Gibraltar Industries Earnings Preview: Key Financial Metrics To Watch

Table of Contents

Gibraltar Industries is a leading manufacturer and distributor of building products, specializing in residential, commercial, and industrial applications. Its market position makes understanding its financial performance critical for investors interested in the construction and building products sectors. The purpose of this article is to provide an overview of the crucial financial metrics you should focus on when reviewing the Gibraltar Industries earnings report.

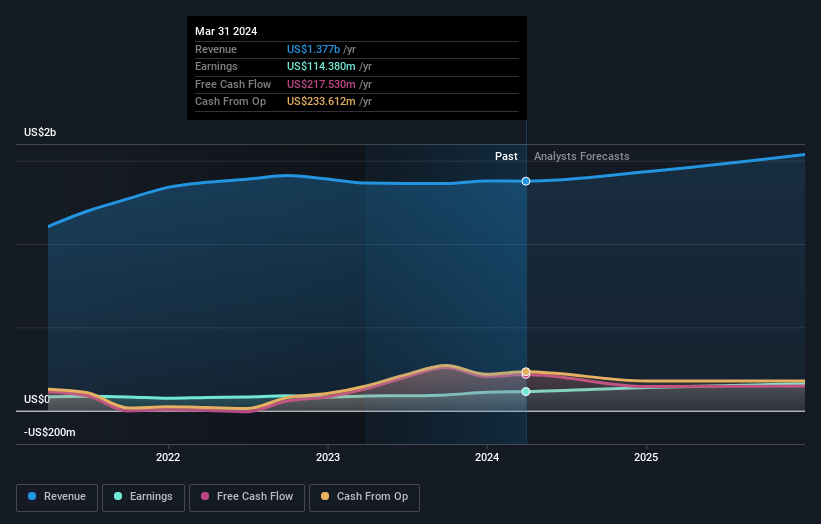

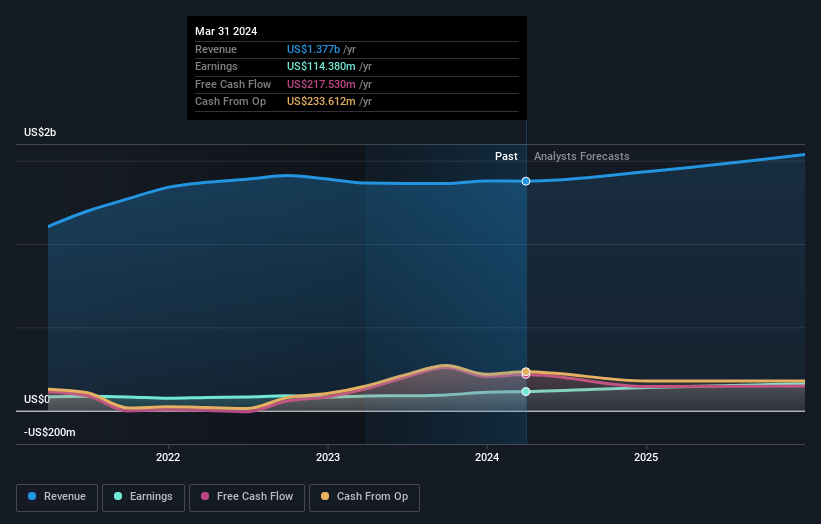

Revenue Growth and Analysis

Analyzing Gibraltar Industries' revenue growth is paramount. We need to examine the projected revenue growth compared to previous quarters and years, identifying the underlying drivers. Factors such as market demand, pricing strategies, and the success of new product launches significantly impact revenue.

- Examine revenue breakdown by segment: Understanding the performance of each segment (residential, commercial, industrial) provides a granular view of Gibraltar Industries' revenue streams and allows for identification of areas of strength and weakness. This analysis of Gibraltar Industries revenue will reveal the contribution of each segment to overall growth.

- Assess the impact of macroeconomic factors: Economic conditions, such as interest rates, inflation, and construction activity, play a significant role. A thorough analysis of these macroeconomic factors will provide context for interpreting Gibraltar Industries revenue performance.

- Compare revenue growth to competitors: Benchmarking against competitors like other building products manufacturers helps assess Gibraltar Industries' market share and competitive positioning. Analyzing year-over-year growth in relation to competitors provides valuable context. This comparison of Gibraltar Industries revenue with that of competitors will highlight areas for improvement.

Keywords: Gibraltar Industries revenue, revenue growth, year-over-year growth, segment performance, market share

Profitability Metrics: Gross Margin & Operating Margin

Profitability is a key indicator of a company's financial health. Gross margin and operating margin provide insights into Gibraltar Industries' efficiency and cost management. Changes in these metrics reflect pricing power, cost control, and overall operational effectiveness.

- Analyze the trends in gross margin and operating margin over time: Tracking these metrics over several quarters and years reveals long-term trends and helps identify potential issues. This analysis is crucial for assessing Gibraltar Industries profitability over time.

- Identify factors contributing to changes in margins: Fluctuations in raw material costs, labor costs, and pricing strategies directly influence margins. Understanding these factors is crucial for predicting future profitability for Gibraltar Industries.

- Compare margins to industry benchmarks: Comparing Gibraltar Industries' gross and operating margins to those of its competitors provides a valuable benchmark for assessing its relative profitability. This comparison of Gibraltar Industries profitability against industry standards shows its competitive advantage.

Keywords: Gibraltar Industries profitability, gross margin, operating margin, cost analysis, efficiency

Cash Flow and Liquidity

Understanding Gibraltar Industries' cash flow and liquidity is essential for assessing its financial strength and stability. This involves examining free cash flow, operating cash flow, and debt levels. Strong cash flow indicates a healthy financial position, while sufficient liquidity ensures the company can meet its short-term obligations.

- Assess the company's ability to generate positive cash flow: Consistent positive cash flow is a sign of financial health and allows for reinvestment, debt reduction, and shareholder returns. Gibraltar Industries cash flow is a key metric to watch.

- Analyze changes in working capital and their impact on liquidity: Changes in accounts receivable, inventory, and accounts payable can affect liquidity. Understanding these changes provides further insight into Gibraltar Industries' working capital management efficiency.

- Evaluate the level of debt and its potential impact on future performance: High debt levels can strain a company's finances and limit its flexibility. The level of debt for Gibraltar Industries and its management will impact future performance.

Keywords: Gibraltar Industries cash flow, free cash flow, operating cash flow, working capital, liquidity, debt levels

Guidance and Future Outlook

Management's guidance on future performance provides crucial insight into Gibraltar Industries' expectations. Analyzing the company's projections for revenue, earnings, and other key metrics allows investors to assess the realism and potential risks associated with the projections.

- Evaluate the credibility and realism of the provided guidance: Consider historical accuracy and any potential headwinds that might impact the forecast. A realistic assessment of Gibraltar Industries guidance is essential for informed decision-making.

- Consider any potential risks or uncertainties mentioned in the guidance: Pay close attention to any potential risks or uncertainties highlighted by management, such as supply chain disruptions or economic downturns. Gibraltar Industries future outlook requires a consideration of all potential risks and uncertainties.

- Compare the guidance to analyst expectations: Comparing management's guidance to analyst consensus helps gauge market sentiment and identify any potential discrepancies. This comparison provides a further perspective on Gibraltar Industries' guidance.

Keywords: Gibraltar Industries guidance, future outlook, earnings forecast, revenue projections, market outlook

Conclusion: Key Takeaways and Call to Action

Analyzing Gibraltar Industries' financial performance requires a comprehensive review of revenue growth, profitability margins, cash flow, and management guidance. Understanding these key metrics offers a holistic view of the company's financial health and future prospects. Thoroughly evaluating these aspects is crucial for making well-informed investment decisions. Stay tuned for our next analysis of Gibraltar Industries' earnings, and remember to thoroughly analyze these key metrics for a well-informed investment strategy. Conduct your own Gibraltar Industries financial analysis and perform a comprehensive Gibraltar Industries earnings review before making any investment decisions.

Featured Posts

-

Nhl Draft Lottery 2024 New York Islanders Secure Top Pick

May 13, 2025

Nhl Draft Lottery 2024 New York Islanders Secure Top Pick

May 13, 2025 -

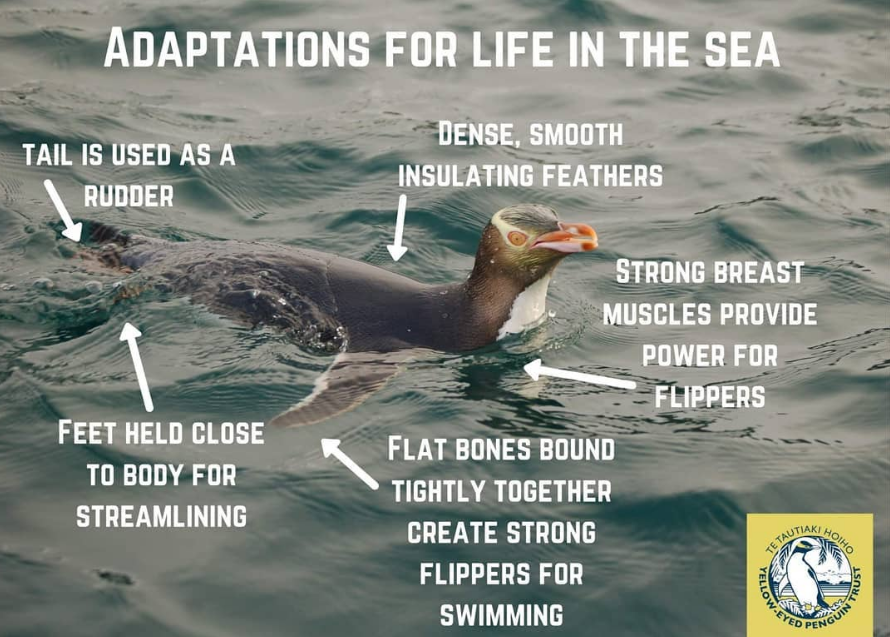

The Wonder Of Animals Their Adaptations And Survival Strategies

May 13, 2025

The Wonder Of Animals Their Adaptations And Survival Strategies

May 13, 2025 -

K 80 Letiyu Pobedy Novye Vyplaty Dlya Veteranov Eao

May 13, 2025

K 80 Letiyu Pobedy Novye Vyplaty Dlya Veteranov Eao

May 13, 2025 -

Un Accord Post Brexit Pour Gibraltar Ou En Sommes Nous

May 13, 2025

Un Accord Post Brexit Pour Gibraltar Ou En Sommes Nous

May 13, 2025 -

Braunschweiger Schoduvel Der Karnevalsumzug Ist Gestartet

May 13, 2025

Braunschweiger Schoduvel Der Karnevalsumzug Ist Gestartet

May 13, 2025