Greenko's Founders Seek Orix Stake Acquisition Via New Deal

Table of Contents

The Greenko-Orix Partnership: A Brief History

Greenko and Orix have enjoyed a long-standing relationship, marked by significant collaboration in India's renewable energy sector. Orix's investment in Greenko represents a crucial part of their broader commitment to sustainable energy solutions globally. This partnership has facilitated the development and expansion of several key renewable energy projects across India.

- Year Orix initially invested in Greenko: [Insert Year - Requires Research]

- Percentage of stake Orix currently holds: [Insert Percentage - Requires Research]

- Significant projects undertaken jointly: [List specific projects with brief descriptions - Requires Research. Example: "The 1000 MW solar park in Andhra Pradesh," "Several wind energy projects across Karnataka."]

Details of the Proposed Acquisition Deal

The specifics of the proposed Greenko Orix acquisition are still emerging, but reports suggest a significant transaction is underway. The potential valuation of Orix's stake is likely to be substantial, reflecting Greenko's impressive growth and market position. The sources of funding for the acquisition remain unclear, but various financing options are likely being explored by Greenko’s founders.

- Proposed acquisition price (if available): [Insert Price or Range - Requires Research]

- Method of acquisition (e.g., direct purchase, secondary market): [Insert Method - Requires Research]

- Expected timeline for completion: [Insert Timeline - Requires Research]

- Key players involved in the negotiation: [List key individuals and firms - Requires Research]

Strategic Implications for Greenko

Acquiring Orix's stake presents several strategic advantages for Greenko. This move would significantly bolster Greenko's market position, consolidate its control, and potentially accelerate its ambitious expansion plans within the Indian renewable energy sector. It also suggests a strengthening of their financial standing.

- Increased control over the company: Gaining full control eliminates potential external influences and allows for more decisive strategic decision-making.

- Potential for accelerated growth and expansion: With complete ownership, Greenko can streamline operations and pursue growth opportunities more aggressively.

- Strengthened financial position: The acquisition could unlock new financing avenues and reduce reliance on external investors.

- Enhanced market share in the renewable energy sector: Consolidation of the Orix stake will significantly boost Greenko's market share, making it a more formidable competitor.

Market Reactions and Expert Opinions

The news of the potential Greenko Orix Acquisition has generated considerable interest in the market. While specific reactions vary, early indications suggest positive sentiment towards Greenko’s strategic move. Industry analysts see this as a significant development within the Indian renewable energy landscape, with potential implications for both Greenko and its competitors.

- Stock market response to the news: [Describe the market reaction – Requires Research. Example: "Greenko's stock price experienced a slight increase following the announcement."]

- Quotes from industry analysts on the deal's potential: [Include quotes from relevant experts – Requires Research. Example: "Analyst X stated that the acquisition is a smart move that strengthens Greenko's position..."]

- Analysis of the impact on rival renewable energy companies: [Discuss the potential impact on competitors – Requires Research. Example: "This acquisition could lead to increased competition and consolidation within the Indian renewable energy market."]

Conclusion

The proposed Greenko Orix acquisition represents a pivotal moment for Greenko and the broader Indian renewable energy sector. The deal, if finalized, promises to significantly enhance Greenko's market position, accelerating its growth and solidifying its leading role in India's renewable energy transition. The strategic implications are far-reaching, potentially impacting the competitive landscape and accelerating the adoption of sustainable energy solutions.

Call to Action: Stay tuned for further updates on the Greenko Orix acquisition as this significant deal unfolds. Keep following our website for the latest news and analysis on this and other key developments in the Indian renewable energy sector. Learn more about the Greenko Orix acquisition and its potential impact by subscribing to our newsletter.

Featured Posts

-

Zivot U Ujedinjenim Arapskim Emiratima Prednosti I Nedostaci

May 17, 2025

Zivot U Ujedinjenim Arapskim Emiratima Prednosti I Nedostaci

May 17, 2025 -

The Diddy Trial Examining Cassie Venturas Account Of Sean Combs Actions

May 17, 2025

The Diddy Trial Examining Cassie Venturas Account Of Sean Combs Actions

May 17, 2025 -

Mlb Betting Tigers Vs Mariners Predictions And Odds For Today

May 17, 2025

Mlb Betting Tigers Vs Mariners Predictions And Odds For Today

May 17, 2025 -

Key Takeaways From Cassie Venturas Testimony In The Diddy Case

May 17, 2025

Key Takeaways From Cassie Venturas Testimony In The Diddy Case

May 17, 2025 -

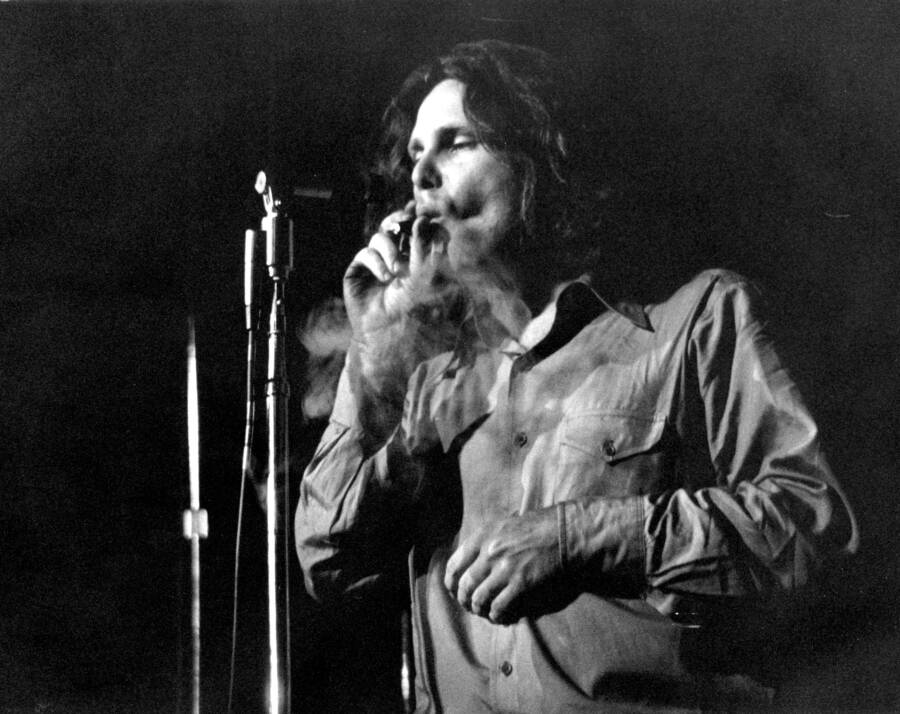

The Jim Morrison Maintenance Man Claim Fact Or Fiction

May 17, 2025

The Jim Morrison Maintenance Man Claim Fact Or Fiction

May 17, 2025

Latest Posts

-

Analisis Del Partido Penarol 0 2 Olimpia Goles Y Resumen

May 17, 2025

Analisis Del Partido Penarol 0 2 Olimpia Goles Y Resumen

May 17, 2025 -

Resultado Penarol Olimpia 0 2 Cronica Goles Y Resumen Del Encuentro

May 17, 2025

Resultado Penarol Olimpia 0 2 Cronica Goles Y Resumen Del Encuentro

May 17, 2025 -

Victoria De Bahia Sobre Paysandu 0 1 Resumen Completo Del Partido

May 17, 2025

Victoria De Bahia Sobre Paysandu 0 1 Resumen Completo Del Partido

May 17, 2025 -

Rf Atakuet Ukrainu Svyshe 200 Raket I Bespilotnikov Zapuscheny

May 17, 2025

Rf Atakuet Ukrainu Svyshe 200 Raket I Bespilotnikov Zapuscheny

May 17, 2025 -

Olimpia Derrota A Penarol 2 0 Resumen Completo Y Goles

May 17, 2025

Olimpia Derrota A Penarol 2 0 Resumen Completo Y Goles

May 17, 2025