High Stock Market Valuations: Why BofA Says Investors Shouldn't Worry

Table of Contents

BofA's Rationale: Low Interest Rates and Strong Corporate Earnings

BofA's argument rests on two fundamental pillars: historically low interest rates and robust corporate earnings. These factors, they contend, justify the current elevated stock market valuation.

-

The Impact of Low Interest Rates: Low interest rates significantly influence stock valuations. A lower discount rate, used in discounted cash flow models (a key method for valuing companies), translates to higher present values of future earnings. Essentially, when borrowing money is cheap, the future earnings of companies are worth more today. This upward pressure on valuations helps explain why, even with seemingly high price-to-earnings (P/E) ratios, BofA remains optimistic.

-

Strong Corporate Earnings – Fueling the Market: The strength of corporate earnings is another critical component. Many companies have reported surprisingly strong earnings, defying initial predictions of a post-pandemic slowdown. This robust performance directly supports the current valuations. For example, [insert data point, e.g., "the S&P 500 companies reported X% earnings growth in Q[Quarter], exceeding analyst expectations by Y%"]. This consistent earnings growth provides a solid foundation for higher stock prices.

-

Earnings Growth and Future Outlook: Looking ahead, BofA anticipates continued strong corporate earnings growth, particularly in sectors like [mention specific high-growth sectors, e.g., technology, renewable energy]. This optimistic outlook further mitigates concerns about overvaluation.

Addressing Inflation Concerns and Their Impact on Valuations

Inflation is a legitimate concern for investors. Rising prices can erode corporate profit margins and potentially trigger a market downturn. However, BofA's analysis suggests a nuanced perspective.

-

Inflation's Trajectory: BofA acknowledges the inflationary pressures but believes the current situation is manageable. They predict [mention BofA's predicted inflation trajectory, e.g., a gradual deceleration of inflation over the next year], citing [mention reasons or data supporting their prediction].

-

Corporate Responses to Inflation: Many companies possess strategies to mitigate the impact of inflation. These include:

- Raising prices: Passing increased costs onto consumers.

- Improving efficiency: Reducing operational costs.

- Investing in automation: Enhancing productivity and reducing labor costs.

-

Impact on Profit Margins: While inflation will undoubtedly impact profit margins, BofA believes that the current earnings strength and the companies' ability to adapt will offset these effects to a significant degree.

Long-Term Growth Prospects and Future Earnings Potential

BofA's confidence in the market is rooted in a positive long-term economic growth outlook.

-

Technological Advancements: Continued innovation and technological advancements across various sectors are expected to drive substantial future growth. This includes advancements in [mention specific technological areas, e.g., artificial intelligence, renewable energy technologies]. These innovations offer the potential for new markets and revenue streams for companies.

-

Sector-Specific Growth: Specific sectors are poised for significant growth. For example, [mention a sector and the reasons for its growth potential, e.g., the renewable energy sector is benefiting from increased government investment and growing consumer demand].

-

Economic Growth Outlook: BofA's long-term economic growth forecast remains positive, implying that current valuations are supported by the potential for continued robust earnings.

Comparing Current Valuations to Historical Data

Analyzing current valuations against historical data provides crucial context.

-

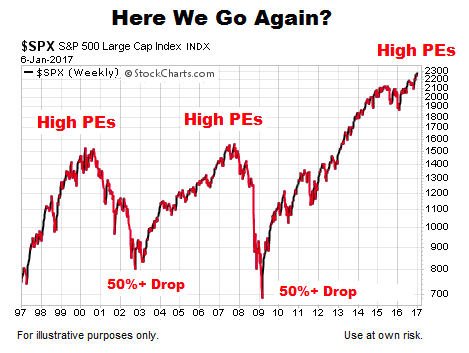

Historical Valuations: A comparison of current valuation multiples (like the price-to-earnings ratio or P/E ratio) to historical averages reveals that while valuations are high, they are not unprecedented. [Insert chart or graph comparing current valuations to historical averages].

-

Past High Valuations: History shows periods of high valuations followed by substantial market growth. [Provide an example of a past period with high valuations and its subsequent market performance]. This demonstrates that high valuations alone do not necessarily predict an imminent market crash.

-

Market Cycles: It's crucial to remember that markets operate in cycles. Periods of high valuations are often followed by periods of consolidation or correction, but this doesn't automatically mean the market is doomed.

Conclusion: Navigating High Stock Market Valuations with Confidence

BofA's analysis suggests that while high stock market valuations are a valid point of consideration, they are not necessarily a reason for panic. The combination of low interest rates, robust corporate earnings, a positive long-term economic outlook, and historical precedent suggests that a well-diversified, long-term investment strategy remains a viable approach. Remember to consider the long-term growth prospects and the impact of low interest rates. For a personalized investment strategy that accounts for the current high stock market valuations, consult with a financial advisor. Don't let anxieties about high stock market valuations derail your long-term financial goals. Develop a robust investment plan today.

Featured Posts

-

The Rose Pardon Debate Weighing The Arguments For And Against A Presidential Pardon

Apr 29, 2025

The Rose Pardon Debate Weighing The Arguments For And Against A Presidential Pardon

Apr 29, 2025 -

Is Betting On The Los Angeles Wildfires A Sign Of Societal Shift

Apr 29, 2025

Is Betting On The Los Angeles Wildfires A Sign Of Societal Shift

Apr 29, 2025 -

Yukon Mine Manager Faces Contempt Charges After Refusal To Testify

Apr 29, 2025

Yukon Mine Manager Faces Contempt Charges After Refusal To Testify

Apr 29, 2025 -

Europe On High Alert Analyzing Recent Russian Military Actions

Apr 29, 2025

Europe On High Alert Analyzing Recent Russian Military Actions

Apr 29, 2025 -

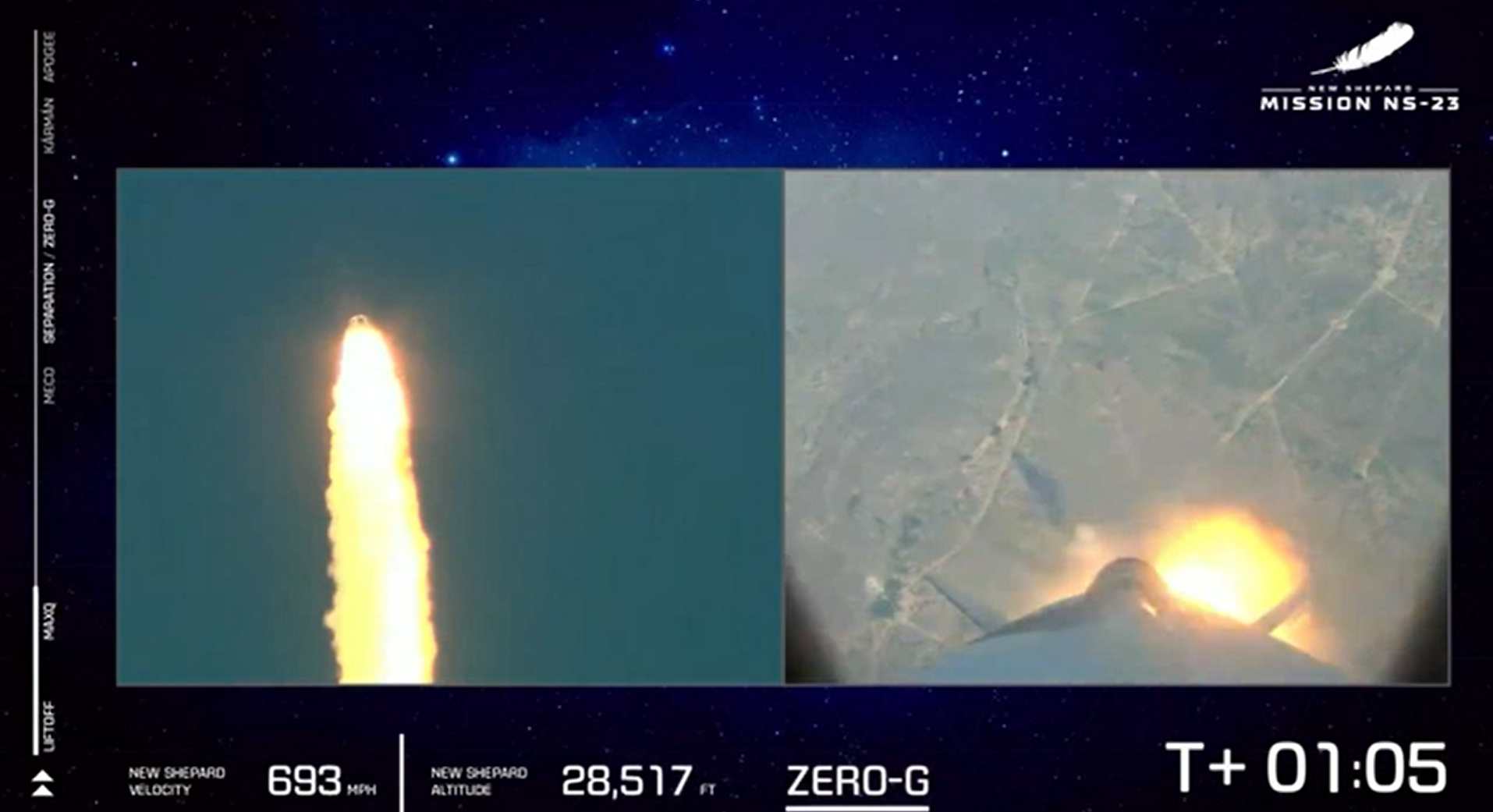

Subystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 29, 2025

Subystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 29, 2025

Latest Posts

-

Porsche 911 S T Riviera Blue Pts Buy Now

Apr 29, 2025

Porsche 911 S T Riviera Blue Pts Buy Now

Apr 29, 2025 -

Why Is The Porsche More Popular Internationally Than In Australia

Apr 29, 2025

Why Is The Porsche More Popular Internationally Than In Australia

Apr 29, 2025 -

Jancker Wird Neuer Austria Klagenfurt Coach

Apr 29, 2025

Jancker Wird Neuer Austria Klagenfurt Coach

Apr 29, 2025 -

Pre Owned Porsche 911 S T Riviera Blue Paint To Sample

Apr 29, 2025

Pre Owned Porsche 911 S T Riviera Blue Paint To Sample

Apr 29, 2025 -

Porsche Popularity A Comparative Study Of Australia And Global Markets

Apr 29, 2025

Porsche Popularity A Comparative Study Of Australia And Global Markets

Apr 29, 2025