Foreign Airlines Acquire 25% Stake In WestJet, Marking Onex Investment Exit

Table of Contents

Details of the WestJet Stake Acquisition

Participating Foreign Airlines

The acquisition involves a consortium of three major international airlines: Lufthansa (Germany), Air France-KLM (France/Netherlands), and ANA (All Nippon Airways, Japan). These airlines bring significant global reach and expertise to the partnership.

- Lufthansa: One of Europe's leading airlines, boasting a vast network across Europe and beyond. Market share: [Insert Lufthansa's approximate market share in Europe].

- Air France-KLM: A major player in the European and transatlantic markets, connecting passengers to destinations worldwide. Market share: [Insert Air France-KLM's approximate market share].

- ANA (All Nippon Airways): Japan's largest airline, renowned for its high-quality service and extensive Asian network. Market share: [Insert ANA's approximate market share in Japan].

Their investment is driven by a strategic aim to expand their North American presence, leveraging WestJet's established domestic network and gaining access to lucrative transpacific routes.

Acquisition Value and Terms

While the exact financial details haven't been publicly disclosed, industry analysts estimate the 25% stake to be valued at approximately [Insert estimated value]. The deal reportedly involved a combination of cash and debt financing, with [Insert details about debt financing, if available]. Future investment options, potentially increasing their stake in WestJet, are rumored to be included in the agreement.

- Purchase Price: [Insert estimated purchase price, if available].

- Debt Financing: [Insert details on debt financing, if any, and the lenders involved].

- Future Options: Potential for further investment in the coming years.

Onex Corporation's Exit Strategy

Onex Corporation, a private equity firm, had held a significant stake in WestJet for [Number] years. Their decision to divest stems from a combination of factors, including maximizing their return on investment and focusing on other investment opportunities within their portfolio.

- Investment Timeline: Onex initially invested in WestJet in [Year].

- Return on Investment: [Insert information on Onex’s ROI, if available].

- Future Plans: Onex will likely reinvest the proceeds from the WestJet sale into other promising ventures.

Impact on WestJet and the Canadian Airline Industry

Changes in WestJet's Strategy

The influx of foreign investment is expected to significantly impact WestJet's strategic direction. We can anticipate:

- Pricing Strategy: Potential adjustments to pricing strategies, potentially leading to more competitive fares on certain routes.

- International Routes: Expansion into new international destinations, especially those served by the investing airlines.

- Fleet Modernization: Investment in new aircraft and fleet upgrades to align with the global standards of its new partners.

Competition in the Canadian Market

This acquisition will undoubtedly reshape the competitive landscape of the Canadian airline market.

- Airfares: The impact on airfares remains to be seen; it could lead to increased competition and lower fares on certain routes, or strategic adjustments by Air Canada to maintain its market position.

- Market Share: A shift in market share amongst Canadian airlines is likely, with WestJet potentially gaining a competitive edge due to its new alliances and resources.

- Route Competition: Increased competition on routes currently dominated by Air Canada and other smaller Canadian players.

Regulatory Considerations

The transaction requires regulatory approval from various bodies, including [List relevant regulatory bodies, e.g., the Canadian Transportation Agency, competition bureaus].

- Antitrust Concerns: Potential antitrust reviews are expected to assess the impact on competition within the Canadian aviation market.

- Regulatory Timeline: The approval process may cause some delays before the deal is fully finalized.

- Ongoing Reviews: Continuous monitoring by regulatory bodies to ensure compliance with competition laws.

Global Implications of the WestJet Deal

Increased Global Connectivity

The partnership between WestJet and these global airlines is likely to improve global air travel connectivity, particularly between Canada and Europe/Asia.

- New Flight Routes: The potential for new, direct flight routes connecting Canadian cities to previously underserved destinations.

- Code-Sharing Agreements: Expanded code-sharing agreements will allow seamless travel between different airline networks.

- Increased Passenger Traffic: Improved connectivity will likely lead to a significant increase in passenger traffic between Canada and other countries.

Strategic Alliances and Partnerships

This acquisition could pave the way for strategic alliances and partnerships.

- Frequent Flyer Programs: Potential integration of frequent flyer programs, allowing for the accumulation of points across multiple airlines.

- Shared Resources: Sharing of airport facilities, ground handling services, and other resources to optimize operations.

- Joint Marketing: Collaborative marketing and advertising campaigns to promote joint offerings.

Conclusion

The acquisition of a 25% stake in WestJet by a consortium of foreign airlines marks a pivotal moment in the Canadian and global airline industry. Onex Corporation's exit signals a significant shift in WestJet's ownership structure, paving the way for potential strategic changes, intensified competition, and increased global connectivity. The regulatory review process will be crucial in determining the final outcome and its overall impact. Stay tuned for further updates on the evolving landscape of the WestJet investment and the impact of this significant foreign airline acquisition on the Canadian and global aviation market.

Featured Posts

-

Competition Win Tickets To The Sold Out Tales From The Track Relay

May 12, 2025

Competition Win Tickets To The Sold Out Tales From The Track Relay

May 12, 2025 -

Ufc 315 Will Fiorot Upset Shevchenkos Retirement Plans

May 12, 2025

Ufc 315 Will Fiorot Upset Shevchenkos Retirement Plans

May 12, 2025 -

Crazy Rich Asians The Upcoming Television Series Everything You Need To Know

May 12, 2025

Crazy Rich Asians The Upcoming Television Series Everything You Need To Know

May 12, 2025 -

Analyzing Adam Sandlers Net Worth The Value Of Comedy

May 12, 2025

Analyzing Adam Sandlers Net Worth The Value Of Comedy

May 12, 2025 -

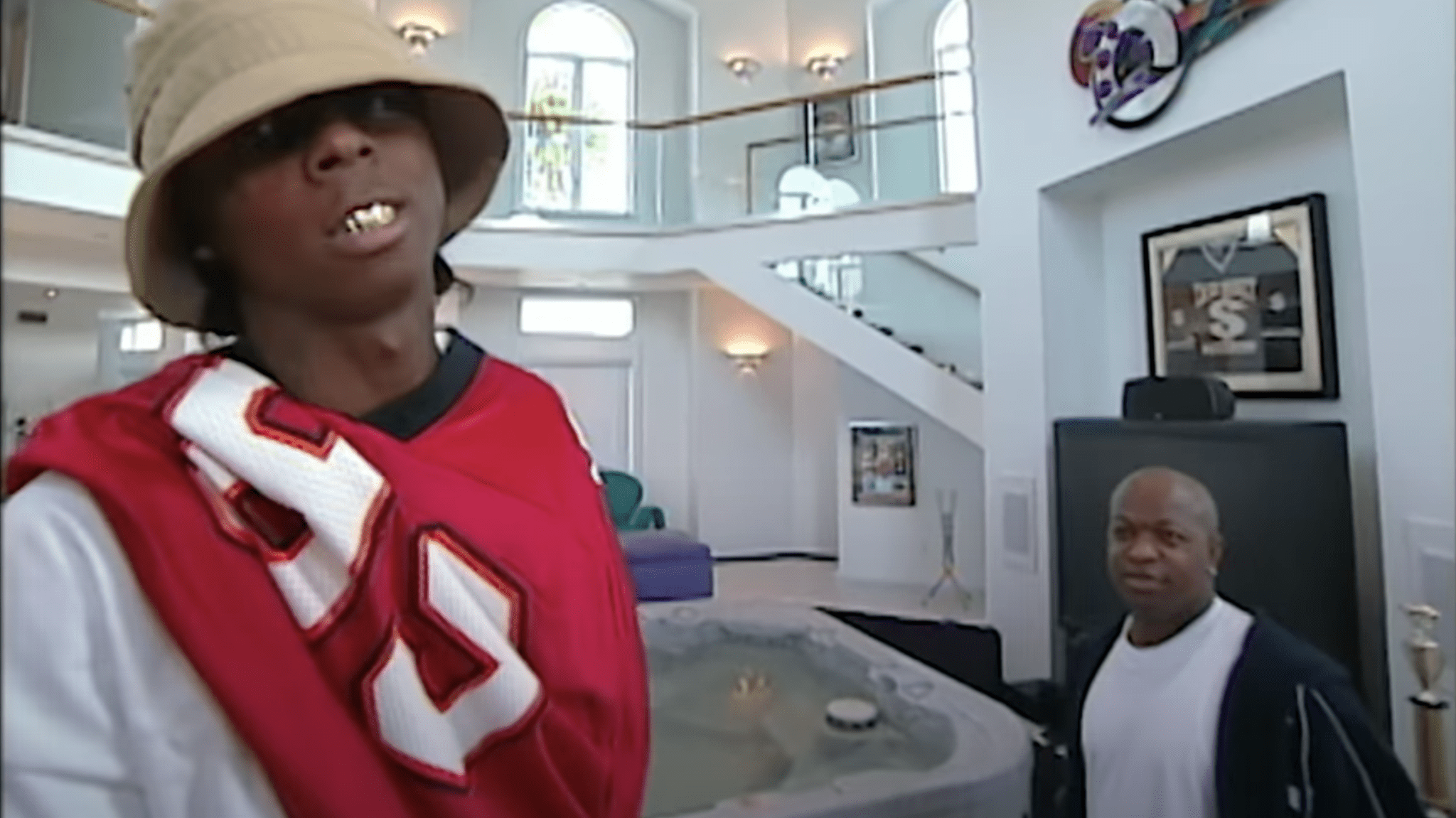

The Most Impressive Beach Houses On Mtv Cribs

May 12, 2025

The Most Impressive Beach Houses On Mtv Cribs

May 12, 2025