French Shipping Giant CMA CGM Purchases Turkish Logistics Player For $440 Million

Table of Contents

CMA CGM's Expansion Strategy in Emerging Markets

CMA CGM, a multinational corporation renowned for its extensive global network and substantial market share in the shipping industry, consistently seeks opportunities to expand its reach. Its growth strategy is heavily focused on penetrating key emerging markets, strategically positioning the company for continued success in a competitive global environment. Turkey, with its unique geographical location at the crossroads of Europe and Asia, represents a crucial strategic hub. Its robust infrastructure and established trade routes make it an ideal gateway for goods moving between continents.

This acquisition aligns perfectly with CMA CGM's overall expansion plans. By securing a foothold in the Turkish logistics market, CMA CGM gains access to a vital transit point and significant growth potential. The strategic benefits are multifaceted:

- Increased market share in the Turkish logistics sector: Gaining a strong presence in a rapidly growing market.

- Access to new customer base and distribution networks: Expanding reach and diversifying customer portfolio.

- Strengthened global supply chain presence: Optimizing global logistics networks and improving efficiency.

- Potential for synergies and operational efficiency improvements: Integrating the acquired company's operations to enhance overall performance.

These advantages solidify CMA CGM's position as a leading player in global logistics and significantly enhance its capacity to manage the complexities of international trade. The acquisition presents a clear pathway for robust growth in this burgeoning market.

The Target Turkish Logistics Company – Profile and Strengths

While the specific name of the acquired Turkish logistics company remains undisclosed, the deal indicates a company with substantial strengths and a significant presence within the Turkish market. The unnamed company likely operates a robust business model specializing in crucial aspects of the logistics chain, such as:

- Specialization in inland transportation: Efficiently moving goods within Turkey.

- Warehousing and storage solutions: Providing secure and effective storage capabilities.

- Freight forwarding and customs brokerage: Streamlining international shipping processes.

- Last-mile delivery services: Ensuring timely and reliable final delivery to customers.

Its key strengths probably include:

- Established customer relationships and strong market reputation: A proven track record of reliable service.

- Modern infrastructure and technology capabilities: Utilizing advanced technology for efficient operations.

- Experienced management team: A skilled team capable of seamless integration with CMA CGM.

These attributes make the company an attractive acquisition target for CMA CGM, providing a solid foundation for expansion and growth within the Turkish market. The deal points towards the high value placed on a robust infrastructure, a strong reputation, and experienced personnel in the competitive Turkish logistics landscape.

Financial Implications and Market Reactions

The $440 million price tag reflects the significant strategic value CMA CGM places on this acquisition. While the exact financial breakdown and projections remain confidential, the investment promises various financial benefits. Potential ROI hinges on successful integration and the realization of expected synergies.

- Return on investment (ROI) projections: Optimistic forecasts anticipate significant returns due to increased market share and operational efficiencies.

- Integration costs and potential synergies: Careful planning is essential to minimize integration challenges and maximize synergies.

- Impact on CMA CGM's financial statements: Positive impacts are expected in terms of revenue growth and profitability.

- Market analysis and expert opinions: Initial market reactions have been largely positive, reflecting confidence in CMA CGM's strategic vision.

The market's response to the news, including stock price fluctuations and analyst commentaries, is a key indicator of the acquisition's perceived value and potential success. Further analysis will be needed to fully evaluate the long-term financial consequences.

Future Prospects and Industry Impact

The acquisition signifies a notable shift in the Turkish logistics sector and broader global shipping industry. This move will likely heighten competition within the Turkish market and stimulate innovation in logistics services. CMA CGM's future strategies in Turkey might involve:

- Increased competition in the Turkish logistics market: Other players will likely respond to this significant development, potentially leading to innovation and improved service offerings.

- Potential for innovation and improvements in logistics services: CMA CGM's expertise and resources could lead to more efficient and technologically advanced logistics solutions in Turkey.

- CMA CGM's future growth strategy in Turkey: The acquired company will likely serve as a springboard for further expansion and investment in the Turkish market.

- Impact on global supply chain dynamics: Improved efficiency and connectivity within the Turkish logistics sector could positively impact global supply chain dynamics.

The long-term implications extend beyond the Turkish market, potentially influencing global supply chain dynamics and prompting other industry players to reassess their strategies.

Conclusion: CMA CGM's Acquisition Signals a Significant Shift in the Global Shipping and Turkish Logistics Landscape

CMA CGM's $440 million acquisition of a Turkish logistics company marks a pivotal moment in the global shipping and Turkish logistics sectors. This strategic move underscores CMA CGM's commitment to expansion in emerging markets and highlights the increasing importance of Turkey as a key transit hub. The acquisition promises significant benefits for CMA CGM, enhancing its global reach, market share, and operational efficiency. The long-term impact on the competitive landscape and industry dynamics remains to be seen, but the initial signs point to a significant shift.

To stay updated on the latest developments in the CMA CGM and Turkish logistics sectors, and to learn more about the specifics of this transformative acquisition as they become available, subscribe to our newsletter, follow us on social media, and check back for further articles on this exciting development in the global shipping industry.

Featured Posts

-

Section 230 And Banned Chemicals New Legal Precedent Set For Online Marketplaces

Apr 27, 2025

Section 230 And Banned Chemicals New Legal Precedent Set For Online Marketplaces

Apr 27, 2025 -

The Role Of Human Creativity In The Age Of Ai Insights From Microsoft

Apr 27, 2025

The Role Of Human Creativity In The Age Of Ai Insights From Microsoft

Apr 27, 2025 -

Camille Claudel Bronze 3 Million Auction Result In France

Apr 27, 2025

Camille Claudel Bronze 3 Million Auction Result In France

Apr 27, 2025 -

At And T Slams Broadcoms V Mware Price Hike A 1050 Increase

Apr 27, 2025

At And T Slams Broadcoms V Mware Price Hike A 1050 Increase

Apr 27, 2025 -

Trumps Trade Pressure Carneys Urgent Message To Canadian Voters

Apr 27, 2025

Trumps Trade Pressure Carneys Urgent Message To Canadian Voters

Apr 27, 2025

Latest Posts

-

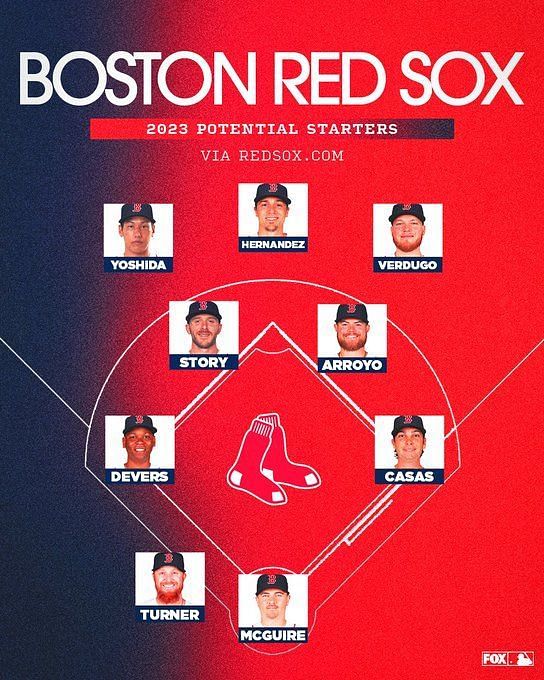

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025 -

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025