Fremantle's Q1 Revenue: A 5.6% Drop Due To Reduced Buyer Spending

Table of Contents

Analysis of Fremantle's Q1 Financial Performance

Fremantle's Q1 2024 financial results revealed a 5.6% decrease in revenue compared to the same period last year. While the exact figures weren't publicly released in detail (at the time of writing), reports suggest a substantial impact across various revenue streams. This represents a concerning trend, marking a departure from previous quarters which showed more positive growth. Comparing this to Q1 2023 and the previous year's performance reveals a clear negative trajectory, highlighting the severity of the situation. The breakdown across specific revenue streams – film, television, and digital – is crucial to understanding the nuanced impact. Preliminary indications suggest a disproportionate effect on certain divisions, with digital revenue potentially feeling a greater impact due to evolving viewing habits. Keywords: Fremantle financials, Q1 results, revenue figures, year-on-year comparison, financial analysis.

Factors Contributing to Reduced Buyer Spending

Several interconnected factors contributed to the overall reduction in buyer spending impacting Fremantle's Q1 performance.

The Impact of Inflation and Economic Uncertainty

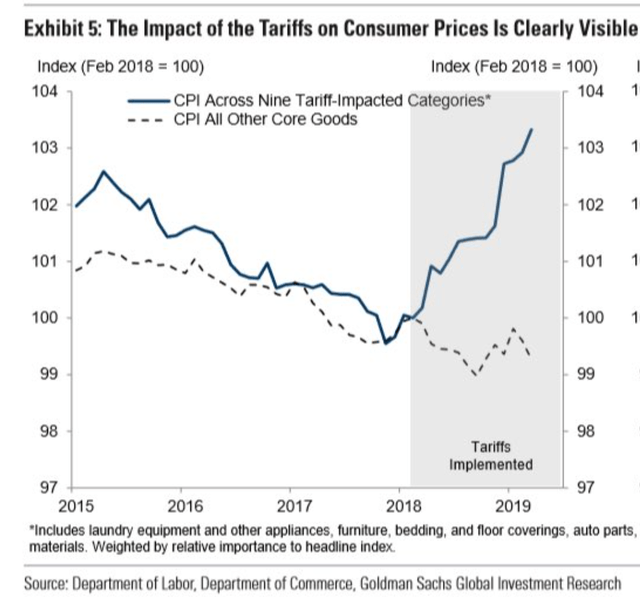

Global inflation and widespread economic uncertainty significantly impact consumer spending. With rising living costs, individuals are forced to prioritize essential expenses, often reducing discretionary spending on entertainment. This translates to decreased subscriptions to streaming services, lower advertising revenue for broadcasters, and reduced investment in new content production. News reports indicate a tightening of budgets across major streaming platforms and broadcasters, directly affecting Fremantle's ability to secure lucrative deals for its content. For instance, recent reports suggest [cite a relevant news article or economic data source here] a significant decrease in advertising expenditure by major players. Keywords: Inflation, economic downturn, consumer spending, streaming platforms, broadcast budgets.

Shifting Market Dynamics and Competition

The entertainment industry is experiencing an unprecedented level of competition. The rise of numerous new streaming services has created a "streaming wars" scenario, fragmenting the audience and increasing the pressure on content creators. This intense competition forces companies to constantly innovate and offer highly competitive pricing models, directly affecting profitability. Existing players like Netflix, Disney+, and Amazon Prime Video are vying for market share, leading to a more challenging environment for securing distribution deals and attracting viewers. Keywords: Market competition, streaming wars, viewer habits, entertainment industry trends.

Changes in Content Consumption and Demand

Consumer preferences are constantly evolving, impacting the demand for various types of content. The success of certain genres in Q1, such as [mention specific examples of successful genres], contrasts sharply with the underperformance of others. This shift in viewer habits requires content creators to adapt quickly and anticipate future trends. Changes in audience demographics also play a significant role, with younger generations exhibiting different consumption patterns compared to older demographics. Keywords: Content consumption, audience demographics, viewer preferences, content trends.

Fremantle's Strategies to Mitigate Revenue Decline

In response to the reduced buyer spending, Fremantle is implementing several strategic initiatives to mitigate the revenue decline and maintain its position in the market. These strategies include:

- Cost-cutting measures: This involves streamlining operations, optimizing production processes, and potentially restructuring certain departments to improve efficiency.

- Diversification of revenue streams: Exploring new avenues for revenue generation beyond traditional television and film distribution, such as branded content creation and licensing deals.

- Focus on high-demand content: Investing in content that resonates with current audience preferences and trends to secure lucrative distribution deals.

- Enhanced distribution strategies: Exploring alternative distribution channels and platforms to broaden the reach of Fremantle's content.

The effectiveness of these strategies will be crucial in determining Fremantle's future financial performance. Keywords: Fremantle strategy, cost-cutting, content strategy, distribution strategy, business response.

Outlook for Fremantle's Future Performance

Predicting Fremantle's future revenue with certainty is challenging, given the volatile nature of the entertainment industry. However, several factors suggest potential opportunities and challenges:

- Potential for recovery: As economic uncertainty subsides and inflation eases, consumer spending on entertainment is expected to rebound, potentially benefiting Fremantle's revenue.

- Continued competition: The intense competition in the streaming market will likely persist, requiring ongoing innovation and adaptation from Fremantle.

- Emerging technologies: The adoption of new technologies, such as metaverse applications and immersive experiences, could offer new avenues for growth and revenue generation.

Industry analysts offer varying perspectives on Fremantle's long-term growth prospects. While the Q1 results are concerning, the company's strong brand reputation and diverse content portfolio could position it for a future recovery. Keywords: Fremantle future, revenue forecast, growth prospects, industry outlook, long-term strategy.

Conclusion: Understanding Fremantle's Q1 Revenue Decline and Future Prospects

Fremantle's 5.6% Q1 revenue drop is a direct consequence of reduced buyer spending, amplified by inflation, economic uncertainty, and intense competition within the entertainment industry. While the situation is challenging, Fremantle's proactive strategies to address these issues offer a path towards recovery. The company's long-term success will depend on its adaptability and its ability to navigate the evolving landscape of content creation and distribution. To stay updated on Fremantle's financial performance and the latest trends in the entertainment industry, subscribe to our newsletter, follow us on social media, or visit the Fremantle website for their official financial reports. Keywords: Fremantle financial reports, Q2 revenue, entertainment industry news.

Featured Posts

-

Abn Amro Huizenprijzen Betaalbaar Volgens Onderzoek Geen Stijl Reageert

May 21, 2025

Abn Amro Huizenprijzen Betaalbaar Volgens Onderzoek Geen Stijl Reageert

May 21, 2025 -

Abn Amro Us Food Exports Halved By Tariffs

May 21, 2025

Abn Amro Us Food Exports Halved By Tariffs

May 21, 2025 -

Understanding Aimscaps Approach To The World Trading Tournament Wtt

May 21, 2025

Understanding Aimscaps Approach To The World Trading Tournament Wtt

May 21, 2025 -

Sta Stoji Iza Promene Imena Vanje Mijatovic

May 21, 2025

Sta Stoji Iza Promene Imena Vanje Mijatovic

May 21, 2025 -

Wwe Raw The Brutal Attack On Sami Zayn By Rollins And Breakker

May 21, 2025

Wwe Raw The Brutal Attack On Sami Zayn By Rollins And Breakker

May 21, 2025