GOP Tax Plan: A Hard Look At The Numbers And The Deficit

Table of Contents

Key Provisions of the GOP Tax Plan

The GOP Tax Cuts and Jobs Act of 2017 significantly altered the US tax code. Several key provisions were designed to stimulate economic activity through tax reductions for both corporations and individuals. These included:

-

Corporate Tax Rate Reduction: The most significant change was the reduction of the corporate tax rate from 35% to 21%. Proponents argued this would make American businesses more competitive globally, attracting investment and creating jobs.

-

Individual Income Tax Bracket Changes: The act also modified individual income tax brackets and rates. While some rates were lowered, the standard deduction was significantly increased. This simplification aimed to reduce the tax burden for many individuals, although the impact varied widely depending on income and family structure.

-

Increased Standard Deduction Amounts: The standard deduction was nearly doubled, simplifying tax preparation for many taxpayers and potentially reducing their tax liability. This change particularly benefited lower and middle-income individuals.

-

Elimination or Modification of Certain Tax Deductions and Credits: Several tax deductions and credits were either eliminated or modified, including limitations on state and local tax (SALT) deductions and changes to the child tax credit. These changes aimed to offset some of the revenue losses from other provisions.

-

Changes to the Alternative Minimum Tax (AMT): The AMT, designed to ensure high-income taxpayers paid a minimum level of tax, was modified. These changes impacted the number of taxpayers subject to the AMT and reduced its overall effectiveness.

Projected Revenue Losses and the National Deficit

The Congressional Budget Office (CBO), a nonpartisan agency, provided estimates of the GOP Tax Plan's impact on federal revenue. Their analysis projected substantial revenue losses over the following decade.

-

CBO Estimates of Revenue Losses over 10 Years: The CBO's initial estimates indicated substantial revenue losses over 10 years, totaling in the trillions of dollars. These projections fueled concerns about increased national debt.

-

Impact on the National Debt: The projected revenue losses directly contributed to a significant increase in the national debt. The long-term implications of this increased debt remain a major point of contention.

-

Discussion of Dynamic Scoring vs. Static Scoring Methodologies: The debate over the plan's economic impact involved differing methodologies for estimating revenue. Dynamic scoring, which considers the potential impact of tax cuts on economic growth, was used by proponents to argue for greater revenue generation. Critics, however, favored static scoring, which doesn't account for such effects, resulting in significantly lower projections of revenue increase.

-

Mention of any Subsequent Revisions to Revenue Projections: Subsequent economic developments and revised CBO projections have further informed the ongoing debate surrounding the plan’s fiscal impact.

Economic Impacts and Arguments for the Plan

Supporters of the GOP Tax Plan argued that its provisions would stimulate economic growth, ultimately leading to increased tax revenue. This argument rested on the principles of supply-side economics.

-

Supply-Side Economics Arguments: Proponents claimed the tax cuts would incentivize businesses to invest more, leading to increased productivity, job creation, and higher wages.

-

Claims of Increased Investment and Job Creation: The lower corporate tax rate was expected to attract foreign investment and encourage domestic companies to expand, generating new jobs.

-

Potential for Higher Wages and Economic Output: Increased investment and job creation were predicted to lead to higher wages and increased overall economic output.

-

Counterarguments and Critiques of these Claims: Critics argued that these benefits disproportionately favored higher-income individuals and corporations, with limited impact on lower and middle-income earners. The lack of substantial revenue offsets also raised concerns about the plan's long-term fiscal sustainability.

Criticisms and Concerns about the GOP Tax Plan

The GOP Tax Plan faced significant criticism, centering on its impact on income inequality and long-term fiscal sustainability.

-

Concerns about Increased National Debt and Deficits: The substantial projected revenue losses fueled serious concerns about the increasing national debt and deficits.

-

Impact on Income Inequality – Disproportionate Benefits to Higher-Income Earners: Critics argued the tax cuts disproportionately benefited wealthy individuals and corporations, exacerbating income inequality.

-

Lack of Sufficient Revenue Offsets: The absence of significant revenue offsets to compensate for the tax cuts raised concerns about fiscal responsibility.

-

Potential for Increased Future Tax Burdens: The increased national debt created by the plan could necessitate future tax increases to manage the debt burden, potentially impacting future generations.

Long-Term Fiscal Sustainability

The long-term implications of the GOP Tax Plan’s substantial revenue reductions on the federal budget remain a key area of concern. The accumulating national debt could lead to increased interest payments, potentially crowding out other essential government spending. Further, the lack of structural reforms to address long-term spending trends raises questions about the sustainability of the current fiscal path. Projections from organizations like the CBO paint a picture of escalating debt-to-GDP ratios, which could have significant negative consequences for the US economy in the decades to come.

Conclusion

The GOP Tax Plan, while aiming to boost economic growth, has demonstrably impacted the national deficit. Understanding the plan’s key provisions, projected revenue losses, and the ongoing debate surrounding its economic and social consequences is critical for informed civic engagement. The long-term effects of the GOP Tax Plan remain a subject of ongoing analysis and debate. Continued monitoring and critical discussion of the GOP Tax Plan are essential for responsible governance and ensuring a sustainable fiscal future for the United States. Further research into the GOP Tax Plan’s multifaceted impacts is encouraged to fully comprehend its complexities and lasting consequences.

Featured Posts

-

Hamiltonin Ferrarin Siirto Mikae Meni Pieleen

May 20, 2025

Hamiltonin Ferrarin Siirto Mikae Meni Pieleen

May 20, 2025 -

Big Bear Ai Stock A Comprehensive Investment Analysis

May 20, 2025

Big Bear Ai Stock A Comprehensive Investment Analysis

May 20, 2025 -

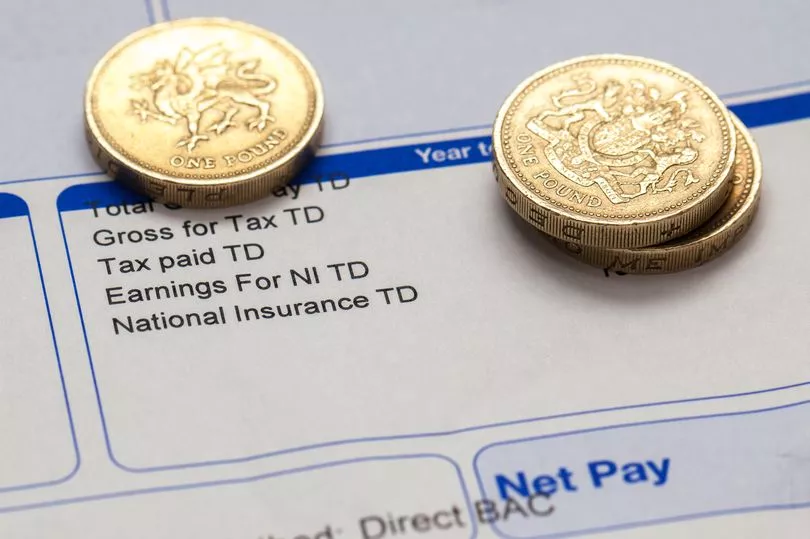

Is Hmrc Owed You Money A Payslip Refund Check

May 20, 2025

Is Hmrc Owed You Money A Payslip Refund Check

May 20, 2025 -

Agatha Christies Poirot A Critical Examination Of His Cases

May 20, 2025

Agatha Christies Poirot A Critical Examination Of His Cases

May 20, 2025 -

Billionaire Boy Challenges Responsibilities And The Burden Of Inheritance

May 20, 2025

Billionaire Boy Challenges Responsibilities And The Burden Of Inheritance

May 20, 2025