Form 20-F: ING Group's 2024 Performance Summary And Financial Data

Table of Contents

Key Financial Highlights from ING Group's 20-F Filing

ING Group's 2024 Form 20-F provides a comprehensive overview of its financial performance. The overall financial performance reflects a complex interplay of global economic factors and the company's strategic initiatives. Let's look at some key figures:

- Net Income: [Insert Net Income Figure from 20-F]. This represents a [Percentage Change]% change compared to 2023. [Provide a brief explanation for the change, citing factors like interest rate changes, market volatility, or specific business decisions].

- Revenue: [Insert Revenue Figure from 20-F]. Showing a [Percentage Change]% change from the previous year. [Again, briefly explain the variance, connecting it to relevant economic conditions or company strategy].

- Profitability: [Insert relevant profitability metrics like Return on Equity (ROE) or Return on Assets (ROA) with percentage changes and explanations]. These metrics highlight the efficiency with which ING Group is generating profits from its assets and shareholder equity. [Explain any significant deviations from previous year's profitability and their underlying causes].

Keywords: ING Group revenue, ING Group net income, ING Group profitability, 20-F financial highlights

Analysis of ING Group's Revenue Streams (Form 20-F)

ING Group operates across diverse financial sectors. Examining its revenue streams helps understand its performance in different market segments. The 20-F provides a detailed breakdown of revenue generation:

- Retail Banking: [Insert Percentage of Total Revenue and brief analysis of performance. Did it grow or decline? What factors contributed to this?]. This segment is usually sensitive to interest rate changes and consumer spending patterns.

- Wholesale Banking: [Insert Percentage of Total Revenue and analysis. Consider factors like global trade, corporate lending, and investment banking activities]. This segment's performance is often linked to global economic growth and market volatility.

- Insurance: [Insert Percentage of Total Revenue and analysis, mentioning factors like insurance premiums, claims, and market competition]. This segment’s performance is impacted by macroeconomic factors and regulatory changes.

- Asset Management: [Insert Percentage of Total Revenue and analysis, highlighting market performance and investment strategies]. This segment is heavily influenced by market conditions and investor sentiment.

[Consider including a chart or graph visually representing the contribution of each segment to overall revenue].

Keywords: ING Group revenue streams, retail banking performance, wholesale banking performance, ING Group segmental revenue

ING Group's Financial Position & Liquidity (Form 20-F)

A review of ING Group's balance sheet and liquidity ratios provides insights into its financial strength and ability to meet its obligations. Key aspects from the 20-F include:

- Assets: [Describe the major asset categories and their changes compared to the previous year]. [Mention if there were significant increases or decreases in specific asset types and their reasons].

- Liabilities: [Describe the major liability categories and comment on any significant changes. Discuss the composition of debt (short-term vs. long-term)]. [Explain implications of any shifts in the debt structure].

- Equity: [Analyze the changes in shareholder equity and discuss any implications for shareholder value].

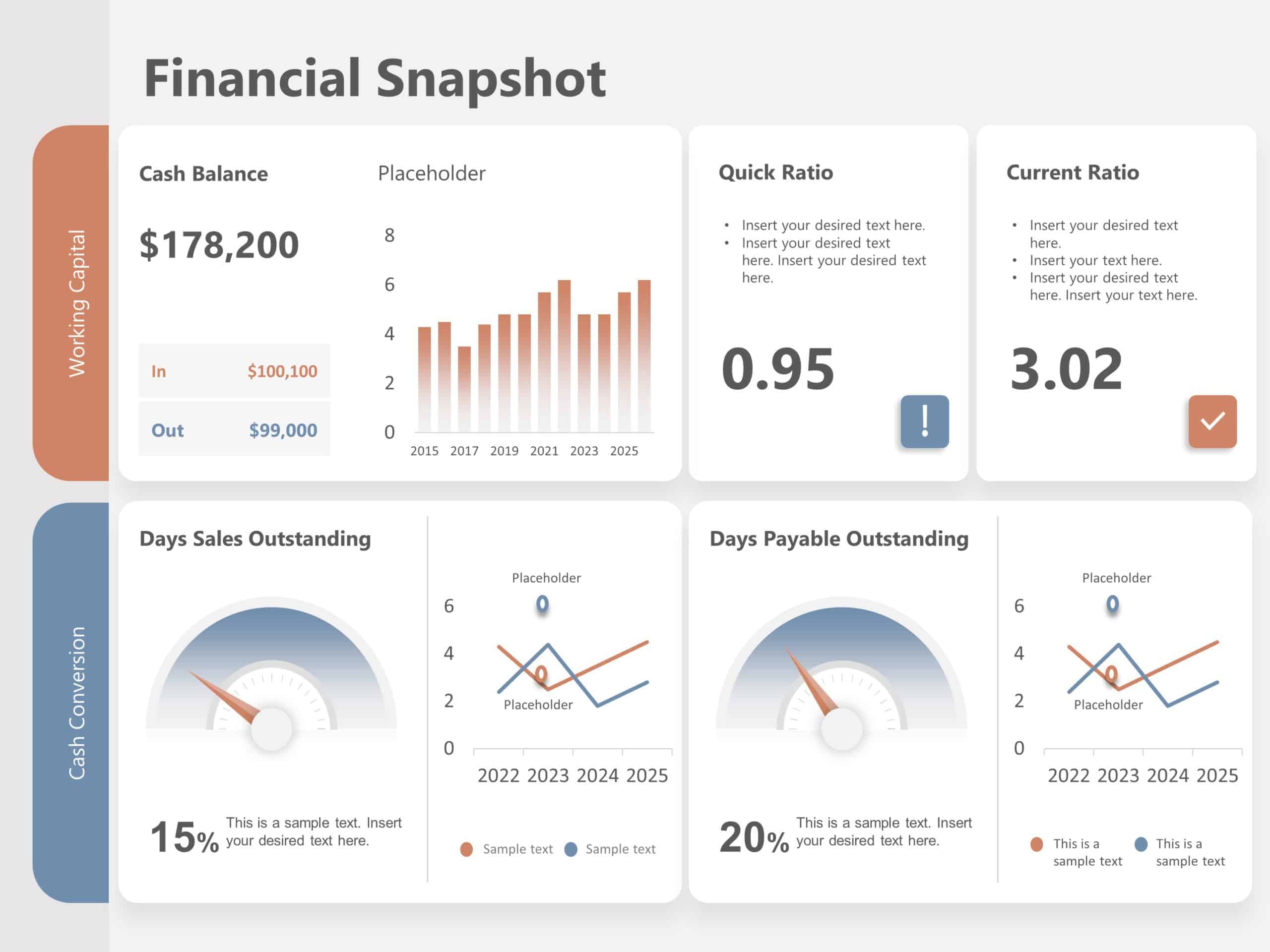

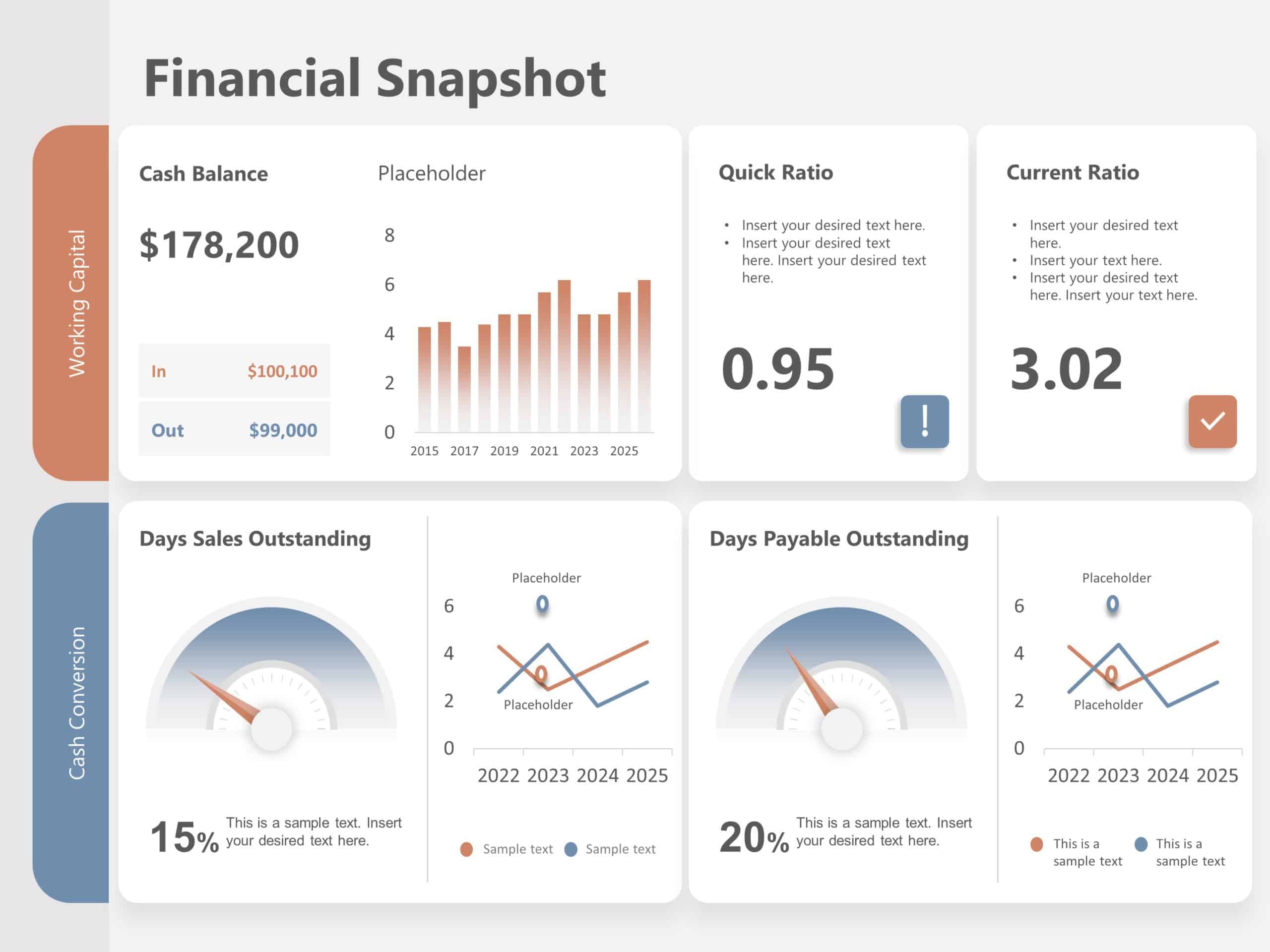

- Liquidity Ratios: [Present key ratios like the current ratio and quick ratio, comparing them to industry benchmarks. Interpret the results to assess ING Group's short-term financial health]. Strong liquidity ratios indicate the company's ability to meet its immediate obligations.

Keywords: ING Group balance sheet, ING Group liquidity, ING Group debt, financial ratios, solvency

Risk Factors Disclosed in ING Group's 20-F

The 20-F also highlights various risks and uncertainties faced by ING Group. Understanding these risks is critical for a comprehensive assessment of the company’s financial health:

- Regulatory Changes: [Discuss the potential impact of evolving regulations on ING Group's operations and profitability].

- Economic Downturn: [Analyze how economic slowdowns or recessions could affect ING Group's revenue, profitability, and credit risk].

- Geopolitical Risks: [Explain how geopolitical instability, conflicts, or sanctions could impact ING Group's business globally].

- Cybersecurity Threats: [Mention the company's exposure to cybersecurity risks and the potential financial and reputational damage].

Keywords: ING Group risk factors, regulatory risks, economic risks, geopolitical risks, Form 20-F disclosures

Conclusion: Understanding ING Group's 2024 Performance through Form 20-F

Analyzing ING Group's 2024 Form 20-F reveals a multifaceted picture of its financial performance. While [mention positive aspects like strong revenue growth in specific segments or improved profitability], the company also faces [mention key challenges or risks identified in the 20-F]. Understanding these dynamics is crucial for assessing the company's future prospects. For a complete understanding of ING Group's financial performance and strategic direction, download and review the full Form 20-F filing available on the SEC's EDGAR database [insert link to EDGAR database]. This deep dive into the ING Group 20-F provides valuable insights into its financial health and helps investors make informed decisions. Keywords: ING Group 20-F, ING Group financial analysis, ING Group SEC filing, understanding ING Group financials

Featured Posts

-

French Cinemas 2025 Rendez Vous A Look At The Upcoming Festival And Awards Ceremony

May 23, 2025

French Cinemas 2025 Rendez Vous A Look At The Upcoming Festival And Awards Ceremony

May 23, 2025 -

Burclar Ve Zeka Hangi Burclar Daha Zekidir

May 23, 2025

Burclar Ve Zeka Hangi Burclar Daha Zekidir

May 23, 2025 -

A Real Pain Kieran Culkins Casting Story And Jesse Eisenbergs Unique Approach

May 23, 2025

A Real Pain Kieran Culkins Casting Story And Jesse Eisenbergs Unique Approach

May 23, 2025 -

Netflix Sirens Everything We Know About The Limited Series

May 23, 2025

Netflix Sirens Everything We Know About The Limited Series

May 23, 2025 -

Alshrtt Thqq Me Ilyas Rwdryjyz Almshtbh Bh Fy Mqtl Mwzfyn Balsfart Alisrayylyt

May 23, 2025

Alshrtt Thqq Me Ilyas Rwdryjyz Almshtbh Bh Fy Mqtl Mwzfyn Balsfart Alisrayylyt

May 23, 2025