy transition by:

- Increased grid stability: BESS can quickly respond to fluctuations in renewable energy generation, preventing grid instability and blackouts.

- Improved frequency regulation: BESS provides ancillary services, helping to maintain the frequency of the electricity grid within acceptable limits.

- Peak demand shaving: BESS can discharge during peak demand periods, reducing the strain on the electricity grid and lowering peak electricity prices.

- Arbitrage opportunities: BESS can buy energy at low prices and sell it at higher prices, generating revenue through arbitrage trading.

Characteristics of the Belgian Merchant Market

The Belgian electricity market operates on a merchant model, meaning electricity is bought and sold on a competitive basis. This presents both opportunities and challenges for BESS projects:

- Price volatility: Electricity prices in the merchant market can fluctuate significantly, impacting the profitability of BESS operations.

- Intraday trading: The ability to participate in intraday markets allows BESS operators to optimize their revenue streams by responding to real-time price changes.

- Ancillary services markets: BESS can provide ancillary services, such as frequency regulation and voltage support, generating additional revenue streams.

- Potential revenue streams from frequency regulation and capacity markets: Participation in these markets can provide a stable and predictable revenue source, mitigating the impact of price volatility.

Regulatory Landscape and Incentives for BESS Deployment

The Belgian government has implemented various regulations and incentives to encourage BESS deployment:

- Tax credits: Tax incentives may be available for investments in BESS projects, reducing the overall capital cost.

- Subsidies: Direct subsidies or grants may be available through regional or national programs designed to support renewable energy integration.

- Feed-in tariffs (if applicable): Although not always the case in merchant markets, specific feed-in tariffs for energy storage might exist.

- Permitting processes: Navigating the permitting and regulatory processes is crucial for timely project deployment. Understanding the timelines and requirements is vital for successful project financing.

Exploring Financing Options for 270MWh BESS Projects in Belgium

Equity Financing

Securing equity financing is a key aspect for large-scale BESS projects. This can come from several sources:

- Private equity: Private equity firms specialize in investing in high-growth sectors, including renewable energy and energy storage.

- Venture capital: Venture capital funds are often involved in early-stage projects with high growth potential.

- Strategic investors: Utilities, energy companies, or industrial players might invest strategically in BESS projects to secure energy supply or gain access to new technologies.

Advantages: Strong financial backing, potential for expertise and industry connections. Disadvantages: Loss of control, dilution of ownership.

Debt Financing

Debt financing provides a substantial portion of the capital required for BESS projects.

- Bank loans: Commercial banks offer various loan products suitable for financing infrastructure projects.

- Green bonds: These bonds are specifically designed to finance environmentally friendly projects, often attracting a wider investor base.

- Project finance: This involves structuring the financing around the specific cash flows of the BESS project, often involving multiple lenders and equity investors.

Bullet points: Different lenders, loan structuring, loan covenants (agreements specifying conditions of the loan), credit ratings influence interest rates.

Hybrid Financing Models

Blending equity and debt financing is a common approach:

- Optimizing capital structure: Combining equity and debt minimizes risk and maximizes return on investment.

- Reducing reliance on any single source of funding: Diversification mitigates risk.

- Attracting a wider range of investors: Different investors might prefer equity or debt.

Public Funding and Grants

Securing public funding is vital for many large-scale projects:

- EU funds: The European Union offers various funding programs to support renewable energy projects.

- Regional subsidies: Regional governments often provide incentives to stimulate economic development and support renewable energy initiatives.

- Research grants: Grants may be available for research and development related to BESS technologies.

Due Diligence and Risk Mitigation in BESS Financing

Technological Risk Assessment

Thorough due diligence is crucial before financing a BESS project:

- Battery technology selection: Choosing a reliable and efficient battery technology is paramount.

- Warranty provisions: Strong warranties from the battery supplier are essential to mitigate technological risks.

- Performance testing: Independent testing verifies the performance and reliability of the BESS system.

- Independent technical due diligence: Employing experts to conduct an independent review is critical.

Market Risk Analysis

Understanding market risks is essential for successful financing:

- Price forecasting: Accurate electricity price forecasting is critical to assess the potential profitability of the BESS project.

- Hedging strategies: Employing hedging instruments can mitigate the risk of price volatility.

- Revenue diversification: Diversifying revenue streams through ancillary services reduces reliance on energy arbitrage.

Regulatory and Policy Risk

Changes in regulations and policies can affect project viability:

- Policy stability analysis: Analyzing the stability of the regulatory environment is critical.

- Scenario planning: Developing various scenarios to account for potential changes in regulations and policies.

- Legal due diligence: Thorough legal due diligence ensures compliance with all relevant regulations.

Conclusion: Securing Funding for Your 270MWh BESS Project in Belgium's Merchant Market

Financing a 270MWh BESS project in Belgium's merchant market requires a comprehensive and well-structured financial plan. This involves careful consideration of equity and debt financing options, leveraging potential public funding, and performing thorough due diligence to mitigate various risks. The Belgian market presents significant opportunities for BESS deployment, but navigating the complexities of financing requires expertise and a strategic approach. By understanding the regulatory landscape, market dynamics, and available financing avenues, developers can secure the necessary capital to bring their projects to fruition and contribute to Belgium's energy transition. Contact our team of experts today to discuss your financing strategy for your 270MWh BESS project in Belgium. [Link to contact information/website]

Featured Posts

-

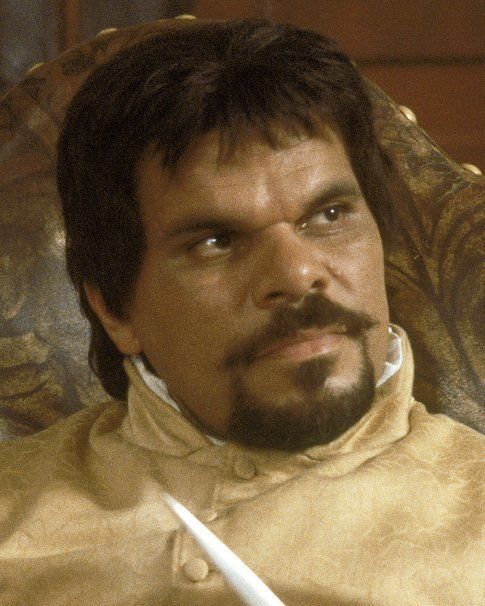

Review The Count Of Monte Cristo A Masterpiece Of Revenge

May 04, 2025

Review The Count Of Monte Cristo A Masterpiece Of Revenge

May 04, 2025 -

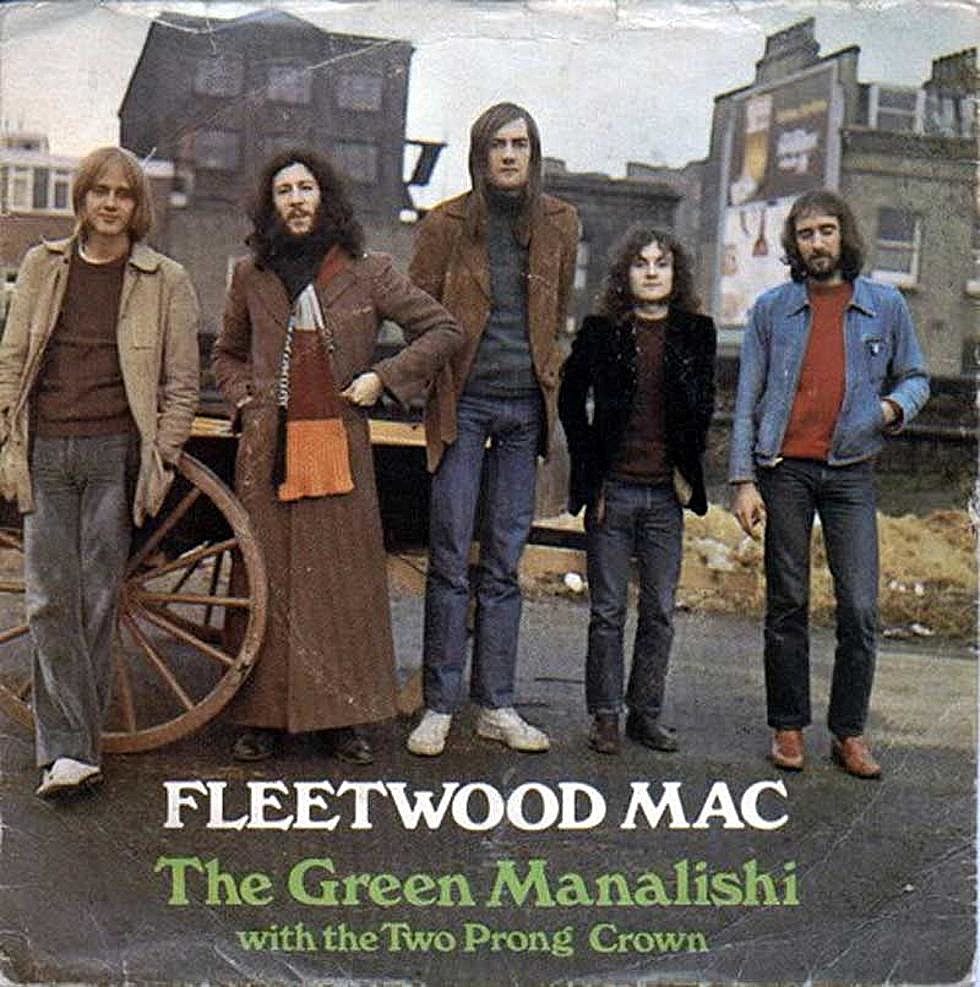

How Peter Green Shaped Fleetwood Macs Identity With 96 1 The Rocket

May 04, 2025

How Peter Green Shaped Fleetwood Macs Identity With 96 1 The Rocket

May 04, 2025 -

A Critical Look At The Count Of Monte Cristo Story Characters And Legacy

May 04, 2025

A Critical Look At The Count Of Monte Cristo Story Characters And Legacy

May 04, 2025 -

Increased Training Intensity For Ajagba Before Bakole Match

May 04, 2025

Increased Training Intensity For Ajagba Before Bakole Match

May 04, 2025 -

Political Responsibility In New Caledonia Valls Third Trip

May 04, 2025

Political Responsibility In New Caledonia Valls Third Trip

May 04, 2025