HMRC Letter Received? Don't Ignore This Important Update For UK Households

Table of Contents

Types of HMRC Letters & What They Mean

HMRC sends various letters for different reasons. Understanding the type of letter you've received is the first step in responding appropriately. Common types include tax assessments, payment reminders, enquiries, and penalty notices. Each requires a different response.

Here are some examples of phrases you might find in your HMRC correspondence:

- "Tax Assessment"

- "Payment Due"

- "Outstanding Tax Liability"

- "Notice of Penalty"

- "Further Information Required"

Let's break down each type:

- Tax Assessment: This letter explains the tax you owe, based on your income and allowances. It specifies the amount due, the payment deadline, and available payment methods.

- Key details included: Total tax due, payment deadline, payment methods (online, bank transfer, cheque), details of your tax code.

- Payment Reminder: You'll receive this if a tax payment is overdue. It highlights the outstanding amount and any penalties that may apply.

- Key details included: Outstanding amount, penalty charges, remaining payment deadline.

- Enquiry: HMRC needs more information from you. The letter will outline what information is needed and how to provide it.

- Key details included: Specific information required, deadline for response, contact details for further assistance.

- Penalty Notice: This letter confirms a penalty for late payment or non-compliance. It details the penalty amount and how to pay it.

- Key details included: Amount of penalty, reason for penalty, options for payment, potential appeal process.

Understanding Your Tax Code and Tax Liability

Your tax code is crucial for determining how much income tax is deducted from your salary or wages. Understanding your tax code helps you avoid unexpected tax bills or refunds. You can easily check your tax code online through your HMRC online account.

How to check your tax code online:

- Visit the GOV.UK website.

- Sign in to your HMRC online account.

- Navigate to your personal tax information.

Your tax liability is the total amount of tax you owe to HMRC. It's calculated based on your income, allowances, and deductions.

Common reasons for tax code changes:

- Change in employment status

- Change in income

- Pension contributions

- Marriage or civil partnership

- Tax relief claims

Resources for calculating tax liability:

- HMRC website's tax calculators

- Professional tax advisors

How to appeal a tax assessment: If you believe your tax assessment is incorrect, you can appeal through the HMRC online portal or by contacting them directly.

How to Respond to an HMRC Letter

Responding promptly and correctly is essential. Always respond within the timeframe specified in the letter. Several methods exist for responding to HMRC correspondence:

- Online: Use your online HMRC account. This is often the quickest and easiest method.

- Post: Send your response by recorded or special delivery post, keeping proof of postage.

- Phone: Contact HMRC directly if you need clarification or assistance.

Steps to take:

- Gather necessary documents: This includes payslips, P60s, self-assessment tax returns, etc.

- Access your online tax account: This provides a secure and convenient way to manage your tax affairs.

- Contact HMRC directly: If you need clarification or assistance, contact them through their helpline or online chat.

- Keep records: Maintain records of all correspondence and any actions taken.

Avoiding HMRC Penalties and Disputes

HMRC penalties can be substantial. Common reasons include late payment of tax, inaccurate information provided, and failure to file returns on time.

Steps to avoid penalties:

- Pay on time: Ensure all tax payments are made by the due date.

- Provide accurate information: Double-check all information submitted to HMRC for accuracy.

- File returns on time: Submit your self-assessment tax return before the deadline.

Understanding penalty rates: Penalty rates vary depending on the severity of the infringement.

Methods for payment: Online banking, bank transfer, cheque.

How to initiate a formal dispute resolution: If you believe a penalty is unjustified, you can follow HMRC's dispute resolution process.

Seeking professional tax advice: If you are struggling to understand your HMRC correspondence or need help navigating a dispute, consult a qualified tax advisor.

Conclusion: Taking Action on Your HMRC Letter

Receiving an HMRC letter requires prompt action. Understanding the type of letter, your tax obligations, and how to respond effectively is crucial to avoid penalties and disputes. Ignoring correspondence can lead to significant financial consequences. Don't delay; address your HMRC letter today. Act on your HMRC letter now to avoid penalties. If you’ve received an HMRC letter, understand your options and take appropriate steps. For further assistance, consult the resources available on the official GOV.UK website. [Link to HMRC website]

Featured Posts

-

Mass Abidjan Un Marche Dedie Aux Technologies Spatiales Africaines

May 20, 2025

Mass Abidjan Un Marche Dedie Aux Technologies Spatiales Africaines

May 20, 2025 -

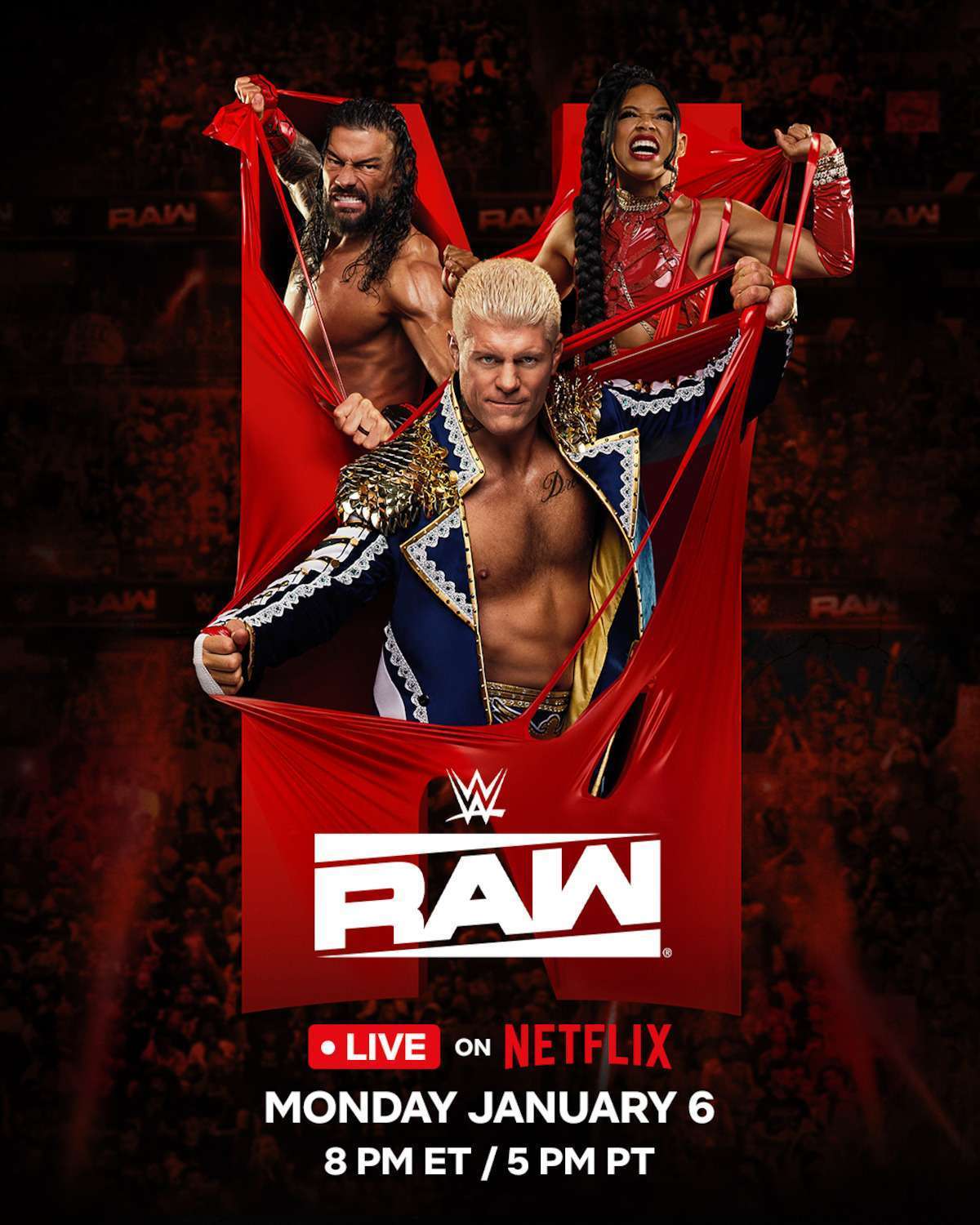

Wwe Monday Night Raw 5 19 2025 Positive And Negative Highlights

May 20, 2025

Wwe Monday Night Raw 5 19 2025 Positive And Negative Highlights

May 20, 2025 -

Comprendre Le Systeme De Numerotation Des Batiments Dans Le District D Abidjan

May 20, 2025

Comprendre Le Systeme De Numerotation Des Batiments Dans Le District D Abidjan

May 20, 2025 -

Richard Mille Rm 72 01 Charles Leclercs New Racing Chronograph

May 20, 2025

Richard Mille Rm 72 01 Charles Leclercs New Racing Chronograph

May 20, 2025 -

How To Dress For Breezy And Mild Conditions

May 20, 2025

How To Dress For Breezy And Mild Conditions

May 20, 2025