Grayscale's XRP ETF Filing: XRP Price Performance Compared To Bitcoin

Table of Contents

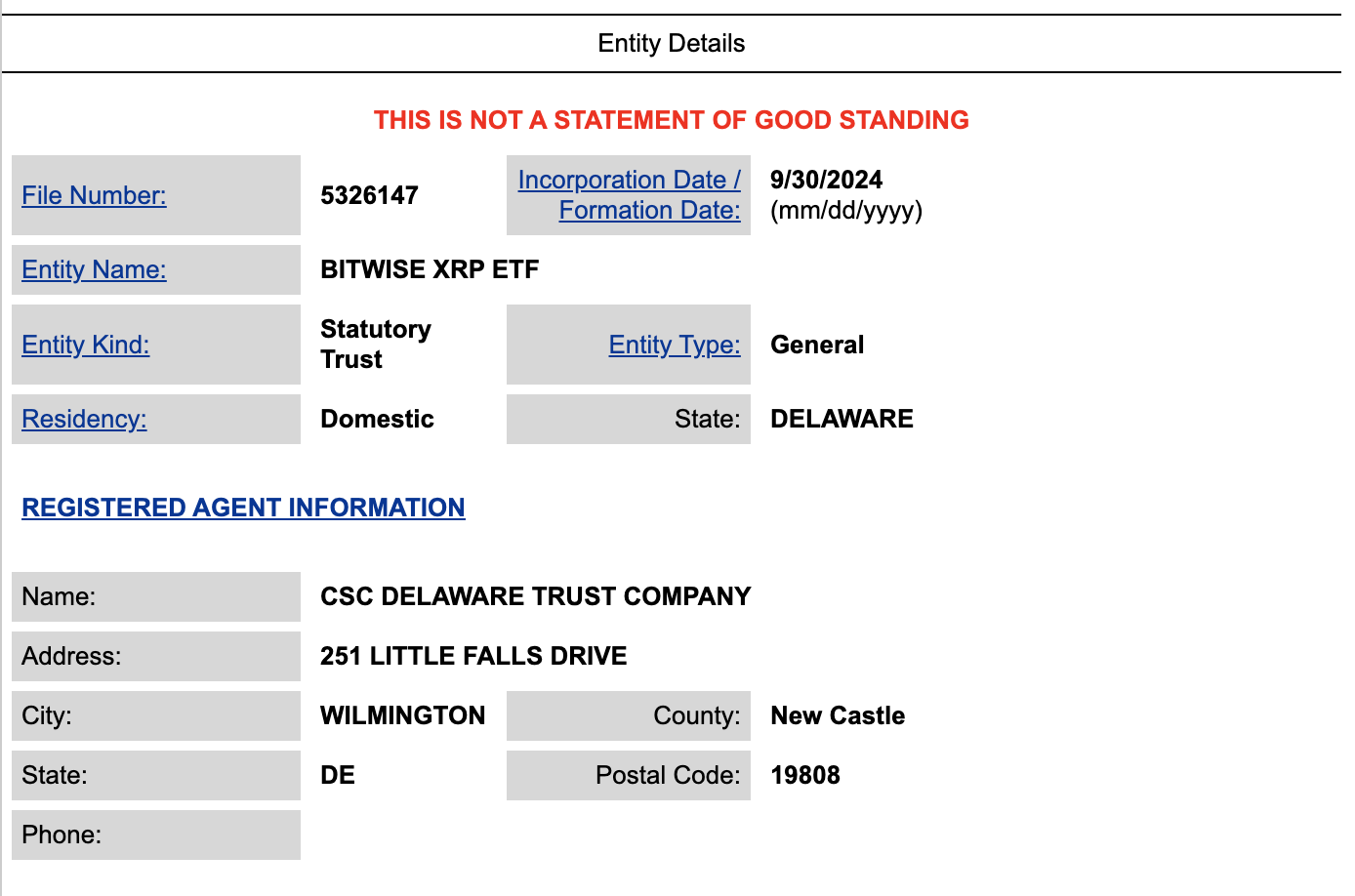

Grayscale's XRP ETF Filing: A Deep Dive

The Significance of the Filing

Grayscale's decision to pursue an XRP ETF is monumental. It signifies a growing acceptance of XRP within the institutional investment sphere, potentially leading to:

- Increased Institutional Interest: Large institutional investors, previously hesitant due to regulatory uncertainty, might gain more confidence in investing in XRP.

- Potential Price Surge: Increased demand from institutional investors could drive up XRP's price, potentially leading to substantial gains for existing holders.

- Enhanced Legitimacy: SEC approval of an XRP ETF would bestow a level of legitimacy on XRP, enhancing its credibility and attracting more mainstream investors.

- Comparison to Other Grayscale Trust Filings: The success or failure of this filing will be closely compared to Grayscale’s experience with its Bitcoin Trust, offering valuable insights into the regulatory process for crypto ETFs.

Regulatory Hurdles and Future Prospects

The path to SEC approval is fraught with challenges. Several hurdles remain, including:

- SEC's Stance on Cryptocurrencies: The SEC's historically cautious approach towards cryptocurrencies presents a major obstacle. Their approval would signal a significant shift in their regulatory stance.

- Potential Timeline for Approval: The approval process could take months, even years, depending on the SEC's review and any potential appeals.

- Comparison with Other ETF Applications: The SEC’s decisions on other cryptocurrency ETF applications will heavily influence their decision regarding Grayscale’s XRP ETF.

- Impact of Market Sentiment: Market sentiment surrounding cryptocurrencies and the broader economic climate will undeniably impact the SEC's decision-making process.

Impact on XRP Market Liquidity and Volume

A successful XRP ETF could drastically reshape the XRP market:

- Increased Trading Activity: The influx of institutional investment would likely lead to a substantial increase in trading volume.

- Potential for Price Volatility: Increased trading activity could translate to increased price volatility in the short term.

- Impact on Smaller Exchanges: Smaller exchanges might experience increased trading activity, but could also face challenges in handling the increased volume.

- Comparison to Bitcoin’s Liquidity: The increased liquidity resulting from the ETF could bring XRP closer to Bitcoin's level of liquidity, making it a more attractive investment option.

XRP Price Performance Analysis: Before and After the Filing

Historical Price Data Comparison (XRP vs. Bitcoin)

[Insert chart comparing XRP and Bitcoin price movements over a relevant timeframe. Clearly label axes and include a legend.]

- Key Price Milestones: Highlight significant price highs and lows for both XRP and Bitcoin.

- Correlation Between Price Movements: Analyze whether the price movements of XRP and Bitcoin show any correlation.

- Factors Impacting Price Fluctuations: Discuss external factors such as market trends, news events, and regulatory changes affecting both cryptocurrencies.

Volatility and Risk Assessment

XRP's price has historically exhibited greater volatility than Bitcoin's:

- Standard Deviation Comparisons: Quantify the volatility of XRP and Bitcoin using standard deviation.

- Sharpe Ratio Analysis: Compare the risk-adjusted returns of XRP and Bitcoin using the Sharpe ratio.

- Market Sentiment and Investor Psychology: Analyze how market sentiment and investor psychology have contributed to the price volatility of both cryptocurrencies.

- Market Capitalization Differences: Acknowledge the significant difference in market capitalization between Bitcoin and XRP, understanding that smaller market cap assets are typically more volatile.

Predictive Modeling and Future Price Projections (Optional)

[If projections are included, clearly state the assumptions and limitations. Emphasize the inherent uncertainty of predictions.]

- Assumptions Behind Projections: Clearly outline the assumptions made in creating the projections.

- Disclaimer About Uncertainty: Stress the unpredictable nature of cryptocurrency markets and the limitations of predictive modeling.

- Emphasis on Due Diligence: Urge readers to conduct their own thorough research before making investment decisions.

Factors Influencing XRP's Price Independent of the ETF Filing

Ripple's Ongoing Legal Battle

The Ripple-SEC lawsuit significantly impacts XRP's price and investor sentiment:

- Potential Outcomes of the Case: Discuss the various possible outcomes and their implications for XRP's price.

- Market Reactions to Key Developments: Analyze how the market has reacted to key developments in the lawsuit.

- Influence on Investor Confidence: Explain how the uncertainty surrounding the lawsuit affects investor confidence and investment decisions.

Technological Developments and Adoption

XRP's underlying technology and adoption play a crucial role in its price:

- New Partnerships and Integrations: Highlight any significant new partnerships or integrations that could boost XRP's adoption.

- Improvements to XRP Ledger: Discuss any upgrades or improvements to the XRP Ledger that might enhance its efficiency and appeal.

- Expanding Use Cases for XRP: Showcase new and emerging use cases for XRP, demonstrating its versatility and potential for future growth.

Macroeconomic Factors

Broader economic conditions influence both XRP and Bitcoin prices:

- Correlation with Traditional Markets: Analyze the correlation between cryptocurrency prices and traditional financial markets.

- Impact of Global Economic Events: Discuss how significant global events (e.g., inflation, recessions) can affect cryptocurrency prices.

Conclusion: Navigating the XRP Market Post-Grayscale Filing

Grayscale's XRP ETF filing represents a pivotal moment for XRP. While the potential for price appreciation is significant, driven by increased institutional interest and improved liquidity, several factors, including the Ripple lawsuit and regulatory uncertainty, contribute to considerable risk. Comparing XRP's price performance to Bitcoin's reveals differing volatility levels, highlighting the need for careful risk assessment. Understanding the interplay between the ETF filing, Ripple's legal battle, technological advancements, and macroeconomic conditions is crucial for making informed investment decisions. Stay informed about the progress of Grayscale's XRP ETF filing and its potential impact on the XRP price, enabling you to make well-informed investment decisions.

Featured Posts

-

Dyshime Te Medha Rrethojne Arsenalin Pas Ndeshjes Me Psg Akuza Per Shkelje Te Rregullave Te Uefa S

May 08, 2025

Dyshime Te Medha Rrethojne Arsenalin Pas Ndeshjes Me Psg Akuza Per Shkelje Te Rregullave Te Uefa S

May 08, 2025 -

Recent Bitcoin Mining Growth A Detailed Examination

May 08, 2025

Recent Bitcoin Mining Growth A Detailed Examination

May 08, 2025 -

Most Intense War Films Streaming Now On Amazon Prime A Viewers Guide

May 08, 2025

Most Intense War Films Streaming Now On Amazon Prime A Viewers Guide

May 08, 2025 -

The 10 Most Memorable Characters In Saving Private Ryan

May 08, 2025

The 10 Most Memorable Characters In Saving Private Ryan

May 08, 2025 -

Road Rage Incident Van Strikes Motorcycle Cnn Coverage

May 08, 2025

Road Rage Incident Van Strikes Motorcycle Cnn Coverage

May 08, 2025

Latest Posts

-

Saglik Bakanligi Personel Alimi 2024 37 Bin Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025

Saglik Bakanligi Personel Alimi 2024 37 Bin Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025 -

Saglik Bakanligi 37 Bin Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025

Saglik Bakanligi 37 Bin Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025 -

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Mnayy Jaye Gy

May 08, 2025

Pakstan Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Mnayy Jaye Gy

May 08, 2025 -

Aym Aym Ealm 12 Wyn Brsy Ky Tqrybat Ka Aghaz

May 08, 2025

Aym Aym Ealm 12 Wyn Brsy Ky Tqrybat Ka Aghaz

May 08, 2025 -

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Ke Mwqe Pr Khswsy Prwgram

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Ke Mwqe Pr Khswsy Prwgram

May 08, 2025