Hong Kong's US Dollar Peg: Intervention After A Two-Year Hiatus

Table of Contents

Understanding Hong Kong's Linked Exchange Rate System

Hong Kong's currency board system, which pegs the Hong Kong dollar (HKD) to the US dollar (USD), is a cornerstone of its economic policy. This system, managed by the HKMA, maintains a narrow band of 7.75 to 7.85 HKD per USD. This means the HKMA is committed to buying or selling US dollars to maintain the HKD within this range.

- Mechanics: The system operates through a currency board, meaning the HKMA holds US dollar reserves to back the HKD in circulation. When the HKD weakens, the HKMA sells US dollars to buy HKD, strengthening the local currency. Conversely, if the HKD strengthens, it buys US dollars to release HKD into the market.

- HKMA's Role: The HKMA's primary responsibility is to maintain the peg's stability. It monitors the exchange rate constantly, intervening when necessary to prevent significant deviations. This involves significant foreign exchange reserves management and sophisticated monetary policy tools.

- Advantages: The peg offers price stability, reducing inflation risks and attracting foreign investment. This fosters confidence in the Hong Kong economy, making it an attractive financial hub.

- Disadvantages: The peg limits Hong Kong's monetary policy independence, making it susceptible to US monetary policy changes. It can also lead to periods of overvaluation or undervaluation, depending on US economic conditions. This rigidity can create challenges during periods of global economic uncertainty.

The Two-Year Hiatus: Reasons for Inaction

The HKMA's decision to abstain from intervention in the currency market for two years is noteworthy. Several factors contributed to this period of inactivity:

- Global Economic Stability (Pre-2022): Before the surge in global uncertainty in 2022, the exchange rate remained relatively stable within the allowed band, requiring no significant intervention.

- Low Volatility: The period leading up to the intervention saw comparatively low volatility in the HKD/USD exchange rate, reducing the need for immediate HKMA action.

- COVID-19 Pandemic's Impact: The pandemic significantly impacted Hong Kong's economy, and the HKMA might have prioritized other policy responses to mitigate the pandemic's economic consequences. Maintaining sufficient US dollar reserves was also a priority during this time.

These factors combined to create an environment where active intervention wasn't considered necessary until the more recent market pressures.

The Recent Intervention: Triggers and Mechanisms

The recent intervention by the HKMA was triggered by increased pressure on the Hong Kong dollar. Several factors contributed:

- US Dollar Strength: The strengthening of the US dollar against other major currencies put upward pressure on the HKD, pushing it towards the strong end of its band.

- Capital Outflows: Concerns about Hong Kong's economic outlook may have led to capital outflows, further weakening the HKD.

- Geopolitical Uncertainty: Rising global geopolitical tensions also contributed to market uncertainty and potentially influenced capital flows.

The HKMA responded by selling US dollars to purchase HKD, thus stabilizing the exchange rate and bringing it back within the acceptable band. The exact amount of intervention remains undisclosed, but its effect was immediate, easing market anxieties. This defense mechanism highlighted the HKMA's commitment to maintaining the peg. The intervention involved significant transactions in the Hong Kong dollar trading market.

Implications and Future Outlook of Hong Kong's US Dollar Peg

The recent intervention has several implications for Hong Kong's economy:

- Short-Term: The intervention provided short-term stability, reassuring investors and preventing excessive exchange rate volatility.

- Long-Term: The long-term implications depend on various factors, including future US monetary policy, global economic growth, and geopolitical developments. The sustainability of the peg is contingent upon the continued strength of the US economy and the stability of global financial markets.

- Risks and Challenges: Maintaining the peg amid rising global uncertainty poses significant risks. Potential challenges include further capital outflows, significant shifts in US monetary policy, and increased geopolitical instability.

- Alternative Scenarios: While the peg is likely to remain in place for the foreseeable future, alternative scenarios, such as a gradual shift towards a more flexible exchange rate system, cannot be entirely ruled out in the long term.

Geopolitical factors will continue to play a crucial role in shaping the future of the HKD's peg to the USD.

Conclusion: Navigating the Future of Hong Kong's US Dollar Peg

The recent intervention by the HKMA after a two-year hiatus underscores the importance of Hong Kong's US dollar peg for maintaining economic stability. While the peg has historically served Hong Kong well, the intervention highlights the ongoing challenges and risks associated with this system in an increasingly volatile global environment. The future of this linked exchange rate system will depend on a complex interplay of domestic and international economic factors. The HKMA's commitment to defending the peg remains clear, but the ability to continue doing so successfully hinges on navigating the challenges posed by global uncertainty. Stay updated on the latest developments concerning Hong Kong's US dollar peg and its implications for your investment strategy. Understanding the intricacies of Hong Kong's linked exchange rate system is crucial for businesses and investors operating in this dynamic market.

Featured Posts

-

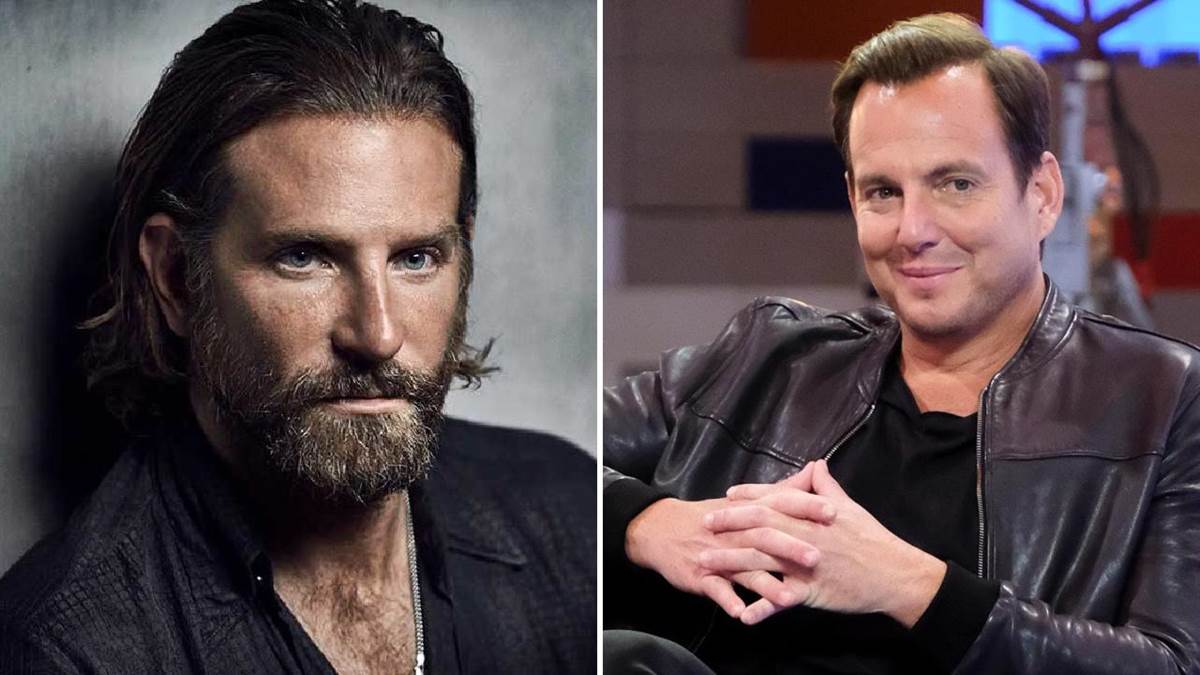

Bradley Cooper And Will Arnett Behind The Scenes Nyc Filming Of Is This Thing On

May 05, 2025

Bradley Cooper And Will Arnett Behind The Scenes Nyc Filming Of Is This Thing On

May 05, 2025 -

Chinas Ev Revolution A Challenge And Opportunity For The Us Auto Industry

May 05, 2025

Chinas Ev Revolution A Challenge And Opportunity For The Us Auto Industry

May 05, 2025 -

La Noche Ufc Vs Canelo Un Duelo Epico En Mexico

May 05, 2025

La Noche Ufc Vs Canelo Un Duelo Epico En Mexico

May 05, 2025 -

Kentucky Derby 2025 Meet The Riders Vying For Victory

May 05, 2025

Kentucky Derby 2025 Meet The Riders Vying For Victory

May 05, 2025 -

Britains Got Talent News On Teddy Magics Rescheduled Act

May 05, 2025

Britains Got Talent News On Teddy Magics Rescheduled Act

May 05, 2025