Friday's Market Outlook: Further Losses Expected For Live Music Stocks

Table of Contents

Macroeconomic Headwinds Impacting Live Music Stock Performance

Several significant macroeconomic factors are currently impacting the performance of live music stocks. These headwinds are creating a challenging environment for both established players and emerging artists.

Inflation and its Effect on Consumer Spending

Increased inflation is significantly reducing discretionary spending, directly impacting the live music industry. Consumers are finding themselves with less disposable income, leading to reduced spending on entertainment, including concerts and music festivals.

- Higher ticket prices leading to decreased demand: As operational costs rise, concert promoters are forced to increase ticket prices, potentially pricing out budget-conscious consumers.

- Reduced spending on ancillary items like merchandise and food/beverage at venues: Lower attendance and tighter budgets mean less revenue from merchandise sales and concessions, impacting overall profitability.

- Impact on artists' touring schedules due to increased operational costs: Rising fuel costs, transportation expenses, and venue rental fees are making tours more expensive to organize, potentially leading to fewer performances.

Post-Pandemic Demand Normalization

The initial surge in demand following the pandemic lockdowns is now normalizing. While concert attendance remains strong compared to pre-pandemic levels in some areas, the explosive growth has plateaued.

- Comparison of pre-pandemic attendance figures with current numbers: While current attendance might be higher than pre-pandemic levels in certain segments, the growth rate has slowed considerably.

- Discussion of the sustainability of current attendance levels: The question remains: can current attendance levels be sustained in the face of economic uncertainty and increased competition from other entertainment options?

- Analysis of the impact of competition from other entertainment options: Consumers now have a wider array of entertainment choices, including streaming services, video games, and other live events, increasing competition for discretionary spending.

Specific Challenges Facing Individual Live Music Companies

Examining the performance of specific companies within the live music industry reveals further challenges impacting live music stock performance.

Case Study 1: Live Nation Entertainment (LYV)

Live Nation Entertainment, a global leader in live entertainment, faces several challenges. While they boast a vast portfolio of venues and artists, their stock price remains sensitive to macroeconomic factors.

- Specific financial indicators (e.g., revenue, profit margins): Analysts are closely monitoring Live Nation's revenue growth and profit margins to assess the impact of inflation and reduced consumer spending.

- Recent announcements or news affecting the stock price: Any news regarding cancellations, reduced attendance, or changes in artist touring schedules can significantly affect Live Nation's stock price.

- Analyst predictions for the company's future performance: Many analysts believe that Live Nation's performance will remain closely tied to the broader economic climate.

Case Study 2: AEG Presents

AEG Presents, another major player in the live music industry, is facing similar headwinds. While they have a strong presence in various markets, they are also vulnerable to economic downturns.

- Similar financial indicators and news analysis as above: AEG's financial performance is being closely scrutinized for signs of impact from inflation and reduced consumer demand.

- Comparison to the first case study, highlighting industry-wide trends: The performance of both Live Nation and AEG Presents serves as an indicator of the overall health and challenges within the live music industry.

Analyst Predictions and Future Outlook for Live Music Stocks

The consensus among financial analysts is cautious regarding the near-term outlook for live music stocks.

Consensus among financial analysts

- Short-term predictions (next few weeks/months): Many analysts predict further downward pressure on live music stock prices in the short term, reflecting ongoing economic uncertainty.

- Long-term predictions (next year and beyond): The long-term outlook depends on the trajectory of inflation and consumer spending, as well as the industry's ability to adapt to changing market conditions.

- Factors that could potentially change the outlook (positive and negative): Positive factors include easing inflation, renewed consumer confidence, and innovative business models. Negative factors include persistent inflation, a prolonged economic downturn, and increased competition.

Investment strategies for navigating market volatility

Investors considering live music stocks should adopt a cautious approach, focusing on risk management and diversification.

- Diversification strategies: Diversifying investment portfolios across various sectors and asset classes can help mitigate risk.

- Risk management considerations: Investors should carefully assess their risk tolerance and only invest an amount they are comfortable losing.

- Potential opportunities amidst the decline: The current market downturn may present opportunities for long-term investors willing to take on moderate to higher risk.

Conclusion: Navigating the Uncertain Future of Live Music Stocks

The negative outlook for live music stocks is primarily driven by macroeconomic headwinds, including inflation and reduced consumer spending, coupled with specific challenges faced by individual companies in the industry. Analysts predict further short-term losses, but the long-term outlook hinges on various factors, including the trajectory of the economy and the industry's ability to adapt. Investors should adopt a cautious approach, diversifying their portfolios and carefully managing risk.

Key takeaways include the impact of inflation on consumer spending, the normalization of post-pandemic demand, and the need for a cautious investment strategy. Remember to stay informed about market trends and company-specific news before making investment decisions. Stay tuned for our next market outlook update for further insights into the evolving landscape of live music stocks, and remember to always conduct thorough research before making any investment decisions.

Featured Posts

-

Country Diary Foraging For The Carrots Roastable Cousin

May 30, 2025

Country Diary Foraging For The Carrots Roastable Cousin

May 30, 2025 -

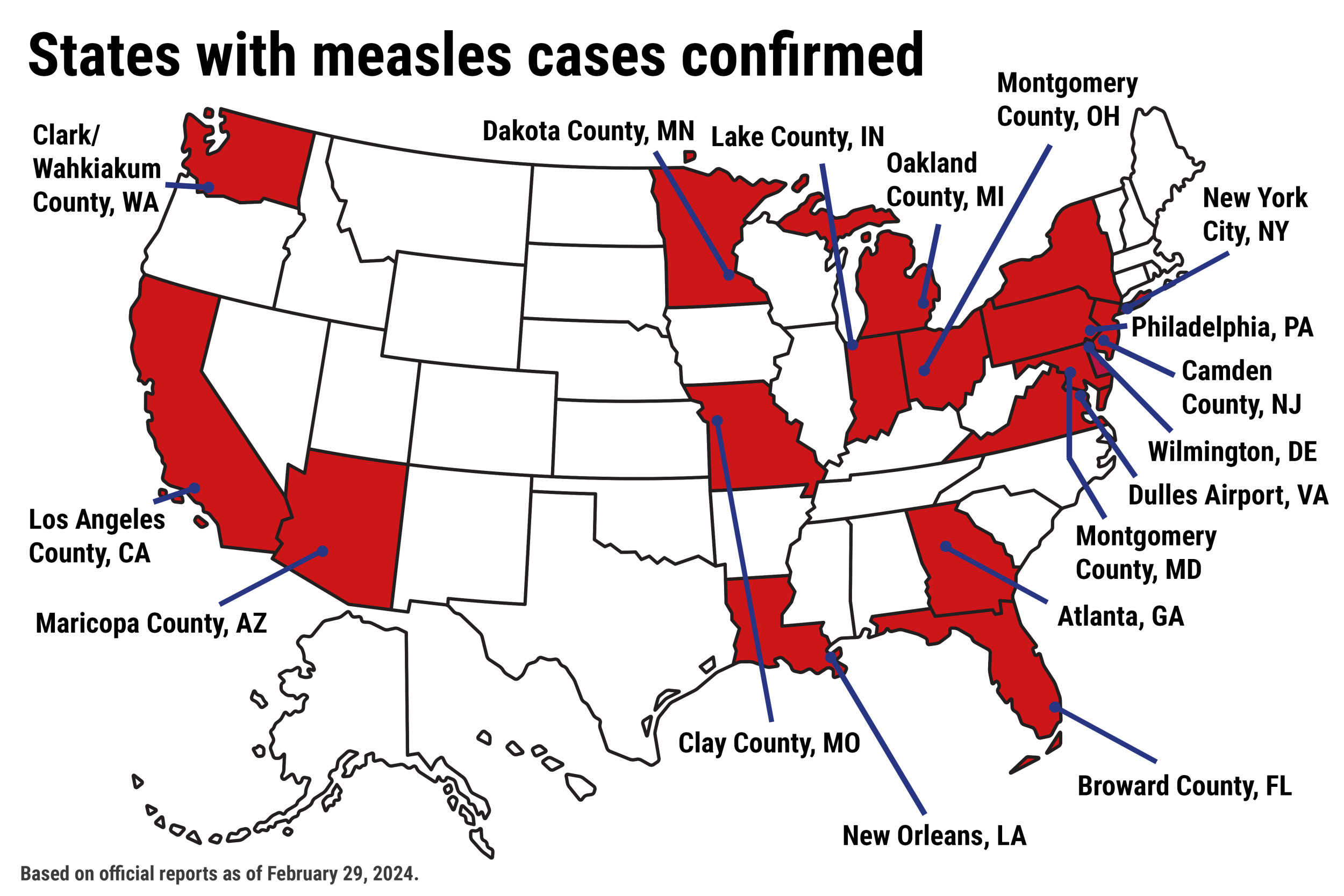

The Return Of Measles Examining The Kansas Outbreak

May 30, 2025

The Return Of Measles Examining The Kansas Outbreak

May 30, 2025 -

Uninvited Avenger Fan Favorite Missing From Mcus Future

May 30, 2025

Uninvited Avenger Fan Favorite Missing From Mcus Future

May 30, 2025 -

Bad Bunny En Madrid Y Barcelona Compra Tus Entradas Ahora Preventa

May 30, 2025

Bad Bunny En Madrid Y Barcelona Compra Tus Entradas Ahora Preventa

May 30, 2025 -

French Rape Survivors Story Gisele Pelicots Book Headed To Hbo

May 30, 2025

French Rape Survivors Story Gisele Pelicots Book Headed To Hbo

May 30, 2025