Governor's Action On Income Tax: Hernando Residents Await Decision

Table of Contents

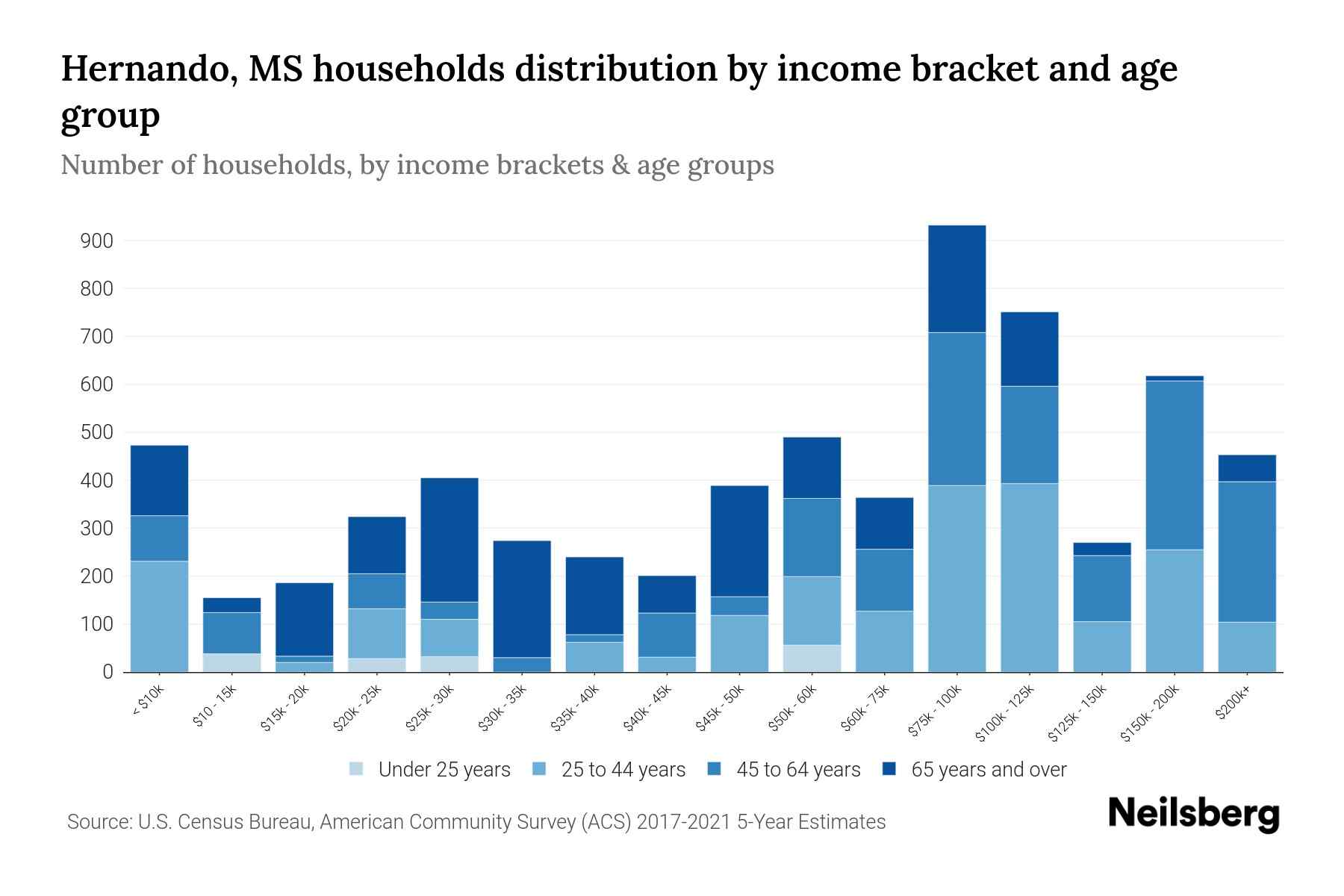

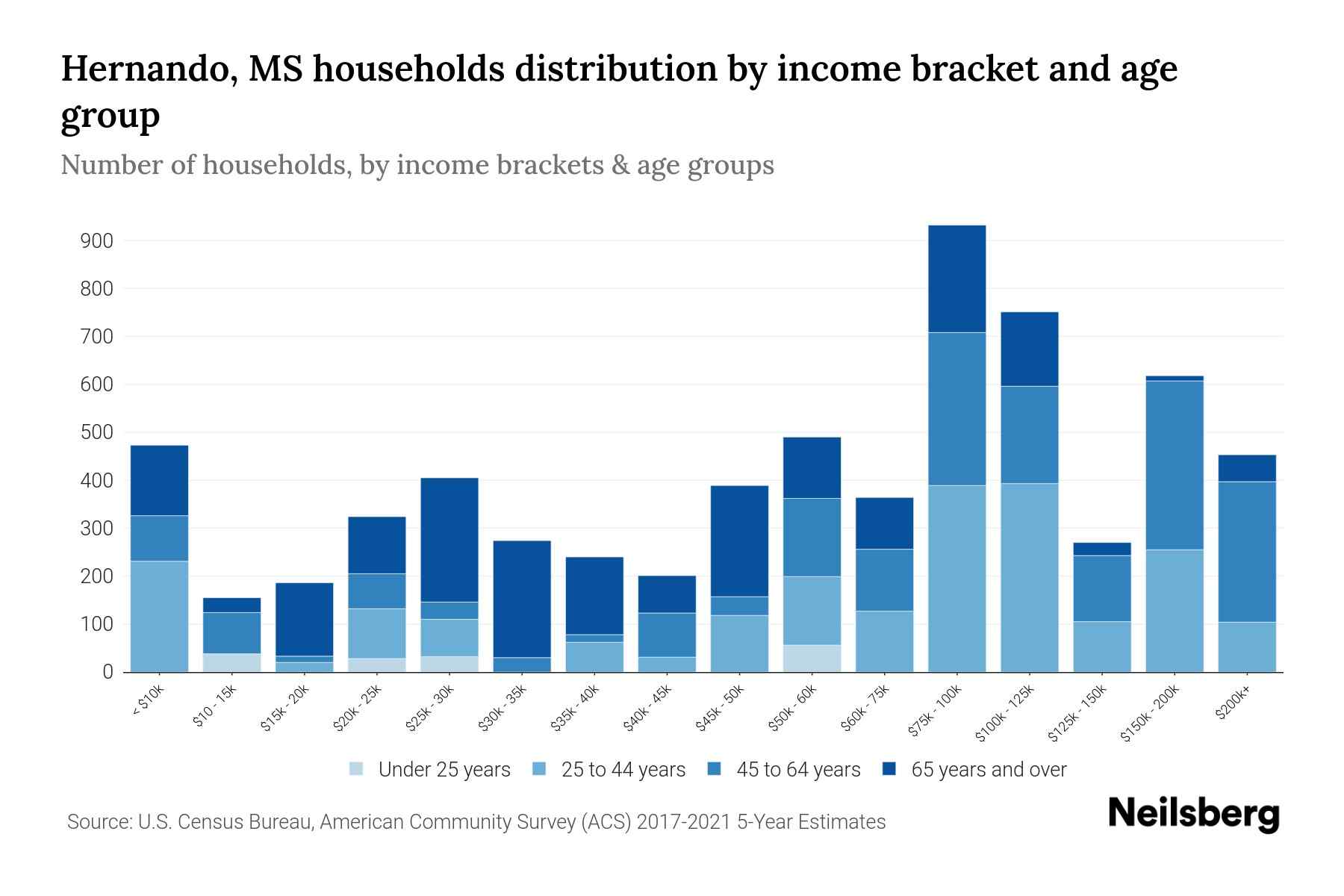

Potential Impacts of the Governor's Income Tax Decision on Hernando County

The Governor's decision on income tax will undoubtedly have a profound impact on the Hernando County economy. The ripple effects of any changes will be felt across various sectors, influencing job creation, business growth, and the overall fiscal health of the county. The potential consequences are multifaceted, presenting both opportunities and challenges. Understanding the economic impact is crucial for residents and businesses alike.

Key aspects to consider include:

- Hernando County economy: The tax burden on residents and businesses directly influences economic activity. Increased tax revenue could stimulate growth, while decreased revenue may stifle it.

- Tax burden: Any changes in income tax rates will directly alter the tax burden on Hernando County residents and businesses. This will affect disposable income and investment decisions.

- Economic impact: The overall economic impact depends heavily on the specifics of the proposed changes and how they are implemented. A poorly designed policy could lead to unintended negative consequences.

- Fiscal policy: The Governor's decision reflects a broader fiscal policy that will shape the county's economic trajectory for years to come.

Bullet Points:

- Improved infrastructure: Increased tax revenue could fund improvements to roads, schools, and other vital infrastructure.

- Essential services at risk: Reduced tax revenue may necessitate cuts to essential services like police and fire departments.

- Local business impact: Businesses may face increased costs or reduced consumer spending depending on the nature of the tax changes.

- Real estate market fluctuation: Changes in property values could result from the overall economic impact of the tax decision.

Hernando Residents' Perspectives and Concerns

The proposed income tax changes have sparked a diverse range of opinions and concerns amongst Hernando County residents. While some anticipate economic benefits, others harbor significant anxieties about the potential negative consequences. Understanding these perspectives is crucial for a comprehensive assessment of the situation.

Keywords: resident concerns, public opinion, community impact, Hernando County residents

Quotes/Anecdotes: (These would be inserted here, gathering real quotes from Hernando County residents about their concerns and hopes.)

Bullet Points:

- Lower-income families: Many worry about the disproportionate impact of tax increases on lower-income families.

- Business owner concerns: Business owners are anxious about increased costs that could affect their profitability and ability to hire.

- Improved public services: Some residents hope that increased revenue will lead to better schools, roads, and public safety.

- Long-term uncertainty: The lack of clarity surrounding the long-term effects contributes to widespread uncertainty and anxiety.

The Governor's Proposed Changes and Their Rationale

The Governor's proposed income tax changes involve [Insert specific details of the proposed changes here, including percentage changes, proposed tax brackets, and any exemptions]. The stated rationale behind these proposals is [Insert the Governor's stated reasoning for the proposed changes, including objectives like economic stimulus, infrastructure improvements, or budget balancing].

Keywords: income tax reform, tax proposal, budget implications, fiscal responsibility

Bullet Points:

- Specific percentage changes: [State the exact proposed percentage changes].

- Proposed tax brackets: [Detail the proposed tax brackets].

- Revenue allocation: [Explain how the potential additional revenue will be allocated].

- Governor's goals: [Clearly state the Governor's explicit goals for these changes].

Political Implications and Future Outlook

The Governor's decision on income tax carries significant political weight, potentially influencing upcoming elections and shaping future state budgets. The political landscape is complex, with various interest groups and opposing parties likely to react to the proposed changes.

Keywords: political impact, election implications, future legislation, policy analysis

Bullet Points:

- Impact on approval ratings: The decision will undoubtedly impact the Governor's approval ratings, potentially boosting or harming their chances in future elections.

- Future state budgets: The changes will significantly influence future state budgets, determining the funding available for various programs and initiatives.

- Opposition challenges: Expect opposition from various groups, potentially leading to legal challenges or legislative battles.

- Interest group response: Various interest groups, from business associations to labor unions, will respond to the decision in ways that reflect their specific interests.

Hernando County Awaits the Governor's Income Tax Decision: What's Next?

The Governor's Action on Income Tax will have profound and lasting consequences for Hernando County residents. The potential impacts on the local economy, public services, and the overall well-being of the community are significant. This decision underscores the importance of staying informed and engaging in the political process. Understanding the Governor's Income Tax Action is crucial for everyone in Hernando County. The impact of income tax changes will be felt for years to come.

Call to Action: Stay informed on the Governor's action on income tax by following our updates and contacting your local representatives to voice your concerns. The future of Hernando County's economy depends on it! Keep checking back for a Hernando County tax update.

Featured Posts

-

Income Disparity And Its Impact On Celebrity Marriages

May 19, 2025

Income Disparity And Its Impact On Celebrity Marriages

May 19, 2025 -

Eurovision 2025 Austria Takes The Crown With Jjs Wasted Love

May 19, 2025

Eurovision 2025 Austria Takes The Crown With Jjs Wasted Love

May 19, 2025 -

Austrias Jj Eurovision 2025 Winner With Wasted Love

May 19, 2025

Austrias Jj Eurovision 2025 Winner With Wasted Love

May 19, 2025 -

Eurovision 2024 I Sverige Svts Beredskapsplaner

May 19, 2025

Eurovision 2024 I Sverige Svts Beredskapsplaner

May 19, 2025 -

Fani Eurowizji Wydali Werdykt Jaki Wynik Otrzymala Steczkowska

May 19, 2025

Fani Eurowizji Wydali Werdykt Jaki Wynik Otrzymala Steczkowska

May 19, 2025