Gold Market Outlook: Understanding The Recent Price Drops In 2025

Table of Contents

H2: Macroeconomic Factors Influencing Gold Prices in 2025

The price of gold is highly sensitive to macroeconomic conditions. Several key factors are currently impacting the gold market outlook and contributing to the recent gold price drops.

H3: Rising Interest Rates and their Impact on Gold Investment

The inverse relationship between interest rates and gold prices is well-established. Higher interest rates make alternative investments, such as bonds, more attractive, reducing the demand for non-yielding assets like gold. This is because higher rates increase the opportunity cost of holding gold, which doesn't generate interest income.

- Mechanics of the Relationship: When interest rates rise, investors often shift their capital from gold to higher-yielding investments like government bonds and treasury bills.

- Central Bank Policies: The Federal Reserve's (and other central banks') monetary policies play a significant role. Aggressive interest rate hikes, such as those seen in early 2025, directly influence bond yields and, consequently, gold prices.

- Interest Rate Forecasts for 2025: Many analysts predict continued, albeit potentially slower, interest rate increases throughout 2025, putting further downward pressure on gold prices. This uncertainty adds to the volatility observed in the gold market. Keywords: interest rate hikes, bond yields, gold investment alternatives.

H3: Inflationary Pressures and the Safe-Haven Appeal of Gold

Gold is often considered a hedge against inflation. However, the relationship isn't always straightforward. While unexpected inflation can boost gold prices as investors seek to protect their purchasing power, controlled inflation may not have the same effect.

- Inflation Rate Data: While inflation rates have shown some signs of cooling in certain regions, uncertainty remains, impacting investor confidence and influencing gold price movements.

- Impact of Unexpected Inflation: Sudden spikes in inflation can significantly increase the demand for gold, driving up prices as investors seek a safe haven asset.

- Inflation Scenarios and Impact on Gold: Various inflation scenarios for 2025 exist. A sustained high inflation environment could potentially support higher gold prices, while a rapid deceleration of inflation could lead to further gold price drops. Keywords: inflation hedge, safe haven asset, purchasing power, gold price inflation correlation.

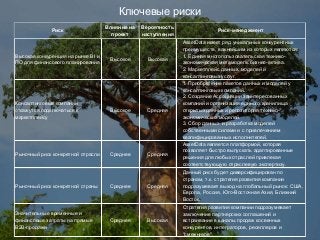

H3: Geopolitical Uncertainty and its Effect on Gold Demand

Geopolitical events significantly influence the demand for gold, often driving investors towards this safe-haven asset during times of global uncertainty.

- Examples of Geopolitical Events: The ongoing conflict in [mention a relevant geopolitical conflict] and escalating trade tensions between major economies have contributed to gold's safe-haven appeal in the past.

- Potential for Future Instability: The potential for future geopolitical instability remains a significant factor. Any escalation of conflicts or unforeseen geopolitical events can increase gold demand and potentially offset the downward pressure from rising interest rates.

- Impact on Gold Market Volatility: Geopolitical uncertainty often translates to increased volatility in the gold market, making it challenging to predict precise price movements. Keywords: geopolitical risk, safe haven asset gold, global uncertainty, gold market volatility.

H2: Supply and Demand Dynamics in the Gold Market 2025

The interplay of supply and demand is crucial in determining gold prices. Analyzing these dynamics is essential for understanding the recent gold price drops and formulating a future gold market outlook.

H3: Gold Mining Production and its Influence on Prices

Gold mining production plays a role in shaping gold prices, although its impact is often less dramatic than shifts in investor demand.

- Changes in Gold Mining Output: Recent data suggests [mention any relevant data on gold mine production changes]. This impacts the overall gold supply available in the market.

- Production Costs: Rising energy prices and other input costs can affect the profitability of gold mining operations, potentially impacting the overall gold supply.

- Technological Advancements: Advances in mining technology can influence production efficiency and ultimately gold supply. Keywords: gold mining production, gold supply chain, gold production costs.

H3: Investment Demand and its Role in Price Fluctuations

Investor sentiment, ETF flows, and central bank actions are major drivers of gold price fluctuations.

- Trends in Gold ETF Holdings: Changes in holdings of gold exchange-traded funds (ETFs) reflect investor sentiment and directly influence demand.

- Central Bank Gold Purchases: Central banks' decisions to buy or sell gold reserves can significantly impact prices.

- Investor Sentiment Towards Gold: Overall market sentiment towards gold—optimistic or pessimistic—plays a major role in shaping prices. Keywords: gold ETF, gold investment trends, central bank gold reserves, investor sentiment gold.

H2: Technical Analysis and Future Gold Price Predictions for 2025

While predicting precise gold prices is inherently challenging, technical analysis can offer insights into potential price movements.

H3: Chart Patterns and Technical Indicators

Technical indicators, such as moving averages and the Relative Strength Index (RSI), can help identify potential trends and support/resistance levels.

- Interpretation of Technical Indicators: [Explain how specific indicators—e.g., a bearish crossover in moving averages—might suggest a downward trend].

- Chart Patterns: Analyzing chart patterns like head and shoulders or triangles can offer clues about potential price reversals or continuations.

- Disclaimer: It is crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis. Keywords: technical analysis gold, gold price charts, gold price predictions 2025, gold trading signals.

H3: Analyst Forecasts and Market Sentiment

Analyst opinions and overall market sentiment paint a picture of the prevailing outlook for gold.

- Different Analyst Viewpoints: While some analysts predict further price drops, others foresee a potential rebound based on various macroeconomic factors.

- Range of Price Forecasts: The range of price forecasts for gold in 2025 is quite wide, reflecting the significant uncertainty in the market.

- Disclaimer: It's important to remember that all forecasts are subject to significant uncertainties and should not be considered financial advice. Keywords: gold market outlook 2025, gold price forecast, gold analyst predictions.

3. Conclusion

The gold market outlook for 2025 remains complex and multifaceted, influenced by a delicate interplay of macroeconomic conditions, supply and demand dynamics, and investor sentiment. Recent gold price drops are a result of several converging factors, including rising interest rates, controlled inflation, and shifts in investment strategies. While geopolitical uncertainty continues to offer some support for gold’s safe-haven appeal, the overall picture points to a challenging environment for gold investors in the short term.

Understanding the intricacies of the gold market is crucial for informed investment choices. Stay updated on the latest gold market outlook, monitor price movements, and consider consulting with a financial advisor before making any gold investment decisions. Remember to carefully analyze gold prices 2025 and the overall gold market outlook before making any investment decisions.

Featured Posts

-

S Sh A Vs Evropa Klyuchevye Strategicheskie Napravleniya

May 04, 2025

S Sh A Vs Evropa Klyuchevye Strategicheskie Napravleniya

May 04, 2025 -

Germanys Eurovision Hopes Rest On Tynnas Voice

May 04, 2025

Germanys Eurovision Hopes Rest On Tynnas Voice

May 04, 2025 -

Super Bowl 2025 Bradley Cooper And Daughter Leas Adorable Matching Outfits

May 04, 2025

Super Bowl 2025 Bradley Cooper And Daughter Leas Adorable Matching Outfits

May 04, 2025 -

Pimblett Vs Chandler Ufc 314 Concerns Raised Over Potential Dirty Fighting

May 04, 2025

Pimblett Vs Chandler Ufc 314 Concerns Raised Over Potential Dirty Fighting

May 04, 2025 -

Ruth Buzzi A Legacy Of Laughter Remembering The Iconic Comedian At 88

May 04, 2025

Ruth Buzzi A Legacy Of Laughter Remembering The Iconic Comedian At 88

May 04, 2025