Frankfurt Stock Exchange: DAX Holds Steady Post-Record High

Table of Contents

The DAX's Recent Record High and Subsequent Consolidation

Factors Contributing to the Record High

Several factors propelled the DAX to its record high. These include:

- Strong Corporate Earnings: Many DAX-listed companies reported robust earnings, fueled by strong domestic and international demand.

- Positive Economic Indicators: Positive economic data from Germany and the Eurozone, such as low unemployment rates and rising consumer confidence, boosted investor optimism.

- Low Interest Rates: The European Central Bank's (ECB) accommodative monetary policy, characterized by low interest rates, encouraged investment and borrowing.

- Global Market Trends: Positive global market sentiment, driven by factors such as technological advancements and emerging market growth, contributed to the DAX's rise.

- Investor Sentiment: A wave of optimism and bullish sentiment among investors, driven by positive economic news and corporate performance, fueled significant buying pressure.

- Specific Sector Performance: Strong performances from sectors like the automotive industry, technology, and luxury goods significantly contributed to the DAX's surge. Companies like Volkswagen and SAP saw substantial growth.

Reasons for the DAX's Current Stability

Despite the record high, the DAX has shown remarkable stability. However, this stability is not without potential headwinds:

- Profit-Taking: After reaching record highs, investors often engage in profit-taking, selling off shares to secure gains, leading to a temporary consolidation.

- Cautious Optimism: While economic indicators remain positive, geopolitical uncertainties and potential economic slowdowns are prompting cautious optimism among investors.

- Geopolitical Concerns: Ongoing geopolitical risks, such as the war in Ukraine and global trade tensions, continue to influence investor sentiment and market volatility.

- Anticipated Central Bank Actions: The ECB's future monetary policy decisions, particularly regarding interest rate adjustments, will significantly impact the DAX's performance.

- Market Volatility: The current market volatility, characterized by periods of both gains and losses, reflects the uncertainty surrounding global economic prospects. This volatility directly impacts the DAX.

Frankfurt Stock Exchange's Role in European Markets

Significance of the FSE as a Leading European Exchange

The Frankfurt Stock Exchange holds a prominent position within the European financial landscape. Its significance stems from:

- Major Player in European Finance: The FSE is one of the largest and most liquid stock exchanges in Europe, facilitating billions of euros in daily trading.

- Capital for German and European Companies: It serves as a crucial platform for German and other European companies seeking capital through initial public offerings (IPOs) and secondary market trading.

- Impact on the European Economy: The FSE's trading volume and market capitalization significantly influence the overall health and performance of the European economy.

Key Indices Traded on the FSE Beyond the DAX

Beyond the DAX, the FSE hosts other important indices, providing a broader view of the German and European markets:

- MDAX: This index tracks the performance of the next 50 largest companies listed on the FSE, offering insights into mid-cap companies.

- SDAX: This index comprises the 70 small-cap companies, providing a look into the growth potential of smaller enterprises.

- TecDAX: This technology-focused index showcases the performance of leading German technology companies.

The performance of these indices often correlates with the DAX, providing a more comprehensive picture of the overall market trend.

Investor Sentiment and Future Outlook for the DAX

Analyzing Current Investor Behavior

Current investor behavior is a mix of cautious optimism and strategic maneuvering:

- Investor Sentiment: While positive, investor sentiment is tempered by geopolitical uncertainties and potential economic slowdowns.

- Investor Strategies: Investors are employing a variety of strategies, including buy-and-hold for long-term growth and short-term trading to capitalize on market fluctuations.

- Shifts in Investor Behavior: There's a noticeable shift towards more defensive investment strategies as investors seek stability amidst uncertainties.

Predicting Future Trends for the DAX

Predicting the DAX's future performance requires careful consideration of several factors:

- Potential Catalysts for Growth: Continued strong corporate earnings, positive economic data, and easing geopolitical tensions could drive further growth.

- Potential Catalysts for Decline: Economic slowdowns, rising interest rates, and escalating geopolitical risks could negatively impact the DAX.

- Factors Impacting Investor Confidence: Any unexpected economic events or policy changes can significantly influence investor confidence and market direction.

[Include relevant charts or graphs here to support the analysis.]

Conclusion: Frankfurt Stock Exchange and the DAX: A Steady Outlook?

The Frankfurt Stock Exchange and the DAX have demonstrated resilience, with the DAX recently reaching record highs and subsequently consolidating its position. This stability reflects strong corporate performance, positive economic indicators, and accommodative monetary policy. However, geopolitical concerns and potential economic headwinds necessitate cautious optimism. Understanding the interplay of these factors is crucial for navigating the complexities of the Frankfurt Stock Exchange and the DAX. To stay informed about the dynamic landscape of the Frankfurt Stock Exchange and the DAX, subscribe to our updates, follow reputable financial news sources, and conduct thorough research. Monitoring the Frankfurt Stock Exchange and the DAX remains crucial for investors seeking success in the European market.

Featured Posts

-

Alexandria International Airport And England Airparks Fly Local Explore Global Campaign Takes Off

May 24, 2025

Alexandria International Airport And England Airparks Fly Local Explore Global Campaign Takes Off

May 24, 2025 -

Escape To The Country Budget Friendly Options And Tips

May 24, 2025

Escape To The Country Budget Friendly Options And Tips

May 24, 2025 -

Jonathan Groff And Just In Time A Tony Awards Prediction

May 24, 2025

Jonathan Groff And Just In Time A Tony Awards Prediction

May 24, 2025 -

Tracking The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Tracking The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

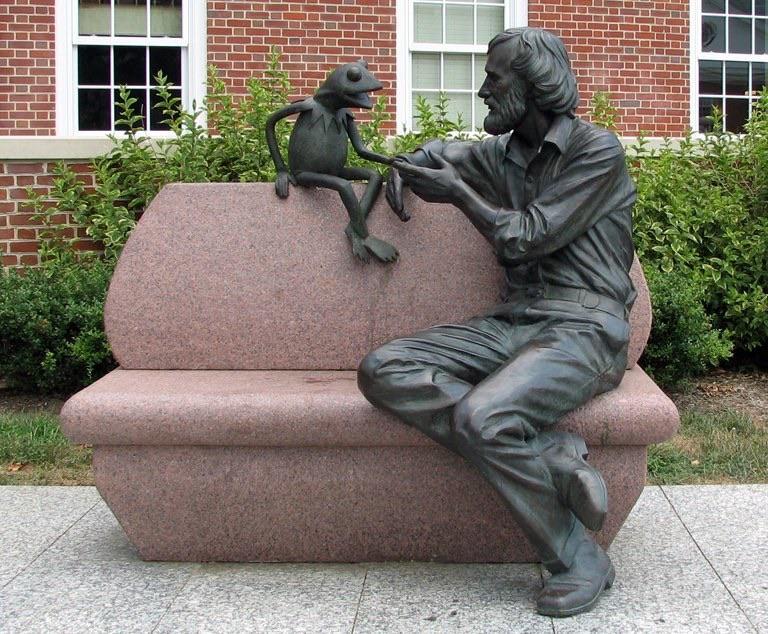

Confirmed Kermit The Frog To Address University Of Maryland Graduates In 2025

May 24, 2025

Confirmed Kermit The Frog To Address University Of Maryland Graduates In 2025

May 24, 2025