Gold Suffers First Double-Digit Weekly Losses Of 2025

Table of Contents

Factors Contributing to the Gold Price Drop

Several interconnected factors contributed to this dramatic gold price drop. The confluence of these elements created a perfect storm that significantly impacted the gold market.

Strengthening US Dollar

The inverse relationship between the US dollar (USD) and gold prices is well-established. When the dollar strengthens, gold becomes less attractive to international investors as it becomes more expensive to purchase using other currencies. This week saw a notable strengthening of the USD, as measured by the DXY index, which climbed to [Insert DXY Index Value – replace with actual data]. This surge was likely fueled by [Insert Specific Economic News or Policy Announcements – e.g., positive economic data, hawkish Fed statements]. This made gold less appealing, impacting international gold investment and leading to selling pressure.

- DXY index reached [Insert Value] on [Date], indicating significant USD strength.

- Positive US economic data fueled investor confidence in the dollar.

- International gold trading volume decreased as the dollar strengthened.

Rising Interest Rates

Rising interest rates further dampened gold's appeal. Higher interest rates make interest-bearing assets, such as bonds and savings accounts, more attractive compared to non-yielding assets like gold. This increases the opportunity cost of holding gold, encouraging investors to shift their capital towards higher-yielding alternatives. Central banks around the world, including the Federal Reserve, have recently implemented [Insert Specific Interest Rate Hikes – e.g., a 25 basis point increase].

- The Federal Reserve increased interest rates by [Percentage] on [Date].

- 10-year Treasury bond yields rose to [Value]%, impacting investor sentiment toward gold.

- The higher returns available on bonds reduced the attractiveness of gold as a safe haven.

Profit-Taking and Technical Analysis

Many investors who had accumulated gold during previous periods of market uncertainty likely engaged in profit-taking this week. This added to the selling pressure. Furthermore, technical analysis indicators, such as the breaking of key support levels and negative signals from moving averages, might have triggered further sell-offs, exacerbating the gold price drop.

- Gold prices breached the crucial support level of [Price] triggering stop-loss orders.

- The 50-day moving average crossed below the 200-day moving average, a bearish signal.

- RSI (Relative Strength Index) indicated oversold conditions, potentially leading to a short-term bounce.

Impact on Gold Investors and the Market

This sharp decline in gold prices has significant implications for both investors and the broader market.

Short-Term Implications

The immediate impact on gold investors is substantial, with many facing potential losses in their portfolios. This necessitates portfolio adjustments and a reassessment of investment strategies. The gold market volatility has also affected the stock prices of gold mining companies.

- Gold ETFs experienced significant outflows.

- Many investors are reevaluating their gold holdings and diversification strategies.

- Gold mining companies' stock prices experienced a corresponding decline.

Long-Term Outlook

The long-term outlook for gold remains uncertain. While this price drop may be a temporary correction, it could also signal a larger trend reversal. Geopolitical factors, inflation expectations, and broader economic trends will all play a role in shaping the future trajectory of gold prices.

- Geopolitical instability could still drive demand for gold as a safe haven asset.

- Persistent inflation could eventually support higher gold prices.

- Diversification into other precious metals or alternative assets may be considered.

Analyzing the Unexpected Severity of the Gold Price Decline

The speed and magnitude of the gold price drop warrants further investigation.

Market Sentiment Shift

A rapid shift in market sentiment played a crucial role. Negative news headlines, analyst reports downgrading gold’s outlook, and potentially even social media trends, all contributed to a sudden change in perception.

- Negative news stories regarding the global economy influenced investor sentiment.

- Several prominent analysts revised their gold price forecasts downwards.

- Social media discussions may have amplified negative sentiment.

Liquidity Concerns

Increased selling pressure might have been exacerbated by liquidity concerns within the gold market. The use of leverage and margin calls could have forced some investors to liquidate their positions, further accelerating the price decline.

- Margin calls forced some leveraged investors to sell their gold holdings.

- Reduced liquidity in certain gold markets contributed to amplified price swings.

Conclusion

The unprecedented double-digit weekly losses in gold prices represent a significant event in the gold market, driven by a confluence of factors including a strengthening US dollar, rising interest rates, and profit-taking. The impact on investors has been substantial, requiring portfolio adjustments and a careful consideration of long-term investment strategies. To navigate this volatile market effectively, it's crucial to monitor the gold market closely, manage your gold investments strategically, and understand the implications of gold price drops. Further research into gold price predictions and market analysis is strongly recommended. Don’t hesitate to consult a financial advisor to optimize your approach to gold investment in light of this recent volatility.

Featured Posts

-

Stanley Cup Playoffs Understanding The First Round Matchups

May 05, 2025

Stanley Cup Playoffs Understanding The First Round Matchups

May 05, 2025 -

A Quiet Competition Blake Lively And Anna Kendricks Premiere Style

May 05, 2025

A Quiet Competition Blake Lively And Anna Kendricks Premiere Style

May 05, 2025 -

Anna Kendricks Silence On Blake Livelys Legal Battle

May 05, 2025

Anna Kendricks Silence On Blake Livelys Legal Battle

May 05, 2025 -

Kentucky Derby 2025 Live Stream Find The Best Online Viewing Options

May 05, 2025

Kentucky Derby 2025 Live Stream Find The Best Online Viewing Options

May 05, 2025 -

Canadas Economic Future Gary Mar Challenges Mark Carney To Prioritize Western Development

May 05, 2025

Canadas Economic Future Gary Mar Challenges Mark Carney To Prioritize Western Development

May 05, 2025

Latest Posts

-

Paddy Pimblett Critiques Dustin Poiriers Retirement

May 05, 2025

Paddy Pimblett Critiques Dustin Poiriers Retirement

May 05, 2025 -

Did Dustin Poirier Make A Mistake Retiring Paddy Pimblett Weighs In

May 05, 2025

Did Dustin Poirier Make A Mistake Retiring Paddy Pimblett Weighs In

May 05, 2025 -

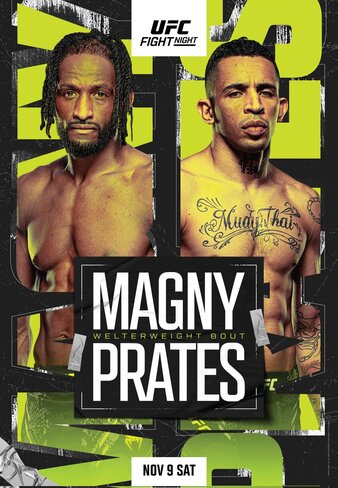

Star Studded Ufc 314 Card Suffers Blow Neal Vs Prates Cancelled

May 05, 2025

Star Studded Ufc 314 Card Suffers Blow Neal Vs Prates Cancelled

May 05, 2025 -

Poirier Retires Paddy Pimbletts Reaction And Analysis

May 05, 2025

Poirier Retires Paddy Pimbletts Reaction And Analysis

May 05, 2025 -

Geoff Neal Vs Carlos Prates Fight Cancellation Impacts Ufc 314

May 05, 2025

Geoff Neal Vs Carlos Prates Fight Cancellation Impacts Ufc 314

May 05, 2025