High-Yield Dividend Investing: Simplicity For Maximum Returns

Table of Contents

Understanding High-Yield Dividend Investing Basics

Defining High-Yield Dividends

What constitutes a "high-yield" dividend? It's not a fixed number; it's relative to the current market and the specific stock. A high dividend yield is generally considered to be significantly above the average yield for the market or a specific sector. However, a high dividend yield alone isn't enough; you need to consider the dividend yield percentage and factors influencing it.

- Dividend Yield Calculation: Dividend yield is calculated by dividing the annual dividend per share by the current market price per share. For example, if a stock pays a $2 annual dividend and trades at $40, the dividend yield is 5% ($2/$40 = 0.05).

- Payout Ratio Importance: The payout ratio, which is the percentage of earnings paid out as dividends, is crucial. A high payout ratio (e.g., above 80%) can be a red flag, indicating the company might struggle to maintain its dividend payments in the future. A sustainable payout ratio is key for long-term high-yield dividend investing.

- Dividend Yield vs. Dividend Growth: While a high dividend yield is attractive, consider dividend growth. Companies that consistently increase their dividend payments over time offer even greater returns in the long run. Look for companies with a history of both high yields and dividend growth.

Identifying Reliable High-Yield Dividend Stocks

Finding stable companies with a history of consistent dividend payments requires a strategic approach. Thorough research is essential before investing in any high-dividend stock.

- Fundamental Analysis: Use fundamental analysis to evaluate a company's financial health. Key metrics include the Price-to-Earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE). A lower P/E ratio can suggest the stock might be undervalued. A healthy debt-to-equity ratio shows financial stability. A strong ROE indicates efficient use of shareholder capital.

- Company Financial Health and Stability: Check the company's financial statements, including income statements, balance sheets, and cash flow statements. Look for consistent revenue growth, profitability, and strong cash flow. A company’s ability to consistently pay dividends depends heavily on its financial health.

- Online Stock Screeners: Utilize online stock screeners to filter stocks based on your criteria (dividend yield, payout ratio, market capitalization, etc.). Many brokerage platforms offer these tools, saving you considerable time and effort in your search for high dividend stocks. Remember that screeners are starting points; always conduct thorough individual research.

Managing Risk in High-Yield Dividend Investing

High-yield dividend stocks, while attractive, are not without risk. Understanding and managing these risks is paramount.

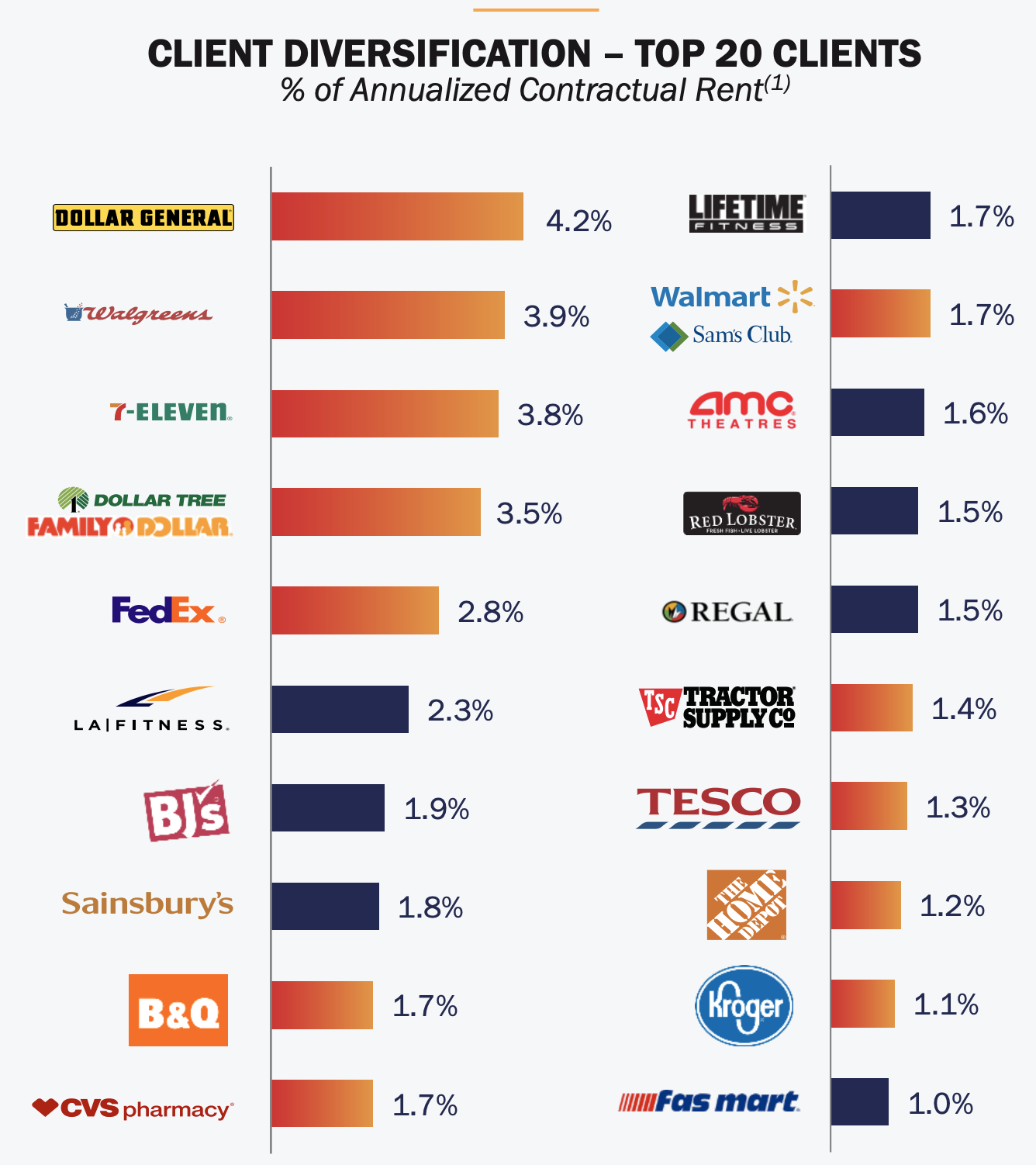

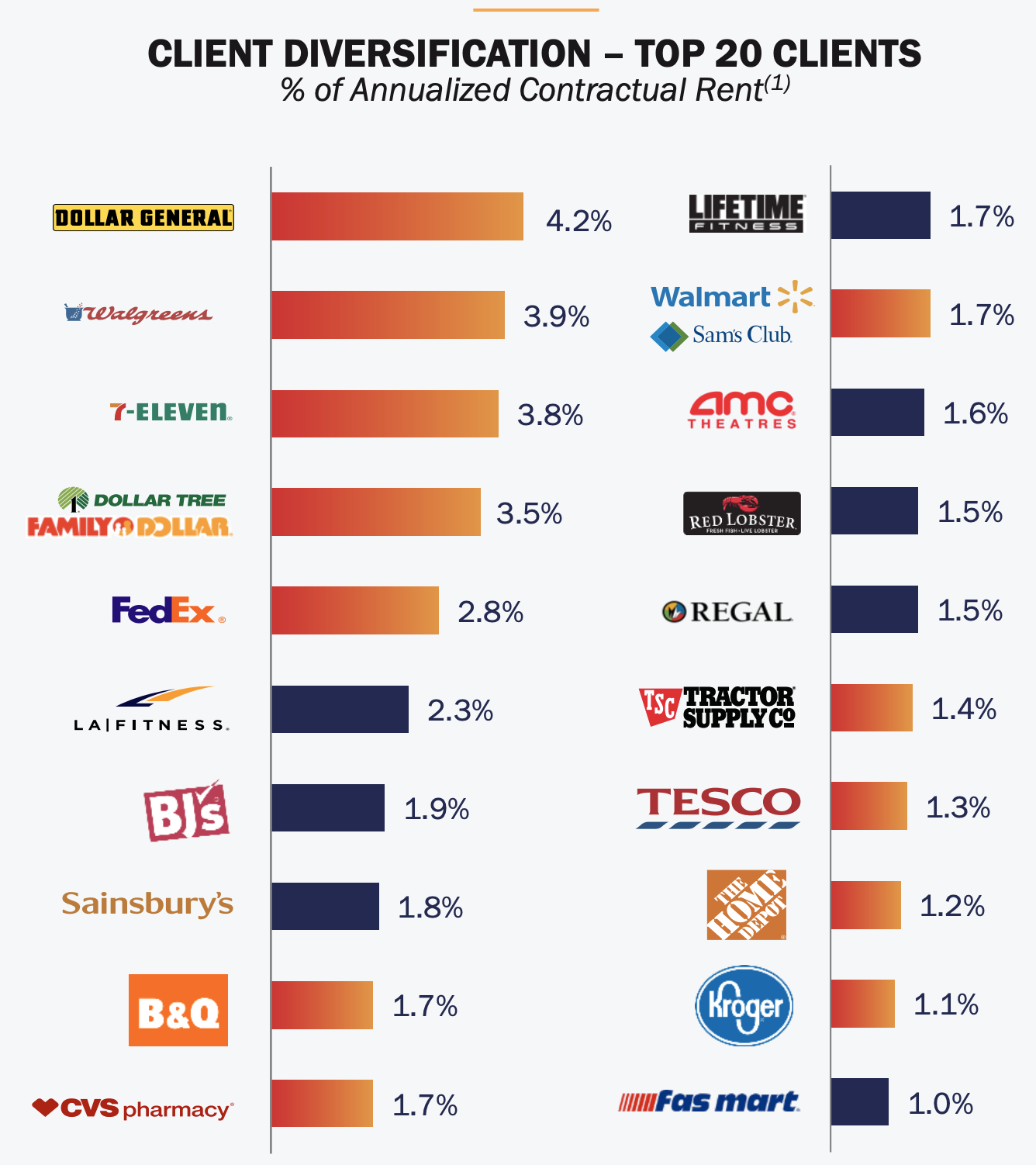

- Diversification: Diversify your portfolio across different sectors and companies to minimize risk. Don't put all your eggs in one basket. Spreading your investment across various sectors reduces the impact of any single company's underperformance.

- Due Diligence: Always conduct thorough due diligence before investing in any stock. Research the company's business model, competitive landscape, management team, and financial performance. Understanding the risks associated with a specific high dividend stock is crucial.

- Risks of Financially Struggling Companies: Be wary of companies with exceptionally high dividend yields, as this could signal financial distress. A company might be paying out a large percentage of its earnings just to attract investors, a sign of potential problems.

- Stop-Loss Orders: Consider using stop-loss orders to limit potential losses. A stop-loss order automatically sells your shares if the stock price falls below a predetermined level.

Strategies for Maximizing Returns from High-Yield Dividend Investing

Dividend Reinvestment Plans (DRIPs)

Dividend reinvestment plans (DRIPs) are powerful tools for accelerating wealth creation.

- How DRIPs Work: DRIPs allow you to automatically reinvest your dividend payments to buy more shares of the same company. This process compounds your returns over time, leading to significant growth.

- Tax Implications of DRIPs: Be aware of the tax implications of DRIPs. Dividends are generally taxed as ordinary income. However, some DRIPs may offer tax advantages depending on your specific circumstances.

- Benefits of Automatic Reinvestment: Automatic reinvestment is a key advantage of DRIPs. It eliminates the need to manually reinvest dividends, ensuring consistent growth.

Portfolio Diversification

Diversification is vital for mitigating risk in high-yield dividend investing.

- Benefits of Diversification: Spreading your investments across multiple companies and sectors reduces your exposure to any single stock's poor performance. This helps protect your portfolio from significant losses.

- Different Sectors for Diversification: Consider diversifying across various sectors, such as healthcare, technology, consumer staples, and utilities. Each sector has unique characteristics and market sensitivities.

- Importance of Asset Allocation: Asset allocation, which refers to the distribution of your investments among different asset classes (stocks, bonds, etc.), is crucial for managing risk and achieving your investment goals.

Long-Term Investment Approach

A long-term investment horizon is crucial for success in high-yield dividend investing.

- Importance of Patience: High-yield dividend investing is a long-term strategy. Market fluctuations are inevitable, but a long-term perspective allows you to weather short-term downturns and benefit from long-term growth.

- Benefits of Long-Term Investing: Over the long term, the power of compounding returns significantly enhances your investment growth. Patience and discipline are key components of successful long-term investing.

- Impact of Compounding Over Time: The longer you reinvest your dividends, the more significant the impact of compounding becomes. This effect can drastically increase your returns over decades.

Simple Steps to Get Started with High-Yield Dividend Investing

Setting Your Investment Goals

Before you begin, define your investment objectives and risk tolerance.

- Importance of Defining Goals: Clear investment goals help you make informed decisions and stay focused on your financial targets.

- Understanding Risk Tolerance: Assess your risk tolerance. Are you comfortable with potential losses in exchange for higher potential returns? Understanding your risk profile will guide your investment choices.

Choosing the Right Brokerage Account

Select a reputable online brokerage account.

- Reputable Online Brokerages: Research and compare different online brokerages to find one that suits your needs and budget. Consider factors like fees, trading platforms, research tools, and customer service. Popular options include Fidelity, Schwab, and Vanguard.

- Comparing Fees and Features: Compare fees for trading, account maintenance, and research tools before making a decision. Different brokerages offer different features; choose one that aligns with your investment strategy.

Starting Small and Gradually Building Your Portfolio

Begin with a small investment and gradually build your portfolio.

- Starting with a Small Investment Amount: You don't need a large sum to start investing. Start with an amount you're comfortable with and gradually increase your investment over time.

- Regular Contributions: Regular contributions, even small ones, contribute significantly to long-term growth. Consistent investing, regardless of market conditions, is crucial.

Conclusion

High-yield dividend investing provides a relatively simple yet powerful path to generating significant passive income and long-term wealth. By carefully selecting high-quality companies with a proven track record of consistent dividend payments and employing smart strategies like diversification and dividend reinvestment, you can significantly increase your chances of success. Remember, thorough research and understanding the inherent risks are crucial for maximizing your returns.

Call to Action: Start your journey towards financial freedom today with high-yield dividend investing! Begin researching high-dividend stocks and build your portfolio steadily for long-term success. Don't delay – begin your high-yield dividend investing strategy now!

Featured Posts

-

Converse Signs Boston Celtics Guard Payton Pritchard

May 11, 2025

Converse Signs Boston Celtics Guard Payton Pritchard

May 11, 2025 -

Understanding Jessica Simpsons Comments On Snake Sperm Consumption

May 11, 2025

Understanding Jessica Simpsons Comments On Snake Sperm Consumption

May 11, 2025 -

Division Title Secured Celtics Dominate Opponent

May 11, 2025

Division Title Secured Celtics Dominate Opponent

May 11, 2025 -

Boris Johnson Ataque De Avestruz En Texas Durante Dia Familiar

May 11, 2025

Boris Johnson Ataque De Avestruz En Texas Durante Dia Familiar

May 11, 2025 -

Can Ipswich Town Women Maintain Top Spot Against Gwalia

May 11, 2025

Can Ipswich Town Women Maintain Top Spot Against Gwalia

May 11, 2025