FIU-IND Imposes ₹5.45 Crore Penalty On Paytm Payments Bank: Money Laundering Lapses

Table of Contents

Details of the FIU-IND Penalty on Paytm Payments Bank

The Amount and Reason for the Penalty

The ₹5.45 crore penalty imposed by FIU-IND on Paytm Payments Bank reflects the severity of the identified money laundering lapses. The FIU-IND cited significant deficiencies in Paytm Payments Bank's KYC and AML compliance framework. These deficiencies represent a substantial failure to meet the regulatory requirements designed to combat financial crime in India.

- Specific shortcomings in customer due diligence processes: The investigation revealed weaknesses in verifying customer identities, potentially allowing individuals involved in illicit activities to open and operate accounts.

- Failures in reporting suspicious transactions: Paytm Payments Bank allegedly failed to adequately monitor transactions and report suspicious activity to the relevant authorities, a critical aspect of AML compliance. This failure to flag potentially illegal transactions facilitated the flow of illicit funds.

- Inadequate monitoring of high-risk accounts: The FIU-IND found that Paytm Payments Bank did not effectively monitor accounts exhibiting high-risk transaction patterns, indicating a lack of proactive risk management.

- Lack of effective internal controls: The investigation revealed significant weaknesses in Paytm Payments Bank's internal control systems, hindering the detection and prevention of money laundering activities. This points to systemic failures in their compliance program.

Paytm Payments Bank's Response to the Penalty

While the official statement from Paytm Payments Bank regarding the penalty is still awaited as of the writing of this article, we will update this section as soon as more information becomes available. This will include an analysis of their response strategy, whether they accept responsibility, intend to appeal the decision, and if they outline any corrective actions to improve their AML and KYC compliance systems.

- Summary of Paytm's official statement: (To be updated with Paytm's official response)

- Analysis of their response strategy: (To be updated with analysis of Paytm's response)

- Indication of future compliance improvements: (To be updated with information on Paytm's planned improvements)

Implications for the Fintech Industry in India

The FIU-IND's penalty imposed on Paytm Payments Bank sets a crucial precedent for other digital payment platforms and fintech companies operating within India. This decisive action emphasizes the importance of stringent AML and KYC compliance for all financial institutions, regardless of size or technological advancement.

- Increased regulatory scrutiny of fintech companies: Expect more thorough audits and inspections of fintech companies' AML and KYC procedures, as regulators strive to ensure compliance across the board.

- Potential for similar penalties against other non-compliant firms: Other financial institutions with inadequate AML/KYC frameworks should anticipate increased scrutiny and potential penalties for non-compliance. This serves as a strong warning to the entire industry.

- Increased focus on enhancing AML and KYC systems across the industry: This penalty will likely trigger investment in more robust AML/KYC systems and training programs to ensure full compliance with the prevailing regulations.

Understanding Anti-Money Laundering (AML) and Know Your Customer (KYC) Norms in India

The Importance of AML/KYC Compliance

AML/KYC compliance is vital for maintaining the integrity of India's financial system and preventing financial crimes such as money laundering and terrorist financing. Adherence to these norms is not merely a regulatory requirement but a crucial element in safeguarding the country's economic stability.

- Prevention of financial crimes such as money laundering and terrorist financing: AML/KYC regulations play a key role in detecting and preventing the movement of illicit funds used for criminal activities.

- Protection of the financial system's integrity: By ensuring that only legitimate businesses and individuals operate within the financial system, AML/KYC compliance enhances the overall stability and reputation of the financial sector.

- Compliance with international standards and regulations: India's AML/KYC norms align with global standards, fostering international cooperation in combating transnational financial crimes.

Key Requirements of AML/KYC Compliance for Payments Banks

Payments banks in India, like other financial institutions, face specific requirements to comply with AML and KYC regulations. These requirements are designed to identify, monitor, and report suspicious transactions effectively.

- Customer identification procedures (CID): Payments banks must employ robust procedures to verify the identity of their customers, ensuring that they are who they claim to be. This involves collecting and verifying supporting documentation.

- Transaction monitoring systems (TMS): These systems are designed to identify unusual or suspicious transaction patterns that could indicate money laundering or other financial crimes.

- Suspicious transaction reporting (STR): Payments banks are obligated to report any suspicious transactions to the relevant authorities, allowing for investigations and the potential disruption of illicit activities.

Conclusion

The FIU-IND's ₹5.45 crore penalty on Paytm Payments Bank serves as a stark reminder of the critical importance of stringent AML and KYC compliance for all financial institutions, particularly within India's rapidly evolving fintech landscape. The penalty highlights the serious consequences of failing to meet these regulatory requirements and underscores the need for proactive measures to prevent money laundering and maintain the integrity of the financial system. Understanding and adhering to stringent AML and KYC norms is paramount for all financial institutions operating in India. Don't risk facing a hefty penalty for money laundering lapses – prioritize robust compliance measures today. Learn more about strengthening your AML/KYC compliance to avoid similar penalties.

Featured Posts

-

Braves Vs Padres Game Prediction And Analysis

May 15, 2025

Braves Vs Padres Game Prediction And Analysis

May 15, 2025 -

Best Black Decker Steam Irons A Comprehensive Guide

May 15, 2025

Best Black Decker Steam Irons A Comprehensive Guide

May 15, 2025 -

Pley Off N Kh L Karolina Oderzhala Ubeditelnuyu Pobedu Nad Vashingtonom

May 15, 2025

Pley Off N Kh L Karolina Oderzhala Ubeditelnuyu Pobedu Nad Vashingtonom

May 15, 2025 -

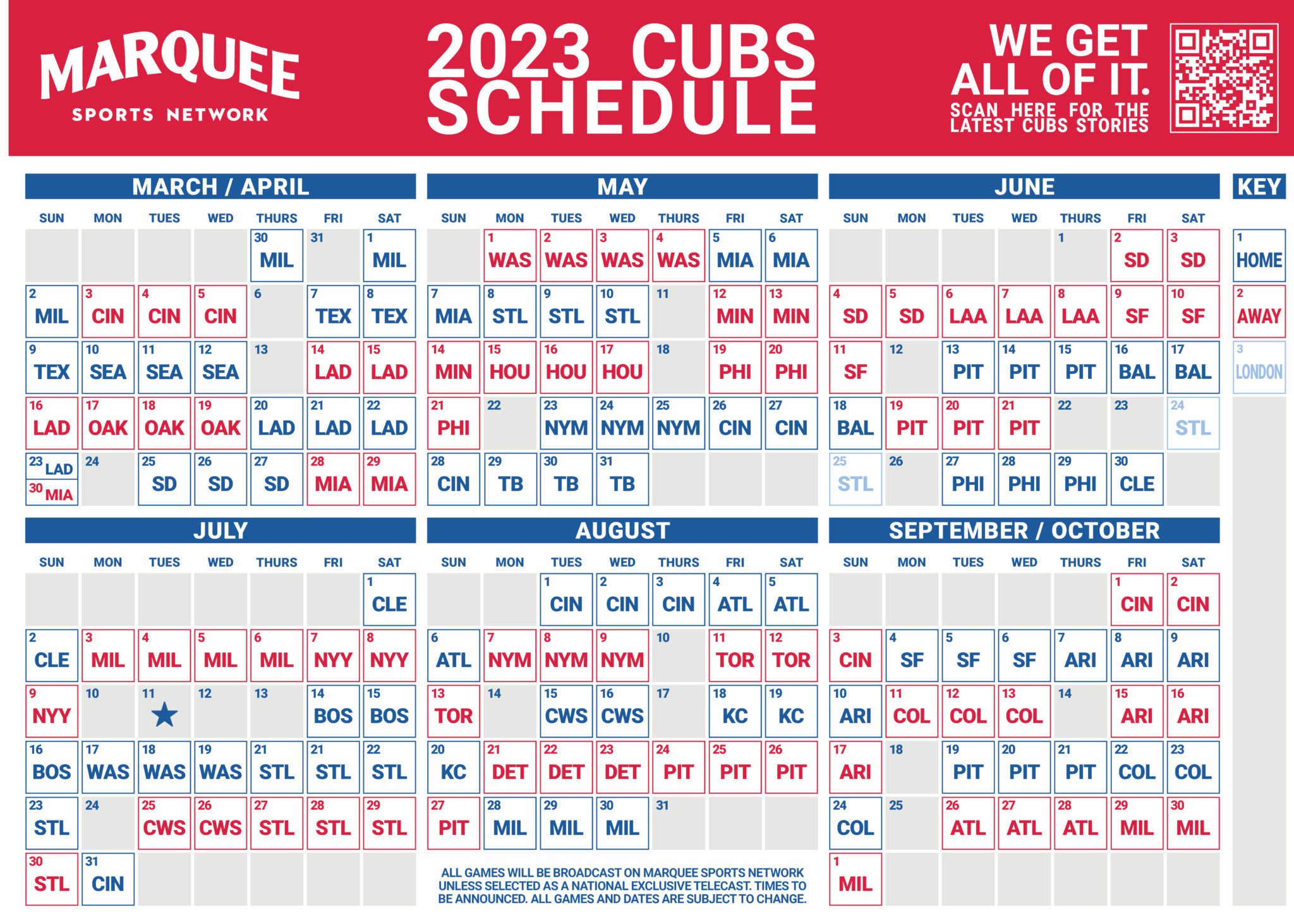

Padres On Deck Ready To Dominate The Cubs In The 2025 Home Opener

May 15, 2025

Padres On Deck Ready To Dominate The Cubs In The 2025 Home Opener

May 15, 2025 -

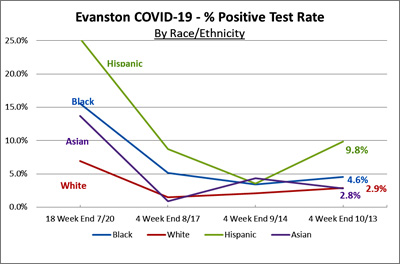

Trust In Evanston Tap Water How Gender Race And Past Experiences Shape Perceptions

May 15, 2025

Trust In Evanston Tap Water How Gender Race And Past Experiences Shape Perceptions

May 15, 2025