From Pregnancy Craving To Global Phenomenon: The Chocolate Bar Fueling Inflation

Table of Contents

The Unexpected Rise in Chocolate Prices

The price of chocolate, once a relatively stable cost, has seen a significant upward trend in recent years. This increase isn't merely due to increased demand; it's a confluence of several interconnected challenges.

Cocoa Bean Production Challenges

Cocoa bean production, the foundation of all chocolate, faces numerous hurdles. Climate change is a major culprit, with erratic weather patterns leading to reduced yields.

- Droughts: Prolonged droughts in key cocoa-producing regions like West Africa significantly diminish crop output.

- Disease: Cocoa crops are vulnerable to various diseases, impacting the overall quality and quantity of beans.

- Political Instability: Civil unrest and conflict in many cocoa-growing nations disrupt farming activities, leading to supply shortages.

Data from the International Cocoa Organization shows cocoa bean prices have fluctuated wildly over the past five years, increasing by over 30% in some periods. This volatility directly translates to higher chocolate prices for consumers.

Increased Demand for Chocolate

The global appetite for chocolate is insatiable, particularly in rapidly developing economies. This surge in demand far outpaces the ability of current production methods to keep up.

- Rising Middle Class: The expanding middle class in Asia and other regions fuels increased chocolate consumption.

- Premium Chocolate Trend: The popularity of high-end, luxury chocolate brands further contributes to the high demand for cocoa beans.

Global chocolate consumption is projected to increase by X% in the next decade, according to [Source - cite a relevant market research report here]. This relentless growth puts immense pressure on cocoa bean supplies, driving up prices.

Supply Chain Disruptions

The journey from cocoa bean to chocolate bar is complex, and supply chain disruptions exacerbate the price increases.

- Port Congestion: Bottlenecks at major ports worldwide delay the shipment of cocoa beans and finished chocolate products.

- Fuel Price Increases: Rising fuel costs significantly impact transportation expenses throughout the supply chain.

- Pandemic Impacts: The COVID-19 pandemic exposed the fragility of global supply chains, further contributing to delays and increased costs.

The Role of Chocolate in Inflationary Pressures

Chocolate's price increase isn't isolated; it reflects broader inflationary trends.

Chocolate as a Commodity

Cocoa beans are a commodity, and their price fluctuations impact a wide range of food products.

- Confectionery Prices: The price of cocoa directly affects the cost of all chocolate products, from inexpensive bars to premium confections.

- Ripple Effect: Price increases in chocolate also impact related industries, such as baking and ice cream manufacturing.

The rising cost of cocoa serves as a prime example of how commodity price inflation ripples through the entire economy.

Inflationary Impact on Consumers

Higher chocolate prices directly impact consumer spending and purchasing power.

- Trade-downs: Consumers are switching from their favorite brands to cheaper alternatives.

- Reduced Consumption: Many are buying less chocolate or forgoing it entirely.

The cumulative effect of these changes can have significant social and economic consequences, particularly for lower-income households.

Government Policies and Their Influence

Government policies, both domestic and international, play a crucial role in shaping chocolate prices.

- Tariffs and Subsidies: Trade agreements and import tariffs can significantly impact the cost of cocoa beans.

- Economic Sanctions: Political sanctions on cocoa-producing countries can disrupt supply chains and further drive up prices.

The Future of Chocolate and Inflation

Navigating the future of chocolate and its price requires addressing several key issues.

Sustainability and Ethical Sourcing

The growing emphasis on sustainable and ethically sourced chocolate offers a potential path to long-term price stability.

- Sustainable Farming Practices: Investing in sustainable farming methods can increase yields and reduce environmental impact.

- Fairtrade and Rainforest Alliance: Certifications like Fairtrade and Rainforest Alliance promote better working conditions and fairer prices for cocoa farmers.

Innovation and Alternatives

Innovation and the exploration of alternatives could help mitigate price increases.

- Plant-Based Chocolate: Plant-based alternatives are gaining popularity, offering potential substitutes for traditional chocolate.

- Technological Advancements: Investing in technology to improve cocoa bean production and processing can increase efficiency and lower costs.

Consumer Behavior and Adaptation

Consumer behavior will likely adapt to the persistently high prices of chocolate.

- Shifting Consumption Patterns: Consumers may reduce their overall chocolate consumption or shift towards cheaper alternatives.

- Acceptance of Higher Prices: Over time, consumers may adjust their expectations and accept higher prices for their favorite chocolate bars.

Conclusion

The seemingly simple chocolate bar serves as a powerful illustration of the complex economic forces driving inflation. From cocoa bean production challenges to supply chain disruptions and the impact of government policies, numerous factors contribute to the rising cost of this beloved treat. Understanding the chocolate bar fueling inflation requires acknowledging these interconnected issues. To learn more about sustainable chocolate consumption and the wider economic factors at play, explore resources from organizations like the International Cocoa Organization and Fairtrade. Let's work towards a future where enjoying our favorite chocolate bar doesn't come at the cost of economic stability and ethical production practices. Understanding the chocolate bar fueling inflation is crucial for navigating these challenging economic times.

Featured Posts

-

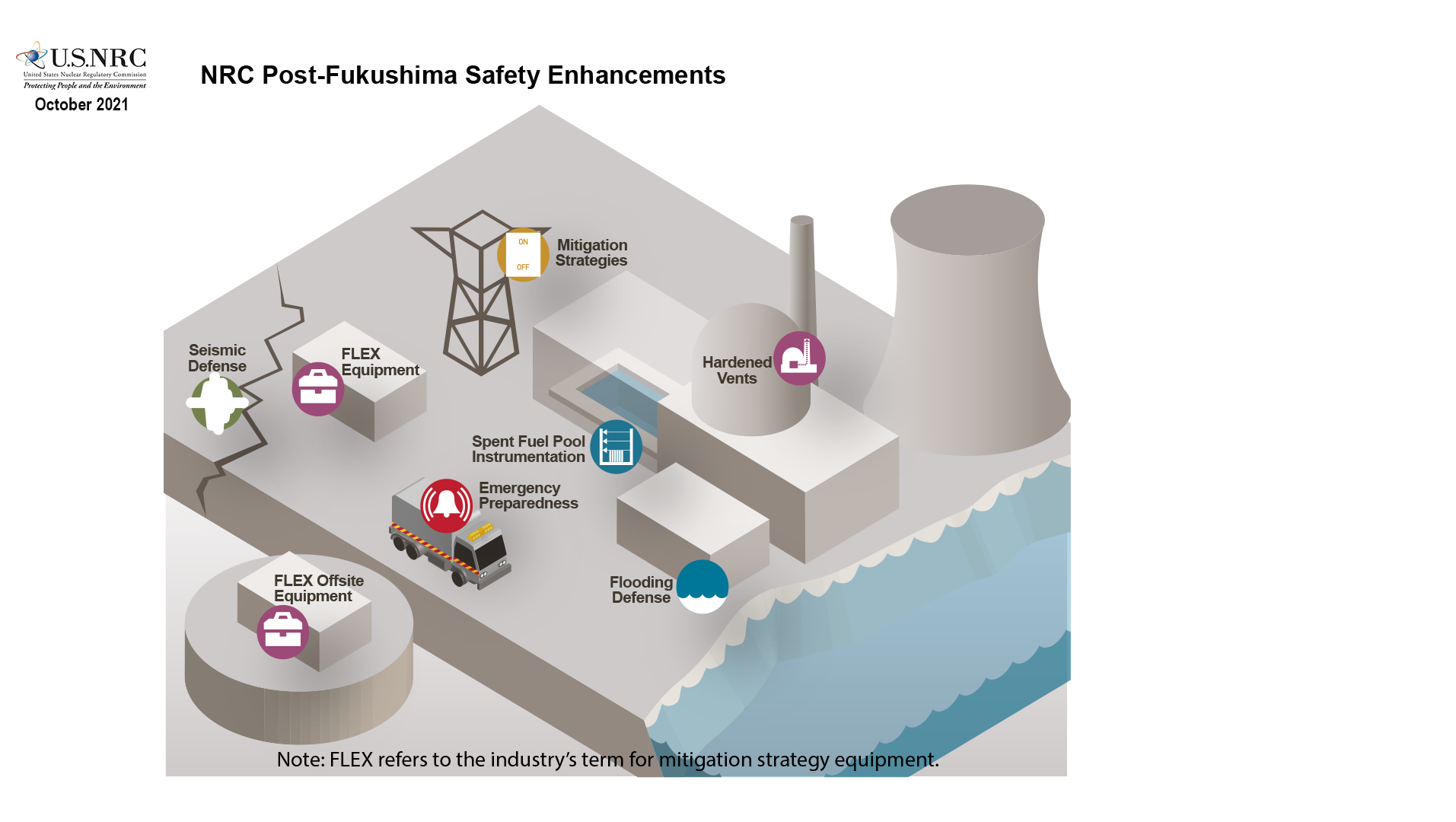

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025

Planning A Reactor Power Uprate Navigating The Nrc Process

May 01, 2025 -

Germany Klingbeil Rebuffing Pressure For Russian Gas Resumption

May 01, 2025

Germany Klingbeil Rebuffing Pressure For Russian Gas Resumption

May 01, 2025 -

Ziaire Williams Nba Redemption A Second Chance Story

May 01, 2025

Ziaire Williams Nba Redemption A Second Chance Story

May 01, 2025 -

Popular Us Cruise Lines Reviews And Comparisons

May 01, 2025

Popular Us Cruise Lines Reviews And Comparisons

May 01, 2025 -

Social Media Frenzy Kashmir Cat Owners React To Viral Videos

May 01, 2025

Social Media Frenzy Kashmir Cat Owners React To Viral Videos

May 01, 2025