Historical Universal Credit Refunds: Find Out If You're Entitled

Table of Contents

Understanding Universal Credit Overpayments and Underpayments

Universal Credit (UC) is a complex benefit system, and errors can occur leading to both overpayments and underpayments. Understanding these errors is the first step in claiming a historical Universal Credit refund.

Overpayments happen when you receive more Universal Credit than you're entitled to. This often occurs due to:

- Incorrect income declaration: Failing to accurately report changes in your income, such as a new job or a pay rise.

- Changes in circumstances not reported: Significant life events like marriage, separation, or a change in living arrangements should be reported promptly to the Department for Work and Pensions (DWP). Failure to do so can result in an overpayment.

- Administrative errors by the DWP: While rare, mistakes can happen in the processing of your claim.

Underpayments, conversely, mean you received less Universal Credit than you were entitled to. Reasons for this include:

- Errors in application processing: Mistakes during the initial application can lead to ongoing underpayments.

- Delays in payments: Delays can occur, resulting in a shortfall in your benefit payments.

- Incorrect assessment of childcare costs: The calculation of childcare costs can be complex, and inaccuracies can lead to underpayment.

- Failure to account for disability benefits: If you receive other benefits alongside Universal Credit, these may not be correctly factored into your UC calculation.

Bullet points summarizing common reasons for UC discrepancies:

- Changes in income not properly reported.

- Incorrect assessment of childcare costs.

- Administrative errors by the DWP.

- Failure to account for disability benefits.

- Changes in household composition not reported.

Who is Eligible for Historical Universal Credit Refunds?

Eligibility for historical Universal Credit refunds depends on several factors, primarily the timeframe and specific circumstances of your claim. There's no single cut-off date, so checking your history is crucial.

Specific groups that may be more likely to qualify for a refund include:

- Those with fluctuating incomes: Inconsistent income can lead to miscalculations.

- Those who experienced delays in processing: Delays in your initial application or subsequent changes to your claim could mean you missed out on payments.

- Those who have experienced a significant life event impacting your entitlement but failed to report it, causing an underpayment.

Bullet points outlining key eligibility factors:

- Claimants who received Universal Credit before a specific date (check your records to determine if you are within the applicable timeframe).

- Individuals who experienced a change in circumstances affecting their entitlement (e.g., job loss, illness).

- People with specific disabilities or health conditions that may affect their entitlement to UC.

- Those who had previously appealed a decision and were successful after some time.

How to Check if You're Entitled to a Refund

Checking for potential historical Universal Credit refunds involves reviewing your past payment statements meticulously.

Step-by-step guide:

- Access your online Universal Credit account: Log in using your Government Gateway credentials.

- Review payment history for discrepancies: Carefully examine each payment, noting any inconsistencies or unusually low amounts. Compare this with your income and expenditure at the time.

- Gather relevant documentation: Collect payslips, bank statements, and any other documents that might support your claim.

- Contact the DWP: If you identify discrepancies, contact the DWP via phone or by writing a formal letter. Keep records of all communication.

- Seek professional assistance: If you're struggling to understand your statements or navigate the process, seek help from Citizens Advice or a similar organization.

Bullet points summarizing the key steps:

- Accessing your online Universal Credit account.

- Reviewing payment history for discrepancies.

- Gathering relevant documentation (payslips, bank statements).

- Contacting the DWP via phone or writing a formal letter.

- Seeking advice from a benefits advisor.

The Process of Claiming a Historical Universal Credit Refund

The process for claiming a historical Universal Credit refund can vary depending on the nature of the error. It may involve submitting a formal request for correction or filing an appeal.

Key aspects of the claims process:

- Accurate completion of forms: Ensure all forms are completed accurately and completely. Inaccurate information could delay or hinder your claim.

- Providing supporting evidence: Include all relevant documentation to support your claim.

- Following up on your application: Regularly check the status of your application.

- Understanding appeal rights: If your claim is rejected, understand your rights to appeal the decision.

Bullet points summarizing the claims process:

- Filling out the necessary forms accurately.

- Providing supporting evidence.

- Following up on your application.

- Understanding appeal rights.

Potential Delays and Obstacles

Claiming a historical Universal Credit refund can be time-consuming. Be prepared for potential delays and obstacles.

- Long processing times: The DWP may take several weeks or even months to process your claim.

- Requesting additional information: They may request further information, potentially delaying the process further.

- Dealing with rejections: If your claim is rejected, you'll need to understand the grounds for rejection and consider appealing.

Be patient and persistent, and keep meticulous records of all communication.

Conclusion

Many people are entitled to historical Universal Credit refunds due to overpayments or underpayments. By carefully reviewing your payment history, gathering relevant documentation, and understanding the claims process, you can determine if you're owed money. Remember to seek professional assistance if needed. Don't miss out on potential money owed to you! Check your eligibility for historical Universal Credit refunds today. Start reviewing your payment history and contact the DWP if you believe you are owed a refund. Consider seeking help from a benefits advisor if you need assistance.

Featured Posts

-

Pierce County Homes Transformation From Historic House To Public Park

May 08, 2025

Pierce County Homes Transformation From Historic House To Public Park

May 08, 2025 -

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 08, 2025

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 08, 2025 -

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 08, 2025

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 08, 2025 -

Psl Matches Revised School Schedules In Lahore

May 08, 2025

Psl Matches Revised School Schedules In Lahore

May 08, 2025 -

Lotto Plus Results Saturday April 12 2025 Check Winning Numbers

May 08, 2025

Lotto Plus Results Saturday April 12 2025 Check Winning Numbers

May 08, 2025

Latest Posts

-

Voter Fraud Case Whittier Residents Rally Behind American Samoan Family

May 09, 2025

Voter Fraud Case Whittier Residents Rally Behind American Samoan Family

May 09, 2025 -

Opinion Celebrating Anchorages Arts And Local Medias Role

May 09, 2025

Opinion Celebrating Anchorages Arts And Local Medias Role

May 09, 2025 -

Anchorage Arts Scene Strong Local Coverage Deserves Recognition

May 09, 2025

Anchorage Arts Scene Strong Local Coverage Deserves Recognition

May 09, 2025 -

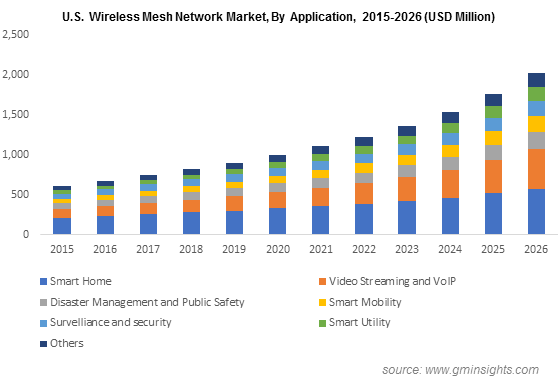

Wireless Mesh Networks Market Growth Drivers And 9 8 Cagr Prediction

May 09, 2025

Wireless Mesh Networks Market Growth Drivers And 9 8 Cagr Prediction

May 09, 2025 -

Rising Temperatures And Soft Mud Challenges In Recovering Anchorage Fin Whale Remains

May 09, 2025

Rising Temperatures And Soft Mud Challenges In Recovering Anchorage Fin Whale Remains

May 09, 2025