High Stock Market Valuations: BofA's Arguments For Investor Calm

Table of Contents

BofA's Arguments for Continued Economic Growth

BofA's optimistic outlook rests on several pillars supporting continued economic growth, mitigating concerns about high stock market valuations.

Robust Corporate Earnings

BofA projects strong corporate earnings growth in the coming quarters, a key factor justifying current valuations. This robust growth is expected to offset concerns related to high price-to-earnings ratios.

- Strong-performing sectors: Technology, healthcare, and consumer staples are projected to continue their strong performance, driven by innovation and increasing global demand.

- Continued profitability: Technological advancements are boosting efficiency and productivity, fueling profitability even in the face of rising costs. Increased global demand, particularly from emerging markets, provides further support.

- High earnings growth: Analysts at BofA forecast high earnings growth rates for the next two years, exceeding historical averages. This positive outlook underpins their belief that current valuations are sustainable. The corporate earnings outlook remains positive despite inflationary pressures.

Low Interest Rates and Monetary Policy

BofA highlights the role of low interest rates in underpinning stock prices. The current monetary policy environment continues to support borrowing and investment.

- Analysis of current monetary policy: The current low interest rate environment keeps borrowing costs low for corporations and consumers, stimulating investment and spending.

- Potential for future rate changes: While interest rates may eventually rise, BofA anticipates a gradual increase, minimizing a disruptive impact on the market.

- Low interest rate effect on valuations: Low interest rates make equities a more attractive investment compared to bonds, contributing to higher valuations. The impact of monetary policy on investor behavior is a key factor influencing their assessment of high stock market valuations.

Strong Consumer Spending

BofA's assessment points towards strong consumer spending as a major driver of economic growth, further supporting their positive market outlook.

- Key indicators of consumer confidence: Consumer confidence surveys suggest a positive outlook on the economy, underpinning continued spending.

- Spending patterns: Data on retail sales and other consumer spending indicators supports the idea of a resilient consumer sector.

- Economic growth drivers: Consumer spending remains a significant driver of economic growth, counteracting concerns about high stock market valuations. This spending power translates into increased corporate revenues and profits.

Addressing the Risk of High Stock Market Valuations

While acknowledging the risks associated with high stock market valuations, BofA offers strategies to mitigate these concerns.

BofA's Perspective on Valuation Metrics

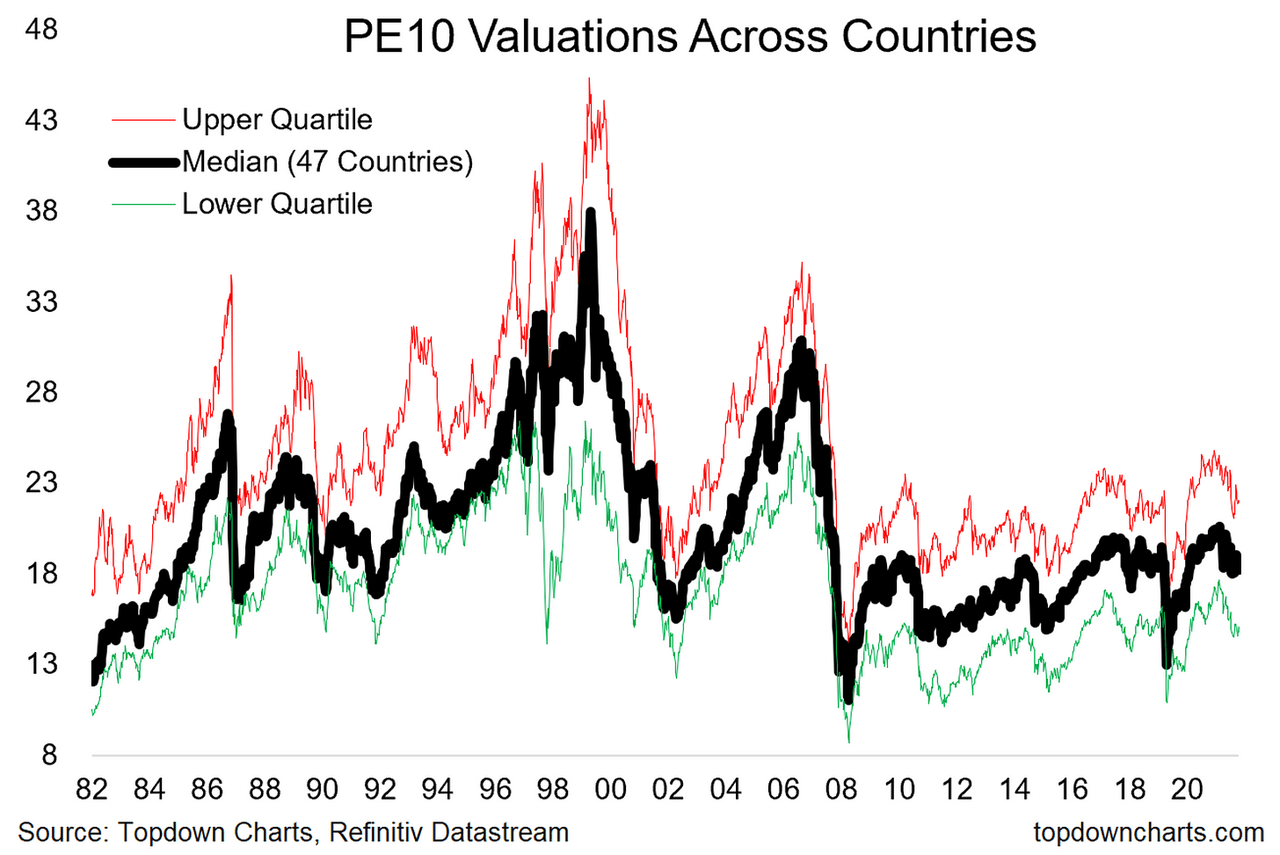

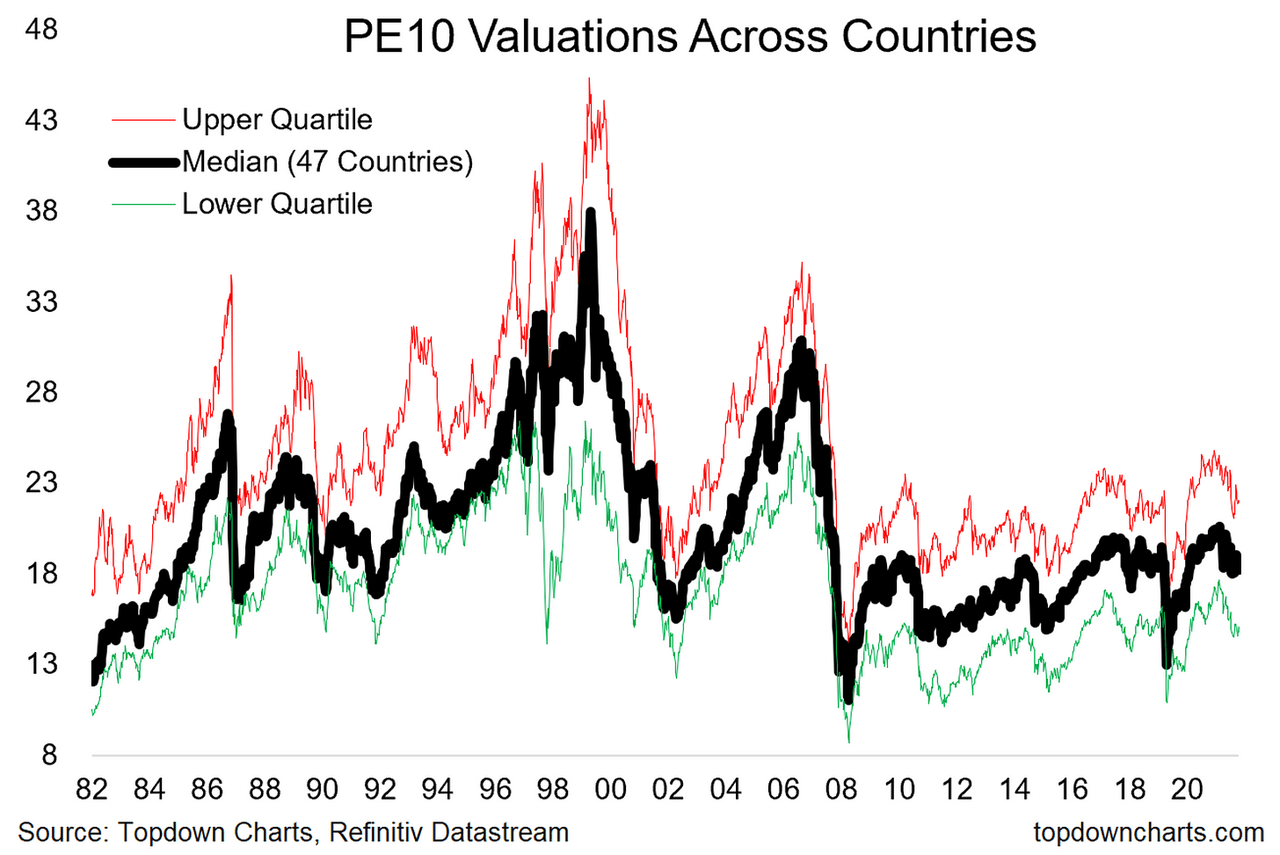

BofA's analysts interpret various valuation metrics, including the price-to-earnings ratio (P/E ratio) and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), to assess the market's current state.

- Explanation of selected valuation metrics: BofA analyzes multiple valuation metrics to gain a comprehensive picture, not relying solely on one indicator.

- Comparison to historical averages: While acknowledging that current valuations are above historical averages, they consider factors such as lower interest rates and strong earnings growth which may justify these higher multiples.

- Justification for current levels: Their analysis suggests that several factors, including robust earnings growth and low interest rates, justify the current market valuation multiples, at least in the near term. Market valuation metrics must be analyzed in context.

Managing Risk Through Diversification

BofA strongly emphasizes the importance of diversification to manage the risks associated with high stock market valuations.

- Importance of diversification across asset classes: Diversifying investments across stocks, bonds, and real estate reduces overall portfolio volatility and minimizes exposure to any single sector's downturn.

- Strategic asset allocation: A well-defined asset allocation strategy tailored to individual risk tolerance is crucial for navigating market fluctuations.

- Investment risk: Understanding and managing investment risk, especially within a market exhibiting high valuations, is crucial for long-term success. Risk management strategies are not one-size-fits-all.

Long-Term Investment Strategy

BofA advocates for a long-term investment strategy to weather the uncertainties inherent in markets with high valuations.

- Importance of long-term investing: A long-term investment horizon allows investors to ride out short-term market fluctuations and benefit from the long-term growth potential of the market.

- Buy-and-hold strategy: A buy-and-hold strategy, coupled with periodic rebalancing, is often recommended for long-term investors.

- Market cycles: Understanding that markets go through cycles – periods of high valuations followed by corrections – is essential for maintaining a long-term perspective. Patient investing is key to success.

Conclusion: Navigating High Stock Market Valuations with Confidence

BofA's analysis suggests that while high stock market valuations present a cause for caution, they are not necessarily a reason for panic. Strong corporate earnings, supportive monetary policy, and robust consumer spending provide a foundation for continued economic growth. However, mitigating the risks associated with high valuations requires a carefully considered investment strategy. Reiterating the importance of diversification across asset classes and adopting a long-term investment horizon are key takeaways. To successfully navigate these high stock market valuations, develop a well-informed investment strategy that aligns with your risk tolerance and long-term financial goals. Consider consulting with a financial advisor to create a personalized plan that addresses your specific circumstances and provides professional guidance on managing your investment portfolio in this environment. Despite current valuation levels, the potential for continued market growth remains, offering opportunities for long-term investors.

Featured Posts

-

Jon M Chu To Helm Crazy Rich Asians Tv Series Adaptation

May 11, 2025

Jon M Chu To Helm Crazy Rich Asians Tv Series Adaptation

May 11, 2025 -

Anunoby Anota 27 Knicks Vencen A 76ers Novena Derrota Para Philadelphia

May 11, 2025

Anunoby Anota 27 Knicks Vencen A 76ers Novena Derrota Para Philadelphia

May 11, 2025 -

Is Betting On The Los Angeles Wildfires A Sign Of The Times Exploring The Ethics And Implications

May 11, 2025

Is Betting On The Los Angeles Wildfires A Sign Of The Times Exploring The Ethics And Implications

May 11, 2025 -

Two Celtics Players Unexpectedly Score 40 Points Each In One Game

May 11, 2025

Two Celtics Players Unexpectedly Score 40 Points Each In One Game

May 11, 2025 -

15 Years Later Jessica Simpsons Highly Anticipated Concert Performance

May 11, 2025

15 Years Later Jessica Simpsons Highly Anticipated Concert Performance

May 11, 2025