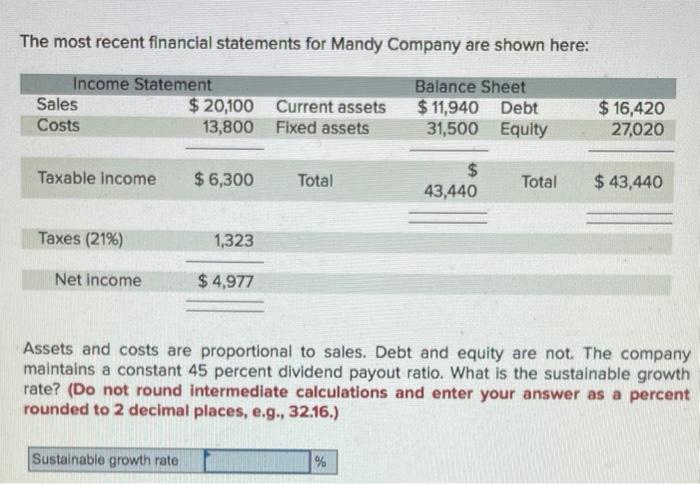

Fremantle's Q1 Revenue Falls 5.6% Amidst Buyer Budget Constraints

Table of Contents

Buyer Budget Constraints: The Primary Driver of Fremantle's Revenue Dip

The primary culprit behind Fremantle's Q1 revenue dip is the widespread tightening of buyer budgets across the entertainment industry. Reduced spending on licensing agreements, co-productions, and acquisitions has created a domino effect, impacting even established players like Fremantle. While precise figures for the overall market contraction are still emerging, anecdotal evidence and reports from various industry analysts suggest a significant slowdown in investment. This reflects a broader economic uncertainty impacting discretionary spending.

- Decreased investment in scripted content: Many broadcasters and streamers are prioritizing cost-effectiveness, leading to fewer greenlit scripted projects.

- Reduced commissioning of new projects: The hesitancy to commit to new productions directly impacts Fremantle's production arm, leading to revenue shortfalls.

- Postponement of planned productions: Several projects have been delayed or shelved altogether due to budgetary concerns, impacting projected revenue streams.

- Increased competition for funding: With less money circulating, securing funding for new projects has become significantly more challenging, resulting in a more competitive landscape.

Impact on Fremantle's Key Revenue Streams

The reduction in buyer budgets has directly impacted Fremantle's key revenue streams. The company’s diverse portfolio, encompassing production, distribution, and licensing, has not been immune to this downturn.

- Decline in licensing fees: Reduced demand for content has translated into lower licensing fees across various platforms.

- Lower than expected advertising revenue: The shift toward subscription-based models has reduced reliance on advertising revenue for some of Fremantle's content, impacting overall revenue.

- Impact on specific Fremantle shows or franchises: While some shows might have continued to perform well, others experienced reduced viewership and, consequently, lower revenue.

- Specific segments most impacted: The impact varied across Fremantle's different divisions, with some segments potentially experiencing a greater revenue decline than others. Further analysis is needed to pinpoint the most affected areas.

Fremantle's Strategic Response to the Market Slowdown

In response to the market slowdown, Fremantle has implemented several strategic measures to mitigate the impact of reduced budgets. These actions reflect a proactive approach to navigating the current economic climate.

- Cost-optimization strategies: Fremantle is actively pursuing cost-cutting measures across its operations to improve efficiency and profitability.

- New partnerships and collaborations: The company is actively seeking collaborations and partnerships to share risk and access new funding opportunities.

- Focus on specific content genres or markets: Fremantle is likely refocusing its production efforts on genres and markets demonstrating greater resilience to the current economic downturn.

- Expansion into new markets or revenue streams: Exploring new revenue streams and geographical markets may be part of Fremantle's strategy to diversify and reduce reliance on specific sectors.

Industry Outlook and Predictions for Fremantle's Future Performance

The future outlook for Fremantle and the broader entertainment industry remains uncertain. While the current economic climate presents challenges, opportunities for growth and innovation still exist.

- Industry-wide trends: The ongoing consolidation of streaming platforms and the increasing demand for high-quality content continue to shape the landscape.

- Potential for recovery in buyer budgets: A recovery in buyer budgets is dependent on various macroeconomic factors and is difficult to predict with certainty.

- Long-term outlook for Fremantle's key markets: Fremantle's long-term success depends on its ability to adapt to evolving consumer preferences and technological advancements.

- Opportunities for innovation and growth: Exploring new technologies and formats (e.g., interactive storytelling, immersive experiences) may offer avenues for growth.

Conclusion: Navigating the Challenges: Fremantle's Path to Revenue Recovery

The 5.6% decline in Fremantle's Q1 revenue highlights the significant impact of buyer budget constraints on the entertainment industry. The company's strategic response, encompassing cost optimization and diversification efforts, is crucial for navigating this challenging period. While the near-term outlook remains uncertain, Fremantle's adaptability and strong brand recognition position it to weather the storm and ultimately recover. Stay informed about the evolving landscape of Fremantle's revenue and the broader entertainment industry by subscribing to our newsletter for the latest updates on Fremantle's Q2 financial results and industry analysis.

Featured Posts

-

Nyt Mini Crossword Help March 5 2025 Answers

May 20, 2025

Nyt Mini Crossword Help March 5 2025 Answers

May 20, 2025 -

Dzhennifer Lourens I Ee Vtoroy Rebenok Poslednie Novosti

May 20, 2025

Dzhennifer Lourens I Ee Vtoroy Rebenok Poslednie Novosti

May 20, 2025 -

Wayne Gretzkys Fast Facts A Career Overview

May 20, 2025

Wayne Gretzkys Fast Facts A Career Overview

May 20, 2025 -

The Us Philippines Military Alliance And The Typhon Missile System A Comprehensive Overview

May 20, 2025

The Us Philippines Military Alliance And The Typhon Missile System A Comprehensive Overview

May 20, 2025 -

Schumacher Bunic O Prima Imagine Cu Noua Generatie

May 20, 2025

Schumacher Bunic O Prima Imagine Cu Noua Generatie

May 20, 2025