Finding The Best Direct Payday Loans With Bad Credit: A Guide To Approval

Table of Contents

Understanding Direct Payday Loans and Bad Credit

Direct payday loans are short-term, small-dollar loans designed to bridge the gap until your next payday. Their advantages include convenience and speed; you can often receive funds within 24 hours of approval. However, obtaining a payday loan with bad credit presents challenges. Lenders perceive borrowers with poor credit history as higher risk, leading to higher interest rates and stricter requirements.

- Direct Lender vs. Broker: A direct lender provides the loan directly, while a broker acts as an intermediary, connecting you with multiple lenders. Using a direct lender streamlines the process.

- Credit Score Impact: Your credit score significantly influences your approval odds and the interest rate offered. A lower credit score generally results in higher interest rates and potentially loan denial.

- Responsible Borrowing: Before applying for any payday loan, understand the terms, fees, and repayment schedule. Borrow responsibly and only take out what you can afford to repay.

Factors Affecting Your Approval Chances for Payday Loans with Bad Credit

Several factors influence your approval chances for payday loans, even with bad credit. Lenders meticulously assess your financial stability to minimize their risk.

- Income Verification: Lenders require proof of regular income to ensure you can repay the loan. This typically involves providing pay stubs or bank statements.

- Employment History: A stable employment history demonstrates your ability to consistently generate income and meet repayment obligations.

- Debt-to-Income Ratio: Lenders examine your debt-to-income ratio (DTI), comparing your monthly debt payments to your monthly income. A high DTI suggests you may struggle to manage additional debt.

- Accurate Information: Providing accurate and complete information is crucial. Inaccuracies or omissions can lead to immediate rejection.

Bullet Points:

- Stable Income and Employment: Consistent employment with a verifiable income source is paramount.

- Existing Debt: High levels of existing debt can negatively impact your approval chances.

- Credit Report and Score: Your credit report and score are key factors in the lender's decision-making process.

- Checking Account: Most lenders require access to your checking account for direct deposit and repayment.

Finding Reputable Direct Lenders for Bad Credit Payday Loans

Navigating the payday loan landscape requires caution. Not all lenders operate ethically. Research is key to finding reputable direct lenders who prioritize fair lending practices.

- Research and Compare: Don't settle for the first lender you find. Compare interest rates, fees, and terms from multiple lenders.

- Avoid Predatory Lenders: Be wary of lenders offering unrealistically low interest rates or hidden fees. These are often predatory lenders aiming to exploit vulnerable borrowers.

Bullet Points:

- Identifying Legitimate Lenders: Look for lenders with valid licenses, positive customer reviews, and transparent terms and conditions.

- Comparing Interest Rates and Fees: Carefully compare the Annual Percentage Rate (APR) and all associated fees to find the most affordable option.

- Resources for Finding Reputable Lenders: Utilize resources like the Consumer Financial Protection Bureau (CFPB) website and online review sites to research lenders before applying.

Tips for Increasing Your Chances of Approval for a Payday Loan with Bad Credit

Improving your chances of approval involves proactive steps to demonstrate your financial responsibility.

- Improve Credit Score: While immediate improvement is unlikely, working towards a better credit score demonstrates commitment to financial health. This involves paying bills on time and reducing existing debt.

- Strong Supporting Documentation: Gather all necessary documentation, such as pay stubs, bank statements, and proof of address, to support your application.

Bullet Points:

- Steps to Improve Credit Score: Pay all bills on time, reduce high credit utilization, and consider credit counseling.

- Gathering Necessary Documentation: Prepare all required documents in advance to expedite the application process.

- Negotiating Loan Terms: While not always possible, attempting to negotiate terms with the lender could potentially increase your chances of approval.

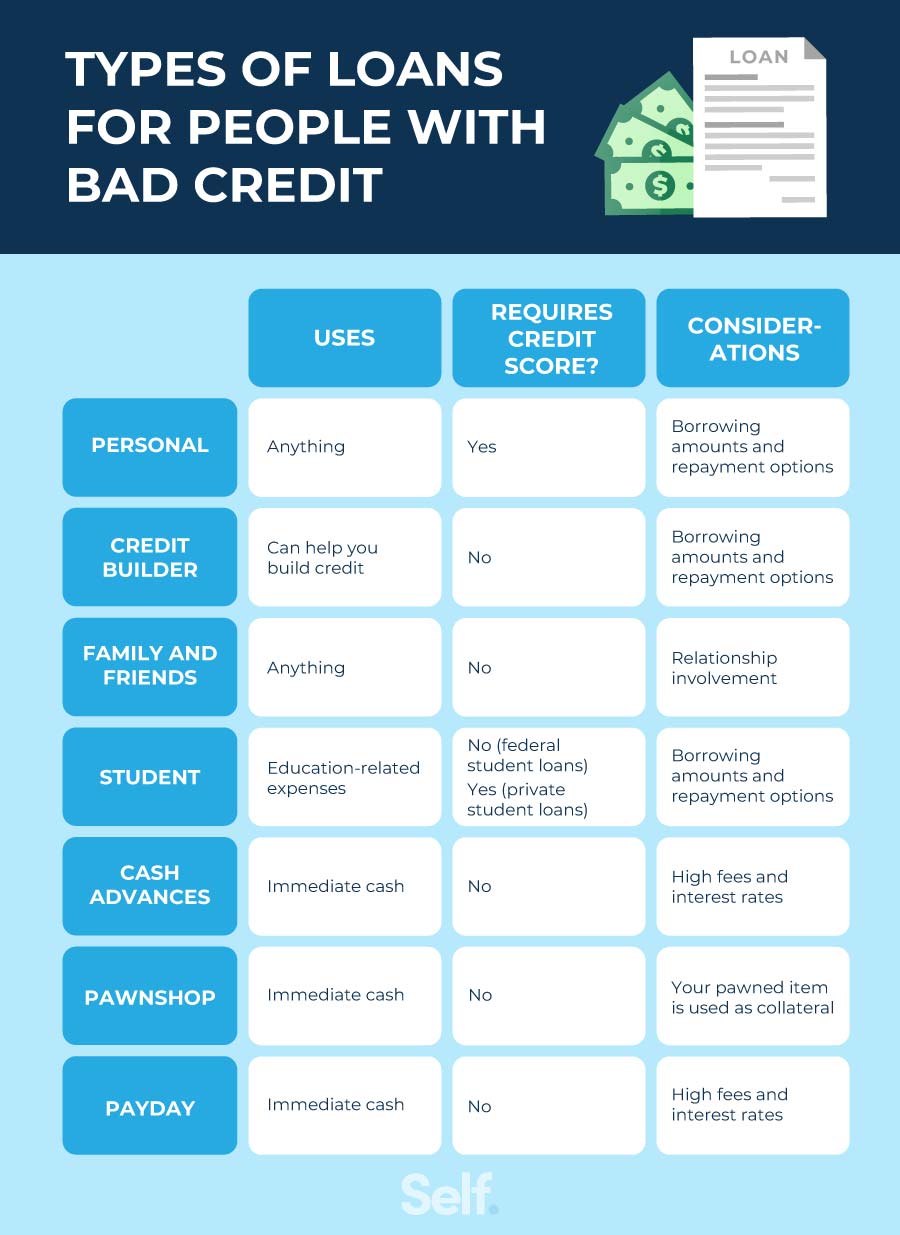

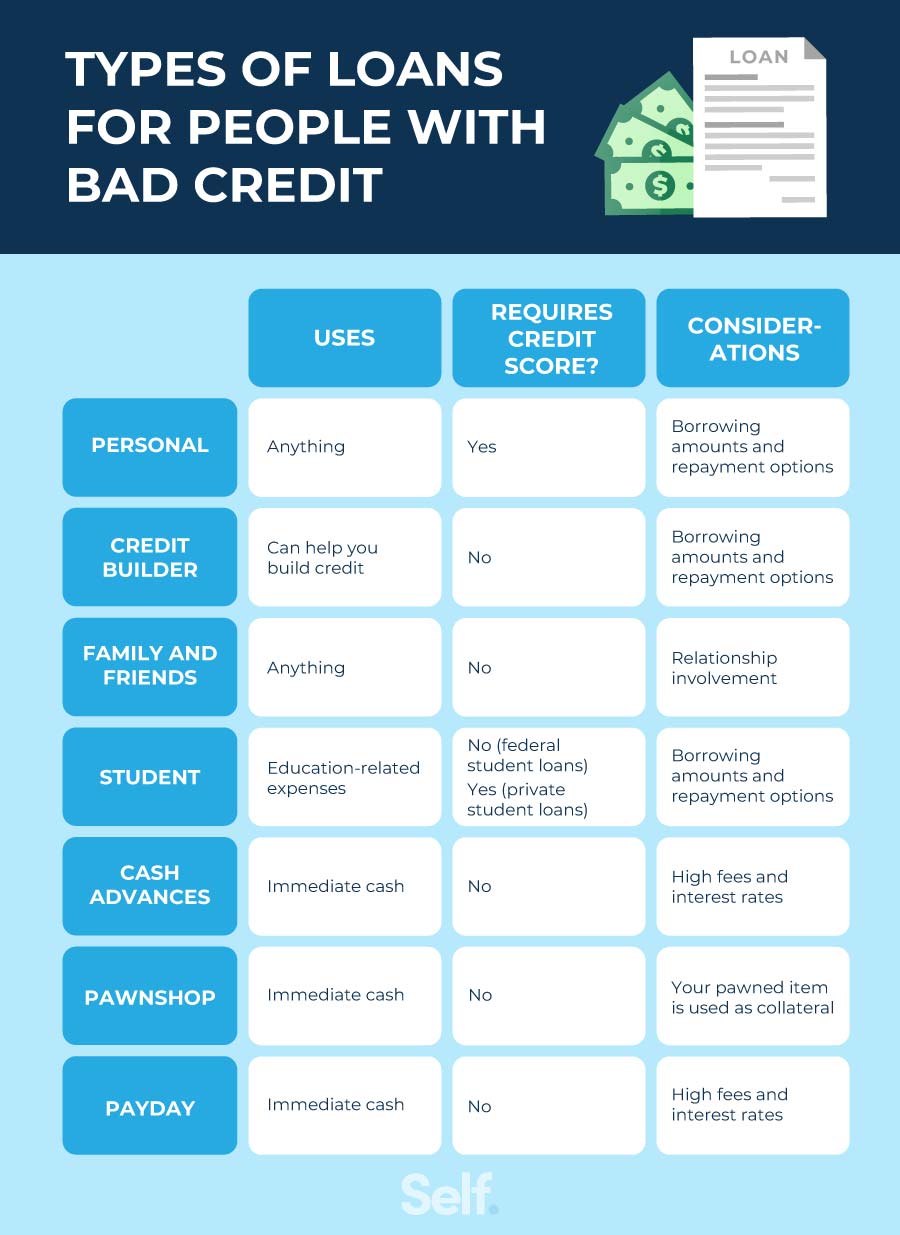

- Exploring Alternative Borrowing Options: If rejected, explore alternative borrowing options like small personal loans from credit unions or asking family and friends for assistance.

Conclusion

Securing a direct payday loan with bad credit requires careful planning and research. By understanding the factors affecting your approval chances, choosing reputable lenders, and improving your financial standing, you can significantly increase your odds of success. Remember to always borrow responsibly and only take out a loan amount you can comfortably repay. Don't let bad credit hold you back – take control of your finances and explore your options for finding the best direct payday loans for your specific needs. Start your search for reliable direct payday loans today and regain your financial stability.

Featured Posts

-

Analyzing Kanye Wests Influence The Bianca Censori Case

May 28, 2025

Analyzing Kanye Wests Influence The Bianca Censori Case

May 28, 2025 -

Is Jennifer Lopez Hosting The 2025 American Music Awards

May 28, 2025

Is Jennifer Lopez Hosting The 2025 American Music Awards

May 28, 2025 -

Euro Millions Winner Irish Shop Sells Winning Ticket Urgent Appeal

May 28, 2025

Euro Millions Winner Irish Shop Sells Winning Ticket Urgent Appeal

May 28, 2025 -

Kyle Stowers Walk Off Grand Slam Fuels Marlins Victory

May 28, 2025

Kyle Stowers Walk Off Grand Slam Fuels Marlins Victory

May 28, 2025 -

Bianca Censoris Bold Fashion Choices Minimalist Style

May 28, 2025

Bianca Censoris Bold Fashion Choices Minimalist Style

May 28, 2025