Fiscal Responsibility: A Missing Element In Canada's Liberal Agenda

Table of Contents

Increased Government Spending and Debt Accumulation

The Liberal government's approach to fiscal policy has been characterized by significant increases in government spending, leading to a burgeoning national debt. This unsustainable trajectory jeopardizes Canada's long-term economic health.

Analysis of Recent Budgetary Allocations

Several recent budgetary allocations demonstrate a lack of fiscal prudence. For example, the substantial increase in spending on social programs, while laudable in intent, has not been accompanied by corresponding revenue increases or sufficient cost-cutting measures elsewhere. This has resulted in a widening budget deficit and a steadily increasing debt-to-GDP ratio. Independent economic analyses, such as those from the Fraser Institute, consistently highlight this growing concern.

- Specific examples of large-scale spending initiatives: The Canada Child Benefit, while popular, has contributed to increased government spending without a clear long-term plan for its sustainability. Similarly, significant investments in infrastructure projects, while necessary, need to be carefully managed to avoid cost overruns and delays.

- Comparison to spending levels under previous governments: A comparison of current spending levels with those under previous Conservative governments reveals a marked increase in the rate of debt accumulation under the current Liberal administration. This necessitates a thorough review of spending priorities and a renewed commitment to fiscal sustainability.

- Mention of independent economic analyses criticizing the government's approach: Numerous independent reports from reputable economic institutions point to the unsustainable nature of the current fiscal trajectory, warning of potential negative consequences for Canada's long-term economic outlook.

Tax Policies and their Impact on Fiscal Health

The current tax policies, while aiming for progressive taxation, haven't effectively addressed the growing need for increased revenue to offset rising government spending. This imbalance further exacerbates the problem of fiscal irresponsibility.

Evaluation of Current Tax Policies

The current tax system suffers from several inefficiencies. While claiming to be progressive, various tax loopholes and deductions disproportionately benefit higher-income earners, reducing the overall tax revenue collected. This undermines the government’s ability to fund essential public services without resorting to increased borrowing.

- Specific examples of tax policies perceived as fiscally irresponsible: Certain tax credits and deductions have been criticized for their lack of targeted effectiveness and their contribution to reduced government revenue. This lack of precision in tax policy design weakens the government's ability to manage its finances responsibly.

- Discussion of potential alternative tax policies that could improve fiscal health: Closing existing tax loopholes, implementing more effective tax collection mechanisms, and exploring alternative tax structures, such as a carbon tax, could generate significant additional revenue and improve fiscal health.

- Mention of the impact of tax policies on different income groups: A thorough review of the impact of current tax policies on various income groups is crucial to ensure equity and efficiency. A fairer and more effective tax system is essential for achieving fiscal responsibility.

Lack of Long-Term Fiscal Planning and Transparency

A glaring deficiency in the Liberal government's approach is the apparent lack of comprehensive long-term fiscal planning and transparency. Without a clear roadmap for sustainable fiscal management, Canada is adrift in a sea of escalating debt.

Critique of Long-Term Economic Projections

The government's long-term economic projections often appear overly optimistic and lack sufficient consideration of potential risks. This unrealistic assessment of future economic conditions undermines the credibility of their fiscal plans and increases the likelihood of future budget shortfalls.

- Specific examples of unrealistic assumptions in government projections: Assumptions regarding future economic growth, inflation rates, and commodity prices often seem overly rosy, failing to account for potential economic downturns or unexpected global events.

- Discussion of the lack of transparency in budgetary processes: The lack of sufficient transparency in budgetary processes prevents proper public scrutiny and accountability. This opacity hampers effective public engagement in fiscal policy debates and reduces the likelihood of informed decision-making.

- Comparison to fiscal planning in other developed nations: A comparison with fiscal planning practices in other developed countries reveals a significant gap in Canada's approach. Many other nations demonstrate a more proactive and transparent approach to long-term fiscal planning.

Consequences of Insufficient Fiscal Responsibility

The continued lack of fiscal responsibility will inevitably lead to a cascade of negative consequences for the Canadian economy.

Potential Negative Impacts on the Canadian Economy

The current fiscal trajectory poses several serious risks to Canada's economic health. These include a potential downgrade in Canada's credit rating, leading to higher borrowing costs and increased interest rates. A weakened Canadian dollar could also result, impacting both imports and exports.

- Discussion of potential impacts on investment and economic growth: High national debt and increased interest rates can discourage private investment and hinder economic growth, making it harder for Canada to compete globally.

- Mention of potential negative impacts on social programs due to budgetary constraints: The government may be forced to cut back on essential social programs due to mounting budgetary pressures, negatively impacting vulnerable populations.

- Discussion of risks to Canada's international standing: A deteriorating fiscal situation can damage Canada's international credibility and its ability to influence global affairs.

Conclusion

The evidence overwhelmingly indicates a critical lack of fiscal responsibility in the current Liberal agenda. The continued pursuit of unsustainable spending policies, coupled with ineffective tax measures and a lack of long-term planning, poses significant risks to Canada's economic future. The potential consequences – reduced credit ratings, higher interest rates, and a weakened Canadian dollar – are too severe to ignore. We must demand greater fiscal responsibility from our government. Contact your elected officials, support organizations advocating for fiscal prudence, and engage in informed political discourse to advocate for promoting fiscal responsibility and ensuring a sustainable economic future for Canada. The need for fiscal responsibility in Canada is not merely a political issue; it is a matter of safeguarding our nation's economic prosperity for generations to come.

Featured Posts

-

Meta Under Trump Zuckerbergs Strategic Challenges

Apr 24, 2025

Meta Under Trump Zuckerbergs Strategic Challenges

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025 -

Three Years Of Data Breaches Cost T Mobile A 16 Million Fine

Apr 24, 2025

Three Years Of Data Breaches Cost T Mobile A 16 Million Fine

Apr 24, 2025 -

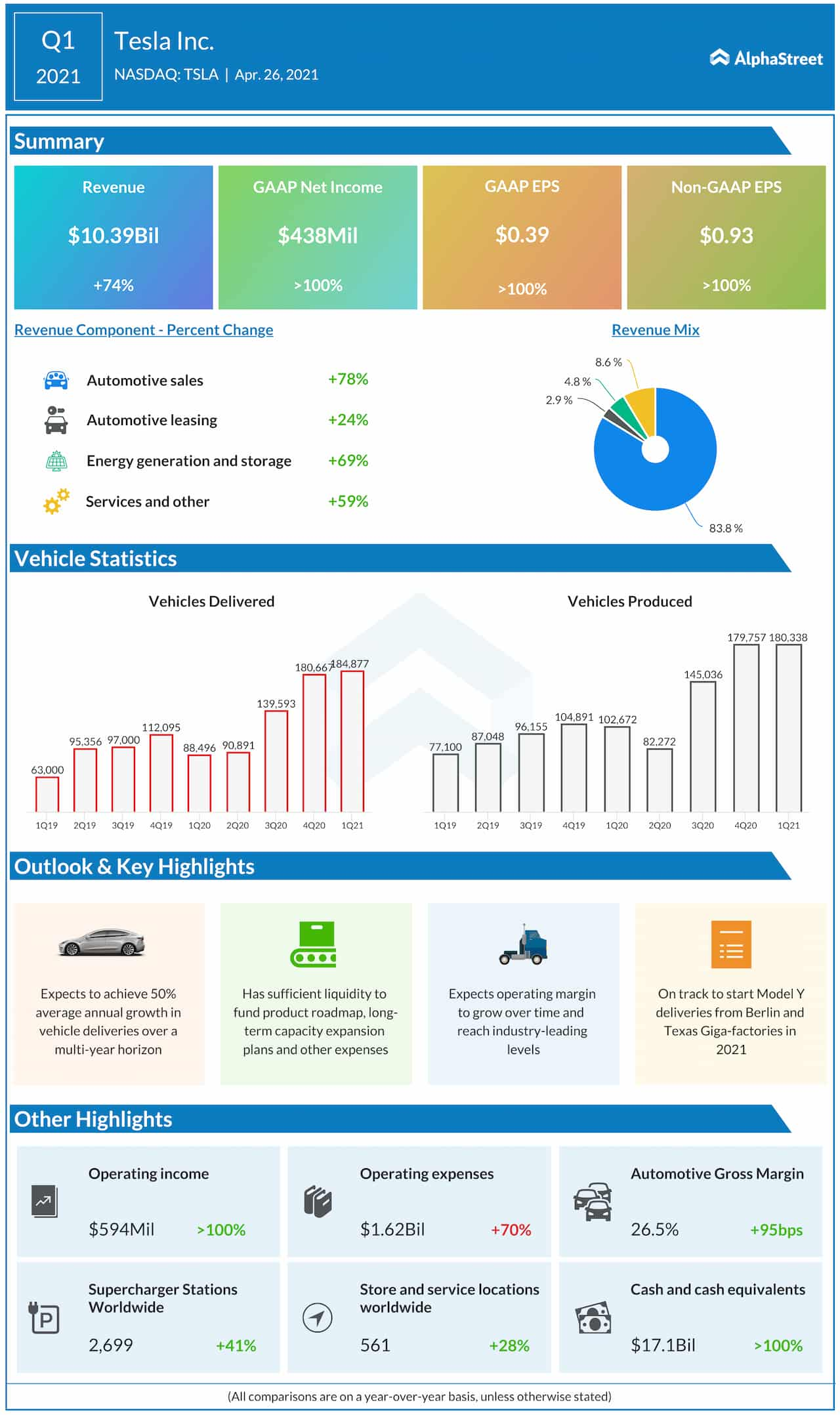

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025 -

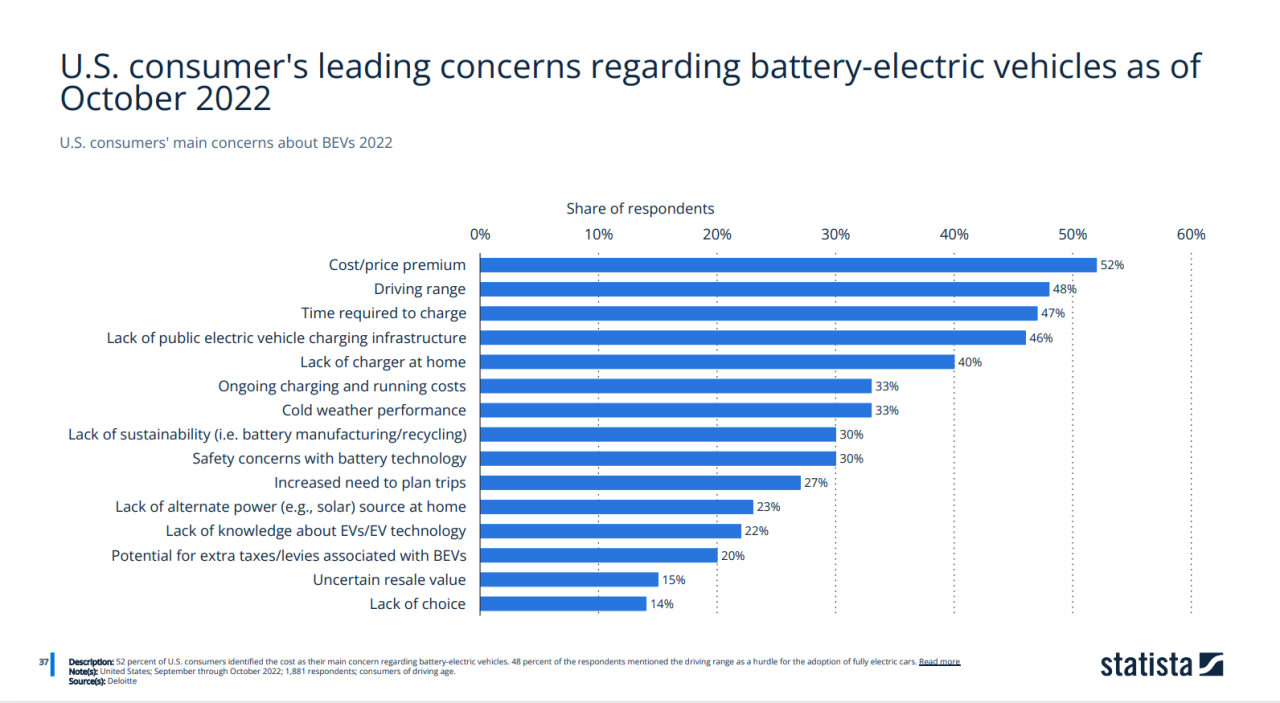

Resistance To Electric Vehicle Regulations Grows Among Car Dealers

Apr 24, 2025

Resistance To Electric Vehicle Regulations Grows Among Car Dealers

Apr 24, 2025