Higher Stock Prices, Higher Risks: What Investors Need To Know

Table of Contents

Understanding the Correlation Between Stock Prices and Risk

The fundamental principle of investing is the inverse relationship between risk and return: higher potential returns usually come with higher risks. Understanding this correlation is critical when navigating periods of high stock prices. Several factors can drive stock prices upwards, but these same factors can also create unsustainable growth, leading to potential market corrections or crashes.

-

Factors Driving Stock Prices Up: Positive economic news, robust corporate earnings, and optimistic investor sentiment all contribute to rising stock prices. Increased demand for specific stocks, driven by factors like technological advancements or positive industry trends, also pushes prices higher.

-

The Bubble Effect: When stock prices rise rapidly, driven primarily by speculation rather than fundamental value, a bubble can form. This unsustainable growth often leads to a sharp correction once the market realizes the overvaluation. Think of the dot-com bubble of the late 1990s or the housing market crash of 2008 as prime examples of this phenomenon.

-

Market Valuation Metrics: Metrics like the Price-to-Earnings ratio (P/E ratio) help assess whether a stock or the overall market is overvalued. A high P/E ratio generally suggests higher risk, indicating that investors are paying a premium for future earnings. Other valuation metrics, such as the Price-to-Sales ratio and Price-to-Book ratio, should also be considered for a comprehensive analysis.

Identifying Potential Red Flags in a Bull Market

While a bull market offers opportunities for growth, it's crucial to identify potential red flags indicating an overvalued market and increased risk. These warning signs can help investors make informed decisions and avoid significant losses.

-

Speculative Investment Frenzy: The emergence of "meme stocks," driven by social media hype rather than fundamental analysis, is a classic sign of speculative excess. Such frenzies often lead to unsustainable price increases followed by sharp declines.

-

Excessive Corporate Debt: High levels of corporate debt can be a significant risk factor. Companies burdened with substantial debt are more vulnerable to economic downturns, potentially impacting their ability to service their obligations and even leading to bankruptcy.

-

Overly Optimistic Sentiment: When investor sentiment becomes excessively optimistic, with little critical analysis of underlying risks, it's a clear indication of potential overvaluation. A lack of skepticism in the market can fuel unsustainable price increases.

-

Geopolitical Instability: Global events, such as geopolitical tensions or unforeseen crises, can significantly impact market sentiment and lead to sharp price corrections. Staying informed about geopolitical risks is essential.

-

Rising Interest Rates: Increases in interest rates often lead to decreased investment in stocks as bonds become more attractive. Higher rates also increase borrowing costs for companies, potentially impacting their profitability and stock valuations.

Diversification and Risk Management Strategies

Diversification is a cornerstone of effective risk management. Spreading investments across various asset classes, sectors, and geographies reduces the impact of losses in any single area.

-

Asset Class Diversification: Investing in a mix of stocks, bonds, real estate, and other asset classes helps balance risk and return. Bonds, for example, generally offer lower returns but provide a degree of stability during market downturns.

-

Sector Diversification: Concentrating investments in a single sector exposes your portfolio to significant risk if that sector experiences a downturn. Diversifying across different industry sectors mitigates this risk.

-

Geographic Diversification: Investing in international markets reduces reliance on a single economy. This strategy helps to mitigate risks associated with regional economic downturns or political instability.

-

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This approach mitigates the risk of investing a large sum at a market peak.

-

Stop-Loss Orders: Stop-loss orders automatically sell a security when it reaches a predetermined price, limiting potential losses. This risk management tool can protect your portfolio during market corrections.

The Importance of Due Diligence and Fundamental Analysis

Thorough research is crucial before making any investment decisions. Fundamental analysis involves evaluating a company's financial health and future prospects to determine its intrinsic value.

-

Analyzing Company Financials: Examine key financial statements like the income statement, balance sheet, and cash flow statement to assess a company's profitability, liquidity, and solvency.

-

Understanding the Business Model: Analyze the company's business model, competitive landscape, and growth strategies to evaluate its long-term sustainability and potential.

-

Considering Industry Trends: Research industry trends and future growth potential to assess the long-term outlook for the company and its sector.

-

Evaluating Management Quality: Assess the quality of the company's management team and its corporate governance structure, as these factors significantly impact a company's performance.

-

Staying Informed: Keep abreast of relevant financial news and market trends to make informed investment decisions.

Conclusion

Higher stock prices don't always equate to higher returns; understanding and managing risk is crucial for successful investing. The correlation between higher stock prices and higher risks is undeniable. Diversification, due diligence, and employing effective risk management strategies, such as dollar-cost averaging and stop-loss orders, are vital tools for navigating markets characterized by high valuations. Don't let the allure of higher stock prices blind you to the inherent risks. Take control of your investments by conducting thorough due diligence and implementing effective risk management strategies. Learn more about protecting your portfolio from the challenges of higher stock prices by consulting a financial advisor today.

Featured Posts

-

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 22, 2025

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 22, 2025 -

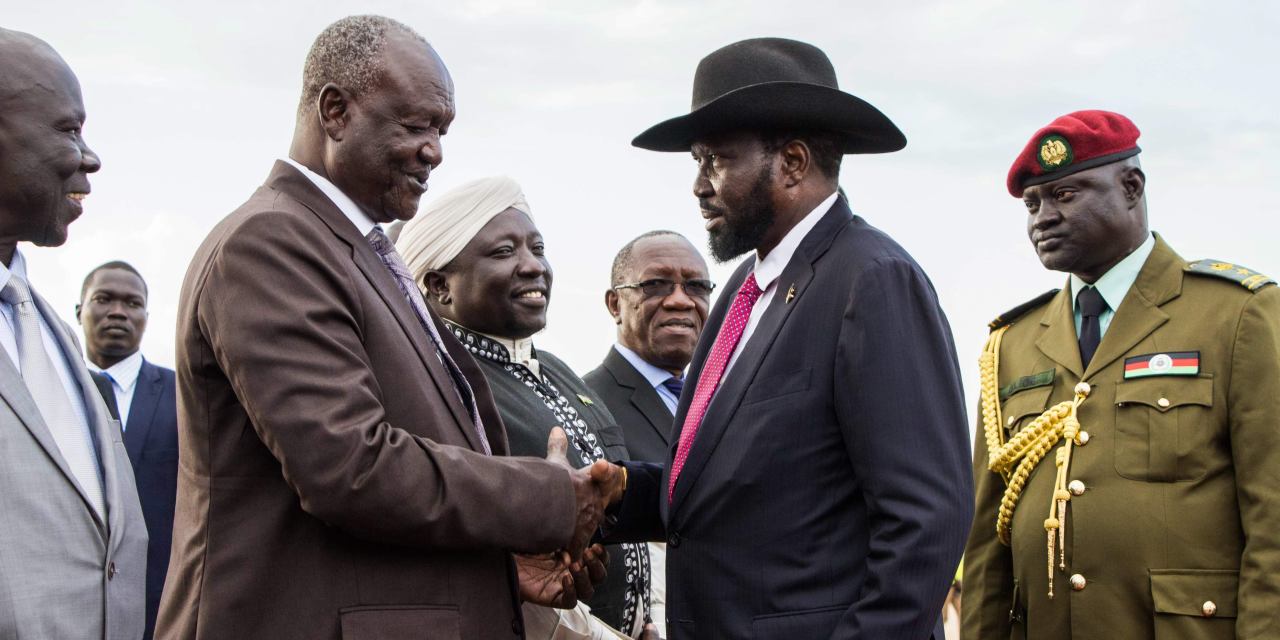

South Sudan Us Agreement On The Return Of Deportees

Apr 22, 2025

South Sudan Us Agreement On The Return Of Deportees

Apr 22, 2025 -

How Trumps Trade Actions Jeopardized Americas Financial Hegemony

Apr 22, 2025

How Trumps Trade Actions Jeopardized Americas Financial Hegemony

Apr 22, 2025 -

Evaluating The Damage Trumps Trade Policies And The Future Of Us Finance

Apr 22, 2025

Evaluating The Damage Trumps Trade Policies And The Future Of Us Finance

Apr 22, 2025 -

Is The Razer Blade 16 2025 Worth It A Detailed Review Of Ultra Performance And Cost

Apr 22, 2025

Is The Razer Blade 16 2025 Worth It A Detailed Review Of Ultra Performance And Cost

Apr 22, 2025