Global Oil Market: News And Price Analysis (May 16, 2024)

Table of Contents

Recent Oil Price Fluctuations and Underlying Factors

Several intertwined factors contribute to the recent swings in oil prices. Let's delve into the key drivers shaping the current global oil market.

Geopolitical Events and their Impact

Geopolitical instability remains a major influence on oil prices. Recent events have significantly impacted the global oil supply and price dynamics.

- The ongoing conflict in [Specific Region]: This conflict has disrupted oil production and transportation, leading to supply chain bottlenecks and higher crude oil prices. Both Brent and WTI benchmarks have shown significant sensitivity to escalating tensions.

- Sanctions on [Specific Country]: These sanctions have reduced oil exports from a major producer, further tightening the global supply and pushing up prices. The impact is particularly noticeable in the Brent crude oil benchmark.

- Increased tensions in [Specific Region]: Rising tensions in this region pose a significant threat to global oil supplies, creating uncertainty and potentially leading to future price spikes. Market participants are closely monitoring the situation for any escalation that could impact both Brent and WTI crude oil prices.

OPEC+ Decisions and Production Levels

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) play a critical role in shaping global oil supply. Recent decisions have had a significant impact on oil price movements.

- Production Cuts: Recent OPEC+ meetings have resulted in decisions to reduce oil production quotas. This aims to support oil prices by reducing the global oil supply. Compliance levels among member states are closely watched.

- Compliance Rate: The adherence of OPEC+ members to production quotas is a crucial factor affecting oil prices. Any deviation from agreed-upon levels can influence the market's supply-demand balance.

- Internal Disagreements: Disagreements among OPEC+ members regarding production strategies can introduce uncertainty into the market, potentially leading to price volatility.

Global Demand Dynamics

Global oil demand is influenced by various factors, including economic growth, seasonal changes, and the adoption of alternative energy sources.

- Economic Outlook: A robust global economy generally translates to higher oil demand, driving prices upwards. Conversely, economic slowdowns can dampen demand and put downward pressure on prices.

- Regional Demand: Asia's rapid economic growth continues to fuel a significant portion of global oil demand. North America and Europe also contribute substantially, though growth rates vary.

- Seasonal Factors: Oil demand typically increases during peak travel seasons (summer and holiday periods), impacting prices.

- Alternative Energy: The increasing adoption of renewable energy sources, such as solar and wind power, gradually reduces reliance on fossil fuels, impacting long-term oil demand.

Supply Chain Disruptions and their Influence on Oil Prices

Disruptions along the oil supply chain can dramatically affect prices.

Production Challenges and Bottlenecks

Several factors can hinder oil production and create supply bottlenecks.

- Weather Events: Hurricanes, extreme weather, and other natural disasters can damage oil infrastructure and disrupt production.

- Infrastructure Issues: Aging oil infrastructure, maintenance shutdowns, and unexpected equipment failures can lead to production shortfalls.

- Refinery Outages: Unexpected refinery closures or reduced capacity due to maintenance or accidents directly affect the availability of refined oil products, impacting prices.

Transportation and Logistics

Efficient transportation of crude oil and refined products is crucial. Disruptions can significantly impact prices.

- Shipping Delays: Port congestion, vessel unavailability, or geopolitical events affecting shipping routes can delay oil shipments, causing temporary supply shortages.

- Pipeline Issues: Pipeline leaks, maintenance shutdowns, or political disputes involving pipelines can lead to significant disruptions in oil transportation.

Inventory Levels and their Significance

Global oil inventory levels are a key indicator of supply and demand dynamics.

- High Inventories: High oil inventories generally suggest sufficient supply and can put downward pressure on prices.

- Low Inventories: Conversely, low inventories signal potential supply shortages and can lead to price increases.

- Strategic Petroleum Reserves: Governments often maintain strategic petroleum reserves to address potential supply disruptions. Releases from these reserves can influence market prices.

Future Outlook for the Global Oil Market

Predicting future oil prices is inherently challenging due to the complexity of the market.

Price Predictions and Forecasting Models

Several forecasting models are used to estimate future oil prices, but uncertainty remains.

- Short-Term Predictions: Short-term forecasts often consider current supply-demand dynamics, geopolitical events, and OPEC+ decisions.

- Long-Term Predictions: Long-term predictions incorporate factors like economic growth, technological advancements, and the adoption of alternative energy sources.

Factors Potentially Impacting Future Prices

Several factors will continue to shape future oil price movements.

- Economic Growth: Sustained global economic growth will likely increase oil demand, pushing prices higher.

- Technological Advancements: Innovations in oil extraction and refining technologies could impact production costs and supply.

- Climate Policies: Government regulations and policies aimed at reducing carbon emissions could influence oil demand and investment in the sector.

- Renewable Energy Adoption: The continued growth of renewable energy sources will gradually reduce dependence on fossil fuels, influencing long-term oil demand.

- Investment in Exploration: Increased investment in oil and gas exploration could potentially lead to increased future supply.

Conclusion

The global oil market continues to exhibit significant price volatility driven by a complex interplay of geopolitical events, OPEC+ decisions, global demand dynamics, and supply chain disruptions. Understanding these interwoven factors is crucial for navigating the current landscape and making informed decisions. While predicting future prices remains challenging, monitoring these key indicators provides valuable insights. Stay updated on global oil market news and price analysis to remain informed about this critical sector. For comprehensive global oil market analysis, return to our site regularly.

Featured Posts

-

Landry Shamet And The New York Knicks A Difficult Decision

May 17, 2025

Landry Shamet And The New York Knicks A Difficult Decision

May 17, 2025 -

Austintown And Boardman Police Blotter Your Local Crime News Source

May 17, 2025

Austintown And Boardman Police Blotter Your Local Crime News Source

May 17, 2025 -

Ambassadors Remarks On China Canada Trade Deal Prospects

May 17, 2025

Ambassadors Remarks On China Canada Trade Deal Prospects

May 17, 2025 -

Perkins Tells Brunson To Ditch Podcast Knicks Star Under Fire

May 17, 2025

Perkins Tells Brunson To Ditch Podcast Knicks Star Under Fire

May 17, 2025 -

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025

Latest Posts

-

Nba Refs Admit Missed Foul Call In Knicks Close Win Over Pistons

May 17, 2025

Nba Refs Admit Missed Foul Call In Knicks Close Win Over Pistons

May 17, 2025 -

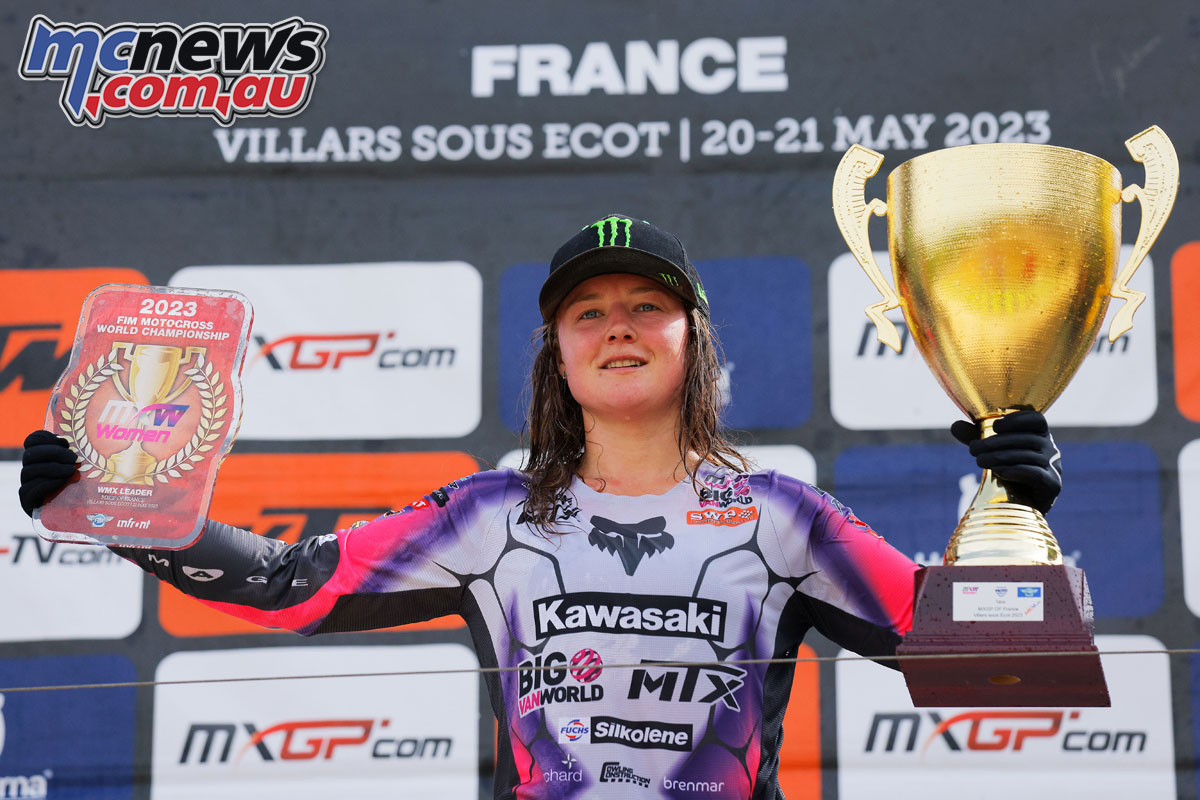

Comprehensive Moto News Gncc Mx Sx Flat Track And Enduro Coverage

May 17, 2025

Comprehensive Moto News Gncc Mx Sx Flat Track And Enduro Coverage

May 17, 2025 -

Your Guide To Moto News Gncc Mx Sx Flat Track And Enduro Racing

May 17, 2025

Your Guide To Moto News Gncc Mx Sx Flat Track And Enduro Racing

May 17, 2025 -

Get The Scoop Moto News From Gncc Mx Sx Flat Track And Enduro Events

May 17, 2025

Get The Scoop Moto News From Gncc Mx Sx Flat Track And Enduro Events

May 17, 2025 -

Motocross News Gncc Mx Sx Flat Track And Enduro Racing

May 17, 2025

Motocross News Gncc Mx Sx Flat Track And Enduro Racing

May 17, 2025