Goldman Sachs: Trump's Stance On $40-$50 Oil Based On Social Media

Table of Contents

Goldman Sachs' Oil Price Prediction and its Rationale

Goldman Sachs' prediction of a $40-$50 oil price range wasn't made in a vacuum. It rests on a careful assessment of various economic and geopolitical factors.

The Economic Factors Behind the Prediction

Goldman Sachs' reasoning encompasses a multifaceted analysis of the global energy market:

- Global Supply and Demand: The firm considered the balance between global oil production and consumption, noting potential supply constraints from OPEC+ production cuts and increased demand driven by economic recovery in certain regions. For instance, [cite source with specific data on supply/demand imbalance].

- OPEC+ Policies: The actions and decisions of the Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) significantly impact oil prices. Goldman Sachs likely factored in OPEC+'s production targets and adherence to those targets in its forecast. [cite source on OPEC+ production levels].

- Economic Growth Forecasts: Global economic growth projections play a crucial role. Stronger economic growth typically leads to higher oil demand, while weaker growth can dampen prices. Goldman Sachs' prediction likely incorporated its own economic growth forecasts. [cite source on Goldman Sachs' economic growth forecasts].

- Geopolitical Instability: Geopolitical events, such as conflicts or sanctions, can dramatically impact oil prices. The ongoing situation in [mention relevant geopolitical hotspot] is a prime example of a factor that likely factored into Goldman Sachs' analysis. [cite source highlighting geopolitical risk].

The potential impact of this price range on the energy sector is substantial. Lower prices could benefit consumers but hurt energy producers, potentially leading to reduced investment in exploration and production. Related industries, such as transportation and manufacturing, would also experience ripple effects.

Market Reactions to Goldman Sachs' Prediction

The initial market reaction to Goldman Sachs' prediction was [describe the initial market reaction – e.g., cautious optimism, mild sell-off, etc.]. Oil prices [describe price movements following the prediction – e.g., fluctuated within a narrow band, experienced a sharp drop, etc.]. The short-term effects were [describe short-term effects], while the long-term implications are expected to [describe long-term effects] for investors. This demonstrates the significant weight given to Goldman Sachs' analysis within the financial community.

Donald Trump's Social Media Activity and its Potential Impact

Donald Trump's frequent use of social media, particularly Twitter, during his presidency, often included commentary on economic issues, including oil prices and energy policy. His pronouncements could potentially sway market sentiment.

Identifying Relevant Tweets and Statements

Analyzing Trump's tweets and public statements relevant to oil prices requires careful examination. For example, [insert a quote from a relevant Trump tweet/statement] demonstrates [explain the context and potential implication of the statement]. The tone of these communications often seemed [describe the general tone – e.g., critical of OPEC, supportive of domestic oil production, etc.], potentially influencing market perception of the energy sector.

Analyzing the Correlation Between Trump's Statements and Oil Price Movements

Determining a direct causal link between Trump's social media posts and oil price movements is challenging. However, it's important to explore any observable correlations. For instance, did oil prices tend to react in a particular way (e.g., increase, decrease, remain stable) following certain types of statements from Trump? The mechanisms by which such influence might operate include impacting investor psychology, encouraging speculation, or affecting confidence in the stability of energy policy. This area requires further research to establish meaningful conclusions.

The Role of Social Media in Shaping Market Perceptions

Social media has fundamentally altered how information spreads and influences market sentiment.

Social Media's Influence on Financial Markets

Social media platforms like Twitter and Facebook have become powerful channels for disseminating information, shaping narratives, and influencing investor decisions. The speed at which news and opinions spread can exacerbate market volatility. Misinformation and manipulation are also concerns, as unsubstantiated claims can quickly impact prices.

Challenges in Analyzing Social Media Data

Analyzing social media data presents challenges. Interpreting the sentiment expressed in tweets, posts, or comments accurately is difficult. Furthermore, biases and limitations in social media analysis techniques must be acknowledged. The sheer volume of data also presents a significant hurdle for effective analysis.

Conclusion

Goldman Sachs' $40-$50 oil price prediction is grounded in economic factors, encompassing global supply and demand, OPEC+ policy, economic growth projections, and geopolitical risks. However, the influence of political figures like Donald Trump, amplified by social media, can introduce considerable complexity and volatility into the market. Social media's speed and reach enhance its impact, but also pose challenges in terms of accurate interpretation and avoiding misinformation. The interplay between these factors is a complex dynamic that requires careful monitoring and sophisticated analysis.

To stay informed about this intricate interplay between economic factors, political statements, and market trends, continue following developments in the oil market. Further research into the combined impact of Goldman Sachs' projections and social media’s influence on future oil price movements is encouraged. Stay informed about the ever-evolving oil market and its susceptibility to multiple influences by consulting reliable sources and staying updated on new analysis.

Featured Posts

-

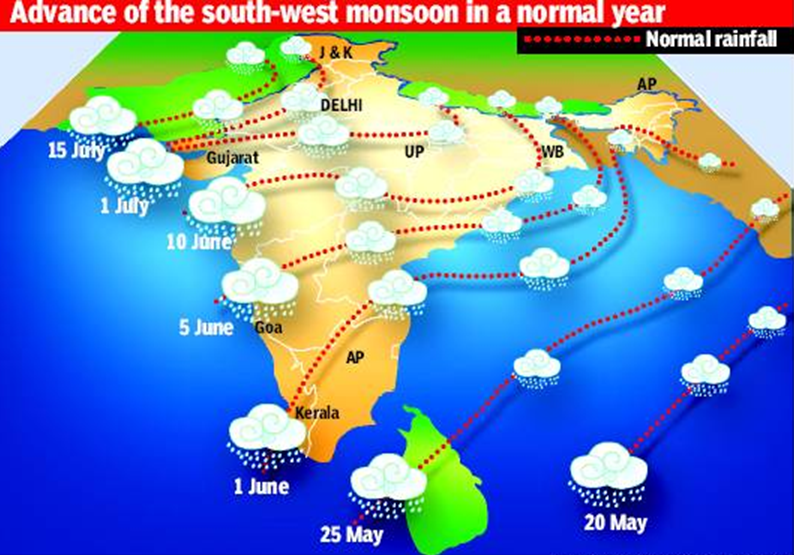

Indias Monsoon Forecast Positive Impact On Agriculture And Consumer Spending

May 15, 2025

Indias Monsoon Forecast Positive Impact On Agriculture And Consumer Spending

May 15, 2025 -

Napadi Na Mediumi I Chistka Vo Sudstvoto Tramp A Zaostruva Situatsi Ata

May 15, 2025

Napadi Na Mediumi I Chistka Vo Sudstvoto Tramp A Zaostruva Situatsi Ata

May 15, 2025 -

First Up Bangladesh Yunus In China Rubios Caribbean Trip And More Top News Today

May 15, 2025

First Up Bangladesh Yunus In China Rubios Caribbean Trip And More Top News Today

May 15, 2025 -

Kibris A Direkt Ucuslar Tatar In Aciklamalarinin Ardindan Yeni Bir Doenem

May 15, 2025

Kibris A Direkt Ucuslar Tatar In Aciklamalarinin Ardindan Yeni Bir Doenem

May 15, 2025 -

Barcelona Vs Real Betis Where To Watch The La Liga Match Live

May 15, 2025

Barcelona Vs Real Betis Where To Watch The La Liga Match Live

May 15, 2025