Grayscale's XRP ETF Filing: Impact On XRP Price And Potential Record High

Table of Contents

The Potential for Increased XRP Demand and Price Surge

The approval of a Grayscale XRP ETF could have a transformative effect on the XRP market, leading to a substantial price increase.

Institutional Investment Floodgates

The approval of a Grayscale XRP ETF would likely open the doors for significant institutional investment. Large-scale investors, previously hesitant due to the complexities and perceived risks of direct cryptocurrency investments, might find ETFs a much more appealing entry point. This influx of capital could significantly boost XRP's price.

- Increased liquidity: A higher trading volume would improve liquidity, making it easier to buy and sell XRP.

- Reduced volatility (potentially): Increased institutional participation could lead to a degree of price stabilization in the long run.

- Greater price stability in the long term: Institutional investors often take a longer-term perspective, potentially leading to more stable pricing.

Enhanced Accessibility and Reduced Barriers to Entry

ETFs are known for their simplicity and regulatory compliance. This makes them far more accessible than trading directly on cryptocurrency exchanges. This will likely attract a broader range of investors.

- Retail investors gain easier access: Investing in XRP becomes simpler for everyday investors through brokerage accounts.

- Brokerage integration simplifies purchasing: Investors can buy XRP through familiar brokerage platforms, eliminating the need for cryptocurrency exchange accounts.

- Reduced risk perception for mainstream investors: The regulated nature of ETFs reduces the perceived risks associated with direct crypto investments.

Positive Market Sentiment and Speculative Buying

The mere filing of the application has already generated considerable positive market sentiment. This could trigger speculative buying, pushing the XRP price higher even before any approval.

- Media coverage and increased awareness: The news surrounding the Grayscale XRP ETF filing generates widespread media coverage, increasing awareness and interest in XRP.

- Short-term price pumps fueled by anticipation: Investors anticipate a price increase upon approval, leading to buying pressure in the short term.

- Potential for "fear of missing out" (FOMO): The potential for substantial returns could trigger FOMO, driving further price increases.

Challenges and Uncertainties Facing Grayscale's XRP ETF Application

Despite the potential upsides, several hurdles could prevent the Grayscale XRP ETF from succeeding.

SEC Regulatory Scrutiny

The Securities and Exchange Commission (SEC) holds considerable sway over the approval process. Their stringent regulations regarding cryptocurrencies mean approval is by no means guaranteed.

- Lengthy review process: The SEC's review process can be lengthy and unpredictable.

- Potential rejection based on regulatory concerns: The SEC might reject the application due to concerns about XRP's classification as a security or other regulatory issues.

- Uncertain timeline for approval or denial: There's no guarantee of a quick decision, creating uncertainty in the market.

Market Volatility and External Factors

The cryptocurrency market is notoriously volatile. External factors can significantly impact XRP's price regardless of the ETF's fate.

- Bitcoin's price movements: Bitcoin's price often influences the entire crypto market, including XRP.

- Global economic uncertainties: Macroeconomic factors can significantly impact investor sentiment and the price of cryptocurrencies.

- Regulatory changes in different jurisdictions: Changes in cryptocurrency regulations worldwide can influence XRP's price.

Competition from other XRP investment vehicles

The existence of other ways to invest in XRP could lessen the impact of a new ETF.

- Direct XRP holdings: Investors can already purchase and hold XRP directly on exchanges.

- Other crypto investment funds: Other investment funds offering exposure to XRP exist, creating competition.

- Competition for investor capital: The Grayscale XRP ETF will need to compete with other investment opportunities for investor capital.

Predicting XRP's Potential Record High: A Realistic Assessment

Whether XRP reaches a new all-time high depends on a complex interplay of factors.

Factors contributing to a potential record high

A successful Grayscale XRP ETF launch, coupled with positive market sentiment and broader adoption, could indeed propel XRP to new heights.

- Increased trading volume: The ETF would dramatically increase trading volume.

- Growing institutional demand: Institutional investment would drive demand for XRP.

- Positive media attention: Continued positive media coverage would bolster investor confidence.

Factors limiting a potential record high

Several factors could prevent XRP from reaching a new record high, even with the ETF's approval.

- SEC rejection of the ETF application: Rejection would likely lead to a significant price drop.

- Negative market sentiment: Broader negative sentiment in the crypto market could impact XRP's price.

- Lack of widespread adoption: If XRP fails to gain widespread adoption beyond the institutional level, the price may remain limited.

Conclusion

Grayscale's XRP ETF filing is a pivotal moment for XRP and the wider crypto market. While the potential for increased demand and a record-high price is substantial, significant challenges and uncertainties persist. The SEC's decision will be critical, and the prevailing market conditions will significantly influence XRP's future price. Stay informed about the progress of the Grayscale XRP ETF application to make well-informed investment decisions. Stay updated on all the news regarding the Grayscale XRP ETF and its potential impact on the XRP price.

Featured Posts

-

Clipper Late Rally Falls Short Against Cavaliers

May 07, 2025

Clipper Late Rally Falls Short Against Cavaliers

May 07, 2025 -

Nhl Potvrdzuje Svetovy Pohar 2028 Je Spaet

May 07, 2025

Nhl Potvrdzuje Svetovy Pohar 2028 Je Spaet

May 07, 2025 -

Mhrjan Lwkarnw Alsynmayy Ymnh Jaky Shan Jayzt Alinjaz Almtmyz

May 07, 2025

Mhrjan Lwkarnw Alsynmayy Ymnh Jaky Shan Jayzt Alinjaz Almtmyz

May 07, 2025 -

Zasieg Publikacji 5 Najlepszych Tekstow Jacka Harlukowicza Z Onetu W 2024

May 07, 2025

Zasieg Publikacji 5 Najlepszych Tekstow Jacka Harlukowicza Z Onetu W 2024

May 07, 2025 -

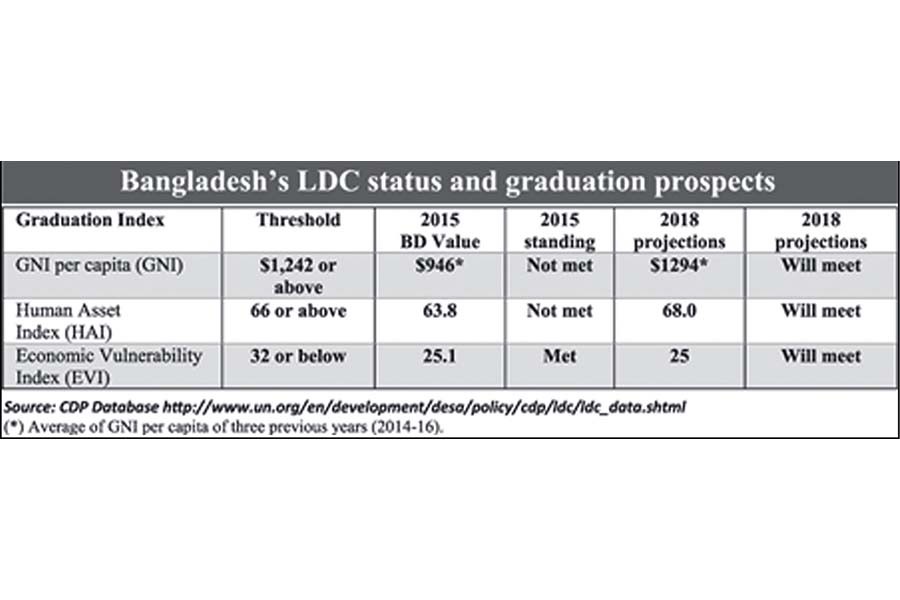

Governments Efforts For Seamless Ldc Graduation Commerce Advisor Highlights Progress

May 07, 2025

Governments Efforts For Seamless Ldc Graduation Commerce Advisor Highlights Progress

May 07, 2025