High Stock Market Valuations: BofA's Reassuring Analysis For Investors

Table of Contents

BofA's Core Argument: Why High Valuations Aren't Necessarily a Bear Market Signal

BofA's optimistic stance on high stock market valuations isn't based on blind faith; it's rooted in a detailed analysis of several key economic factors. They argue that while valuations appear elevated compared to historical averages, several mitigating factors suggest sustained growth is still possible.

- Low Interest Rates: BofA highlights the continued influence of low interest rates, making borrowing costs for businesses and consumers relatively manageable. This supports continued investment and spending, bolstering corporate earnings and fueling economic growth.

- Strong Corporate Earnings: The report emphasizes robust corporate earnings as a key factor supporting current valuations. Many companies have demonstrated impressive growth and profitability, justifying, in BofA’s view, the higher price-to-earnings (P/E) ratios.

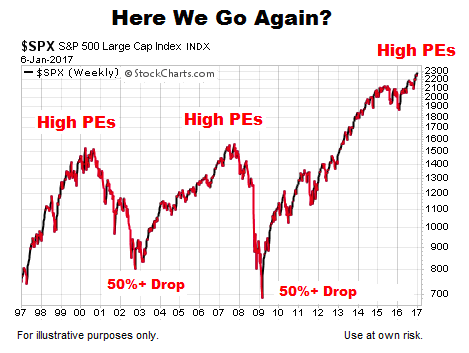

- Historical Context: BofA's analysis includes historical comparisons of market valuations, showing that while current levels are high, they're not unprecedented. They point to periods in the past where similar valuations preceded further market expansion. Specifically, they reference [insert specific example and citation from BofA's report here, including chart if possible]. This perspective helps contextualize current concerns within a longer-term market view.

Addressing Investor Concerns: Key Risks and Mitigation Strategies

Despite BofA's optimistic outlook, acknowledging potential risks is crucial for any investor. High valuations naturally bring about valid concerns:

- Inflation: Rising inflation can erode purchasing power and impact corporate profitability, potentially dampening market growth. BofA addresses this by [insert BofA's specific analysis and counter-arguments regarding inflation from their report].

- Interest Rate Hikes: The prospect of interest rate hikes by central banks poses a risk, potentially increasing borrowing costs and slowing economic activity. BofA's analysis likely incorporates various interest rate scenarios and their potential impact on the market. [Insert BofA’s analysis and predictions here].

- Geopolitical Instability: Global geopolitical events can introduce significant market volatility. BofA acknowledges these risks and likely factors their potential impact into their overall forecast. [Include BofA’s handling of geopolitical risk].

BofA suggests mitigating these risks through:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors helps reduce portfolio volatility.

- Long-Term Investment Horizon: Focusing on long-term growth rather than short-term market fluctuations minimizes the impact of temporary downturns.

BofA's Recommendations for Investors Navigating High Valuations

Based on their analysis, BofA likely provides investors with specific recommendations:

- Sector Rotation: Identifying sectors poised for outperformance within the current economic environment is key. This might involve shifting investments towards sectors benefiting from specific trends (e.g., technology, sustainable energy).

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer attractive risk-adjusted returns.

- Asset Allocation: Adjusting the balance of assets within a portfolio to align with risk tolerance and long-term goals is crucial. This might include adjusting the allocation between stocks and bonds based on market conditions.

- Risk Management: Employing stop-loss orders and other risk management techniques to protect capital is essential, particularly in a market with high valuations.

Comparing BofA's Analysis with Other Market Perspectives

It's crucial to remember that BofA's outlook is just one perspective. Other financial analysts and institutions may hold differing viewpoints on high stock market valuations. [Insert comparisons with other prominent financial institutions like Goldman Sachs, Morgan Stanley etc. and cite sources. Highlight similarities and differences in their outlooks]. This comparative analysis provides a more nuanced understanding of the prevailing market sentiment.

Understanding High Stock Market Valuations: A Path Forward

BofA's analysis suggests that while high stock market valuations exist, they aren't necessarily a harbinger of an imminent bear market. Their optimistic outlook is supported by factors like low interest rates and strong corporate earnings. However, investors must carefully consider potential risks such as inflation and geopolitical instability. Effective risk management, diversification, and a long-term investment strategy are crucial for navigating this environment successfully.

Remember, this article summarizes BofA's perspective. To make informed investment decisions, conduct thorough research, consult with a qualified financial advisor, and develop a well-informed investment strategy to navigate high stock market valuations effectively. Consider BofA's analysis as one important piece of the puzzle in your investment decision-making process.

Featured Posts

-

San Jose Earthquakes Vs Seattle Sounders Matchday Preview

May 16, 2025

San Jose Earthquakes Vs Seattle Sounders Matchday Preview

May 16, 2025 -

The Best Ps 1 Esque Games On Steam Deck Verified And Ready To Play

May 16, 2025

The Best Ps 1 Esque Games On Steam Deck Verified And Ready To Play

May 16, 2025 -

Ex Cnn Reporter Alleges Cover Up In Biden Health Coverage

May 16, 2025

Ex Cnn Reporter Alleges Cover Up In Biden Health Coverage

May 16, 2025 -

Jim Cramer On Foot Locker Fl A Winning Investment

May 16, 2025

Jim Cramer On Foot Locker Fl A Winning Investment

May 16, 2025 -

Michael Chandler And Paddy Pimblett Joint Ufc 314 Predictions

May 16, 2025

Michael Chandler And Paddy Pimblett Joint Ufc 314 Predictions

May 16, 2025