Gold Investment Soars On Trump's Latest Trade Actions

Table of Contents

Uncertainty Drives Safe-Haven Demand for Gold

Gold has long been considered a safe-haven asset, a reliable store of value during times of economic and political turmoil. When market volatility increases, investors often flock to gold as a hedge against losses in other asset classes. This "flight to safety" is precisely what we're witnessing now. The current climate of uncertainty is characterized by:

- Increased geopolitical risks: Ongoing global conflicts and political instability contribute to a sense of unease in the markets.

- Trade war concerns impacting global markets: Trump's trade policies, including tariffs and trade disputes, have created significant uncertainty about the future direction of the global economy. This uncertainty directly impacts investor confidence.

- Weakening of the US dollar: As the US dollar weakens against other major currencies, gold, priced in US dollars, becomes relatively more attractive to international investors.

- Investor flight to safety: Investors are actively seeking to protect their capital from potential losses, leading to increased demand for gold, a traditionally stable asset.

Gold prices have reflected this shift. For instance, the price of gold increased by X% in the last Y months, directly correlating with periods of heightened trade tensions. Data from [cite reputable source, e.g., World Gold Council] confirms this surge in investment.

Impact of Trump's Trade Policies on Gold Prices

President Trump's trade policies have been a significant catalyst for the recent gold price increases. His actions have injected volatility into the global markets, triggering a rush towards safer investment options like gold. Specific actions include:

- Tariffs imposed on specific goods: Tariffs on imported goods increase prices for consumers and businesses, impacting economic growth and investor sentiment.

- Trade disputes with major economies: Ongoing trade wars with countries like China create uncertainty and disrupt global supply chains.

- Impact on global supply chains: Disruptions to global supply chains lead to increased production costs and potential shortages, impacting business profitability and fueling investor anxiety.

- Effect on currency exchange rates: Trade disputes and uncertainty can lead to fluctuations in currency exchange rates, further impacting gold prices.

Reports from [cite reputable source, e.g., Bloomberg, Financial Times] highlight the direct correlation between Trump's trade actions and increased market volatility, fueling demand for gold as a safe haven.

How Investors are Responding to the Gold Rush

Investors are responding to this heightened demand for gold in several ways:

- Increased demand for gold ETFs: Exchange-Traded Funds (ETFs) that track the price of gold have seen a significant increase in investment. This provides a convenient and accessible way for investors to gain exposure to gold.

- Growth in gold mining stock prices: The increased price of gold has also led to a rise in the prices of gold mining stocks, offering another avenue for investors to participate in the gold market.

- Retail investor interest in physical gold: Many retail investors are purchasing physical gold bars and coins, viewing them as a tangible store of value.

- Diversification strategies incorporating gold: Many investors are incorporating gold into their portfolios as a way to diversify and mitigate risk during times of market uncertainty.

Long-Term Implications for Gold Investment

The long-term outlook for gold investment remains uncertain, but several factors suggest potential for continued price increases:

- Potential for continued price increases: If global uncertainty persists, gold prices could continue to rise as investors seek safe havens.

- Factors that could influence future gold prices: Geopolitical events, inflation rates, and central bank policies will all play a role in shaping future gold prices.

- Risks associated with gold investment: Gold's price can be volatile, and it doesn't generate income like dividend-paying stocks or bonds.

- Advice for investors considering gold: It's essential to consider your risk tolerance and investment goals before investing in gold. Consult with a financial advisor to determine if gold is a suitable investment for your portfolio.

Navigate the Gold Investment Landscape

In summary, the surge in gold investment is strongly correlated with President Trump's trade actions and the resulting market uncertainty. Gold's role as a safe-haven asset has been reaffirmed, as investors seek to protect their portfolios from economic volatility. Understanding the factors driving gold investment, particularly in light of recent trade actions, is crucial for investors looking to protect their portfolios. Explore different gold investment strategies today and secure your financial future. Learn more about gold investment options and make informed decisions to navigate the ever-changing gold market.

Featured Posts

-

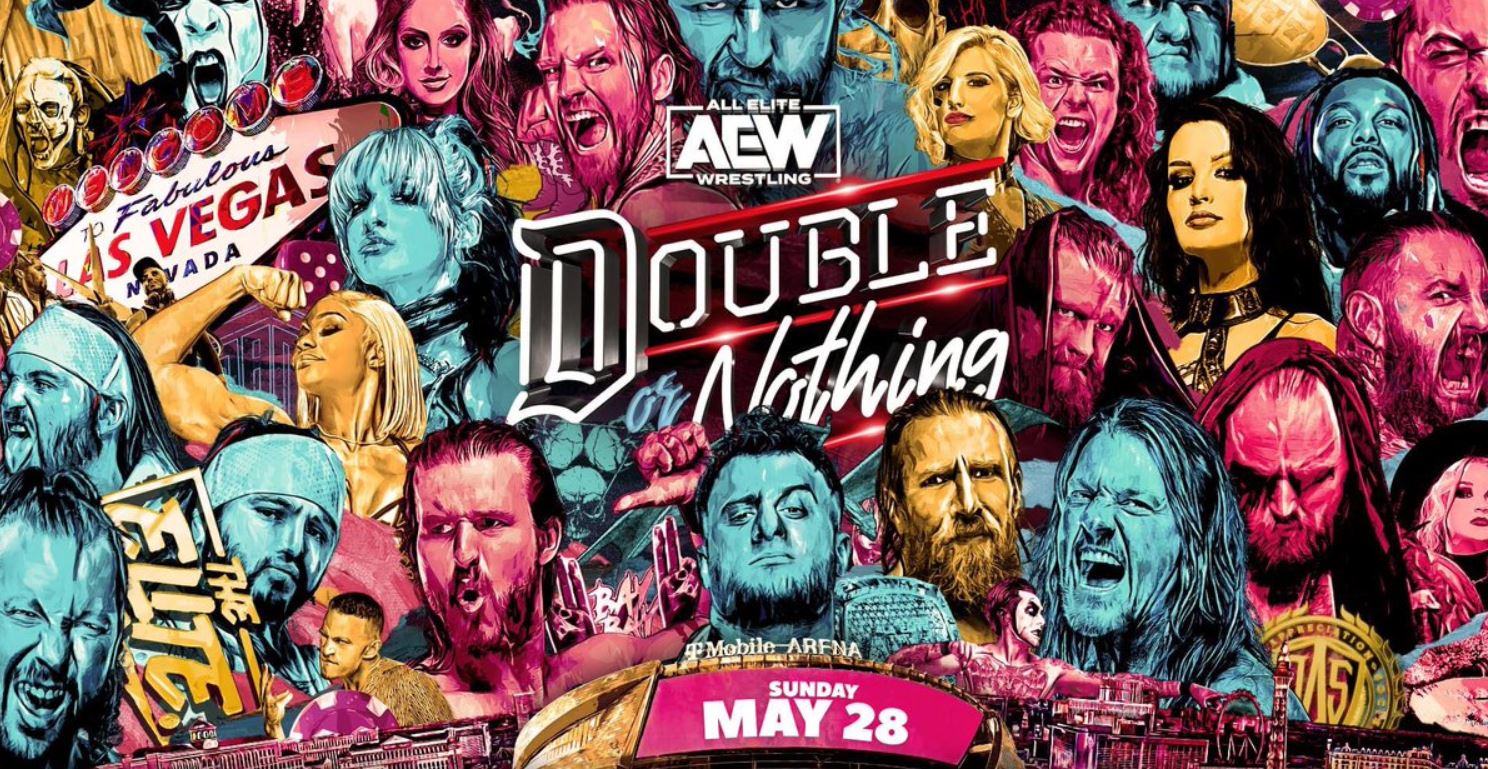

Aew Double Or Nothing 2025 Your Guide To The Event

May 27, 2025

Aew Double Or Nothing 2025 Your Guide To The Event

May 27, 2025 -

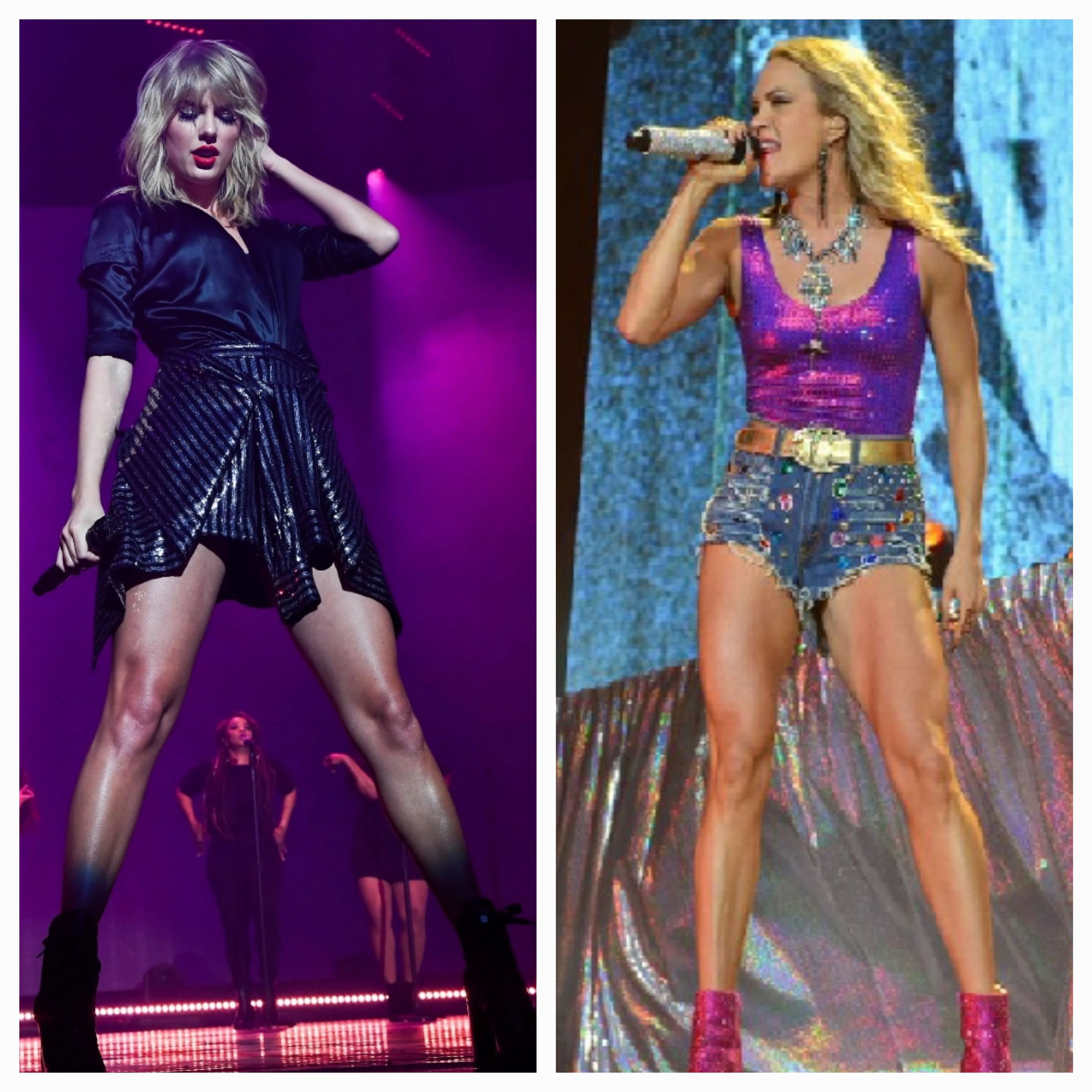

Carrie Underwoods Actions Towards Taylor Swift What Really Happened

May 27, 2025

Carrie Underwoods Actions Towards Taylor Swift What Really Happened

May 27, 2025 -

Shrakt Jzayryt Amrykyt Afaq Alteawn Fy Qtae Altyran

May 27, 2025

Shrakt Jzayryt Amrykyt Afaq Alteawn Fy Qtae Altyran

May 27, 2025 -

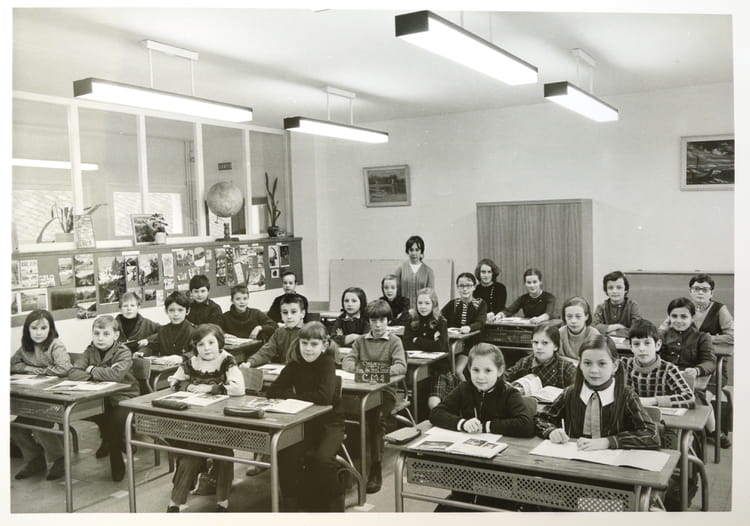

Ecole Maternelle De Saint Ouen Demenagement Printanier Face Aux Problemes De Trafic De Drogue

May 27, 2025

Ecole Maternelle De Saint Ouen Demenagement Printanier Face Aux Problemes De Trafic De Drogue

May 27, 2025 -

Earths Unexpected Aliens Predicting Non Xenomorph Lifeforms

May 27, 2025

Earths Unexpected Aliens Predicting Non Xenomorph Lifeforms

May 27, 2025