Home Depot Earnings Report: Lower Than Expected, Tariff Outlook Unchanged

Table of Contents

Lower-Than-Expected Earnings: A Detailed Look

Home Depot's Q[Quarter] earnings revealed a less-than-stellar performance compared to both previous quarters and analyst predictions. While the company remains a dominant force in the home improvement sector, several key metrics fell short of expectations, impacting Home Depot stock and investor confidence. Let's examine the specifics:

-

Actual EPS vs. expected EPS: Home Depot reported an EPS of [Insert Actual EPS], falling short of the anticipated [Insert Expected EPS]. This represents a [Insert Percentage] decrease compared to the same period last year.

-

Percentage change in revenue compared to the same period last year: Revenue grew by [Insert Percentage], a slower pace than many analysts had predicted. This lower-than-expected revenue growth significantly impacted the overall financial results.

-

Analysis of comparable sales growth (same-store sales): Comparable sales, a key indicator of retail performance, increased by only [Insert Percentage], signaling a slowdown in sales growth compared to the previous quarter and the same period last year.

-

Mention any specific product categories that underperformed: [Insert specific product categories and explain the reasons for underperformance, e.g., lumber sales were down due to decreased housing starts; appliance sales were impacted by increased competition].

-

Impact of macroeconomic factors (e.g., housing market trends): The slowdown in the housing market likely played a significant role in the decreased sales, impacting demand for key Home Depot products. Higher interest rates and reduced consumer confidence also contributed to the weaker-than-expected performance.

Tariff Impact Remains a Key Factor

The ongoing trade war and associated tariffs continue to be a major factor influencing Home Depot's financial performance. While the company hasn't drastically altered its outlook on tariffs, the impact is clearly felt.

-

Home Depot's official stance on tariffs: Home Depot has publicly acknowledged the negative effects of tariffs on its supply chain and import costs, stating that they are actively working to mitigate these challenges.

-

Strategies employed to mitigate tariff-related costs (e.g., sourcing changes, cost-cutting measures): The company is exploring various strategies including sourcing materials from alternative suppliers and implementing cost-cutting measures to offset the increased costs associated with tariffs. However, these measures have yet to fully offset the impact.

-

Impact of tariffs on product availability and pricing: While Home Depot has attempted to absorb some of the tariff increases, some products have seen price increases, potentially impacting consumer demand. The company has also stated that the tariffs have had some effect on product availability due to supply chain disruptions.

-

Potential future implications of tariffs on Home Depot’s financial performance: The continued uncertainty surrounding trade policy and tariffs poses a significant risk to Home Depot's future financial performance.

Future Outlook and Investor Sentiment

The market reacted negatively to Home Depot's Q[Quarter] earnings report, with the Home Depot stock price [Insert details of stock price reaction]. The company's guidance for the remainder of the year provides some insight into the expected trajectory.

-

Home Depot's stock price performance following the earnings announcement: The stock price experienced a [Insert Percentage] decline immediately following the earnings release, reflecting investor concerns about the lower-than-expected results.

-

Analyst ratings and price targets: Following the announcement, several analysts revised their ratings and price targets for Home Depot stock, reflecting a more cautious outlook.

-

The company's outlook for the remainder of the year: Home Depot provided [Insert details of company guidance for future quarters], hinting at [Positive/Negative/Neutral] growth expectations.

-

Potential risks and opportunities for Home Depot in the coming quarters: The key risks remain the ongoing impact of tariffs, the overall health of the housing market, and increased competition within the home improvement retail sector. Opportunities exist in continued investment in e-commerce and expansion into new markets.

Conclusion

Home Depot's Q[Quarter] earnings report revealed lower-than-expected results, driven by a slowdown in sales growth and the ongoing impact of tariffs. While the company is actively managing the challenges presented by the trade war and macroeconomic factors, the future remains uncertain. Understanding the intricacies of the Home Depot earnings report is vital for investors and industry professionals alike.

Call to Action: Stay informed about future Home Depot earnings reports and the evolving impact of tariffs on the home improvement sector. Regularly check for updates and analysis of Home Depot stock and its performance within the retail market. Thorough analysis of the Home Depot earnings report and its underlying factors is crucial for making informed investment decisions and staying ahead in this dynamic market.

Featured Posts

-

Solved The 21 Year Old Mystery That Shocked Peppa Pig Fans

May 22, 2025

Solved The 21 Year Old Mystery That Shocked Peppa Pig Fans

May 22, 2025 -

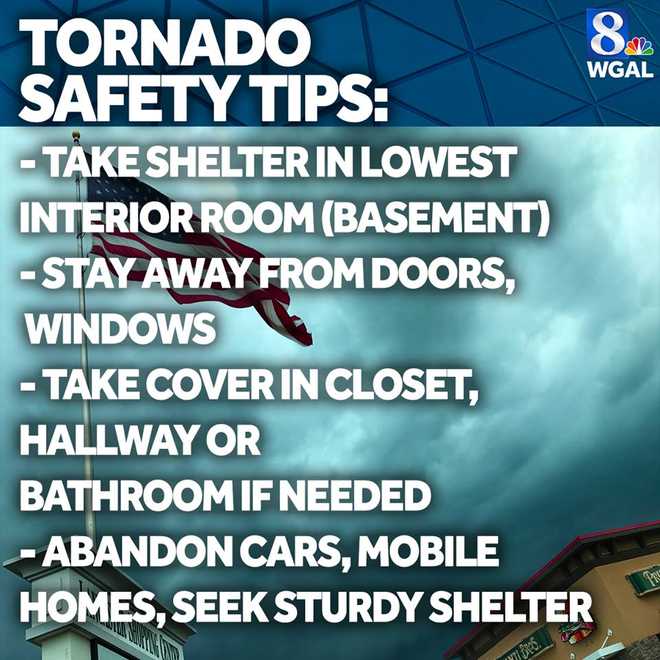

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Remediation

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Remediation

May 22, 2025 -

Lower Gas Prices In The Toledo Area A Detailed Look

May 22, 2025

Lower Gas Prices In The Toledo Area A Detailed Look

May 22, 2025 -

Local Casper Resident Uncovers Huge Zebra Mussel Problem

May 22, 2025

Local Casper Resident Uncovers Huge Zebra Mussel Problem

May 22, 2025 -

Core Weave Crwv Jim Cramers Assessment Of Its Growth Potential

May 22, 2025

Core Weave Crwv Jim Cramers Assessment Of Its Growth Potential

May 22, 2025