FTC Vs. Meta: Understanding The Antitrust Implications For WhatsApp And Instagram

Table of Contents

The FTC's Case Against Meta: A Deep Dive

The FTC's lawsuit against Meta centers on the allegation that the acquisitions of WhatsApp and Instagram were anti-competitive moves designed to stifle competition and solidify Meta's dominance in the social media landscape.

Allegations of Anticompetitive Behavior

The FTC claims Meta engaged in several anticompetitive practices:

- Suppression of Competition: The FTC argues Meta acquired potential competitors, preventing them from challenging Meta's market dominance. This prevented the emergence of innovative alternatives and limited consumer choice.

- Leveraging Market Power: The FTC alleges Meta used its existing market power to leverage its acquisitions, further entrenching its position and making it difficult for new entrants to gain a foothold. This included using data gathered from one platform to benefit another.

- Hindering Innovation: By eliminating potential competitors, Meta allegedly hindered innovation in the social media market, reducing the pace of technological advancement and improvements to user experience.

The FTC's core argument is that Meta's acquisitions were not about innovation or integration but about eliminating nascent threats and maintaining a monopolistic grip on the market.

Evidence Presented by the FTC

The FTC's case relies on a substantial amount of evidence, including:

- Internal Meta Documents: These documents allegedly reveal internal discussions and strategies indicating a deliberate plan to eliminate competitive threats through acquisitions.

- Market Data: The FTC presented market share data illustrating Meta's overwhelming dominance in the social media sector, arguing that the acquisitions further solidified this dominance.

- Expert Testimony: Economic experts testified on the anti-competitive effects of the acquisitions, analyzing market structures and the impact on competition.

The strength of the FTC's evidence remains a point of contention, with Meta challenging both the interpretation and significance of the presented data. The role of user data and network effects—the value of a platform increasing with the number of users—is central to the FTC's argument, suggesting Meta leveraged this to its advantage post-acquisition.

Meta's Defense: Justifying the Acquisitions

Meta's defense strategy focuses on portraying the acquisitions as beneficial for innovation and user experience, not anti-competitive maneuvers.

Arguments for Integration and Innovation

Meta argues that the integration of WhatsApp and Instagram with its existing platforms fostered innovation and improved user experience:

- Increased Innovation: Meta claims the acquisitions led to technological advancements, such as improved messaging features and cross-platform functionalities.

- Enhanced User Experience: Meta asserts that the integrations created a seamless and more convenient experience for users, allowing for effortless communication and content sharing across platforms.

- Economies of Scale: The company argues that combining resources and operations led to cost savings and improved efficiency, ultimately benefiting users and driving innovation.

Meta’s legal team has provided numerous examples of specific technological improvements and user-benefit features that were a direct result of these integrations.

Counterarguments Against Anticompetitive Claims

Meta counters the FTC's allegations with several key arguments:

- Competitive Market: Meta argues that the social media market is dynamic and competitive, citing the existence of numerous alternative platforms like TikTok, Twitter, and Snapchat.

- Lack of Monopoly Power: Meta disputes the notion of a monopoly, arguing its market share does not restrict competition or prevent new entrants from challenging its position.

- Benefits to Consumers: Meta maintains that the acquisitions have ultimately benefited consumers by providing better services and a wider range of features.

Legal Precedents and Antitrust Law

The FTC vs. Meta case involves several key antitrust laws and legal precedents.

Relevant Antitrust Laws and Regulations

The core legal framework for the case involves:

- Sherman Act: This act prohibits monopolies and anti-competitive practices.

- Clayton Act: This act aims to prevent mergers and acquisitions that substantially lessen competition.

Key legal terms at play include: market definition (identifying the relevant market), market power (the ability to control prices or exclude competition), and anti-competitive conduct (actions that restrain trade). Previous landmark antitrust cases, such as those involving Microsoft and Google, serve as important precedents.

The Burden of Proof and Legal Challenges

The FTC carries the burden of proving Meta engaged in anti-competitive behavior. This requires demonstrating:

- Market Definition: Clearly defining the relevant market (e.g., is it global social media or a specific niche?).

- Market Power: Showing Meta possesses substantial market power.

- Anti-competitive Conduct: Proving the acquisitions had a demonstrably anti-competitive effect.

Prosecuting such cases in the complex digital marketplace presents significant challenges. Defining markets, measuring market power, and proving causation are all difficult tasks. The outcome of this case will significantly impact future antitrust enforcement in the tech sector.

Conclusion

The FTC vs. Meta case represents a critical legal battle with far-reaching implications for the future of social media and antitrust regulation. Both sides have presented compelling arguments highlighting the complexities of balancing innovation with the prevention of monopolies. The FTC’s concerns about anti-competitive behavior and stifling innovation are weighed against Meta’s claims of integration-driven improvements and the continued dynamism of the social media market. The outcome will shape how future tech acquisitions are scrutinized and could set new precedents for antitrust law in the digital age.

The FTC vs. Meta case is a landmark legal battle with profound implications for the future of social media and antitrust law. Staying informed about the evolving legal landscape and understanding the nuances of antitrust regulations concerning acquisitions like those of WhatsApp and Instagram is crucial. Keep following updates on this case and similar antitrust battles to stay ahead of the curve in the ever-changing tech world. Further research into the FTC vs. Meta case and the broader topic of antitrust law is encouraged.

Featured Posts

-

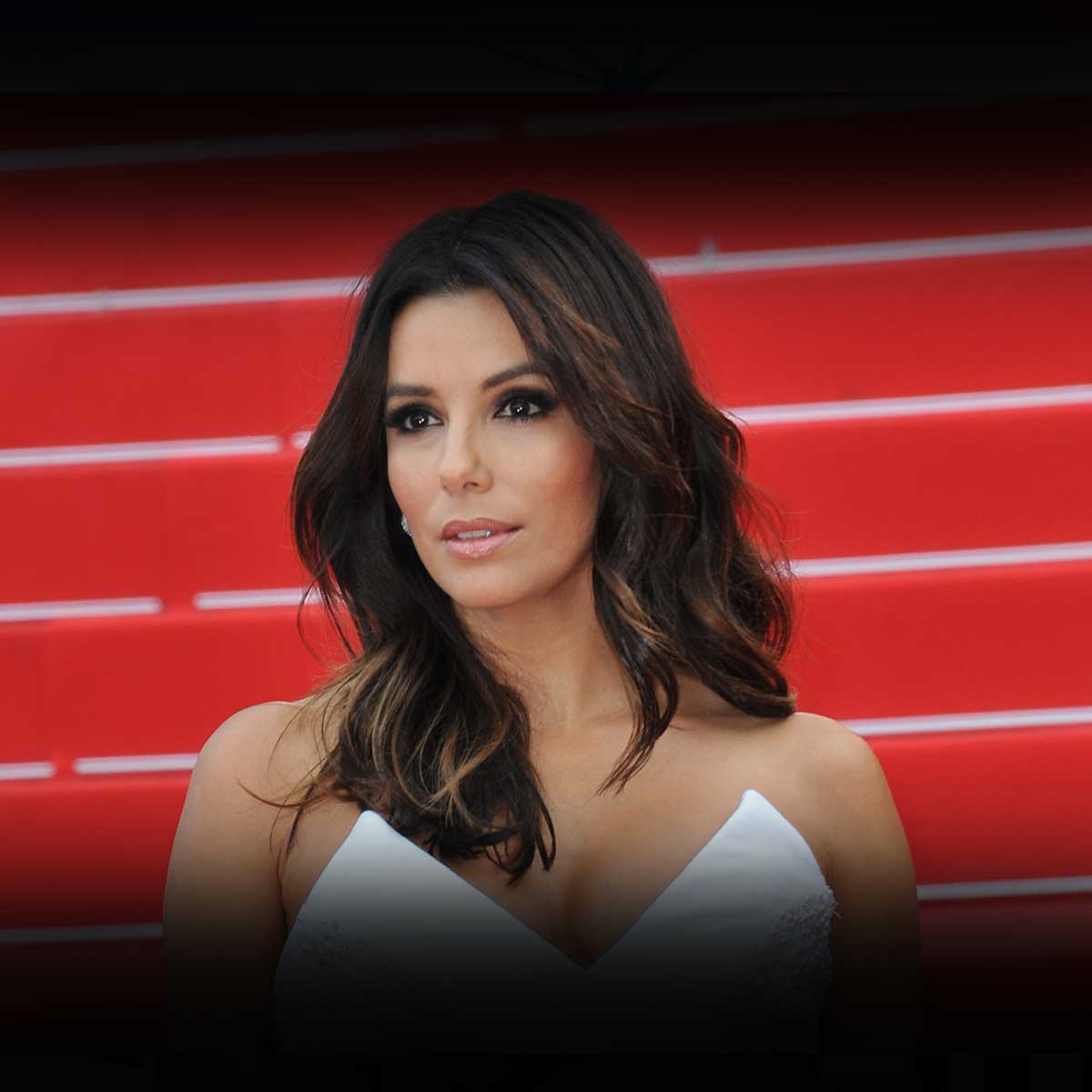

The Best Of Eva Longoria Stunning Photos For Her 50th Birthday

May 13, 2025

The Best Of Eva Longoria Stunning Photos For Her 50th Birthday

May 13, 2025 -

Local Death Notices And Obituaries

May 13, 2025

Local Death Notices And Obituaries

May 13, 2025 -

Ekspose Foto Jaringan Penipuan Online Internasional Di Myanmar Libatkan Warga Indonesia

May 13, 2025

Ekspose Foto Jaringan Penipuan Online Internasional Di Myanmar Libatkan Warga Indonesia

May 13, 2025 -

Edan Alexander Released Understanding The Hamas Hostage Deal

May 13, 2025

Edan Alexander Released Understanding The Hamas Hostage Deal

May 13, 2025 -

Reviewing The Climax The Hobbit The Battle Of The Five Armies

May 13, 2025

Reviewing The Climax The Hobbit The Battle Of The Five Armies

May 13, 2025