Global Bond Market Instability: A Posthaste Warning

Table of Contents

Rising Interest Rates and Their Impact

Central bank actions to combat inflation directly influence bond prices and yields. Understanding the mechanics of interest rate hikes is crucial for investors to protect their portfolios.

The Mechanics of Interest Rate Hikes

Interest rate risk is the risk that changes in interest rates will negatively impact the value of a bond. When central banks raise interest rates, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This leads to a decrease in the price of existing bonds. The yield curve, which depicts the relationship between the yield and maturity of bonds, also shifts, impacting the pricing of bonds across the maturity spectrum. Duration risk, which measures a bond's sensitivity to interest rate changes, becomes particularly relevant in a rising rate environment. Longer-duration bonds are more sensitive to interest rate fluctuations than shorter-duration bonds.

- Rising rates lead to falling bond prices: As yields on new bonds increase, the price of older bonds with lower coupon rates must fall to match the market.

- Impact on different bond types: Government bonds, while generally considered less risky, are still susceptible to interest rate hikes. Corporate bonds, especially those with lower credit ratings, face even greater challenges as borrowing costs rise.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of borrowing for governments and corporations, potentially slowing economic growth.

- The effect on fixed-income investors: Fixed-income investors relying on consistent returns from their bond portfolios face decreased income and capital losses in a rising interest rate environment.

Inflationary Pressures and Bond Market Volatility

High inflation significantly erodes the real return on bonds, creating further instability in the global bond market.

Inflation's Erosive Effect on Bond Returns

Inflation diminishes the purchasing power of future interest payments and the principal repayment at maturity. The real yield, which is the nominal yield minus the inflation rate, represents the true return an investor receives after adjusting for inflation. When inflation rises unexpectedly, real yields fall, impacting investor confidence and bond prices. Inflation expectations play a crucial role in bond pricing; higher expected inflation typically leads to higher nominal yields to compensate for the erosion of purchasing power.

- Inflation's impact on bond yields: High inflation generally pushes bond yields higher as investors demand a higher return to compensate for the loss of purchasing power.

- The role of inflation expectations in bond pricing: Market participants anticipate future inflation, and this expectation is factored into bond prices.

- Strategies for mitigating inflation risk in bond portfolios: Investors can consider inflation-protected securities (TIPS) or incorporate assets such as real estate or commodities that tend to perform well during inflationary periods into their portfolio.

Geopolitical Risks and Their Influence on Bond Markets

Geopolitical events introduce significant uncertainty, influencing investor sentiment and creating volatility in the bond market.

Global Uncertainty and Bond Market Sentiment

Wars, trade disputes, and political instability can significantly impact bond yields and market sentiment. Investors often seek safe-haven assets, such as government bonds of highly stable economies (e.g., US Treasuries, German Bunds), during times of uncertainty. This "flight to safety" can lead to increased demand and lower yields on these safe-haven assets while negatively affecting other bond markets.

- Impact of major geopolitical events on bond yields: Major geopolitical events often lead to increased volatility and potentially higher yields on riskier bonds as investors seek safety.

- Safe-haven assets and their role during times of uncertainty: Investors flock to assets perceived as safe, reducing their risk exposure in volatile markets.

- Diversification strategies to manage geopolitical risk: Diversification across geographies and asset classes is crucial to manage risks linked to specific regions or geopolitical events.

Assessing and Managing Risk in the Current Environment

Effective risk management is paramount in today's volatile bond market environment.

Diversification and Portfolio Allocation

Diversification is a cornerstone of effective risk management. Spreading investments across different bond types (government, corporate, municipal), maturities, and geographies helps reduce the impact of any single negative event. Considering alternative investments, such as real estate or private equity, can further reduce the overall exposure to the fluctuations in the bond market.

- Diversifying across different bond types and maturities: This approach allows you to manage interest rate risk and credit risk more effectively.

- Considering alternative investments to reduce bond market exposure: This helps create a more resilient investment portfolio and helps reduce reliance on any single asset class.

- Importance of professional financial advice: A financial advisor can help design a tailored strategy based on your risk tolerance, financial goals, and investment horizon.

Conclusion

Global bond market instability is driven by a confluence of factors: rising interest rates, inflationary pressures, and persistent geopolitical risks. Understanding these risks and implementing appropriate strategies is crucial for maintaining portfolio stability. The key takeaways are the need for diligent risk assessment, effective diversification, and proactive portfolio management. Don't let global bond market instability catch you off guard. Take control of your financial future by carefully assessing your portfolio and implementing a robust risk management strategy. Consult with a financial advisor to develop a plan tailored to your individual needs and risk tolerance, ensuring you navigate the challenges of global bond market instability successfully.

Featured Posts

-

Manchester United Transfer News Ten Hags Brobbey Pursuit And Hojlunds Success

May 23, 2025

Manchester United Transfer News Ten Hags Brobbey Pursuit And Hojlunds Success

May 23, 2025 -

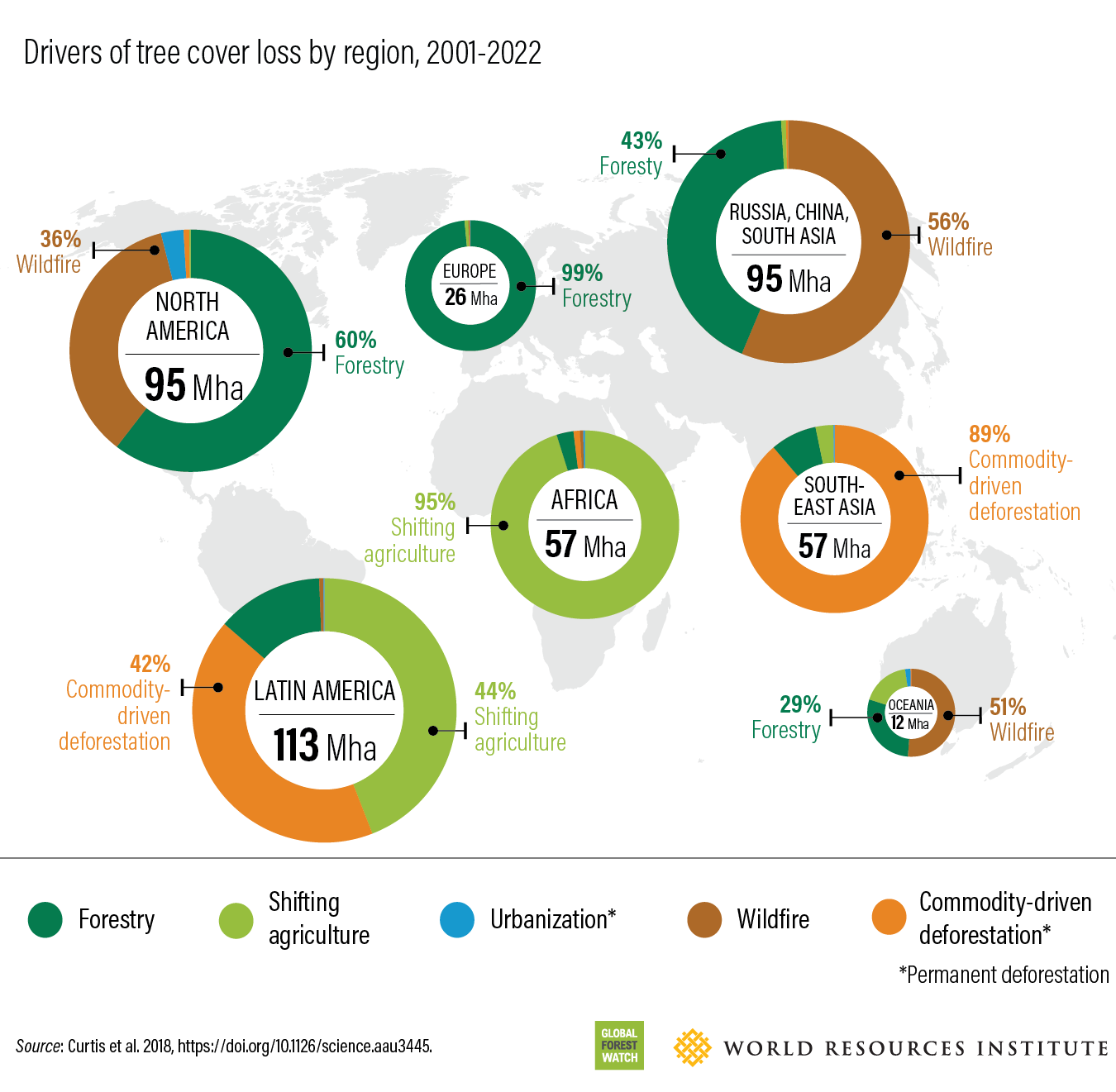

Global Forest Loss Surges To Record Levels Amidst Widespread Wildfires

May 23, 2025

Global Forest Loss Surges To Record Levels Amidst Widespread Wildfires

May 23, 2025 -

Jasprit Bumrah Top Ranked Test Bowler In Icc Rankings

May 23, 2025

Jasprit Bumrah Top Ranked Test Bowler In Icc Rankings

May 23, 2025 -

New Claims Surface Regarding Dc Jewish Museum Suspect Elias Rodriguez

May 23, 2025

New Claims Surface Regarding Dc Jewish Museum Suspect Elias Rodriguez

May 23, 2025 -

This Morning Cat Deeleys Perfect Denim Midi Dress And The Cowboy Trend

May 23, 2025

This Morning Cat Deeleys Perfect Denim Midi Dress And The Cowboy Trend

May 23, 2025