Finding The Real Safe Bet: A Practical Guide To Secure Investing

Table of Contents

Understanding Your Risk Tolerance

Before diving into any investment, honestly evaluate your current financial health. Understanding your risk tolerance is crucial for making sound investment decisions. A conservative investor might prioritize capital preservation, while a more aggressive investor may be comfortable with higher risk for potentially higher returns. This understanding forms the bedrock of a successful secure investment strategy.

Assessing Your Financial Situation

Before you even consider investment options, you need a clear picture of your current financial health. This involves:

- Current income: What is your regular monthly or annual income?

- Expenses: Track your spending to understand where your money is going.

- Debts: List all outstanding debts (credit cards, loans, etc.) and their interest rates.

- Existing savings: How much money do you currently have in savings and emergency funds?

- Short-term financial goals: What are your goals within the next 1-3 years (e.g., down payment, emergency fund)?

- Long-term financial goals: What are your goals beyond 3 years (e.g., retirement, children's education)?

Understanding your financial situation allows you to determine your risk tolerance – your comfort level with the possibility of losing some or all of your investment. A thorough financial assessment is the first step towards secure investing. Keywords: Risk tolerance, financial assessment, investment goals, risk management.

Defining Your Investment Timeline

Your investment timeline significantly impacts your investment choices. The time horizon dictates the level of risk you can comfortably take.

- Short-term goals (1-3 years): These require lower-risk, easily accessible investments to ensure you can access your money when needed. Examples include emergency funds or a down payment.

- Medium-term goals (3-10 years): You can tolerate slightly more risk for potentially higher returns. Think education savings or a vacation fund.

- Long-term goals (10+ years): Long-term goals, like retirement, allow for more aggressive strategies with a higher potential for growth.

Matching your investment strategy to your timeline is crucial for secure investing success. Keywords: Investment timeline, short-term investments, long-term investments, investment strategy.

Diversification: Spreading Your Risk

A core principle of secure investing is diversification. Don't put all your eggs in one basket! Diversifying across various asset classes helps mitigate risk and smooth out market fluctuations.

The Importance of Asset Allocation

Asset allocation is the process of dividing your investments across different asset classes. This includes:

- Stocks: Represent ownership in companies and offer potential for high growth but also higher risk.

- Bonds: Debt instruments issued by governments or corporations, generally considered less risky than stocks.

- Real estate: Investing in property can provide income and potential appreciation, but it's less liquid than other assets.

- Mutual funds: Professionally managed portfolios that invest in a diversified range of assets.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but traded on exchanges like stocks.

- Alternative investments: Less traditional assets such as commodities, private equity, or hedge funds.

A well-diversified portfolio helps to reduce the impact of losses in any single asset class. Keywords: Diversification, asset allocation, portfolio diversification, risk mitigation, asset classes.

Choosing the Right Mix

The ideal asset allocation is highly personalized and depends on your risk tolerance and investment timeline.

- Consider your risk tolerance: A more conservative investor might allocate a larger portion to bonds and less to stocks.

- Consider your investment timeline: Long-term investors can generally tolerate more risk than short-term investors.

- Consult a financial advisor: A professional can help you create a personalized asset allocation strategy tailored to your specific circumstances and financial goals.

Finding the right mix is a crucial element in crafting a secure investment strategy that aligns with your personal risk profile. Keywords: Asset allocation strategy, portfolio management, risk-adjusted return, financial advisor.

Secure Investment Options

Secure investing offers a range of options, categorized by their risk levels.

Low-Risk Investments

These options prioritize capital preservation over high returns. They are suitable for investors prioritizing safety and stability.

- High-yield savings accounts: Offer higher interest rates than regular savings accounts.

- Certificates of Deposit (CDs): Fixed-term deposits offering a fixed interest rate.

- Government bonds: Generally considered very low-risk due to the backing of the government.

- Money market accounts: Similar to savings accounts but often offer slightly higher interest rates.

These low-risk investments are ideal for short-term goals or a portion of your long-term portfolio dedicated to preserving capital. Keywords: Low-risk investments, capital preservation, high-yield savings accounts, CDs, government bonds.

Moderate-Risk Investments

These options provide a balance between risk and reward, offering potential for growth while maintaining a reasonable level of safety.

- Index funds: Track a specific market index, providing broad diversification at a low cost.

- Dividend-paying stocks: Offer regular income streams from dividend payments, in addition to potential capital appreciation.

- Balanced mutual funds: Invest in a mix of stocks and bonds, aiming for a balance between growth and stability.

Moderate-risk investments can form a significant portion of a well-diversified portfolio, offering a path to growth while managing risk effectively. Keywords: Moderate-risk investments, index funds, dividend stocks, mutual funds, balanced portfolio.

Conclusion

Finding the "real safe bet" in investing involves a thorough understanding of your financial situation, risk tolerance, and investment timeline. By diversifying your portfolio across different asset classes and selecting investments aligned with your goals, you can build a secure and potentially profitable investment strategy. Remember to seek professional advice if needed. Don't hesitate to start building your secure investment plan today – take control of your financial future by exploring different options for secure investing and building a portfolio that reflects your unique needs and aspirations.

Featured Posts

-

Harry Styles New Mustache A 70s Vibe In London

May 09, 2025

Harry Styles New Mustache A 70s Vibe In London

May 09, 2025 -

Melanie Griffith And Siblings Support Dakota Johnson At Movie Premiere

May 09, 2025

Melanie Griffith And Siblings Support Dakota Johnson At Movie Premiere

May 09, 2025 -

Jeanine Pirro Fact Checked Aocs Response On Fox News

May 09, 2025

Jeanine Pirro Fact Checked Aocs Response On Fox News

May 09, 2025 -

Representative Ocasio Cortez Criticizes Trumps Appearance On Fox News

May 09, 2025

Representative Ocasio Cortez Criticizes Trumps Appearance On Fox News

May 09, 2025 -

Harry Styles Snl Impression Backlash The Singers Response

May 09, 2025

Harry Styles Snl Impression Backlash The Singers Response

May 09, 2025

Latest Posts

-

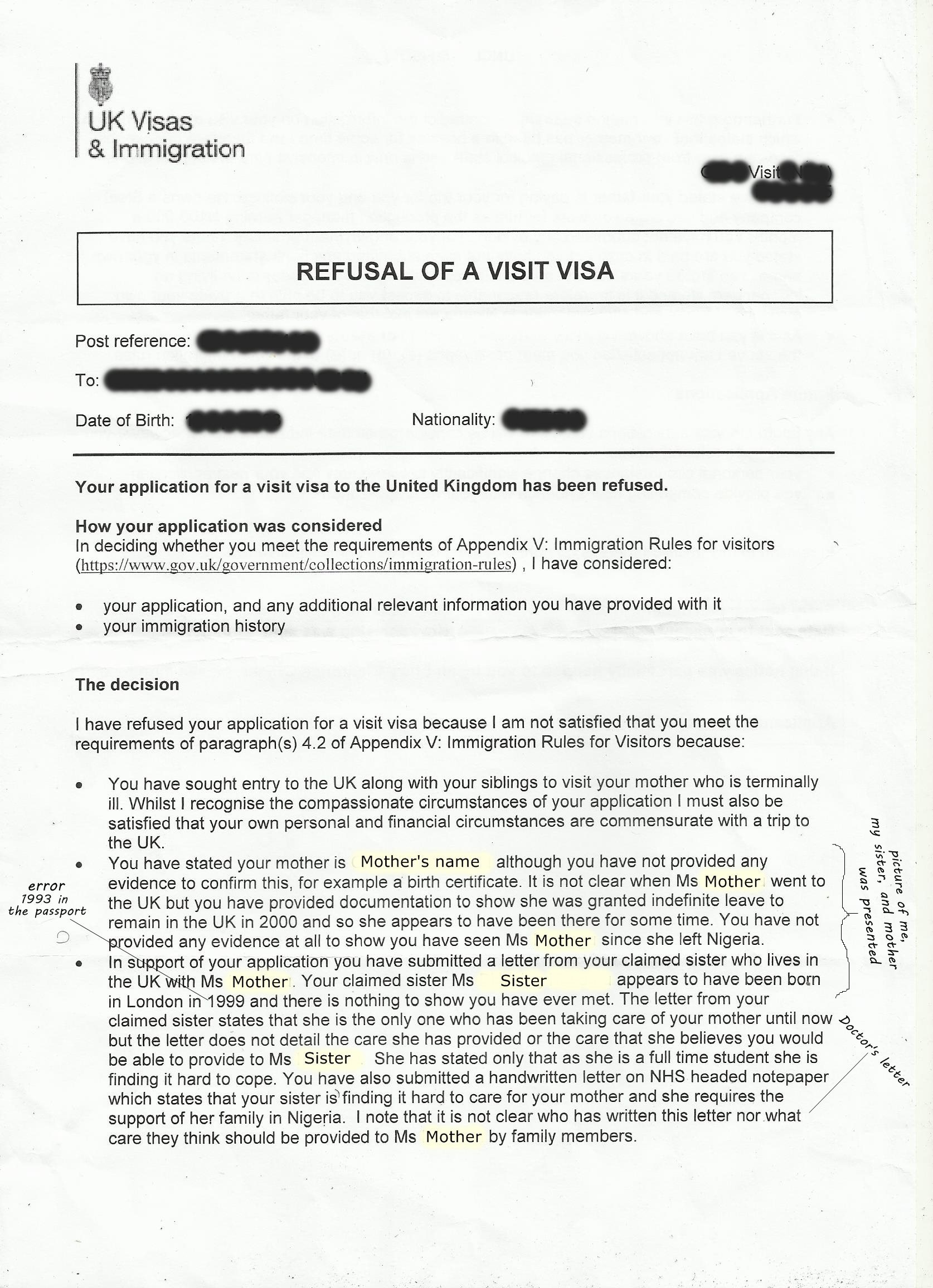

Uk Asylum Crackdown Targets Migrants From Three Countries

May 09, 2025

Uk Asylum Crackdown Targets Migrants From Three Countries

May 09, 2025 -

Updated Uk Immigration Policy Emphasis On English Language Skills

May 09, 2025

Updated Uk Immigration Policy Emphasis On English Language Skills

May 09, 2025 -

New Report Potential Changes To Uk Visa Application Process For Select Nationalities

May 09, 2025

New Report Potential Changes To Uk Visa Application Process For Select Nationalities

May 09, 2025 -

Uk Visa Application Changes Potential Nationality Based Restrictions

May 09, 2025

Uk Visa Application Changes Potential Nationality Based Restrictions

May 09, 2025 -

New Uk Immigration Rules English Language Fluency For Residency

May 09, 2025

New Uk Immigration Rules English Language Fluency For Residency

May 09, 2025