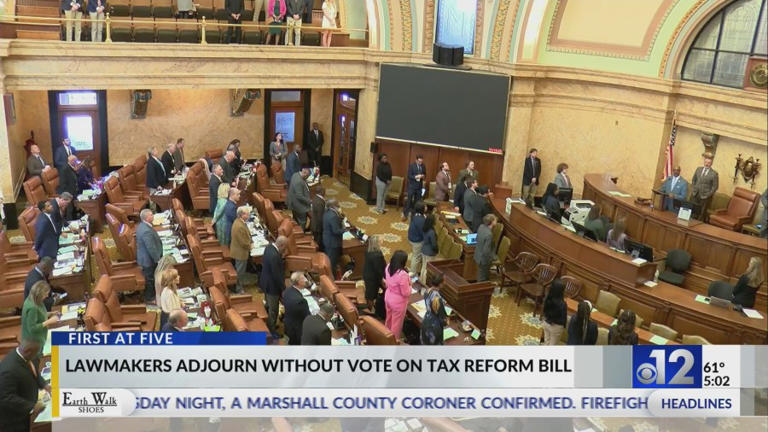

Hernando, Mississippi: Impact Of Potential Income Tax Elimination

Table of Contents

Potential Economic Growth in Hernando from Income Tax Elimination

Eliminating Mississippi's income tax could act as a powerful magnet, attracting new residents and businesses to Hernando. The allure of a tax-free income is undeniable, potentially leading to significant population growth in Hernando. This influx of people could, in turn, stimulate the local economy in several ways. We can expect a surge in demand for housing, leading to a boost in property values in Hernando. Existing businesses would likely see increased revenue from a larger consumer base, while new businesses might be encouraged to establish roots, creating more job opportunities. This positive feedback loop could lead to a significant period of economic growth for Hernando.

- Increased population and workforce: A tax-free environment could attract families and professionals seeking better financial opportunities, leading to a larger and more diverse workforce.

- Attracting higher-income earners: The absence of state income tax is particularly appealing to higher-income individuals, potentially increasing the average income level within the community and boosting local spending.

- Boost to the real estate market in Hernando: Increased demand for housing would likely drive up property values, benefiting existing homeowners and attracting further investment in the real estate sector.

- Stimulus for new business development and expansion of existing ones: A thriving population translates into a larger consumer base and a more attractive environment for entrepreneurship, encouraging new businesses to open and existing ones to expand.

- Increased consumer spending: With more disposable income, residents are likely to spend more in local businesses, further boosting the local economy and creating a positive cycle of growth. This increased consumer spending fuels the Hernando MS economy.

Potential Downsides and Challenges of Income Tax Elimination in Hernando

While the prospect of economic growth is enticing, it's crucial to acknowledge potential drawbacks. The elimination of income tax would undoubtedly lead to a significant reduction in government revenue for essential services in Mississippi. This could strain public services such as schools, infrastructure maintenance (roads, water systems, etc.), and public safety, potentially impacting the quality of life in Hernando. To compensate for the lost income tax revenue, there could be a substantial increase in property taxes, which could disproportionately affect low-income residents.

- Reduced funding for public schools and infrastructure: Less state revenue could mean cuts in education funding and deferred maintenance of crucial infrastructure, potentially impacting the long-term development of Hernando.

- Potential increase in property taxes: To maintain essential services, the local government might need to raise property taxes, potentially making homeownership more expensive for residents.

- Challenges in maintaining essential public services: Reduced funding could affect the quality and availability of crucial public services like police, fire, and emergency medical services.

- Possible impact on social programs: Funding for social safety nets and support programs might also be affected, leading to potential cuts or reductions in services. This is a crucial consideration for the Hernando MS economy and its residents.

Comparative Analysis: Hernando vs. Other Mississippi Cities

To understand the potential impact of income tax elimination on Hernando, it's helpful to compare its situation with other Mississippi cities. Some cities might be better positioned to absorb the shock of reduced state revenue, while others might face more significant challenges. Hernando's unique strengths, such as its proximity to Memphis and its existing robust economic base, could influence its ability to adapt and thrive even with reduced state funding. However, a detailed comparative analysis across various economic indicators is needed to assess the potential disparities in impact across different demographics within Hernando and other similar cities in Mississippi.

- Comparison of economic indicators between Hernando and similar cities: Analyzing key economic indicators like population growth, employment rates, and income levels across various cities can help predict Hernando's potential trajectory.

- Analysis of Hernando's unique strengths and weaknesses: Factors such as its proximity to major metropolitan areas, its existing infrastructure, and its business environment can influence its resilience in the face of tax reform.

- Discussion of potential disparities in impact across different demographics: The impact of income tax elimination might not be uniform across all segments of Hernando's population; a thorough analysis is required to assess potential inequalities. This is a crucial aspect of understanding the overall impact on the Hernando MS economy.

Long-Term Outlook and Predictions for Hernando's Economy

Predicting the long-term economic consequences of income tax elimination requires careful consideration of both the potential benefits and drawbacks. While the initial influx of residents and businesses could significantly boost the local economy, the long-term sustainability of this growth depends on effective planning and management of potential challenges. Maintaining essential public services, addressing potential increases in property taxes, and mitigating any negative impacts on lower-income residents will be crucial for ensuring a balanced and sustainable economic future for Hernando.

- Projected population growth in Hernando: Modeling potential population growth based on various scenarios can offer insights into the long-term implications of income tax elimination.

- Estimated changes in employment rates: Analyzing employment trends and projections can help predict the impact on the job market and the overall economic health of Hernando.

- Predictions on the long-term impact on local businesses: Understanding how local businesses are expected to adapt and thrive (or struggle) under the new tax regime is crucial.

- Potential future challenges and opportunities for Hernando: Identifying future challenges and opportunities allows for proactive planning and strategic decision-making to ensure a robust economic future for Hernando. This careful analysis provides a realistic view of the Hernando MS economy's future.

Conclusion: The Future of Hernando, Mississippi After Potential Income Tax Elimination

The potential elimination of income tax in Mississippi presents a complex scenario for Hernando. While it offers the exciting possibility of significant economic growth through increased population, business development, and property value increases, it also carries risks, particularly regarding the funding of essential public services. A balanced approach, considering both short-term gains and long-term sustainability, is crucial. The future of Hernando's economy hinges on responsible planning and proactive measures to address potential challenges while maximizing the potential benefits of this significant policy change. Stay informed about the proposed Mississippi tax policy and its potential impact on the Hernando MS economic future. Your engagement is vital to shaping the future of Hernando, Mississippi.

Featured Posts

-

Fewer Passengers Expected At Maastricht Airport 2025 Analysis

May 19, 2025

Fewer Passengers Expected At Maastricht Airport 2025 Analysis

May 19, 2025 -

Finding The Connections Nyt Puzzle 688 Hints And Answers April 29

May 19, 2025

Finding The Connections Nyt Puzzle 688 Hints And Answers April 29

May 19, 2025 -

Behind The Glamour The Financial Challenges Faced By Wives Of A List Stars

May 19, 2025

Behind The Glamour The Financial Challenges Faced By Wives Of A List Stars

May 19, 2025 -

Lengthy Cellcom Outage Impact On Calls And Text Messaging

May 19, 2025

Lengthy Cellcom Outage Impact On Calls And Text Messaging

May 19, 2025 -

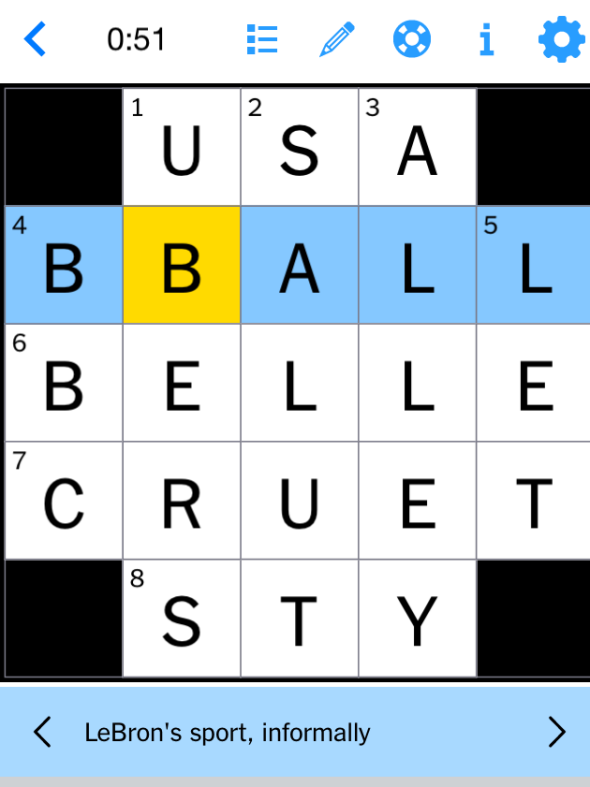

Nyt Mini Crossword Answers For April 18 2025

May 19, 2025

Nyt Mini Crossword Answers For April 18 2025

May 19, 2025