High Stock Market Valuations: Why BofA Thinks Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's position on current high stock market valuations is nuanced. They acknowledge the elevated levels but argue that several underlying factors justify, at least partially, these valuations. Let's break down their key arguments.

Strong Corporate Earnings and Profitability

A core component of BofA's argument rests on the robust performance of corporate earnings. Despite the high valuations, many companies are demonstrating impressive profitability. For instance, S&P 500 earnings growth projections for 2024 remain positive, suggesting continued strength in the corporate sector. This strong earnings growth is not uniform across all sectors; however, robust performance in sectors like technology is helping to offset concerns about high valuations in other areas.

- Robust earnings growth in the tech sector: Innovation and strong demand continue to fuel significant profits for many technology companies.

- Strong consumer spending driving positive corporate results: Resilient consumer spending has supported positive corporate earnings across various sectors.

- Increased efficiency and cost-cutting measures: Many companies have implemented strategies to enhance profitability even in the face of economic uncertainty.

The Impact of Low Interest Rates

Low interest rates play a significant role in supporting current stock market valuations. When interest rates are low, bonds offer relatively lower returns. This makes stocks, even at seemingly high valuations, a more attractive investment option for many investors seeking higher yields.

- Low borrowing costs enabling companies to invest and expand: Low interest rates reduce the cost of capital for corporations, allowing them to invest in growth initiatives and expand their operations.

- Reduced returns on bonds push investors towards higher-yielding equities: With bond yields remaining low, investors are often drawn to the potentially higher returns offered by the stock market.

Long-Term Growth Potential and Future Projections

BofA maintains a positive long-term outlook for the economy and the stock market. They point to several factors supporting continued growth, suggesting that focusing on the long-term perspective can mitigate concerns about short-term valuation fluctuations.

- Technological innovation driving future economic growth and corporate profits: Breakthroughs in technology continue to create new opportunities and drive economic expansion.

- Growth opportunities in developing economies: Emerging markets present significant growth potential for companies expanding globally.

- Demographic shifts and increased global demand: Shifting demographics and rising global demand contribute to sustained economic growth.

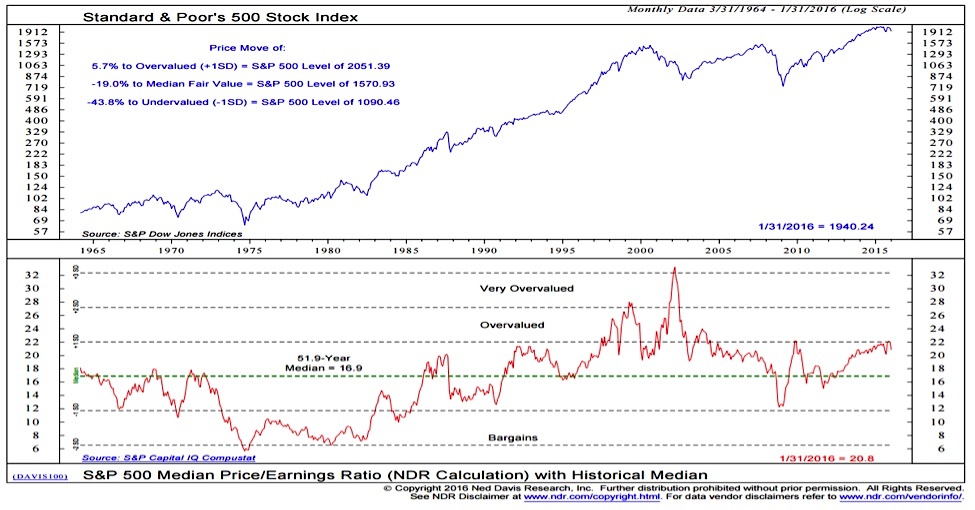

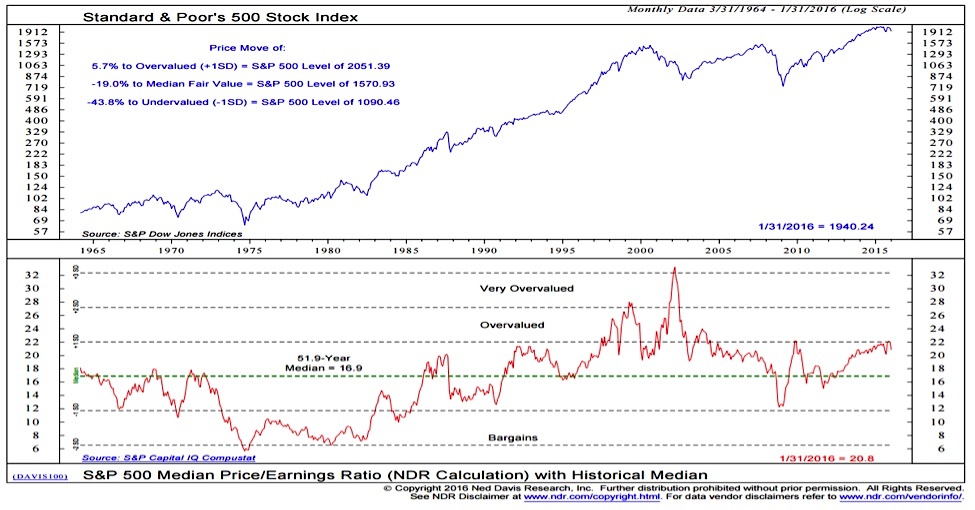

Addressing Specific Valuation Metrics

While high stock market valuations are undeniable, it's crucial to analyze specific valuation metrics within their proper context. Metrics like the Price-to-Earnings (P/E) ratio and the Shiller PE ratio (CAPE ratio) are often cited. [Insert Image Here: A chart comparing current P/E ratios to historical averages with alt text: "Historical comparison of S&P 500 P/E ratio"]. BofA likely argues that current metrics, while elevated compared to historical averages, are justifiable given the factors mentioned previously – strong earnings growth, low interest rates, and long-term growth prospects.

- Comparing current PE ratios to historical averages and explaining deviations: Contextualizing current valuations against historical trends helps determine whether they are truly excessive.

- Considering the impact of low interest rates on traditional valuation metrics: Low interest rates can artificially inflate valuation metrics, requiring adjustments in interpretation.

Diversification and Risk Management Strategies

Even with BofA's optimistic view, investors must acknowledge the risks associated with high valuations. A crucial strategy for mitigating these risks is portfolio diversification. By spreading investments across different asset classes (stocks, bonds, real estate, etc.), investors can reduce their overall portfolio risk.

- Investing across different asset classes to reduce overall portfolio risk: Diversification helps cushion against losses in any single asset class.

- Regular portfolio rebalancing to maintain desired asset allocation: Periodically adjusting the portfolio to maintain the target allocation ensures a balanced approach to risk management.

Navigating High Stock Market Valuations – A Balanced Approach

In summary, BofA's perspective on high stock market valuations emphasizes a balanced approach. While acknowledging the elevated levels, they highlight strong corporate earnings, the influence of low interest rates, and the promise of long-term growth as supporting factors. The key takeaway is the importance of long-term investing and a well-diversified portfolio. Informed decision-making, based on a thorough understanding of the market dynamics and individual risk tolerance, is paramount. Don't let concerns about high stock market valuations paralyze you. Develop a well-informed investment strategy with the help of a financial professional. Explore various high stock market valuation strategies to find the best approach for your unique circumstances.

Featured Posts

-

Joint Nordic Defense Swedens Tank Assets And Finlands Military Personnel

Apr 22, 2025

Joint Nordic Defense Swedens Tank Assets And Finlands Military Personnel

Apr 22, 2025 -

Kyivs Dilemma Weighing Trumps Plan To End The Ukraine War

Apr 22, 2025

Kyivs Dilemma Weighing Trumps Plan To End The Ukraine War

Apr 22, 2025 -

Strengthening Regional Security China Indonesia Security Dialogue

Apr 22, 2025

Strengthening Regional Security China Indonesia Security Dialogue

Apr 22, 2025 -

Investors Defy Market Trends A Risky Strategy

Apr 22, 2025

Investors Defy Market Trends A Risky Strategy

Apr 22, 2025 -

The Nationwide Anti Trump Movement Protester Perspectives

Apr 22, 2025

The Nationwide Anti Trump Movement Protester Perspectives

Apr 22, 2025