Harvard And Yale Face Steep Endowment Tax Hike Under New House Proposal

Table of Contents

Details of the Proposed Endowment Tax Hike

The House proposal outlines a significant increase in the tax rate levied on university endowments exceeding a certain threshold. While the exact figures are still subject to debate and potential amendments, the core tenets remain: a substantial percentage increase in taxation on endowments above a pre-defined value. This "university endowment tax," as it's becoming known, seeks to address wealth inequality and generate revenue for various social programs.

Key features of the proposed legislation include:

- Tax Rate Percentage: A proposed increase of [Insert Proposed Percentage]% on the portion of the endowment exceeding the threshold. (Note: Replace bracketed information with actual figures from the proposal once available).

- Exemption Levels: A potential exemption for endowments below [Insert Exemption Amount] may be included. (Note: Replace bracketed information with actual figures from the proposal once available).

- Proposed Use of Tax Revenue: Funds generated from this endowment tax increase are intended to be allocated towards [Insert Intended Uses from the Proposal, e.g., financial aid for low-income students, infrastructure improvements in public schools, etc.].

- Timeline for Implementation: The proposed implementation date is [Insert Proposed Implementation Date from the Proposal]. (Note: Replace bracketed information with actual figures from the proposal once available).

"This legislation is designed to ensure fairness and address the growing disparity in wealth," stated [Insert Name and Title of Representative sponsoring the bill]. (Note: Replace bracketed information with a real quote from the proposal or a relevant representative.) The exact wording and specific details will likely evolve as the proposal progresses through the legislative process.

Potential Impact on Harvard and Yale Universities

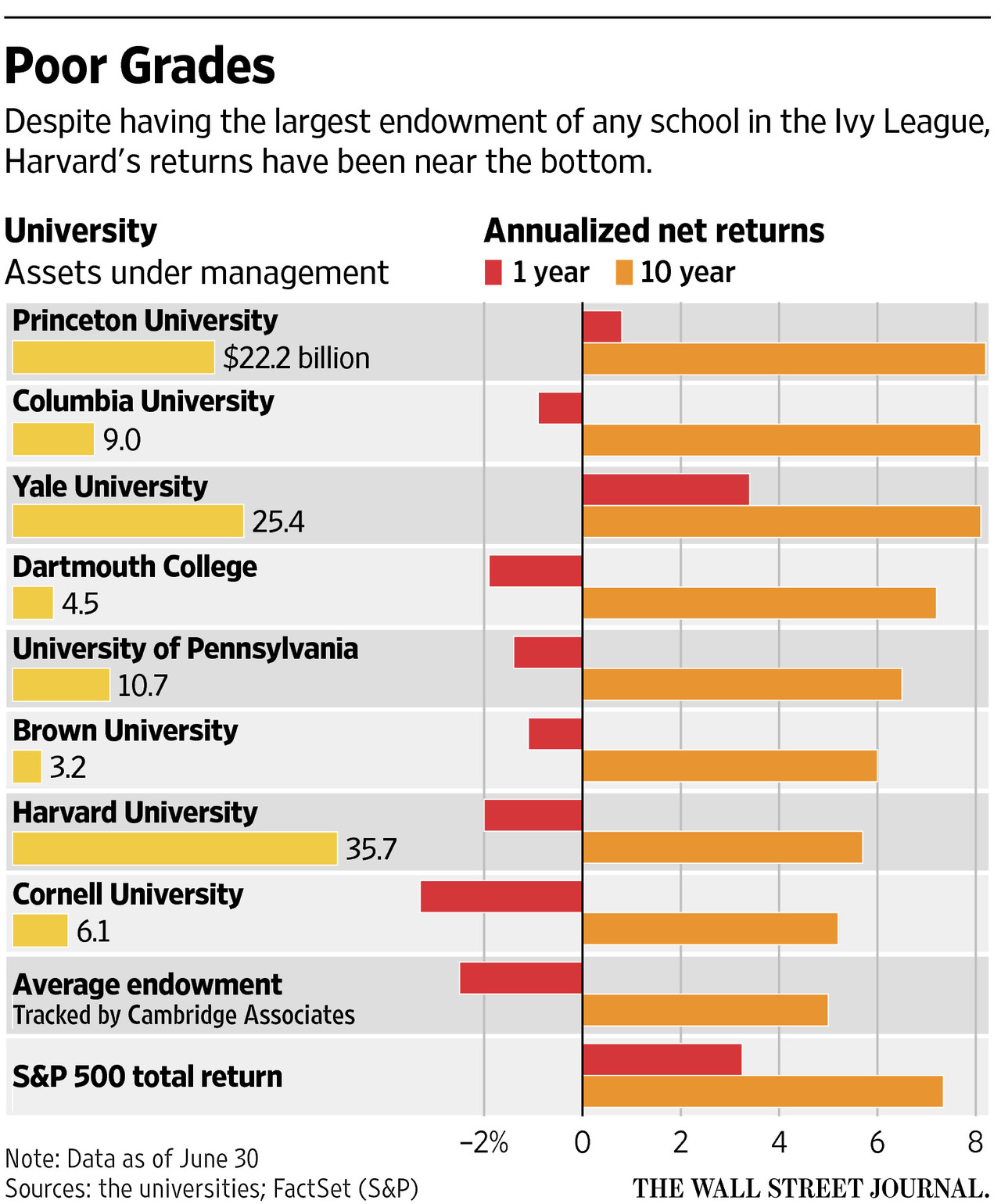

The financial implications for Harvard and Yale, two universities with endowments among the largest globally, are potentially staggering. The proposed endowment tax increase could translate into a loss of billions of dollars annually for each institution. This substantial revenue loss could force significant adjustments to their operational budgets, potentially affecting several key areas:

- Impact on Tuition Fees: The loss of endowment revenue might necessitate increases in tuition fees to maintain current levels of services and programs.

- Changes to Financial Aid Packages: Reductions in financial aid packages could become necessary to compensate for the shortfall in endowment income.

- Reductions in Research Funding and Grants: Research initiatives, a cornerstone of these universities' prestige, might face significant cuts due to budgetary constraints.

- Potential Impact on Student Recruitment and Retention: Reduced funding across the board could impact the overall quality of the student experience and potentially affect the universities' ability to attract and retain top students.

The Harvard endowment and the Yale endowment, already massive, would be directly impacted by this "endowment tax increase." The resulting financial strain could fundamentally alter these institutions' ability to fulfill their missions.

Arguments For and Against the Proposed Tax Hike

The proposed endowment tax has sparked a fierce debate, with proponents and opponents presenting compelling arguments.

Pro-Tax Hike Arguments:

- Addressing Wealth Inequality: Supporters argue that the immense wealth accumulated in university endowments should be used to address societal inequalities and fund public services.

- Funding Social Programs: The tax revenue generated could significantly bolster funding for crucial social programs, including education, healthcare, and infrastructure.

- Promoting Social Responsibility: Proponents believe that taxing university endowments is a socially responsible action, aligning universities' immense wealth with public good.

Anti-Tax Hike Arguments:

- Stifling Innovation: Opponents warn that the tax hike could severely restrict universities' ability to fund groundbreaking research and innovation.

- Harming Education: The tax could lead to tuition increases, reduced financial aid, and overall reductions in the quality of education.

- Hindering Philanthropy: The tax could discourage future philanthropic donations to universities, undermining a vital source of funding for higher education.

Expert opinions are sharply divided, with economists and education policymakers offering contrasting perspectives on the potential economic and social consequences of this proposed legislation.

Reactions and Future Outlook

The proposed endowment tax has generated a strong reaction from various stakeholders. Universities have expressed concerns about the potential negative impact on their operations and ability to fulfill their academic missions. Students and faculty are worried about the possible repercussions on tuition, financial aid, and research opportunities. Policymakers remain divided, reflecting the complex nature of this issue and its potential implications for the future of higher education funding.

The likelihood of the proposal passing through Congress remains uncertain. The political implications are significant, with potential for protracted debate and compromise. The "congressional debate" surrounding this "higher education policy" is far from over. The long-term impact on higher education funding will largely depend on the final form of the legislation and its effectiveness in achieving its intended goals.

Conclusion: The Future of Harvard and Yale Endowments and the Proposed Tax Hike

The proposed endowment tax hike represents a significant challenge to the financial stability and operational capacity of institutions like Harvard and Yale. The potential consequences – ranging from tuition increases to research cuts – are substantial. While arguments for and against the proposal highlight the complex ethical and economic considerations, the ultimate outcome will shape the future of higher education funding in the United States. The "Harvard Yale endowment tax" debate is a critical one, and staying informed about its legislative progress is crucial. We urge readers to contact their representatives to voice their opinions and ensure their concerns are heard in this crucial "endowment tax debate" affecting the future of university endowments.

Featured Posts

-

Doom The Dark Ages Early Access Release Date Time And Preload Guide

May 13, 2025

Doom The Dark Ages Early Access Release Date Time And Preload Guide

May 13, 2025 -

Edinaya Rossiya Sbor Predlozheniy Dlya Predvybornoy Programmy Ot Deputatov

May 13, 2025

Edinaya Rossiya Sbor Predlozheniy Dlya Predvybornoy Programmy Ot Deputatov

May 13, 2025 -

Chronological Doom Game Order The Ultimate Playing Guide

May 13, 2025

Chronological Doom Game Order The Ultimate Playing Guide

May 13, 2025 -

Ayorbaba Himbau Dukungan Penuh Untuk Persipura

May 13, 2025

Ayorbaba Himbau Dukungan Penuh Untuk Persipura

May 13, 2025 -

Diddys Ex Cassie Expecting Her Third Child

May 13, 2025

Diddys Ex Cassie Expecting Her Third Child

May 13, 2025