Harvard's Tax Exemption: President Labels Attempts To Revoke As Illegal

Table of Contents

The Legal Basis of Harvard's Tax Exemption

Harvard's tax-exempt status rests on its classification as a 501(c)(3) organization under the Internal Revenue Code. This designation is granted to non-profit organizations that serve a public benefit and adhere to strict regulations. Harvard's tax-exempt status has a long history, dating back to its founding, reflecting its commitment to education and research. The university's ongoing eligibility hinges on consistent adherence to IRS guidelines.

- Public Benefit: Harvard provides significant public benefit through its educational programs, groundbreaking research, and contributions to scholarship. This includes offering a wide range of undergraduate and graduate programs, conducting impactful research across numerous disciplines, and making its research and educational resources accessible to a wider audience.

- IRS Compliance: Harvard maintains meticulous records and operates within IRS guidelines regarding lobbying activities and political endorsements. Any involvement in political activities must strictly adhere to legal limits to maintain its tax-exempt status.

- Financial Transparency: Harvard adheres to rigorous financial transparency and reporting requirements, regularly submitting detailed financial reports to the IRS and making much of this information publicly available.

Arguments for Revoking Harvard's Tax Exemption

Despite its long-standing tax-exempt status, critics have raised several arguments for revoking Harvard's exemption. These concerns often center on the university's massive endowment and questions about its allocation and use.

- Endowment Size: Harvard's enormous endowment, one of the largest in the world, is a primary target of criticism. Critics argue that such substantial wealth contradicts the spirit of a tax-exempt organization intended to serve the public good.

- Financial Aid Concerns: Critics point to what they perceive as insufficient financial aid provided to students, despite the institution's vast resources. The argument suggests that a larger portion of the endowment should be directly allocated to making education more accessible.

- Investment Strategies: Harvard's investment strategies have also come under scrutiny, with some raising concerns about potential conflicts of interest and the ethical implications of certain investment choices.

President Bacow's Response and Legal Challenges

President Bacow has vehemently rejected attempts to revoke Harvard's tax exemption, labeling them as illegal. He has based his assertions on Harvard's consistent compliance with IRS regulations and its substantial contributions to the public good. Harvard is prepared to vigorously defend its tax-exempt status through legal channels.

- Legal Arguments: Harvard's legal team is likely to emphasize the university's longstanding commitment to public service, its adherence to IRS regulations, and its significant contributions to research, education, and the broader community.

- Legal Precedents: The legal battle will likely involve referencing precedents established in similar cases involving non-profit organizations and their tax-exempt status.

- Consequences of Revocation: The potential consequences of losing its tax-exempt status are severe, including substantial increases in operational costs and a significant reduction in its ability to attract philanthropic donations.

The Broader Implications for Higher Education

The case concerning Harvard's tax exemption has significant implications for higher education and non-profit organizations nationwide. The outcome will likely influence future tax policies and shape the landscape of charitable giving.

- Uncertainty for Other Universities: The outcome will create uncertainty for other universities with large endowments, prompting concerns about their own tax-exempt statuses and potential future challenges.

- Chilling Effect on Philanthropy: The uncertainty surrounding Harvard's tax exemption could have a chilling effect on charitable giving, potentially discouraging significant donations to higher education and other non-profit institutions.

- Future of Tax Policy: This case will undoubtedly influence future discussions and debates on tax policy related to non-profit organizations and the definition of "public benefit."

Conclusion: The Future of Harvard's Tax Exemption and the Implications for Higher Education

The debate surrounding Harvard's tax exemption remains highly contentious. President Bacow’s firm stance against the attempts to revoke it highlights the significant stakes involved. While Harvard maintains its commitment to public service and legal compliance, the arguments against its tax-exempt status raise important questions about the responsibilities and obligations of large, wealthy non-profit institutions. The legal battles ahead will shape not only Harvard's future but also the future of higher education and the broader landscape of non-profit organizations. Stay informed about developments in the case of Harvard's tax exemption and its implications for higher education; the debate surrounding Harvard's tax exemption is far from over. Understanding the complexities of Harvard University's tax-exempt status is crucial for anyone interested in the future of higher education funding and the non-profit sector.

Featured Posts

-

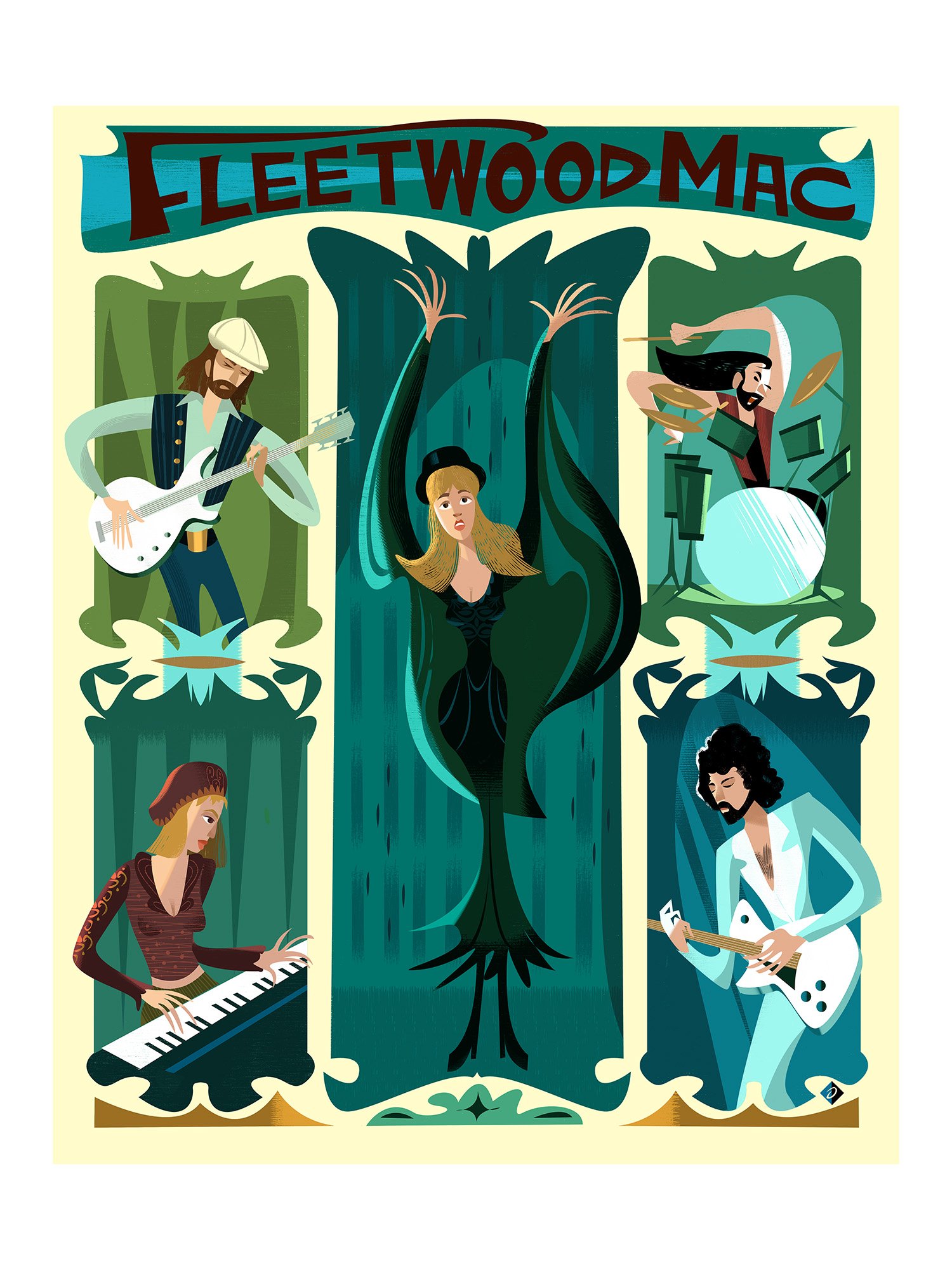

Fleetwood Mac Achieves Top Chart Position In The Us With Existing Catalog

May 04, 2025

Fleetwood Mac Achieves Top Chart Position In The Us With Existing Catalog

May 04, 2025 -

Dana White Alex Pereiras Heavyweight Shot Hinges On Ufc 313 Jon Jones Fight

May 04, 2025

Dana White Alex Pereiras Heavyweight Shot Hinges On Ufc 313 Jon Jones Fight

May 04, 2025 -

Koncert Gibonnija U Puli Detalji O Nadolazecem Spektaklu

May 04, 2025

Koncert Gibonnija U Puli Detalji O Nadolazecem Spektaklu

May 04, 2025 -

Teddy Magic Britains Got Talent Responds To Audience Concerns

May 04, 2025

Teddy Magic Britains Got Talent Responds To Audience Concerns

May 04, 2025 -

Canelo Alvarez Plant Fight Takes Priority Crawford Talk Postponed

May 04, 2025

Canelo Alvarez Plant Fight Takes Priority Crawford Talk Postponed

May 04, 2025