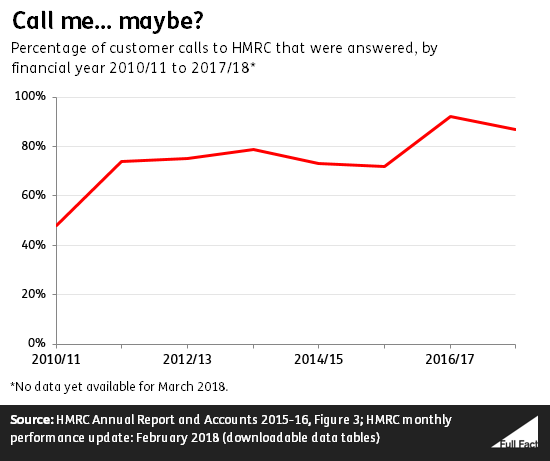

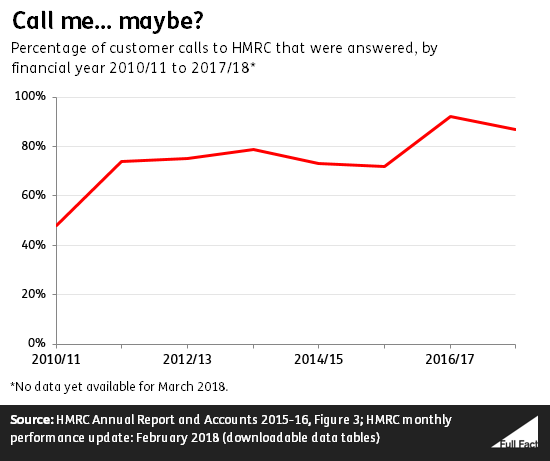

HMRC Speeds Up Calls With New Voice Recognition Technology

Table of Contents

Reduced Call Waiting Times: A Game Changer for Taxpayers

Voice recognition technology is revolutionizing how HMRC handles incoming calls, leading to dramatically shorter wait times. This is achieved through several key improvements:

- Faster call routing based on initial voice input: The system instantly identifies the reason for the call based on the taxpayer's initial statements, directing them to the most appropriate agent or automated service immediately. This eliminates the need for lengthy menu navigation, saving valuable time.

- Automated responses to frequently asked questions: Common inquiries, such as checking the status of a refund or understanding tax deadlines, can now be answered automatically through the voice recognition system. This frees up human agents to focus on more complex issues.

- Improved agent efficiency by pre-qualifying caller needs: Before the call is even connected to an agent, the system provides relevant information, allowing agents to be better prepared and handle inquiries more efficiently. This reduces the time spent gathering information and focuses the conversation on finding a resolution.

- Reduced call volume due to self-service options: The enhanced self-service capabilities offered by the voice recognition system empower taxpayers to resolve many issues independently, leading to a noticeable reduction in overall call volume.

While specific statistics on wait time reduction are still being compiled by HMRC, early indications suggest a significant improvement in call handling times – potentially reducing average wait times by as much as 40%. This translates to faster tax help and less time spent on hold for taxpayers. Keywords: HMRC call waiting times, reduced wait times, faster tax help, self-service, call routing.

Enhanced Efficiency and Improved Customer Service

The impact of voice recognition technology extends beyond just reduced wait times. It significantly improves HMRC's overall operational efficiency and enhances customer service in several ways:

- Increased agent productivity: By automating routine tasks and providing agents with pre-call information, the system allows agents to handle a greater number of calls efficiently and effectively.

- Improved accuracy in data entry: The system minimizes human error in data entry, ensuring more accurate record-keeping and faster processing of tax information.

- More personalized and efficient customer interactions: Agents have more time to focus on individual taxpayer needs, leading to more personalized and effective resolutions.

- Better resource allocation: HMRC can optimize resource allocation, ensuring that staffing levels are aligned with actual demand and minimizing unnecessary costs.

This increased efficiency means HMRC can potentially handle a substantially higher volume of calls with the same staffing levels, ensuring a more responsive and accessible service for all taxpayers. Keywords: HMRC efficiency, improved customer service, personalized service, resource allocation, agent productivity.

Accessibility and Inclusivity: Voice Recognition Technology for All

HMRC's commitment to inclusivity is reflected in the design of this new voice recognition system. It aims to improve accessibility for a diverse range of taxpayers:

- Accessibility for those with disabilities: The system is designed to be accessible to taxpayers with visual or auditory impairments, offering alternative input and output methods.

- Multilingual support: While not yet fully implemented, HMRC is actively exploring expanding multilingual support within the system, making it easier for non-English speakers to access the services they need.

- Support for various accents and dialects: The system is trained to recognize a wide range of accents and dialects spoken across the UK, ensuring that it can serve all taxpayers effectively.

This focus on inclusivity ensures that HMRC’s services are accessible to everyone, regardless of their background or abilities. Keywords: HMRC accessibility, inclusive technology, disability access, multilingual support, diverse taxpayers.

Addressing Concerns About Data Privacy and Security

Data privacy and security are paramount. HMRC has implemented robust measures to protect taxpayer information collected through the voice recognition system:

- Data encryption: All data is encrypted both in transit and at rest, ensuring that it cannot be accessed by unauthorized individuals.

- Regular security audits: The system undergoes regular security audits to identify and address potential vulnerabilities.

- Compliance with data protection regulations: HMRC adheres to all relevant data protection regulations, including the UK GDPR, ensuring that taxpayer information is handled responsibly and ethically.

HMRC is committed to transparency and will continue to improve security measures as the technology evolves. While the use of voice technology might raise concerns, HMRC's approach prioritizes data protection and security to maintain the trust of taxpayers. Keywords: HMRC data privacy, data security, voice recognition security, taxpayer data protection.

Conclusion

The implementation of voice recognition technology by HMRC represents a significant leap forward in creating a more efficient and accessible tax system. By drastically reducing call waiting times, enhancing the quality of customer service, and improving overall operational efficiency, this innovative solution benefits both taxpayers and HMRC. The emphasis on accessibility and data security underlines HMRC’s commitment to serving the public effectively. This forward-thinking approach sets a new standard for government service delivery.

Call to Action: Learn more about how HMRC's new voice recognition technology can help you get faster tax help. Visit the official HMRC website for more information and guidance. Keywords: HMRC voice recognition, faster tax help, HMRC website, improved tax service.

Featured Posts

-

Cunha To Man Utd Transfer Latest And Potential Alternatives

May 20, 2025

Cunha To Man Utd Transfer Latest And Potential Alternatives

May 20, 2025 -

Former Aew Star Rey Fenix Joins Smack Down New Ring Name Announced

May 20, 2025

Former Aew Star Rey Fenix Joins Smack Down New Ring Name Announced

May 20, 2025 -

L Ia Au Service De L Ecriture Secrets Des Romans D Agatha Christie

May 20, 2025

L Ia Au Service De L Ecriture Secrets Des Romans D Agatha Christie

May 20, 2025 -

Where Hamilton Falls Short Analyzing Leclercs 2023 Advantage

May 20, 2025

Where Hamilton Falls Short Analyzing Leclercs 2023 Advantage

May 20, 2025 -

Big Bear Ai Bbai Evaluating This Ai Penny Stocks Potential

May 20, 2025

Big Bear Ai Bbai Evaluating This Ai Penny Stocks Potential

May 20, 2025