Gold Price Slumps: Two Consecutive Weekly Losses In 2025

Table of Contents

Main Points: Deciphering the Gold Price Decline

Several intertwined factors contributed to the dramatic gold price slumps witnessed in 2025. Let's analyze the most significant contributors:

2.1 Impact of Rising Interest Rates on Gold Prices

H3: The Inverse Relationship: Gold, traditionally viewed as a safe haven asset, often sees its value inversely correlated with interest rates. Higher interest rates make government bonds and other fixed-income instruments more attractive, diverting investment capital away from non-yielding assets like gold. This phenomenon is particularly relevant in a period of economic uncertainty where investors may prioritize safer, higher-yielding options.

- Interest Rate Hikes and Gold's Response: The Federal Reserve's (Fed) two consecutive 0.25% interest rate hikes in June and July 2025 directly impacted gold prices. Each hike triggered immediate, albeit slight, downward pressure on gold, accelerating the decline.

- European Central Bank (ECB) Actions: Similarly, the ECB's hawkish stance and hints at further rate increases further strengthened the dollar and negatively impacted gold prices.

- Data Points: The June rate hike saw a 1.5% drop in gold prices within the first 48 hours, while the July hike resulted in a further 1% decline.

2.2 The Role of a Strengthening US Dollar

H3: Dollar's Strength Dampens Gold Appeal: The US dollar's strength plays a crucial role in gold's price fluctuations. A strong dollar makes gold more expensive for investors holding other currencies, thereby reducing global demand. This is because gold is priced in US dollars, so when the dollar rises, the price of gold in other currencies also increases.

- Factors Contributing to Dollar Strength: Strong economic indicators in the US, coupled with relative geopolitical stability, propelled the US Dollar Index (DXY) to its highest levels in several years. This increased demand for the dollar relative to other currencies indirectly impacted gold.

- DXY and Gold Price Correlation: Charts clearly demonstrate a strong negative correlation between the DXY and gold prices during this period. As the DXY climbed, gold prices experienced a parallel decline.

- Expert Opinion: Several leading financial analysts pointed out the dollar's significant contribution to the recent gold price slump, highlighting the inverse relationship between these two assets.

2.3 Geopolitical Factors and Their Influence

H3: Geopolitical Uncertainty and Gold's Safe-Haven Status: Gold often acts as a safe haven during times of geopolitical uncertainty. However, a period of relative calm and reduced geopolitical risk can decrease gold's appeal as investors perceive less need for a safe haven asset.

- Reduced Geopolitical Tensions: The relative easing of tensions in several global hotspots during this period contributed to decreased investor anxiety. This shift in perception reduced the demand for gold, which usually benefits from flight-to-safety investments during times of conflict.

- Risk Appetite Increase: With diminished geopolitical uncertainty, investor risk appetite increased, leading to a shift towards higher-return, higher-risk assets, further diverting capital away from gold.

- News Reports: Several news reports highlighted the decreased demand for gold as investors shifted towards other asset classes, citing the reduced geopolitical uncertainty as a key contributing factor.

2.4 Technical Analysis and Market Sentiment

H3: Chart Patterns and Investor Behavior: Technical analysis and overall market sentiment played a significant role in exacerbating the gold price decline.

- Bearish Chart Patterns: Technical indicators showed bearish patterns, such as head-and-shoulders formations, indicating a potential price reversal. These chart patterns signaled a change in market sentiment to analysts and traders.

- Shift in Investor Sentiment: A clear shift from bullish to bearish sentiment among investors further fueled the sell-off. This was evident in decreased trading volumes of gold futures and options.

- Trading Volume and Open Interest: Data showed a decline in trading volume and open interest in gold futures contracts, signifying a decrease in both investor interest and speculation.

Conclusion: Navigating the Shifting Sands of the Gold Market

The gold price slumps observed in 2025, specifically the two consecutive weekly losses, resulted from a confluence of factors. Rising interest rates, a strengthening US dollar, reduced geopolitical uncertainty, and a shift in market sentiment all contributed to the decline. This two-week downturn highlights the volatile nature of the gold market and emphasizes the importance of careful monitoring and diversification. The future trajectory of gold prices remains uncertain, but staying informed about interest rate decisions, dollar strength, and geopolitical events is crucial. We advise you to closely monitor future gold price slumps by following reputable financial news sources and considering professional financial advice before making any investment decisions. Don't hesitate to consult a financial advisor to help you navigate this dynamic market and develop a robust investment strategy tailored to your needs.

Featured Posts

-

No Trump Tariff Support Says Warren Buffett Fact Check Of Recent Reports

May 05, 2025

No Trump Tariff Support Says Warren Buffett Fact Check Of Recent Reports

May 05, 2025 -

Emma Stones Snl Appearance Analyzing The Viral Popcorn Butt Lift Dress

May 05, 2025

Emma Stones Snl Appearance Analyzing The Viral Popcorn Butt Lift Dress

May 05, 2025 -

Fridays Nhl Games Playoff Implications And Updated Standings

May 05, 2025

Fridays Nhl Games Playoff Implications And Updated Standings

May 05, 2025 -

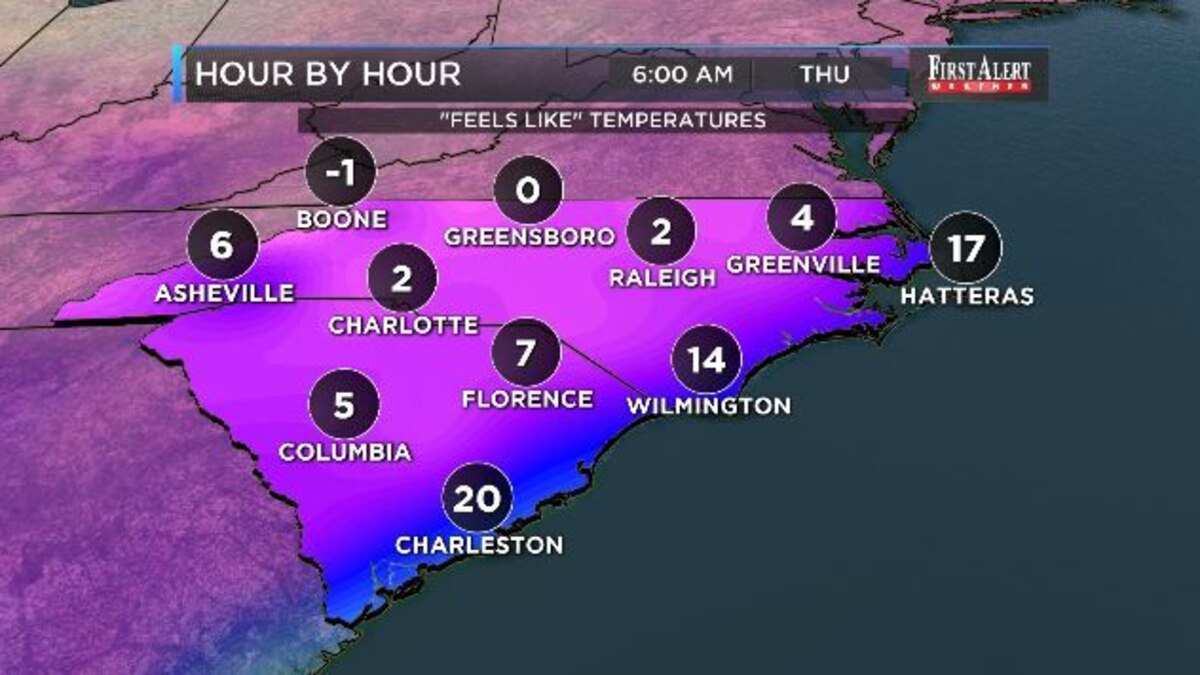

West Bengal Weather Alert Plunging Temperatures And Forecast

May 05, 2025

West Bengal Weather Alert Plunging Temperatures And Forecast

May 05, 2025 -

Sydney Sweeney And Jonathan Davino Breakup Rumors Swirl Following Recent Hotel Stay

May 05, 2025

Sydney Sweeney And Jonathan Davino Breakup Rumors Swirl Following Recent Hotel Stay

May 05, 2025