HMRC Child Benefit: Important Notices You Need To See

Table of Contents

Understanding Your Child Benefit Entitlement Letter

The initial HMRC Child Benefit entitlement letter is your confirmation of eligibility. This important document outlines your payment details and serves as your official record of your entitlement. It's vital to check this letter carefully for accuracy.

Key information included in your entitlement letter includes:

- Your child's name and date of birth.

- Your National Insurance number.

- The amount of Child Benefit you will receive.

- The payment dates.

- The payment method (e.g., direct debit, bank transfer).

Verification Steps:

- Check child's details: Ensure the child's name and date of birth are correct.

- Verify the payment amount: Confirm the amount matches your understanding of your entitlement.

- Note the payment method and frequency: Understand how and when you'll receive your payments.

- Keep the letter safe: Store the letter securely for your records. This will be invaluable if you need to refer to it later.

Dealing with HMRC Child Benefit Changes of Circumstances Notices

Your circumstances can change, impacting your HMRC Child Benefit entitlement. It's vital to notify HMRC immediately of any changes that could affect your payments. Failing to do so could result in overpayments, penalties, or even cessation of your benefits.

Changes requiring notification include:

- Income changes: Changes to your or your partner's income could affect your eligibility.

- Family circumstances: Marriage, separation, or the birth of another child will necessitate an update.

- Child's status: Your child turning 16, leaving full-time education, or changes to their living arrangements all need reporting.

- Address changes: Ensure HMRC has your current contact details to avoid missed communications.

Actions to take:

- Notify HMRC promptly: Report changes as soon as they occur.

- Provide supporting documentation: Be prepared to provide evidence to support your claim (e.g., payslips, marriage certificate).

- Understand the impact: Be aware that changes might affect the amount of Child Benefit you receive. HMRC will inform you of any adjustments.

Interpreting HMRC Child Benefit Overpayment Notices

An overpayment notice from HMRC means you've received more Child Benefit than you were entitled to. This can happen due to several reasons:

- Incorrect information: Providing inaccurate information on your application.

- Unreported changes: Failing to notify HMRC of changes in your circumstances.

- Administrative errors: Occasionally, HMRC may make a mistake in their calculations.

Dealing with an overpayment:

- Review the calculation carefully: Check all the details to understand how the overpayment was calculated.

- Request a review: If you disagree with the calculation, contact HMRC to request a review of your case.

- Arrange a repayment plan: If the overpayment is confirmed, work with HMRC to establish a manageable repayment plan.

- Understand the penalties: Failing to repay an overpayment can lead to significant penalties and interest charges.

Recognizing and Avoiding HMRC Child Benefit Scam Notices

Scammers often target individuals receiving government benefits. Be vigilant and protect yourself from phishing scams related to your HMRC Child Benefit.

Identifying fraudulent communications:

- Suspicious email addresses: Legitimate HMRC emails will use a gov.uk address.

- Incorrect HMRC branding: Fraudulent emails often have poor quality logos or branding.

- Urgent requests for personal information: HMRC will never request sensitive information via email or phone unless you initiated the contact.

Steps to take if you suspect a scam:

- Never click on links from unknown senders.

- Never share personal information unsolicited.

- Report suspicious emails or calls to HMRC and Action Fraud.

- Verify any communication through official HMRC channels.

Conclusion: Taking Action on Your HMRC Child Benefit Notices

Understanding your HMRC Child Benefit notices is essential for avoiding potential problems. Prompt action is key to ensuring the accuracy of your payments and avoiding penalties. Carefully review all communications, verify information, and don't hesitate to contact HMRC if you have any questions or concerns about your Child Benefit payments from HMRC or your HMRC Child Benefit entitlement. Regularly check your online account to stay informed about your payments and report any changes to your circumstances without delay. Visit the official HMRC website for further information and resources.

Featured Posts

-

Wayne Gretzkys Daughter Paulina In A Mini Dress For A Playdate

May 20, 2025

Wayne Gretzkys Daughter Paulina In A Mini Dress For A Playdate

May 20, 2025 -

The Future Of Factory Jobs In America Addressing Trumps Promises

May 20, 2025

The Future Of Factory Jobs In America Addressing Trumps Promises

May 20, 2025 -

Gaite Lyrique Evacuation Des Salaries Et Demande D Intervention De La Mairie De Paris

May 20, 2025

Gaite Lyrique Evacuation Des Salaries Et Demande D Intervention De La Mairie De Paris

May 20, 2025 -

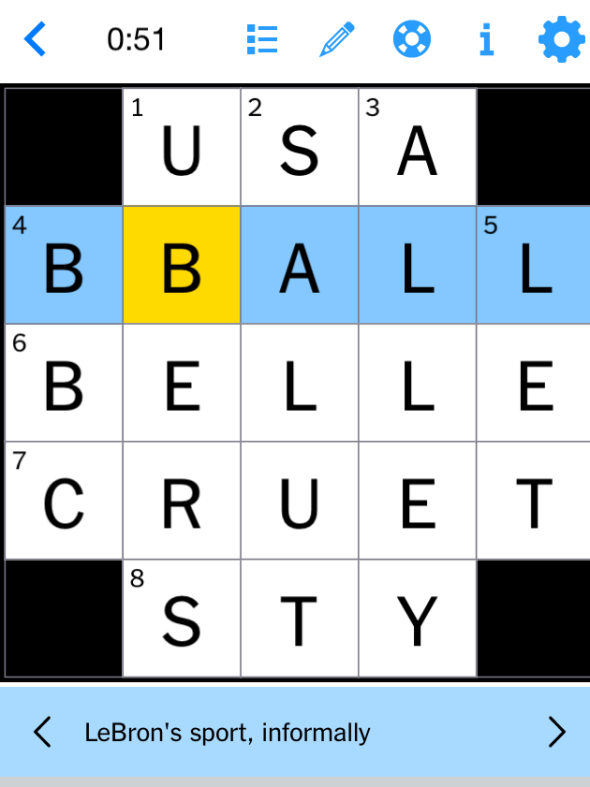

Find The Answers Nyt Mini Crossword March 18 Solutions

May 20, 2025

Find The Answers Nyt Mini Crossword March 18 Solutions

May 20, 2025 -

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025