Foodpanda Taiwan Acquisition Abandoned By Uber: Regulatory Challenges

Table of Contents

Antitrust Concerns and Competition Issues in the Taiwanese Market

The Taiwan Fair Trade Commission (FTC) likely played a crucial role in the demise of the Uber-Foodpanda Taiwan deal. Antitrust laws in Taiwan, designed to protect consumers and promote fair competition, were evidently triggered by the potential merger. Several key concerns likely contributed to the FTC's intervention:

- Market Dominance: The combined market share of Uber (already a significant player in ride-hailing) and Foodpanda Taiwan in the food delivery sector would have been substantial. This raised concerns about the creation of a near-monopoly, potentially stifling competition and harming consumers.

- Reduced Competition: The merger would have significantly reduced the number of major players in the Taiwanese food delivery market. This lack of competition could lead to higher prices, reduced service quality, and less innovation for consumers.

- Potential Anti-Competitive Practices: The FTC likely scrutinized Uber and Foodpanda's business practices to assess the potential for anti-competitive behavior after the merger. This might have included examining pricing strategies, delivery network control, and access to restaurants and vendors.

- FTC's Rigorous Review: The Taiwan Fair Trade Commission is known for its thorough and rigorous review process for mergers and acquisitions. Their commitment to enforcing competition laws played a decisive role in blocking the deal.

The precise market share held by Foodpanda and Uber's other services in Taiwan isn't publicly available in sufficient detail, but it's clear that the potential for substantial market consolidation raised significant red flags for the FTC. This underscores the importance of detailed market analysis before attempting any acquisition in a regulated environment.

Regulatory Hurdles and Bureaucratic Processes in Taiwan

Navigating the complex regulatory landscape of Taiwan proved a significant challenge for Uber. The process of securing regulatory approval for mergers and acquisitions can be lengthy and intricate, and this deal was no exception. Several factors contributed to the difficulties:

- Lengthy Approval Process: Taiwan's regulatory approval processes are known for their duration. The time required to satisfy all regulatory requirements likely contributed to the deal's collapse, perhaps exceeding Uber's timeline or tolerance for uncertainty.

- Specific Regulations: Taiwan has specific regulations governing foreign investment in various sectors, including the food delivery industry. Uber may have encountered difficulties meeting these specific requirements.

- Compliance Challenges: Discrepancies between Uber's standard business practices and specific Taiwanese regulations may have emerged during the due diligence process, hindering the acquisition's progress.

- Operational Complexity: Merging two large companies with differing operational structures, IT systems, and employee bases adds significant complexity to the regulatory approval process, requiring extensive documentation and justification.

The exact timeframes and specific regulations involved remain largely confidential, but the overall experience highlights the importance of thorough legal and regulatory due diligence before proceeding with acquisitions in Taiwan.

Impact on Foodpanda Taiwan's Future and the Broader Market

The failed acquisition leaves Foodpanda Taiwan's future somewhat uncertain. The absence of Uber's substantial resources might impact its ability to compete effectively against other players in the growing Taiwanese food delivery market.

- Increased Competition for Foodpanda: Without Uber's backing, Foodpanda Taiwan will face increased pressure from competitors, requiring innovative strategies to maintain market share.

- Opportunities for Rivals: Other food delivery companies operating in Taiwan could benefit from the failed merger. The absence of a merged entity could lead to a more fragmented but perhaps more competitive market.

- Uncertain Impact on Consumers: In the short term, consumers may not notice significant changes. However, the long-term effects on pricing, service quality, and innovation remain to be seen.

- Lesson for Future Acquisitions: The outcome serves as a strong reminder of the necessity to meticulously research and understand the regulatory environment before embarking on large-scale acquisitions in any jurisdiction.

Conclusion

The abandonment of Uber's acquisition of Foodpanda Taiwan underscores the critical role of regulatory challenges in shaping the Taiwanese food delivery market. Antitrust concerns and the complexities inherent in Taiwan's regulatory processes proved insurmountable obstacles. This case study emphasizes the need for thorough due diligence, proactive engagement with regulatory bodies like the Taiwan Fair Trade Commission, and a comprehensive understanding of antitrust laws for anyone considering mergers and acquisitions in this sector. Understanding the intricacies of the Taiwanese regulatory environment is crucial for future success in the competitive Foodpanda Taiwan market. Businesses must engage in thorough due diligence and proactive engagement with regulatory bodies to avoid similar pitfalls.

Featured Posts

-

Exploring The Reebok X Angel Reese Sneaker Line

May 17, 2025

Exploring The Reebok X Angel Reese Sneaker Line

May 17, 2025 -

Comprehensive Moto News Gncc Mx Sx Flat Track And Enduro Coverage

May 17, 2025

Comprehensive Moto News Gncc Mx Sx Flat Track And Enduro Coverage

May 17, 2025 -

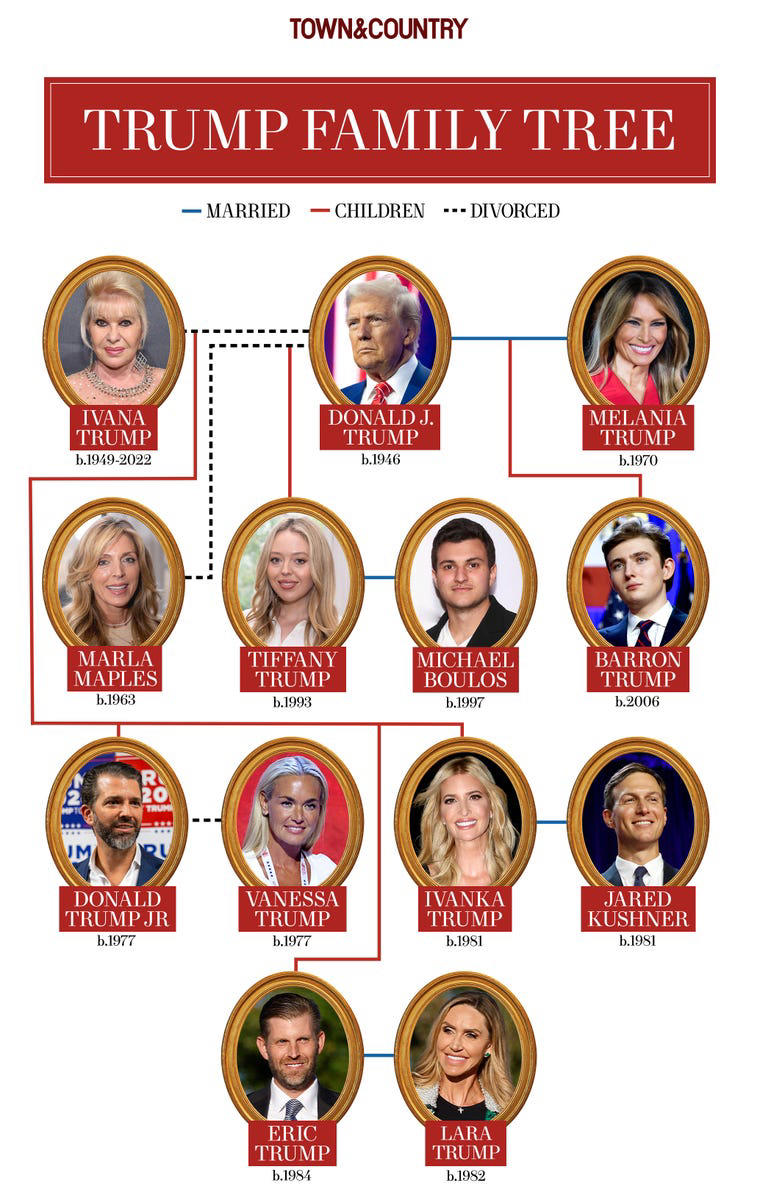

Donald Trumps Family A Detailed Look At His Ancestry And Descendants

May 17, 2025

Donald Trumps Family A Detailed Look At His Ancestry And Descendants

May 17, 2025 -

The Impact Of Trump Tariffs On Cell Phone Repair Prices

May 17, 2025

The Impact Of Trump Tariffs On Cell Phone Repair Prices

May 17, 2025 -

Generalka Srbije Pred Evrobasket U Bajernovoj Dvorani Sve Vesti I Detalji

May 17, 2025

Generalka Srbije Pred Evrobasket U Bajernovoj Dvorani Sve Vesti I Detalji

May 17, 2025

Latest Posts

-

Potential Wnba Strike Angel Reeses Perspective On Fair Compensation

May 17, 2025

Potential Wnba Strike Angel Reeses Perspective On Fair Compensation

May 17, 2025 -

Ultraviolette Tesseract 20 000 48

May 17, 2025

Ultraviolette Tesseract 20 000 48

May 17, 2025 -

Angel Reese Comments On Potential Wnba Player Strike For Better Pay

May 17, 2025

Angel Reese Comments On Potential Wnba Player Strike For Better Pay

May 17, 2025 -

Baigtas Justes Jocytes Etapas Vilerbane Analize Ir Perspektyvos

May 17, 2025

Baigtas Justes Jocytes Etapas Vilerbane Analize Ir Perspektyvos

May 17, 2025 -

Ultraviolette Tesseract 48 20 000

May 17, 2025

Ultraviolette Tesseract 48 20 000

May 17, 2025