HMRC's New Nudge Letters Target Online Sellers On EBay, Vinted, And Depop

Table of Contents

What are HMRC's Nudge Letters?

HMRC nudge letters are essentially proactive communications aimed at online sellers who may be under-reporting their income or failing to comply fully with tax regulations. They aren't necessarily accusations of wrongdoing, but rather gentle prompts encouraging sellers to review their tax affairs. The purpose is to improve tax collection and address the "shadow economy" – untaxed income generated through online marketplaces. These letters are part of HMRC's increasingly sophisticated data-matching and analysis capabilities, allowing them to identify potential discrepancies between declared income and the volume of sales activity on platforms like eBay, Vinted, and Depop.

- Purpose: To encourage voluntary tax compliance and prevent more serious investigations.

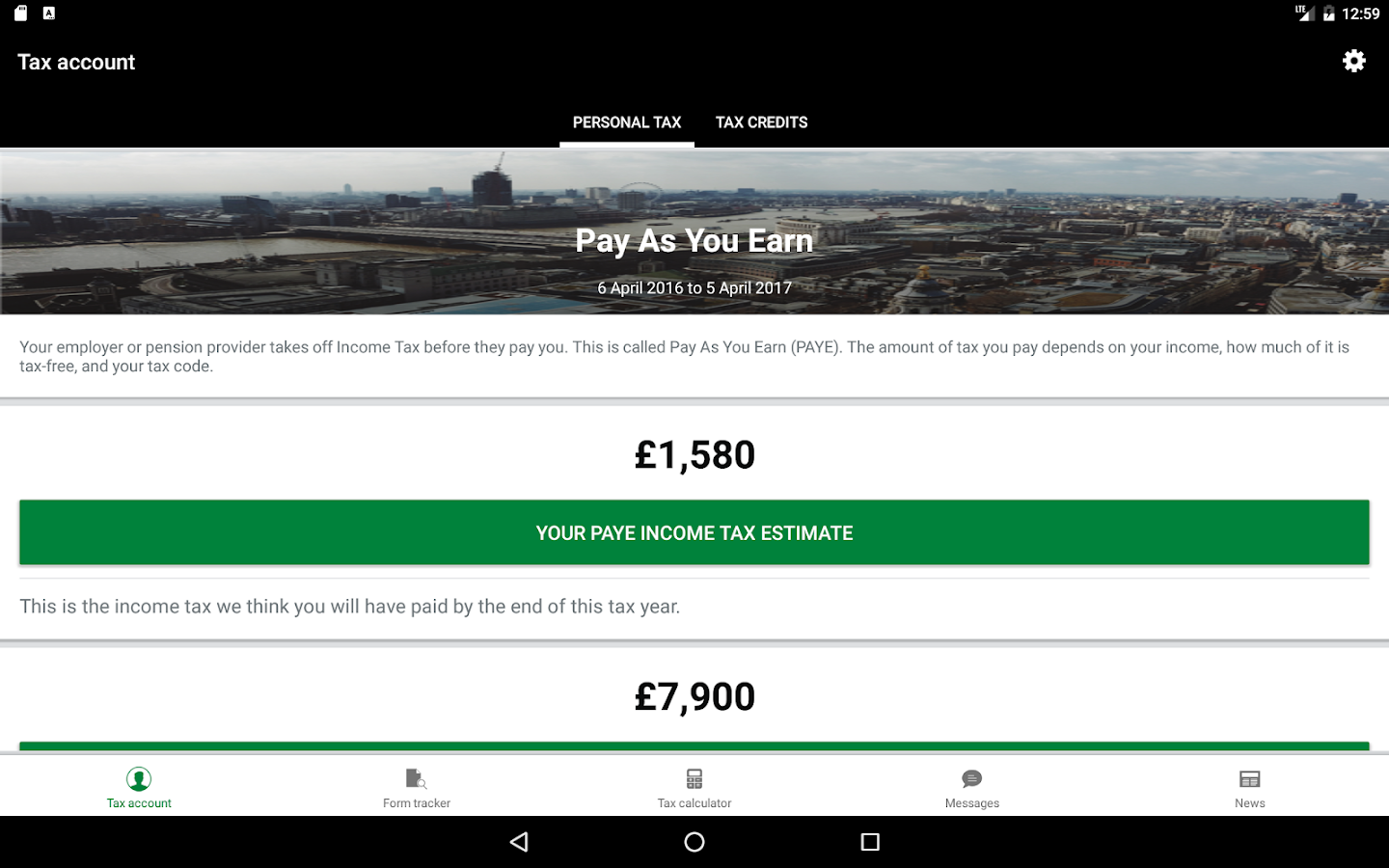

- Content: These letters typically highlight potential discrepancies between reported income and sales data obtained from online marketplaces. They might include:

- A summary of your reported income.

- An estimate of your potential taxable income based on sales data.

- A request for clarification or further information.

- Information on how to file a self-assessment tax return correctly.

- Target: Sellers who show inconsistencies in their tax returns compared to their online selling activity.

Who is Targeted by these Letters?

HMRC's nudge letters aren't sent randomly. They target online sellers who are most likely to have under-declared income. This often includes:

- High-volume sellers: Those making numerous sales regularly.

- High-value sellers: Those selling expensive items.

- Sellers with inconsistent reporting: Those with a history of inaccurate or incomplete tax returns.

HMRC likely uses sophisticated algorithms to analyze data from various sources, including:

- Online marketplace transaction data (eBay, Vinted, Depop, etc.)

- Bank statements

- Self-assessment tax returns

The platforms themselves don't directly share data with HMRC, but HMRC may use other means to obtain information about sales activity.

What to Do if You Receive an HMRC Nudge Letter?

Receiving an HMRC nudge letter shouldn't be cause for panic, but it does require prompt and careful attention. Here's a step-by-step guide on how to respond:

- Read the letter carefully: Understand exactly what information HMRC is requesting.

- Gather your records: Collect all relevant documentation, including sales records, expense receipts, and bank statements.

- Review your tax returns: Ensure your previously submitted returns are accurate and complete.

- Respond promptly: Meet the deadline specified in the letter.

- Provide accurate information: Be truthful and thorough in your response.

- Seek professional help (if needed): If you're unsure how to respond or need assistance, consult a qualified accountant or tax advisor. Ignoring or improperly responding to an HMRC nudge letter can lead to penalties, further investigations, and potential legal action.

Preventing Future HMRC Nudge Letters

The best way to avoid future HMRC nudge letters is to maintain meticulous records and ensure your tax affairs are in order. Here are some crucial steps:

- Accurate record keeping: Keep detailed records of all sales, expenses, and stock purchases. Use accounting software tailored for online sellers to simplify this process.

- Utilize accounting software: Programs designed for online sellers automatically track sales and expenses, making tax preparation much easier and more accurate.

- Understand your tax obligations: Familiarize yourself with the specific tax rules and regulations applicable to online selling.

- Proactive tax planning: Consult a tax professional to develop a tax strategy that minimizes your tax liability while remaining fully compliant.

Conclusion: Understanding and Responding to HMRC Nudge Letters for Online Sellers

HMRC nudge letters are a clear sign of increased scrutiny on online selling platforms. Understanding their purpose, knowing who is targeted, and responding appropriately are crucial for online sellers on eBay, Vinted, Depop, and other similar platforms. By maintaining accurate records, utilizing appropriate accounting software, and seeking professional advice when needed, you can significantly reduce the risk of receiving these letters and ensure your tax compliance. Review your tax records today, and if you have any concerns, don't hesitate to seek guidance from a qualified accountant or tax advisor. You can also find helpful resources and guidelines on the official HMRC website. [Link to relevant HMRC resources here]. Remember, proactive tax planning and accurate record keeping are key to successful and compliant online selling.

Featured Posts

-

Novaya Sharapova Talant Ambitsii I Buduschee Rossiyskogo Tennisa

May 20, 2025

Novaya Sharapova Talant Ambitsii I Buduschee Rossiyskogo Tennisa

May 20, 2025 -

I Megali Tessarakosti Esperida Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025

I Megali Tessarakosti Esperida Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025 -

Escola Na Tijuca Destruida Por Incendio Impacto Na Comunidade E Repercussao

May 20, 2025

Escola Na Tijuca Destruida Por Incendio Impacto Na Comunidade E Repercussao

May 20, 2025 -

Hmrc Website Crash Hundreds Of Uk Users Locked Out Of Accounts

May 20, 2025

Hmrc Website Crash Hundreds Of Uk Users Locked Out Of Accounts

May 20, 2025 -

Hmrc To Implement Voice Recognition For Faster Call Handling

May 20, 2025

Hmrc To Implement Voice Recognition For Faster Call Handling

May 20, 2025