Gold Market Update: Back-to-Back Weekly Declines For 2025

Table of Contents

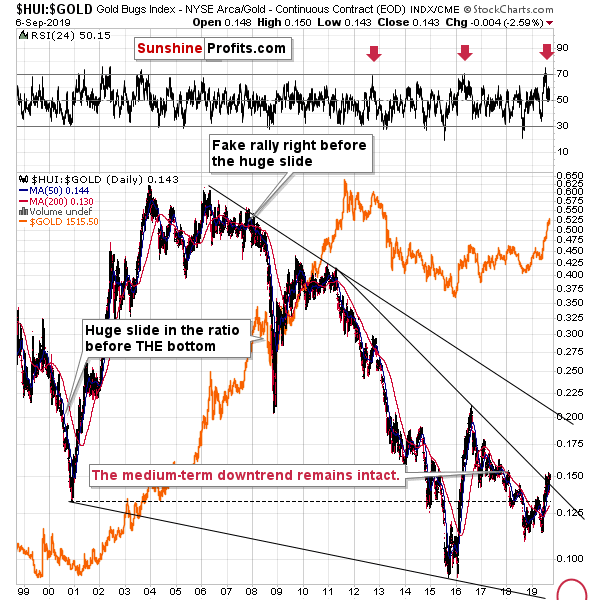

Analyzing the Factors Behind the Gold Price Decline

Several factors converged to contribute to the recent gold price decline. Let's examine the most significant:

The Impact of Rising Interest Rates

A key factor influencing gold prices is the inverse relationship with interest rates. As interest rates rise, holding non-interest-bearing assets like gold becomes less attractive. Investors often shift their funds towards interest-bearing instruments like bonds and savings accounts, which offer higher returns. The Federal Reserve's announcement of a 0.25% interest rate hike in February 2025, followed by another in March, significantly impacted investor sentiment. This led to a reduction in demand for gold, contributing to the price drop.

- Higher yields: Increased interest rates make bonds and other fixed-income securities more competitive against gold.

- Opportunity cost: Holding gold means foregoing potential interest earnings from other investments.

- Data impact: The subsequent decline in gold prices correlated directly with these interest rate increases, as evidenced by market data showing a 2% decrease in gold prices within the month following the rate hikes.

Strengthening US Dollar

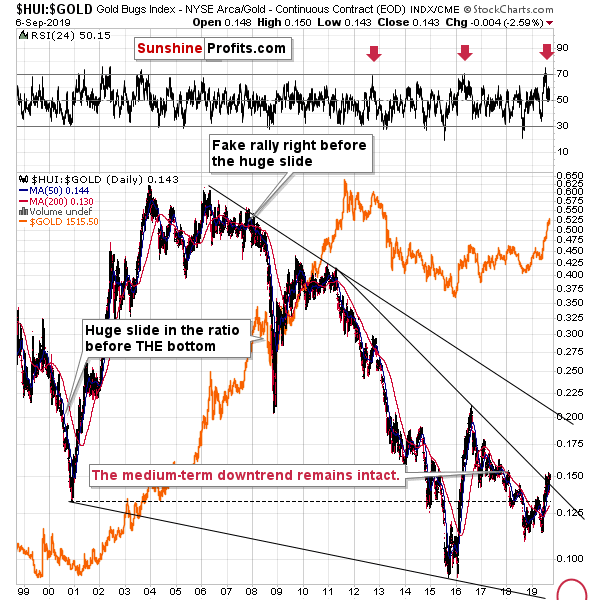

The US dollar's strength is another significant factor influencing gold prices. Gold is priced in US dollars, so a stronger dollar makes gold more expensive for holders of other currencies. This reduces demand and puts downward pressure on prices. During the period of the gold price decline, the US Dollar Index (DXY) showed a marked increase, further exacerbating the situation.

- Dollar as a safe haven: Increased demand for the USD often diminishes the appeal of gold as a safe haven asset.

- Correlation analysis: Charts clearly illustrate a negative correlation between the DXY and gold prices during this period.

- International impact: Investors outside the US found it more expensive to purchase gold due to the strengthening USD.

Geopolitical Factors and their Influence

Geopolitical uncertainty often drives investors towards safe haven assets like gold. However, during this period, a relative calm in global geopolitical tensions—despite ongoing minor conflicts—might have lessened the demand for gold as a safe haven. The absence of major escalations in existing conflicts or new significant geopolitical crises likely reduced the appeal of gold as a hedge against risk.

- Reduced safe-haven demand: A perceived lower global risk profile contributed to the decreased demand for gold.

- Market expectations: The market's anticipation of a stable geopolitical environment further weakened the price of gold.

- News analysis: Major news outlets reported a decline in safe-haven investment during this period.

Changes in Investor Sentiment and Market Speculation

A shift in investor sentiment, coupled with market speculation, also played a role. Reports indicated a surge in profit-taking among some gold investors, leading to increased selling pressure. Additionally, some market analysts speculate that algorithmic trading contributed to the amplified price volatility and downward trend.

- Profit-taking: Investors cashed in on previous gains, leading to increased selling.

- Algorithmic trading: High-frequency trading algorithms might have exacerbated the price decline.

- ETF flows: Analysis of gold ETF flows indicated net outflows during this period, suggesting reduced investor confidence.

Implications for Gold Investors and Future Market Outlook

Understanding the implications of these factors is crucial for making informed investment decisions.

Short-Term Implications

Investors holding gold experienced a short-term loss in value. This necessitates a review of portfolio allocations and risk tolerance. Some investors may consider diversifying their holdings or adjusting their investment strategies based on their risk appetite.

Long-Term Outlook

The long-term outlook for gold remains complex. While the recent decline is significant, factors like inflation, geopolitical uncertainty, and the strength of the US dollar will continue to impact its price. Experts offer varied predictions, with some suggesting a potential rebound while others foresee continued price volatility.

Strategies for Investors

Investors should consider several strategies:

- Dollar-cost averaging: Regularly investing a fixed amount regardless of the price can mitigate risk.

- Diversification: Including other asset classes in your portfolio reduces reliance on gold's performance.

- Long-term perspective: Maintaining a long-term investment horizon can help weather short-term price fluctuations.

Risk Management

Risk management is paramount, particularly during periods of market volatility. Avoid making emotional decisions based on short-term price swings. Consult with a financial advisor to develop a tailored investment strategy that aligns with your risk tolerance and financial goals.

Conclusion: Navigating the Shifting Sands of the Gold Market

The back-to-back weekly declines in gold prices in early 2025 stemmed from a confluence of factors, including rising interest rates, a strengthening US dollar, a relatively calm geopolitical environment, and changes in investor sentiment. Understanding these "Gold Market Update: Back-to-Back Weekly Declines for 2025" factors is crucial for investors to navigate the fluctuating gold market. While the short-term impact involves potential losses, the long-term outlook remains uncertain, necessitating a strategic and cautious approach. Stay informed about future market analyses and consult a financial advisor before making significant investment decisions. We will continue to provide updates on this evolving market situation.

Featured Posts

-

Edwards Berlanga Showdown Star Power Title Implications And Benavidezs Absence

May 05, 2025

Edwards Berlanga Showdown Star Power Title Implications And Benavidezs Absence

May 05, 2025 -

Abor And Tynna Das Wiener Duo Erobert Den Eurovision Song Contest

May 05, 2025

Abor And Tynna Das Wiener Duo Erobert Den Eurovision Song Contest

May 05, 2025 -

The Inside Scoop Two Days At An Exclusive Crypto Party

May 05, 2025

The Inside Scoop Two Days At An Exclusive Crypto Party

May 05, 2025 -

Streamline Spotify Payments On Your I Phone

May 05, 2025

Streamline Spotify Payments On Your I Phone

May 05, 2025 -

Oscars 2025 Fashion Emma Stones Show Stopping Sequin Dress And Pixie Haircut

May 05, 2025

Oscars 2025 Fashion Emma Stones Show Stopping Sequin Dress And Pixie Haircut

May 05, 2025