High Stock Market Valuations: BofA's Reasons For Investor Calm

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Cause for Concern

BofA's optimistic stance isn't based on simply ignoring the high price-to-earnings ratios (P/E ratios) often cited as indicators of an overvalued market. Instead, their analysis points to a confluence of factors that, in their view, justify the current valuations, at least to some extent. Their core argument centers on the strength of underlying economic fundamentals and future growth potential.

-

Strong Corporate Earnings Growth: Despite economic headwinds like inflation and geopolitical uncertainty, many corporations have reported surprisingly robust earnings growth. This suggests resilience and adaptability within the business sector, supporting higher valuations. For example, [Insert example of a company with strong earnings growth and link to a relevant source]. This trend counters the narrative of an impending economic downturn.

-

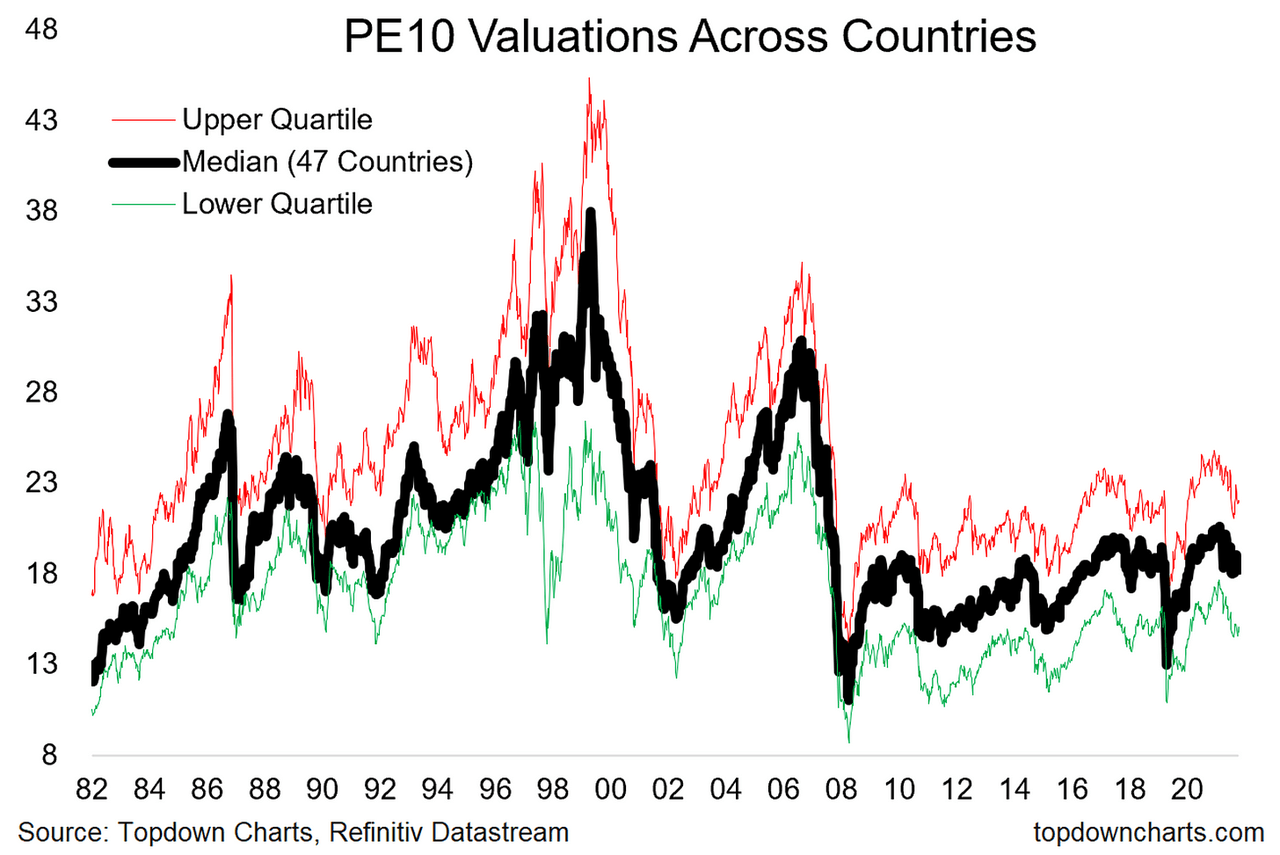

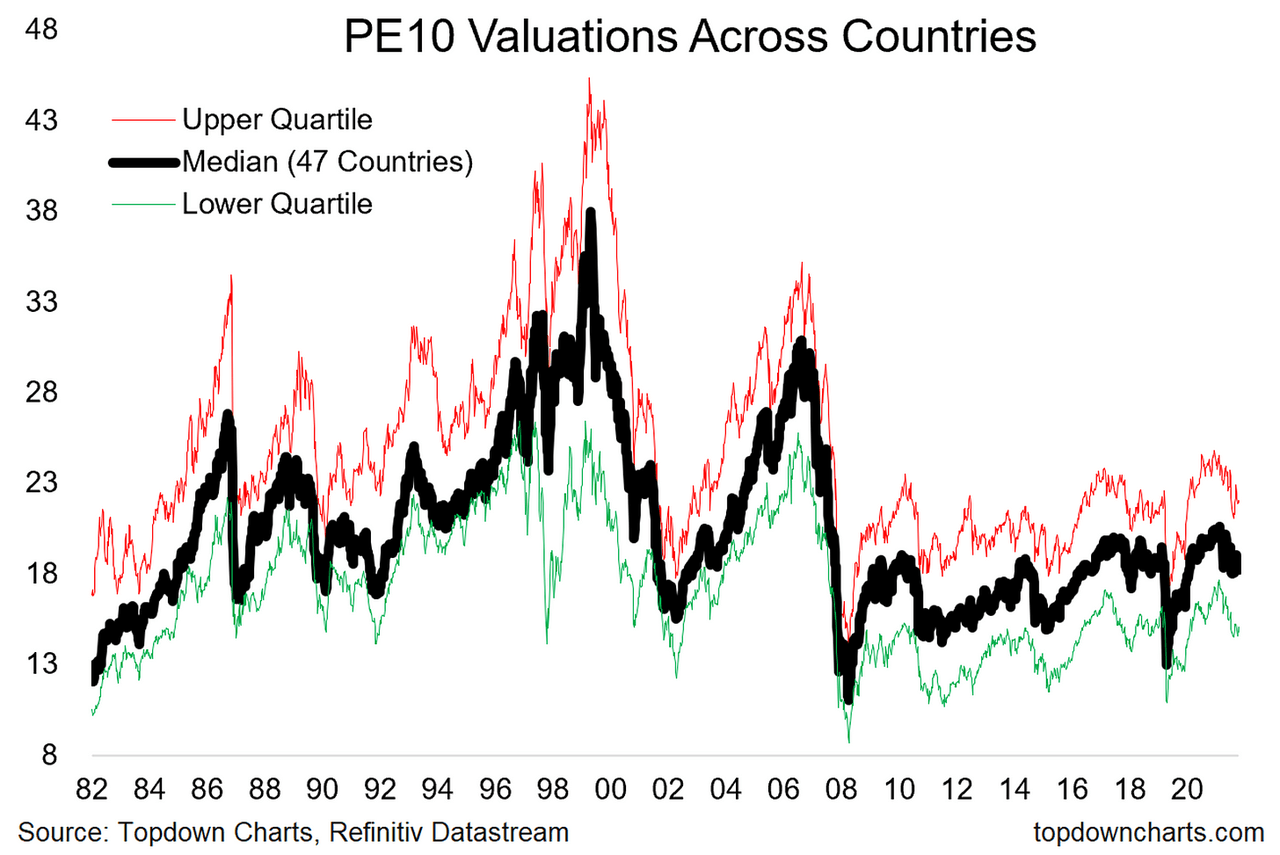

Potential for Further Interest Rate Cuts: While interest rates have risen recently, some economists predict potential future cuts if inflation cools significantly or economic growth slows more than anticipated. Lower interest rates typically stimulate the stock market, making higher valuations more sustainable. [Insert data or chart illustrating interest rate projections and its potential impact on stock valuations].

-

Resilience of the Consumer Spending Sector: Despite inflationary pressures, consumer spending has remained relatively strong in certain key areas. This indicates consumer confidence and a continued demand for goods and services, supporting corporate profits and justifying higher valuations. [Cite relevant data on consumer spending and consumer confidence indexes].

-

Technological Advancements Driving Future Growth: Breakthroughs in areas like artificial intelligence, renewable energy, and biotechnology are poised to fuel significant future growth. Investors are increasingly betting on these sectors, driving up valuations in anticipation of future earnings. [Provide examples of companies leading in these sectors and their market performance].

Analyzing the Factors Contributing to High Stock Market Valuations

Several factors contribute to the current high stock market valuations, even in the face of potential risks. Understanding these factors is crucial for navigating the market effectively.

-

Low Interest Rates (and their lingering impact): Historically low interest rates for an extended period have made borrowing cheaper for companies and investors, fueling investment and driving up asset prices, including stocks. Even with recent rate hikes, the impact of years of low rates is still felt.

-

Quantitative Easing (QE) and its Lingering Effects: The massive injections of liquidity into the market through QE programs have had a long-lasting effect on asset prices. This excess liquidity continues to influence market valuations, even as QE programs have concluded. [Include data on the scale of QE programs and their correlation with market valuations].

-

Increased Liquidity in the Market: Beyond QE, various factors have increased overall market liquidity, making it easier for investors to buy and sell assets. This increased trading activity can push up prices, contributing to higher valuations.

-

Investor Confidence in Specific Sectors: Investors are showing strong confidence in specific sectors, such as technology and renewable energy, driving up valuations in those areas. This sector-specific optimism, however, also concentrates risk.

Assessing the Risks Associated with High Stock Market Valuations

While BofA's outlook is relatively positive, it's essential to acknowledge the inherent risks associated with high stock market valuations.

-

Market Correction Potential: High valuations make the market more susceptible to corrections or even crashes. The severity of any potential correction is difficult to predict but warrants careful consideration. [Discuss historical examples of market corrections and their causes].

-

Inflationary Pressures: Persistent inflationary pressures can erode corporate profits and investor confidence, potentially leading to a decline in stock prices. [Analyze the relationship between inflation and stock market performance].

-

Geopolitical Uncertainty: Geopolitical events, such as wars or trade disputes, can significantly impact market sentiment and lead to volatility, potentially causing a market downturn.

-

Potential for Interest Rate Hikes: Further interest rate hikes, aimed at curbing inflation, could negatively impact corporate earnings and investor borrowing, leading to lower stock valuations.

BofA's Investment Strategies in a High-Valuation Market

While specific recommendations may change, BofA generally advises a balanced approach, emphasizing diversification to mitigate risk. Their strategies often include sector-specific recommendations, focusing on companies with strong fundamentals and long-term growth potential within less volatile sectors. A long-term investment horizon is typically recommended over short-term speculation, allowing for weathering market fluctuations.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

High stock market valuations present both opportunities and risks. While the potential for a correction exists, BofA's analysis highlights several factors supporting their cautiously optimistic outlook. Their reasoning emphasizes strong corporate earnings, the potential for interest rate adjustments, resilient consumer spending, and the growth potential of innovative sectors. However, investors should remain aware of the risks associated with high valuations, including inflation, geopolitical instability, and the potential for interest rate hikes. Understand the nuances of high stock market valuations by further researching BofA's analysis and consider their suggested strategies to develop a well-informed investment strategy in the face of these conditions. Learn more about BofA's perspective on current market conditions and develop a robust approach to navigating these high stock market valuations.

Featured Posts

-

Remont Pivdennogo Mostu Detalniy Analiz Proektu Ta Finansuvannya

May 21, 2025

Remont Pivdennogo Mostu Detalniy Analiz Proektu Ta Finansuvannya

May 21, 2025 -

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 21, 2025

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 21, 2025 -

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

May 21, 2025

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

May 21, 2025 -

Benjamin Kaellman Uusi Aikakausi Huuhkajissa

May 21, 2025

Benjamin Kaellman Uusi Aikakausi Huuhkajissa

May 21, 2025 -

Is Apples Llm Siri On The Verge Of A Resurgence

May 21, 2025

Is Apples Llm Siri On The Verge Of A Resurgence

May 21, 2025