Finding Stability: Microsoft Among Software Stocks In Turbulent Times

Table of Contents

Microsoft's Diversified Revenue Streams

Microsoft's remarkable stability stems largely from its impressively diversified revenue streams. Unlike companies heavily reliant on a single product or market segment, Microsoft's portfolio mitigates risk and provides resilience against economic downturns.

Cloud Computing (Azure)

Azure, Microsoft's cloud computing platform, is a significant contributor to the company's revenue and boasts immense growth potential. It competes directly with giants like Amazon Web Services (AWS) and Google Cloud, yet Azure consistently gains market share, fueled by its strong integration with other Microsoft products and its robust feature set.

- Market share: While trailing AWS, Azure's market share is steadily increasing, reflecting strong growth and adoption.

- Growth rate: Azure's revenue growth consistently outpaces many other cloud providers, demonstrating its ongoing success.

- Key features: Azure offers a comprehensive suite of cloud services, including compute, storage, networking, and AI, appealing to a wide range of businesses.

- Competitive landscape: While competition is fierce, Azure's strong integration within the Microsoft ecosystem provides a significant competitive advantage.

Productivity and Business Processes (Office 365, Dynamics 365)

Microsoft's subscription-based Office 365 and Dynamics 365 offerings contribute substantially to its recurring revenue. This recurring revenue model provides exceptional stability, as these subscriptions remain relatively consistent even during economic slowdowns. Businesses are less likely to cancel essential productivity and business management tools during tough times.

- Subscription growth: The number of Office 365 and Dynamics 365 subscribers continues to grow steadily, indicating strong demand and market penetration.

- Market penetration: These products hold a dominant position in the market for business productivity and enterprise resource planning (ERP) software.

- Enterprise adoption: Large enterprises heavily rely on these suites, ensuring a consistent revenue stream from key accounts.

Gaming (Xbox)

Microsoft's gaming segment, encompassing the Xbox console and services like Xbox Game Pass, adds another layer of diversification. While cyclical, the gaming industry shows remarkable resilience, and Xbox Game Pass's subscription model offers further stability. Expansion into mobile gaming further enhances growth prospects.

- Console sales: While console sales can fluctuate, Xbox's market presence remains strong.

- Game Pass subscriber numbers: The growing number of Xbox Game Pass subscribers represents a significant and recurring revenue stream.

- Expansion into mobile gaming: Microsoft's strategic moves into mobile gaming broaden its reach and potential audience.

Other Revenue Streams (LinkedIn, Advertising)

LinkedIn, the professional networking platform, and Microsoft's advertising business contribute further to the company's diversified income. These segments demonstrate relative stability, adding to the overall resilience of Microsoft's financial performance.

- LinkedIn user growth: LinkedIn's continued user growth ensures sustained revenue from premium subscriptions and advertising.

- Advertising revenue trends: Microsoft's advertising revenue demonstrates resilience compared to some more volatile ad-dependent companies.

Strong Financial Performance and Stability

Beyond diversification, Microsoft's inherent financial strength significantly contributes to its stability as a software stock.

Consistent Profitability

Microsoft boasts a long history of consistent profitability and robust cash flow generation, even during economic downturns. This track record reflects the company's efficient operations and enduring market position.

- Recent financial results: Microsoft consistently reports strong earnings, showcasing its financial health.

- Dividend payouts: Microsoft's regular dividend payouts demonstrate its commitment to returning value to shareholders.

- Debt levels: Microsoft maintains relatively low debt levels, further enhancing its financial stability.

Robust Balance Sheet

Microsoft's balance sheet is exceptionally strong, characterized by significant cash reserves and a healthy debt-to-equity ratio. This financial fortitude allows the company to weather economic storms and pursue strategic opportunities.

- Cash reserves: Microsoft possesses substantial cash reserves, providing a financial cushion during periods of uncertainty.

- Debt-to-equity ratio: Microsoft's low debt-to-equity ratio signifies a strong financial position.

- Credit rating: Microsoft enjoys a high credit rating, reflecting its excellent financial health and low risk profile.

Long-Term Growth Potential

Microsoft's stability is not solely based on its current performance; it also possesses significant long-term growth potential.

AI and Innovation

Microsoft is heavily investing in artificial intelligence (AI) and other emerging technologies, positioning itself for continued growth and a strong competitive advantage.

- Investments in AI research: Microsoft dedicates substantial resources to AI research and development.

- Partnerships with AI companies: Strategic partnerships enhance Microsoft's AI capabilities and market reach.

- Potential applications of AI in Microsoft products: AI integration across Microsoft's product portfolio promises significant growth opportunities.

Strategic Acquisitions

Strategic acquisitions have further solidified Microsoft's position and diversified its offerings, contributing to its long-term growth prospects.

- Examples of significant acquisitions and their impact on Microsoft's business: Several acquisitions have expanded Microsoft's capabilities and market reach, driving revenue growth.

Comparison to Other Software Stocks

Compared to other major software companies, Microsoft demonstrates superior stability during market uncertainty. Its diversified revenue streams, strong financial performance, and robust balance sheet give it a significant edge.

- Comparative analysis of stock performance, revenue diversification, and financial health: Analyzing Microsoft against peers highlights its relative stability and resilience.

Conclusion

Microsoft's diversified revenue streams, strong financial performance, and substantial long-term growth potential make it a compelling choice for investors seeking stability in the software stock market. Its resilience in turbulent market conditions is undeniable. Consider Microsoft stock as part of a diversified investment portfolio to enhance stability during uncertain times. Learn more about investing in Microsoft and research Microsoft's financial performance to make informed investment decisions. Microsoft stock represents a strong option for those seeking stable investments within the often-volatile world of software stocks.

Featured Posts

-

House Gops Trump Tax Plan A Comprehensive Overview

May 15, 2025

House Gops Trump Tax Plan A Comprehensive Overview

May 15, 2025 -

Dodgers Defeat Giants Freeman Kim Hit Key Home Runs

May 15, 2025

Dodgers Defeat Giants Freeman Kim Hit Key Home Runs

May 15, 2025 -

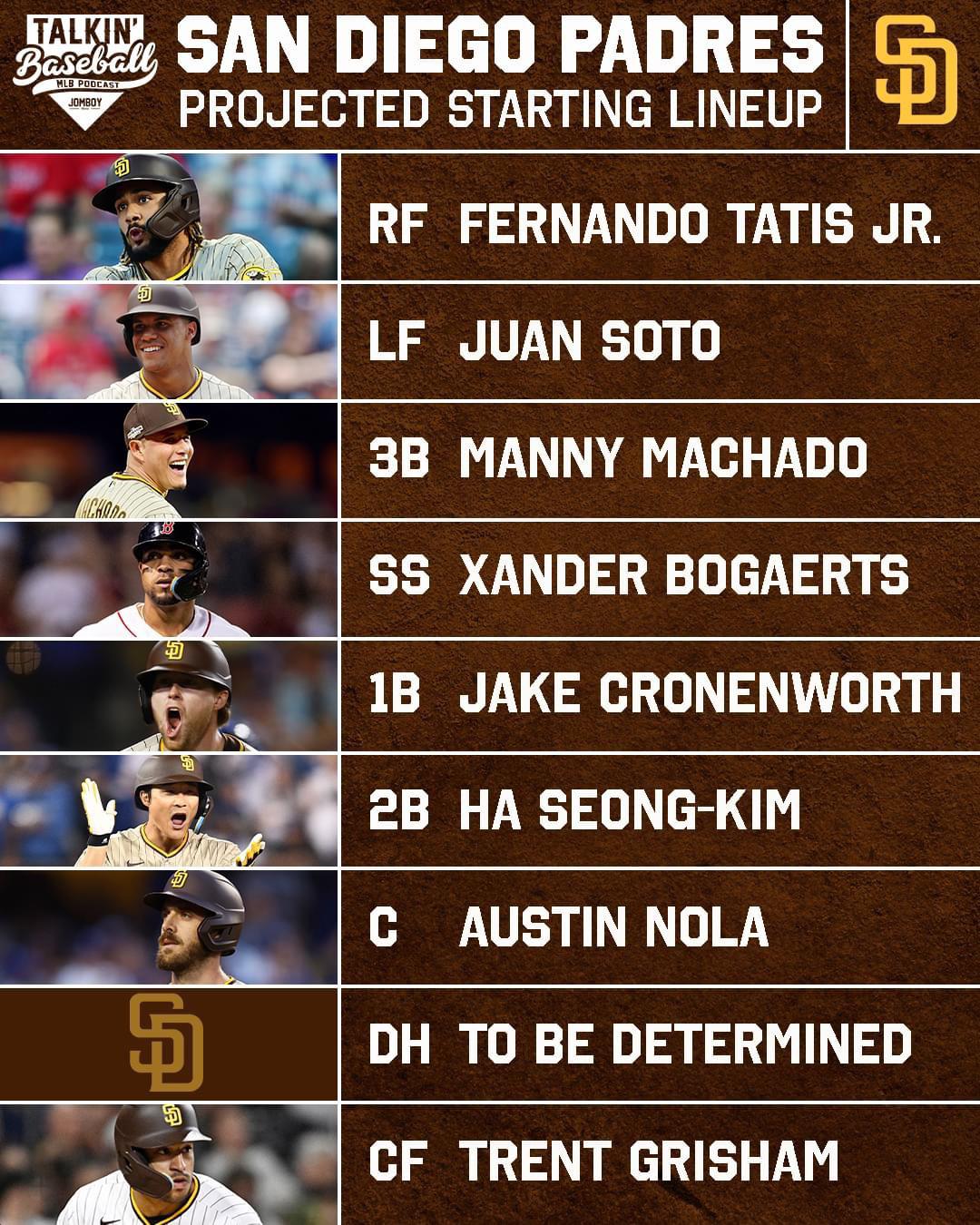

Gurriels Pinch Hit Wins It For Padres Against Braves

May 15, 2025

Gurriels Pinch Hit Wins It For Padres Against Braves

May 15, 2025 -

First To 10 Wins Padres Top Athletics In Mlb

May 15, 2025

First To 10 Wins Padres Top Athletics In Mlb

May 15, 2025 -

Analysis Gordon Ramsays Perspective On Chandlers Ufc Loss To Pimblett

May 15, 2025

Analysis Gordon Ramsays Perspective On Chandlers Ufc Loss To Pimblett

May 15, 2025