Fremantle Q1 Revenue Down 5.6%: Impact Of Buyer Budget Cuts

Table of Contents

Analysis of Fremantle's Q1 Revenue Decline

Detailed Breakdown of the 5.6% Drop

Fremantle's announcement of a 5.6% decrease in Q1 revenue compared to the same period last year paints a concerning picture. This drop wasn't uniform across all revenue streams. The official report (source needed - cite official Fremantle financial report here) provides a more granular look:

- Advertising Revenue: Experienced a sharper decline than other streams, potentially reflecting a broader downturn in the advertising market. (Insert percentage change here if available from the source).

- Streaming Revenue: Showed a (Insert percentage change here if available from the source) change, indicating challenges in securing lucrative streaming deals amidst increased competition.

- Licensing Revenue: While often more stable, this stream also experienced a (Insert percentage change here if available from the source) decrease, possibly attributed to fewer new productions and reduced buyer interest in acquiring licenses.

- (Add other revenue streams if applicable from the official report, with corresponding percentage changes.)

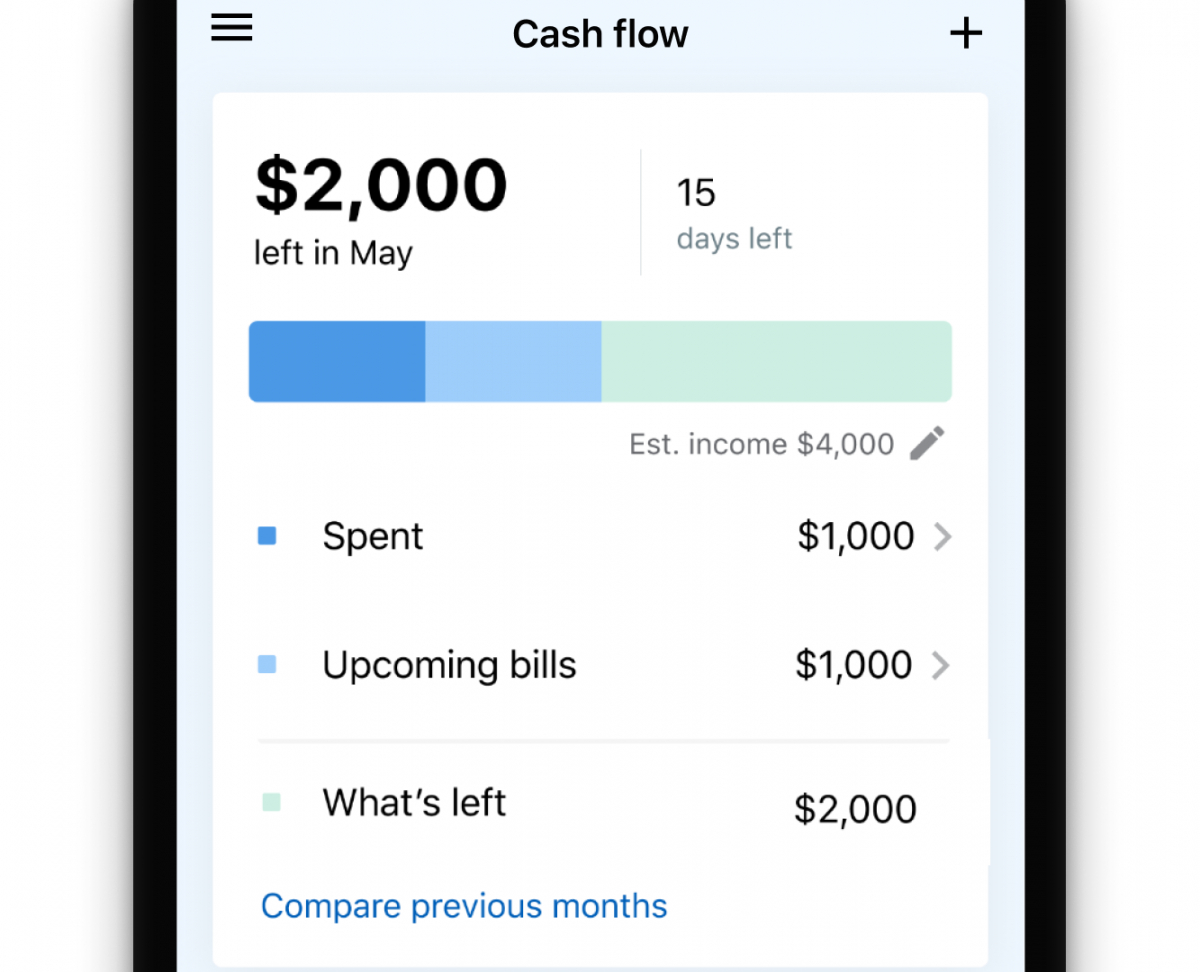

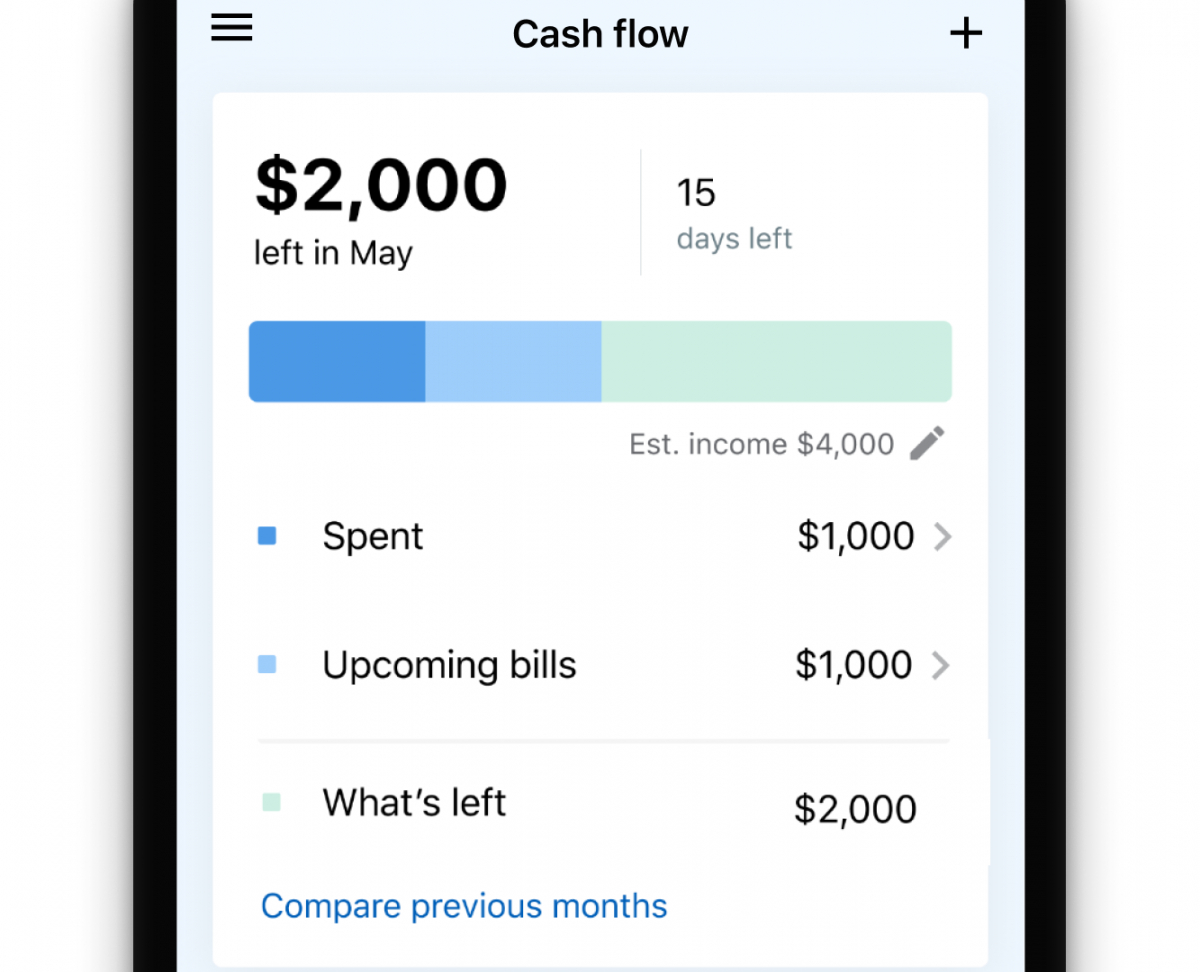

(Include a chart or graph visualizing the breakdown of revenue streams and their percentage changes for enhanced readability and visual appeal.)

Comparison to Previous Quarters and Industry Trends

Comparing Fremantle's Q1 2024 performance to previous quarters reveals a concerning trend. (Insert comparison data here – Q4 2023, Q1 2023 etc., showing percentage changes). This decline is not isolated; many companies in the entertainment sector are grappling with similar challenges. The “streaming wars” and a general economic downturn are impacting consumer spending and, consequently, the willingness of buyers to invest in new content. Comparing Fremantle's performance to direct competitors (e.g., Endemol Shine Group, Banijay) would provide a more nuanced understanding of the market dynamics at play.

The Role of Buyer Budget Cuts

Impact of Reduced Spending on Production

The primary driver behind Fremantle's Q1 revenue slump appears to be reduced spending by buyers. Streamers and broadcasters, facing their own financial pressures, are tightening their budgets for content acquisition and commissioning. This directly translates to:

- Fewer new productions: Fremantle may have secured fewer new projects due to buyers' reluctance to commit to large-scale productions.

- Production delays and cancellations: Existing projects may be facing delays or even cancellations due to budget constraints imposed by buyers. (Include specific examples if available).

- Smaller budgets per project: Even commissioned projects may have smaller budgets, impacting production quality and potentially affecting the final product’s appeal.

Shifts in Content Demand and Acquisition Strategies

Buyer budget cuts are also forcing a shift in content demand. Buyers are increasingly favoring:

- Cheaper formats: Reality shows and shorter-seasoned dramas might be favored over expensive, large-scale productions.

- Proven franchises: Renewals of existing successful shows are prioritized over risky, unproven concepts.

- Genre shifts: A higher demand for specific genres which are less expensive to produce might be noticed.

Fremantle's response likely includes exploring new avenues:

- Cost-cutting measures: Streamlining production processes and negotiating better deals with suppliers.

- Focus on specific genres: Concentrating efforts on producing more cost-effective content that aligns with current market demand.

- Strategic partnerships: Collaborating with other companies to share production costs and risks.

Potential Long-Term Implications for Fremantle

Strategic Adjustments Needed for Future Growth

To navigate this challenging period, Fremantle needs to implement several strategic adjustments:

- Diversification of revenue streams: Explore new avenues beyond traditional television and streaming, such as branded content or gaming.

- Innovation in content creation: Develop more cost-effective production models while maintaining high-quality content.

- Data-driven decision-making: Leverage data analytics to better understand audience preferences and optimize content strategies.

Outlook for the Remainder of 2024 and Beyond

The outlook for Fremantle’s remainder of 2024 and beyond remains uncertain. While the Q1 results are discouraging, the company's extensive catalog and established relationships in the industry provide a degree of resilience. The success of new show launches and securing new partnerships will significantly impact its performance. A cautious but ultimately optimistic outlook might be reasonable, dependent on the wider economic climate and the evolution of the streaming landscape.

Conclusion: Understanding the Fremantle Q1 Revenue Dip and its Future Implications

The Fremantle Q1 revenue down 5.6% highlights the significant impact of buyer budget cuts on the entertainment industry. The decline underscores challenges across various revenue streams, reflecting broader industry trends like the streaming wars and economic uncertainty. While the outlook remains uncertain, Fremantle's established position and potential for strategic adaptation offer reasons for cautious optimism. The company's response to these challenges will be crucial in determining its long-term success. Stay tuned for further updates on Fremantle's financial performance and learn how this impact affects the broader television and streaming landscape. Keep an eye on our site for more analysis of Fremantle Q1 revenue and industry trends.

Featured Posts

-

Bundesliga Matchday 34 Fsv Mainz 05 Bayer 04 Leverkusen Match Report

May 21, 2025

Bundesliga Matchday 34 Fsv Mainz 05 Bayer 04 Leverkusen Match Report

May 21, 2025 -

Updated Trans Australia Run World Record Attempt

May 21, 2025

Updated Trans Australia Run World Record Attempt

May 21, 2025 -

Bbc Antiques Roadshow Arrest Follows Us Couples Appraisal

May 21, 2025

Bbc Antiques Roadshow Arrest Follows Us Couples Appraisal

May 21, 2025 -

I Xronia Kakodaimonia Ton Sidirodromon Mia Analytiki Matia

May 21, 2025

I Xronia Kakodaimonia Ton Sidirodromon Mia Analytiki Matia

May 21, 2025 -

Rashfords Double Aston Villa Cruise Past Preston In Fa Cup

May 21, 2025

Rashfords Double Aston Villa Cruise Past Preston In Fa Cup

May 21, 2025