Foot Locker's Q4 2024 Financial Results: Assessing The Success Of The Lace Up Plan

Table of Contents

Revenue Analysis: Examining Sales Growth and Key Drivers

Foot Locker's Q4 2024 revenue performance is a critical indicator of the Lace Up Plan's success. Analyzing sales growth requires a multifaceted approach, looking beyond the headline numbers to understand the underlying drivers. Key metrics include overall revenue, revenue broken down by product category, e-commerce sales contribution, same-store sales performance, and identification of key growth catalysts.

-

Overall Revenue: Comparing Q4 2024 revenue to Q4 2023 and previous years provides a historical perspective on growth trends. Significant year-over-year increases would signal the plan's effectiveness. Conversely, a decline would raise concerns.

-

Product Category Breakdown: Separating revenue into footwear, apparel, and accessories allows for a granular understanding of performance within each segment. This helps identify which categories are driving growth and which might require further attention. Strong footwear sales are crucial given Foot Locker's core competency, but apparel and accessories growth showcases broader strategic success.

-

E-commerce Sales: The contribution of e-commerce sales to overall revenue is increasingly important. Strong growth in online sales demonstrates the effectiveness of Foot Locker's digital transformation initiatives within the Lace Up Plan. Analyzing conversion rates, average order value, and website traffic can further refine this assessment.

-

Same-Store Sales (Comparable Store Sales): This metric measures sales growth in existing stores, excluding the impact of new store openings or closures. Positive same-store sales growth indicates improved in-store strategies and customer engagement. This is a key indicator of the Lace Up Plan’s effectiveness in driving foot traffic and sales within existing locations.

-

Key Drivers of Revenue Growth: Identifying the specific factors driving revenue growth is crucial. This could include the success of new product launches, impactful marketing campaigns (e.g., collaborations with popular brands), or successful loyalty programs that boost customer retention and spending.

Profitability and Margins: Evaluating Operational Efficiency

Analyzing Foot Locker's profitability is essential for evaluating the Lace Up Plan’s overall impact. This involves examining gross profit margin, operating income, net income, and the factors influencing these key performance indicators. Operational efficiency, cost control, and inventory management play critical roles.

-

Gross Profit Margin: Changes in gross profit margin compared to previous quarters or years reveal the impact of pricing strategies, cost of goods sold, and the efficiency of supply chain management. Improved margins signify successful cost-cutting measures or effective pricing strategies implemented as part of the Lace Up Plan.

-

Operating Income and Net Income: These metrics reflect the company's overall profitability after considering operating expenses and other costs. Trends in these figures provide a clear picture of the financial health of the business. Strong growth in operating and net income demonstrates the financial benefits of the Lace Up Plan.

-

Cost Control Measures: Evaluating the effectiveness of cost control measures implemented under the Lace Up Plan is crucial. This might involve analyzing expenses related to marketing, logistics, and store operations. Reductions in these expenses, without compromising sales, highlight successful cost optimization.

-

Inventory Management: Efficient inventory management is vital for profitability. Analyzing inventory turnover rates and minimizing write-offs due to obsolete stock are key aspects. The Lace Up Plan's impact on inventory management can be gauged by comparing these metrics to prior periods.

-

Pricing Strategies: Any changes to pricing strategies and their influence on profit margins should be carefully examined. Strategic pricing adjustments, implemented as part of the Lace Up Plan, could be contributing factors to changes in profitability.

The Lace Up Plan's Impact: Assessing Strategic Initiatives

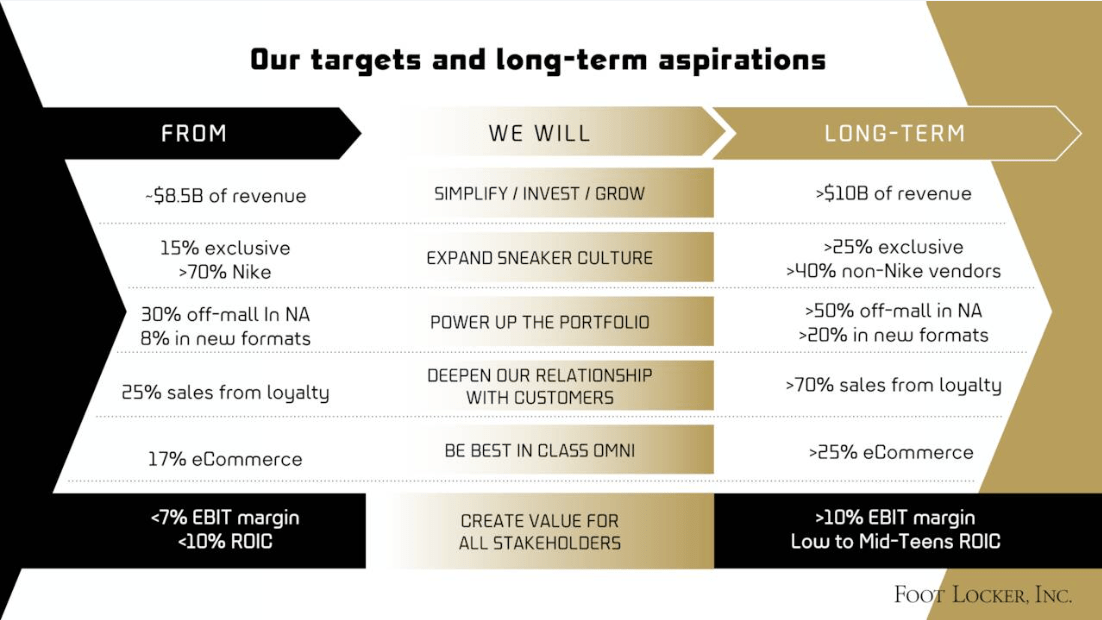

Foot Locker's Lace Up Plan is a multi-faceted strategy encompassing several key initiatives. Evaluating its impact requires examining each component's contribution to the overall financial results.

-

Key Components of the Lace Up Plan: Understanding the core tenets of the Lace Up Plan, such as improved customer engagement, strategic brand partnerships, digital transformation, and supply chain optimization, is fundamental to evaluating its success. The Q4 2024 results should reflect progress toward these goals.

-

Customer Engagement: The Lace Up Plan likely includes initiatives aimed at enhancing customer engagement. This might involve loyalty programs, personalized shopping experiences, or improved customer service. Metrics such as customer retention rates, average customer lifetime value, and customer satisfaction scores provide insights into the success of these efforts.

-

Brand Partnerships and Collaborations: Strategic partnerships and collaborations with popular brands can significantly impact sales. The success of these collaborations should be reflected in the revenue generated from specific product lines or events.

-

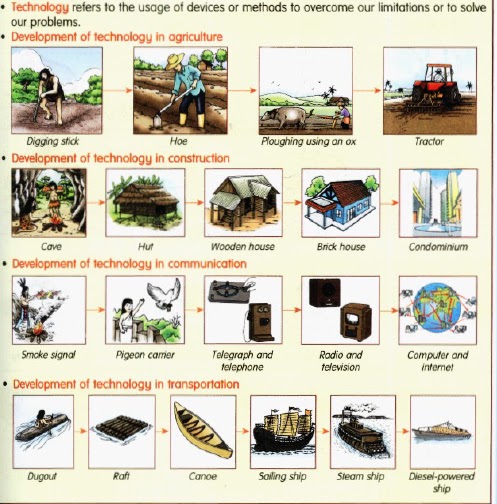

Digital Transformation: Progress in digital transformation efforts—including upgrades to the e-commerce platform, mobile app enhancements, and improved omnichannel integration—should be reflected in online sales growth, customer engagement metrics, and operational efficiencies.

-

Supply Chain Optimization: Analyzing metrics like inventory turnover, delivery times, and logistics costs reveals the success of supply chain optimization initiatives implemented as part of the Lace Up Plan. Improved efficiency translates to lower costs and potentially higher profit margins.

Competitive Landscape and Future Outlook: Predicting Foot Locker's Trajectory

Assessing Foot Locker's position in the competitive landscape and predicting its future trajectory requires understanding market trends and the performance of competitors.

-

Competitive Analysis: Comparing Foot Locker's performance to major competitors like Nike, Adidas, and other sneaker retailers helps gauge its market share and competitive advantage. Analyzing market share trends reveals whether the Lace Up Plan is improving Foot Locker's position relative to its rivals.

-

Sneaker Market Trends: Understanding the overall health of the sneaker retail market is crucial for predicting Foot Locker's future. Factors such as consumer spending patterns, evolving fashion trends, and the impact of economic conditions influence the company's prospects.

-

Future Trajectory: Based on Q4 2024 results and the ongoing success (or challenges) of the Lace Up Plan, a realistic prediction of Foot Locker's future trajectory can be made. This should include projections for revenue growth, profitability, and market share.

-

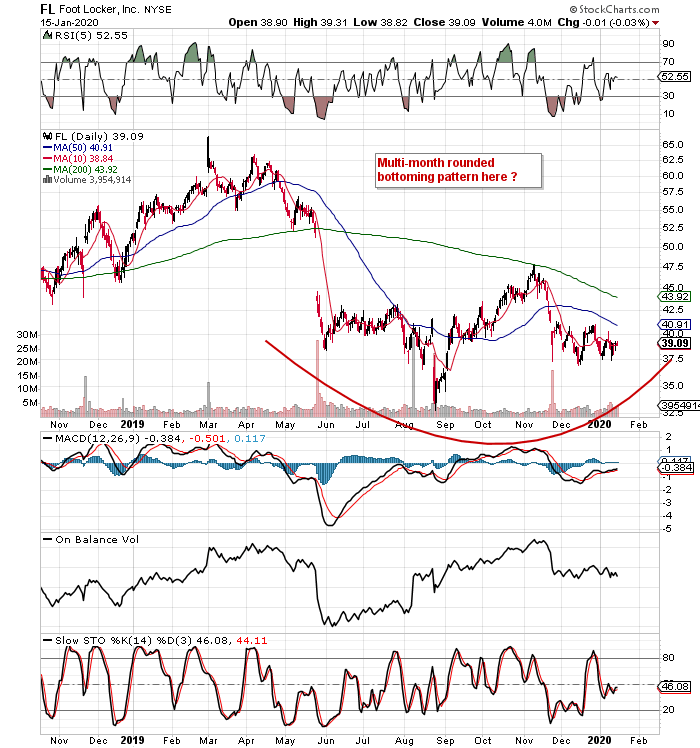

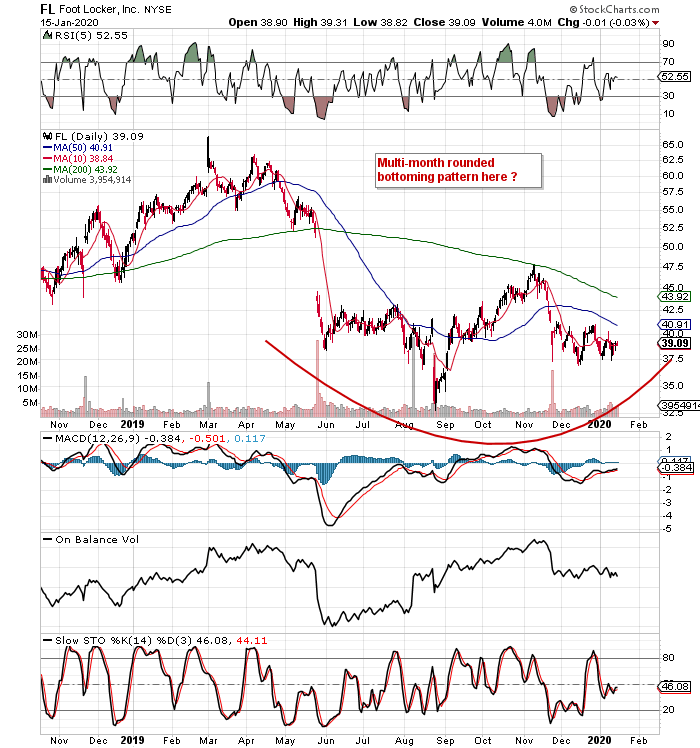

Foot Locker Stock Implications: The Q4 2024 results and the overall assessment of the Lace Up Plan's effectiveness will significantly impact investor sentiment and Foot Locker's stock price. Analyzing market reactions to the earnings report will provide valuable insights.

Conclusion

Foot Locker's Q4 2024 financial results provide crucial insights into the performance of the Lace Up Plan. By analyzing revenue growth, profitability, and strategic initiatives, we can assess the plan's effectiveness in driving the company's success. The results will likely reveal a mixed bag, with some initiatives showing strong progress while others may need further refinement. A careful examination of the data is crucial for understanding the true impact of this ambitious strategy.

Call to Action: Stay tuned for further analysis and updates on Foot Locker's progress as we continue to monitor the performance of the Lace Up Plan and its impact on future financial results. Keep up-to-date with the latest Foot Locker news and financial reporting to fully understand the long-term implications of this critical strategic initiative. Understanding Foot Locker's financial health, particularly in the context of the Lace Up Plan, is key for investors and industry observers alike.

Featured Posts

-

Predicting The Padres Vs Yankees Series A 7 Game San Diego Victory

May 16, 2025

Predicting The Padres Vs Yankees Series A 7 Game San Diego Victory

May 16, 2025 -

Is The Us Economically Independent Of Canada Examining Trumps Statements

May 16, 2025

Is The Us Economically Independent Of Canada Examining Trumps Statements

May 16, 2025 -

Block Mirror Investigating The Technology Behind Blocked Content Access

May 16, 2025

Block Mirror Investigating The Technology Behind Blocked Content Access

May 16, 2025 -

More Executive Changes At Foot Locker Analyzing The Future

May 16, 2025

More Executive Changes At Foot Locker Analyzing The Future

May 16, 2025 -

High Bids Mark Kid Cudi Auction Of Personal Items

May 16, 2025

High Bids Mark Kid Cudi Auction Of Personal Items

May 16, 2025